- Bitcoin shorts can contribute to higher prices in a short squeeze scenario

- At the time of writing, the bulls remained in control despite recent highs and growing expectations of downside

AMBCrypto has previously looked at the possibility of extended liquidations if Bitcoin returns after hitting its most recent all-time high. Despite being overbought, selling pressure remained weak across the board and at the time of writing, BTC holders were still strong.

One of the main reasons why Bitcoin selling pressure has not prevailed is because market confidence was still strong after the recent top. Heavy inflows into Bitcoin ETFs over the past 24 hours have contributed to this. ETF flows have proven to be a relatively accurate measure of market confidence. Even according to Bloomberg Eric Balchunas,

“HOOVER CITY: Bitcoin ETFs raised a record $1.4 billion yesterday (the Trump effect). $IBIT alone was +$1.1 billion. That’s +$6.7 billion in the last month and $25.5 billion YTD. All told, they have consumed around 18,000 BTC in one day (vs. 450 mined) and are now 93% on track to surpass Satoshi’s 1.1 million BTC.”

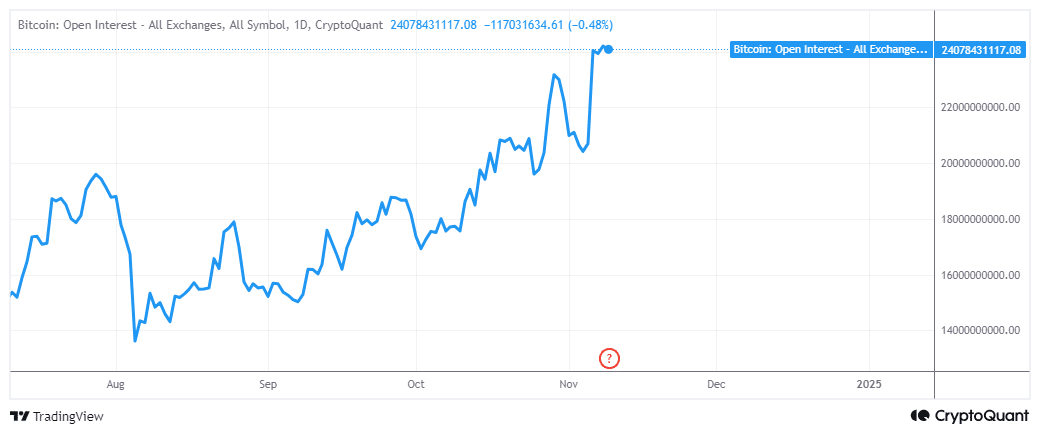

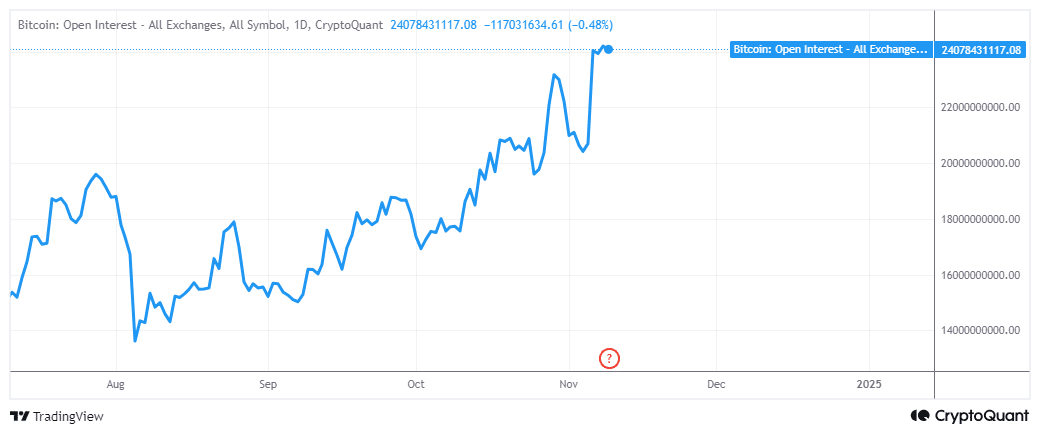

The surge in ETF inflows could push Bitcoin to greater heights. A recent one cryptoQuant Analysis recently examined whether such an outcome could constitute a short squeeze. According to the analysis, although open interest was high, financing rates were negative.

