- Ethereum Classic regained its bullish market structure the day after a 20% rally

- Liquidity levels indicate that a decline below $20 is likely before a move beyond $22 occurs

Ethereum classic [ETC] has performed well since November 4. Besides Bitcoin [BTC]the altcoin has posted a 19% gain since the day’s low of $17.29.

Despite recent gains, the price was still unable to rise past the local highs of $21, which have been thwarting buyers since August. Will this step be different?

The accumulation indicator indicates that a breakout is likely

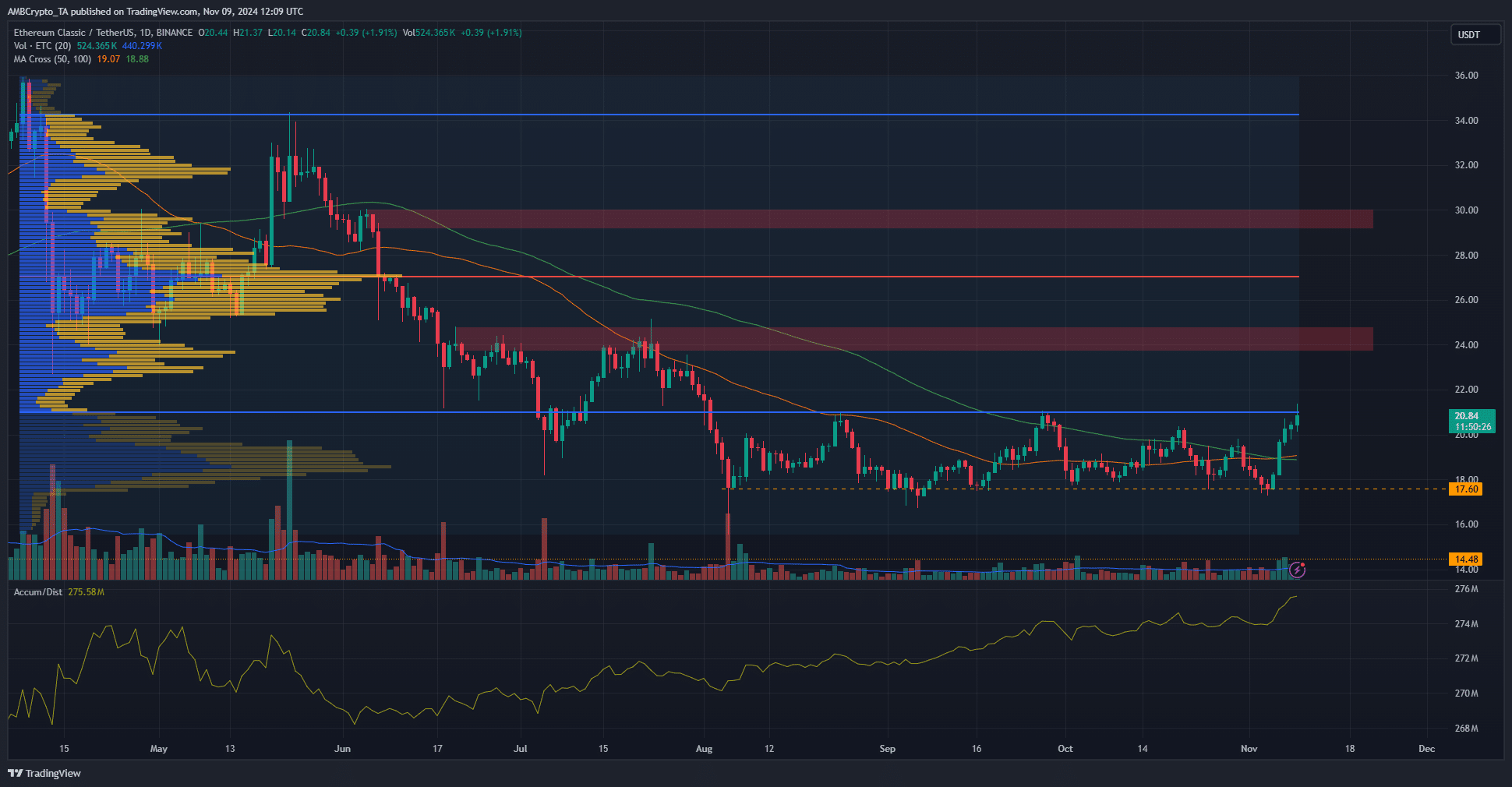

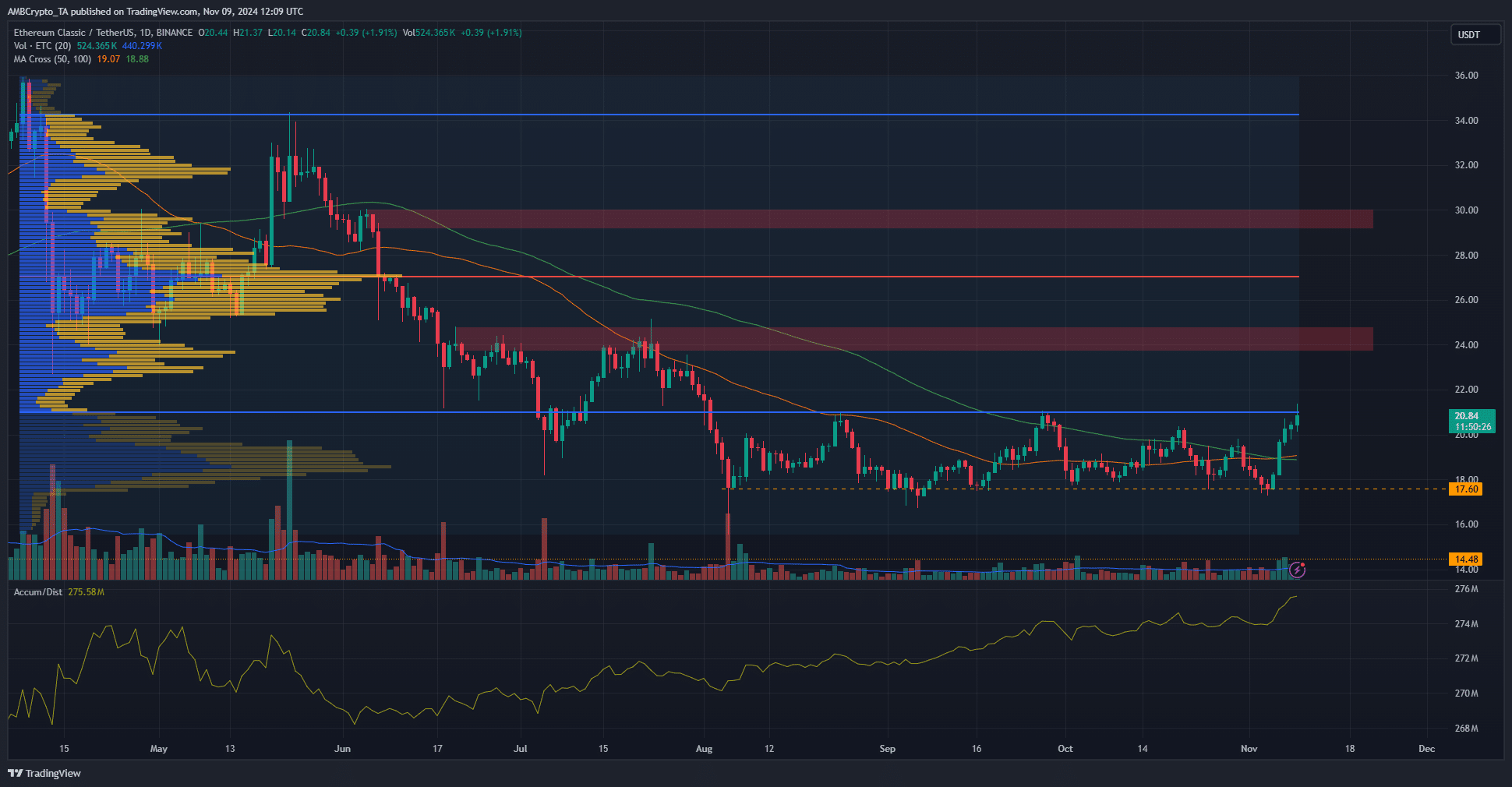

Source: ETC/USDT on TradingView

The market structure had turned bullish on the daily chart earlier this week, following the move past the recent lower high at $19.82.

