This article is available in Spanish.

On-chain data shows that metrics related to network activity have been rising for Ethereum lately, something that could pave the way for a further rally.

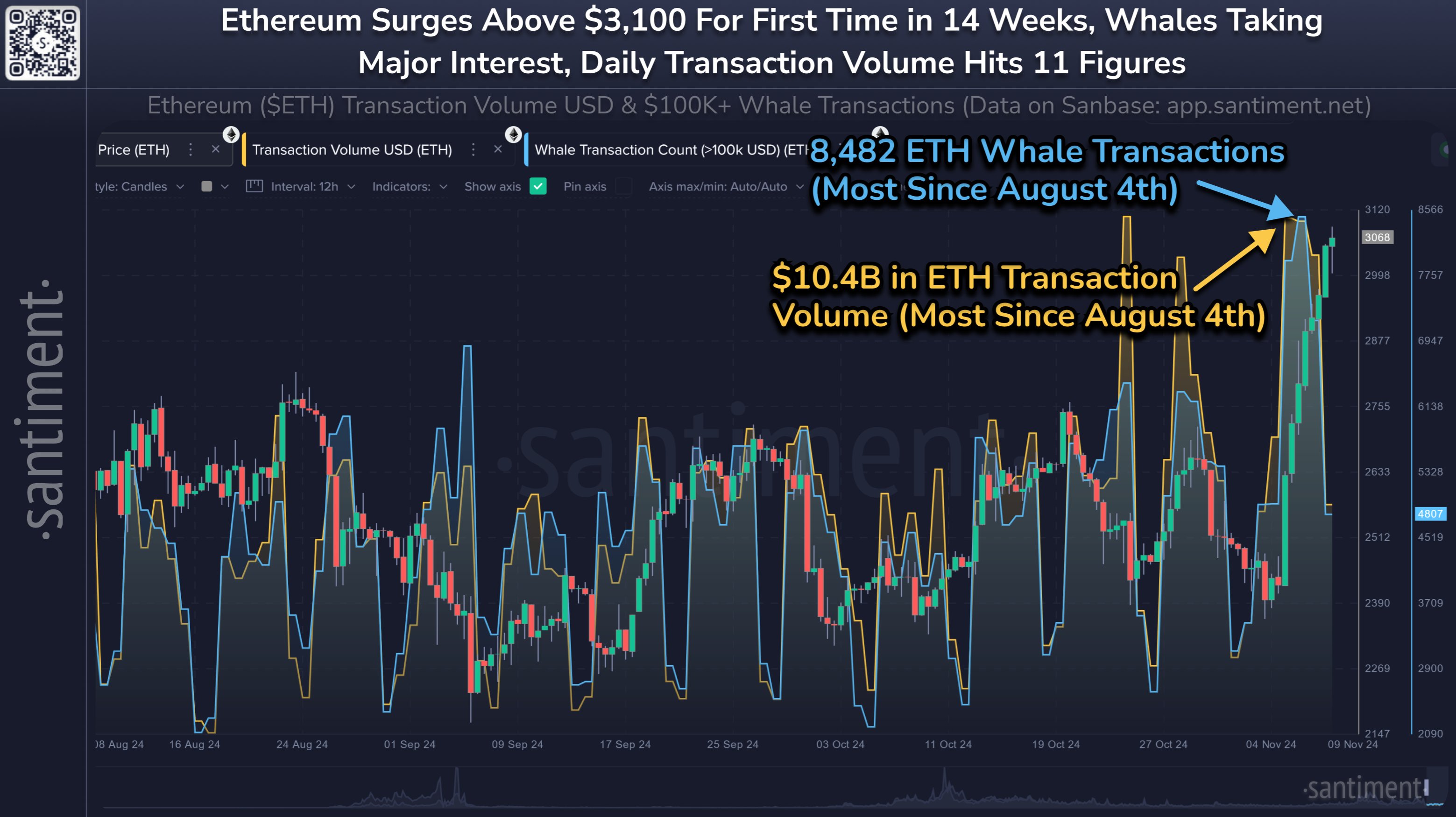

Ethereum transaction volume and whale transfers have recently increased

This is evident from data from the on-chain analysis company SantimentEthereum has seen an increase in two activity-related metrics. The indicators in question are the transaction volume and the number of whale transactions.

The first of these, ‘Transaction Volume’, tracks the total amount of cryptocurrency (in USD) that users on the ETH Network move across the network with their transactions.

Related reading

When the value of this metric is high, it means that the ETH blockchain is currently processing the transfer of a large number of coins. Such a trend suggests that investors are actively investing in asset trading.

On the other hand, the low indicator implies that interest in the cryptocurrency may be low at the moment because holders are only moving a small amount of ETH.

Here is a chart showing the trend in Ethereum transaction volume over the past few months:

As shown in the chart above, Ethereum transaction volume has recently recorded a sharp increase, implying that interest in the asset has increased alongside the price rally.

This can be considered a constructive development for the cryptocurrency as increasing network activity is generally required for rallies to be sustainable.

In the past, some price movements started sharply, but at the same time the transaction volume did not show a large increase. Such movements generally died out quickly.

The chart also contains the data for the other relevant metric here, the ‘Whale Transaction Count’. This indicator measures the total amount of ETH transfers worth more than $100,000.

Transactions of this size are believed to originate from the whale entities, so the Whale Transaction Count reflects the activity level of the major investors.

The chart shows that this indicator has recently peaked for Ethereum as well, implying that the recent increase in volume is a sign of interest not only from the smaller investors, but also from the giant hands.

Of course, it is impossible to tell whether investors are buying or selling based on these indicators alone, because all types of trades look the same from their perspective. Since ETH has been on a sharp rally lately, this activity so far has likely been focused on accumulation.

Related reading

The analytics company explains:

Expect any growth in Bitcoin during this bull run to see the gains redistribute into Ethereum and possibly push it to its own all-time high, while network activity looks very healthy.

ETH price

After witnessing an increase of over 27% in the past seven days, Ethereum has broken past the $3,150 level.

Featured image from Dall-E, Santiment.net, chart from TradingView.com