Negative funding rates historically indicate a shift in market sentiment, particularly toward a bearish outlook in the derivatives segment. This shift was supported by Coinglass’ BTC long/short ratio, which showed that shorts were higher than longs over the past three days.

Source: Coinglass

This increase in short positions was likely because derivatives traders expected the previous top to act as a resistance level. Or at least short-term profit taking to trigger another pullback. However, short positions run the risk of being liquidated if the price goes up.

Meanwhile, Bitcoin’s Open Interest appeared to level off after reaching a new ATH. The figures for this peaked at $24.19 billion on November 8.

Source: CryptoQuant

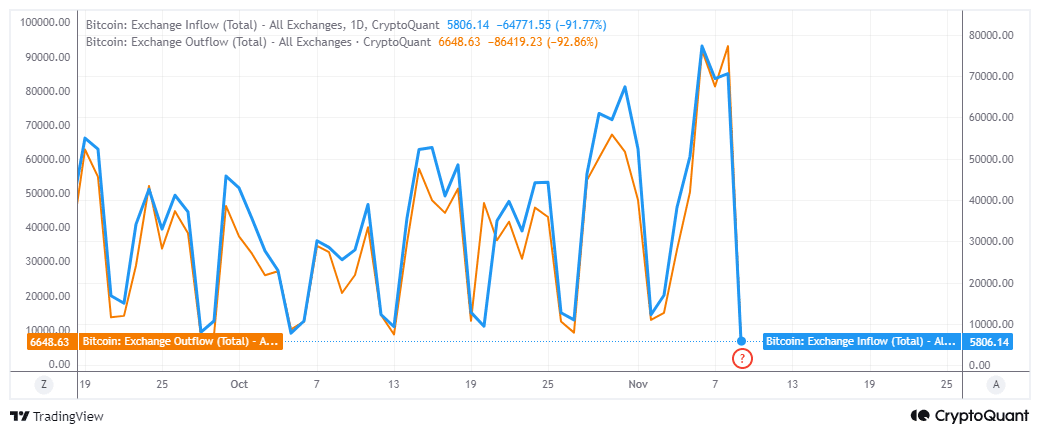

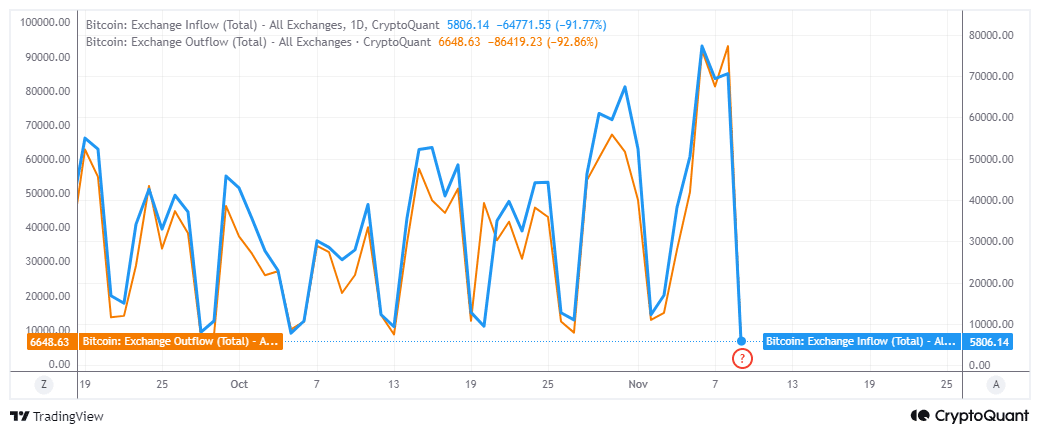

Exchange rate flows show that demand still exceeded selling pressure

Stock market flow data has fallen significantly recently, indicating signs of possible bullish exhaustion. Despite this finding, the amount of BTC flowing out of exchanges was still slightly higher than BTC inflows.

Source: CryptoQuant

Bitcoin had an outflow of 6,648 BTC on November 9, compared to an inflow of 5,806 BTC. This suggested that demand was still in favor of the bulls and that the price could still rise.

Based on the above data, it seemed clear that there was still bullish momentum preventing the bears from taking control. This, combined with demand from Bitcoin ETFs, may explain the widespread optimism. However, this does not necessarily mean that the situation will remain the same.

BTC’s price action showed that the bulls are struggling to move higher. This could be a sign that demand is cooling, which could then pave the way for a bearish retracement once selling pressure begins to gain momentum.