The A/D indicator has been in a steady uptrend since August, while the price formed a range between $17.6 and $21.

With sentiment in the crypto space becoming increasingly bullish, ETC is likely to break past the $21 level. The Fixed Range Volume Profile showed that the $21 level formed strong resistance.

It formed the lower band of the value area, where 70% of trading volume has taken place since April. It was a challenge to break into the value area.

The 50 and 100 period moving averages formed a bullish crossover, another sign that an uptrend is becoming increasingly likely.

The next major resistance zone above $21 was at $23.8. This area contained both a bearish order block and a high volume node.

Short-term sentiment favors ETC bulls

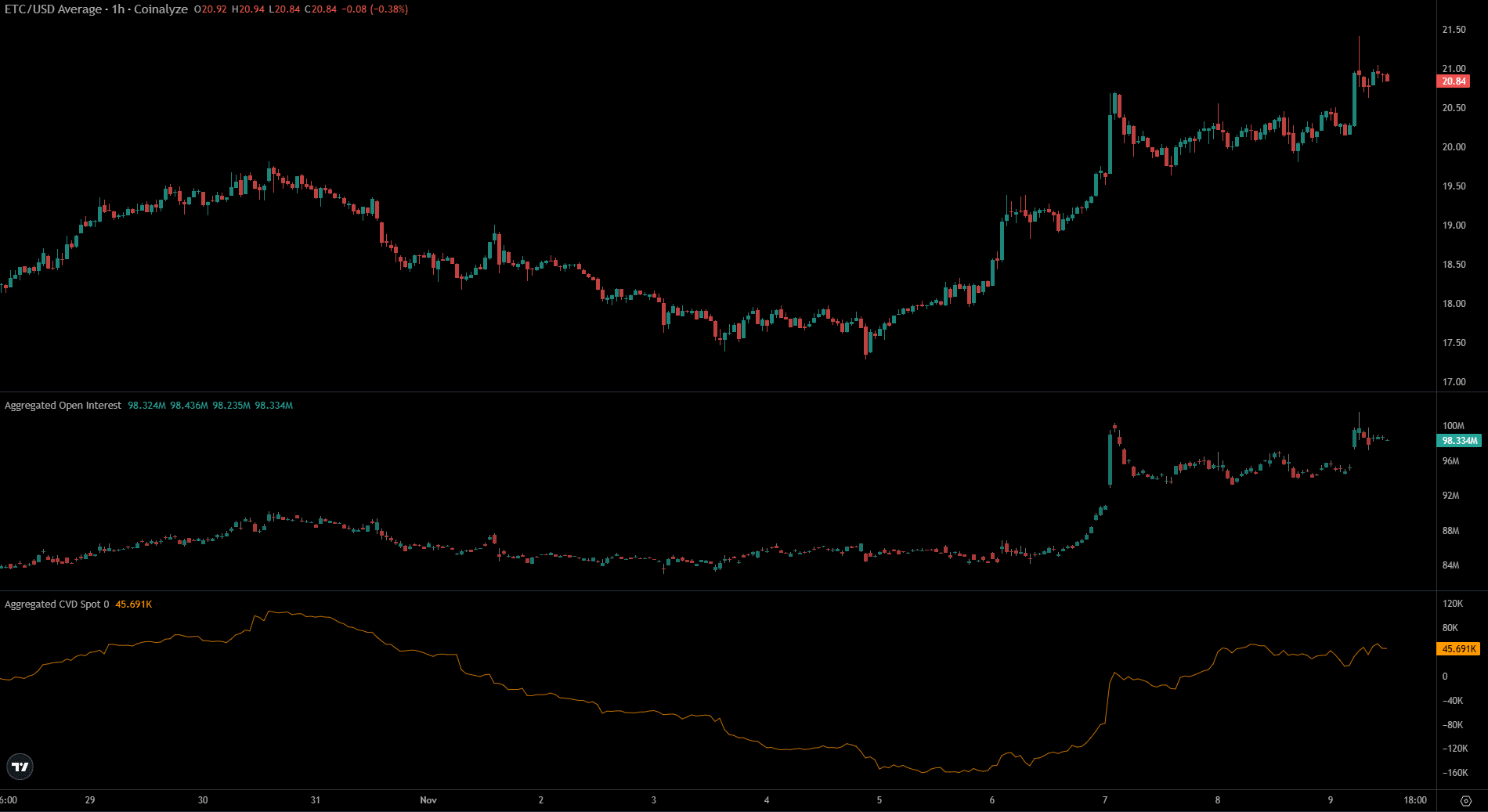

Open Interest rose from $86 million on November 6 to $98.3 million at the time of writing, while the price rose 20%. This reflected a bullish sentiment among speculators.

The spot CVD also climbed higher in recent days, demonstrating demand in the spot markets.

Read Ethereum Classic’s [ETC] Price forecast 2024-25

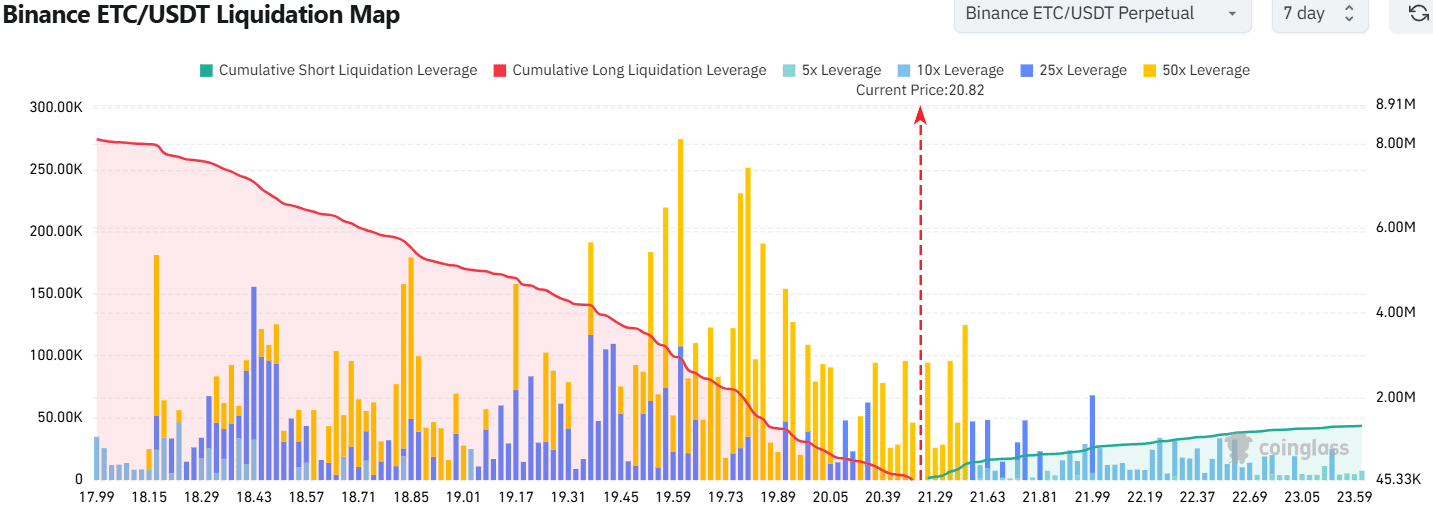

The ETC liquidation chart showed that a retracement to $19.61 and $19.37 would trigger a large number of extended liquidations. Relatively smaller liquidity pools were present in the North, down to $21.99.

As liquidity picks up prices, ETC could witness a dip below $20, which would lead to these long liquidations in the coming days.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer