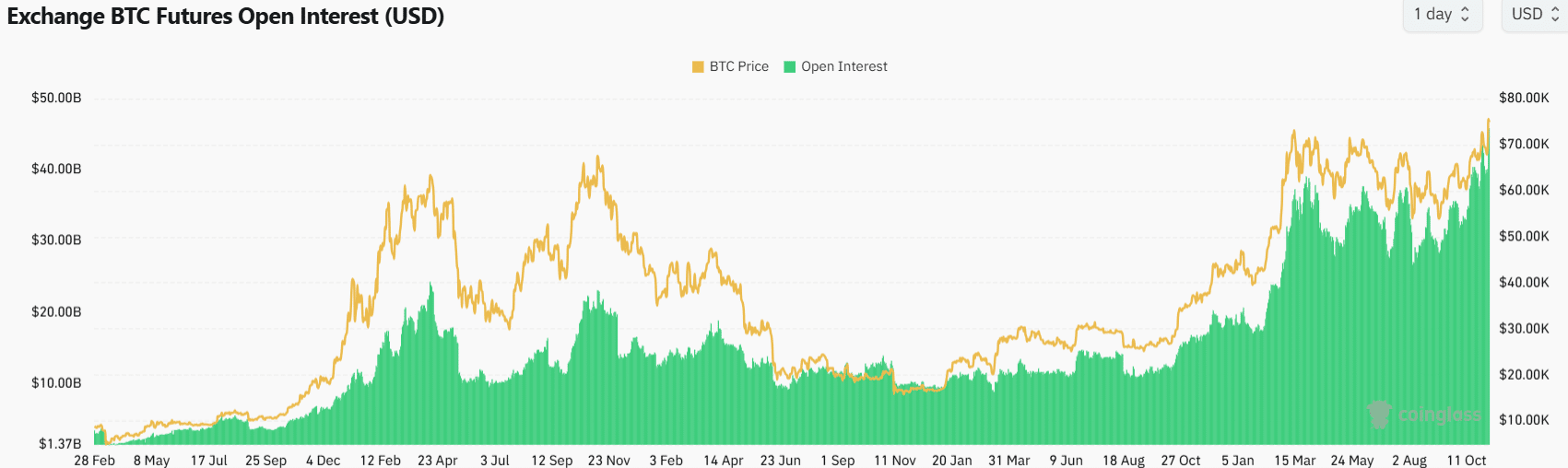

- Bitcoin set a new Open Interest record, reaching $45.8 billion.

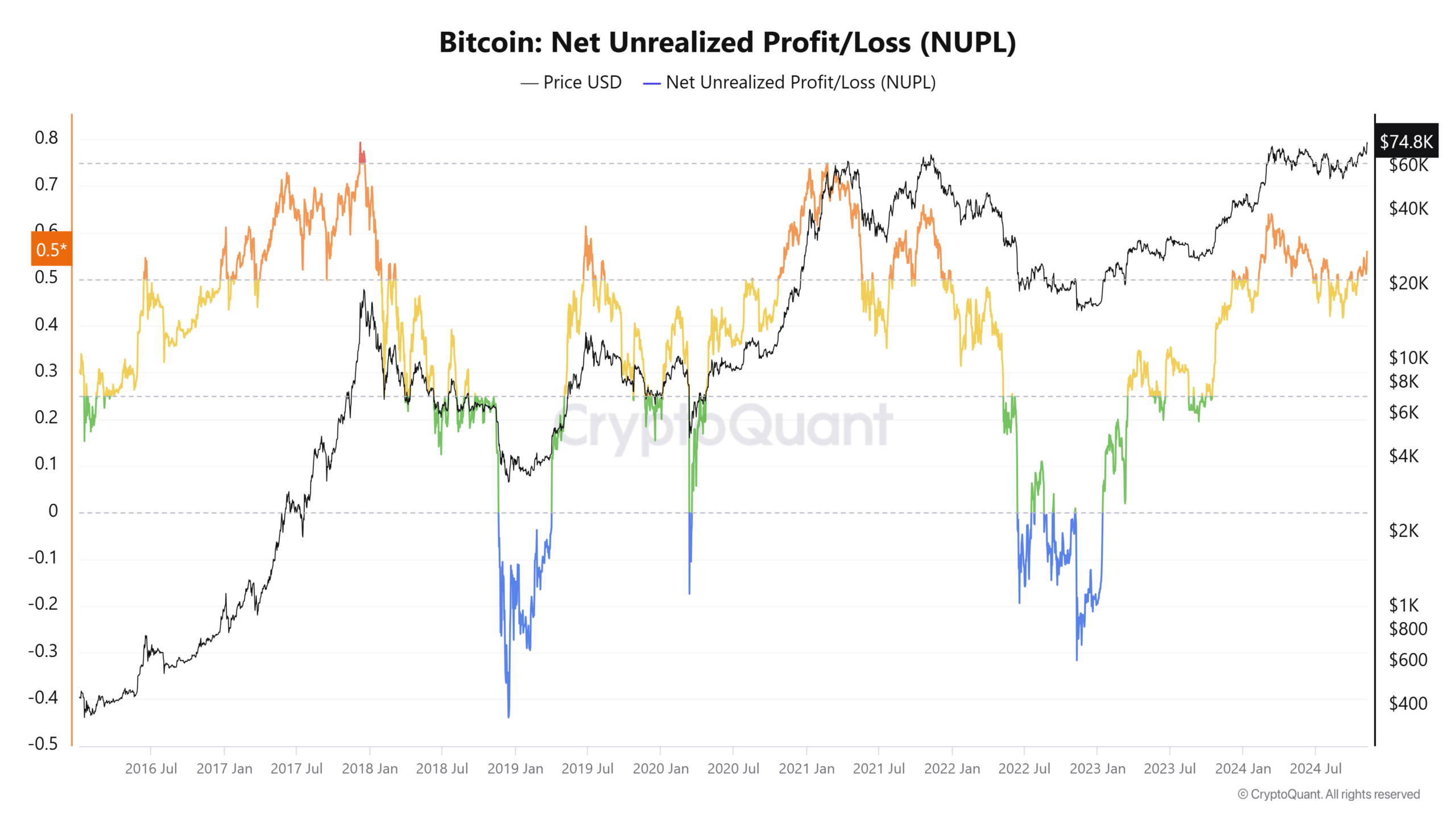

- The NUPL statistic shows that the bull run is probably still in its early stages.

Bitcoin [BTC] has set a new all-time record as the US presidential election comes to an end, with Donald Trump the clear winner.

Historical trends suggest that November and December would be strongly bullish months for crypto.

Founder of CryptoQuant Ki Young Ju highlighted that we may not see more than 30%-40% gains here going forward, and not the 368% move we saw in the last cycle.

Still, Open Interest set a new all-time high at $45.8 billion, while Bitcoin also set a new ATH at $76.4k, indicating strong bullish sentiment. Furthermore, on-chain metrics were not yet near cycle top levels.

Futures Open Interest Surges Past 2024 Highs

Open Interest has grown steadily over the past three years. The rally from October 2023 to March 2024 took OI from $11.9 billion to $38 billion.

These highs were broken on October 17 and then again on November 7.

Rising prices and Open Interest indicate healthy bullish sentiment, although the price discovery phase could see high volatility. Traders should be cautious of deep pullbacks in the coming months.

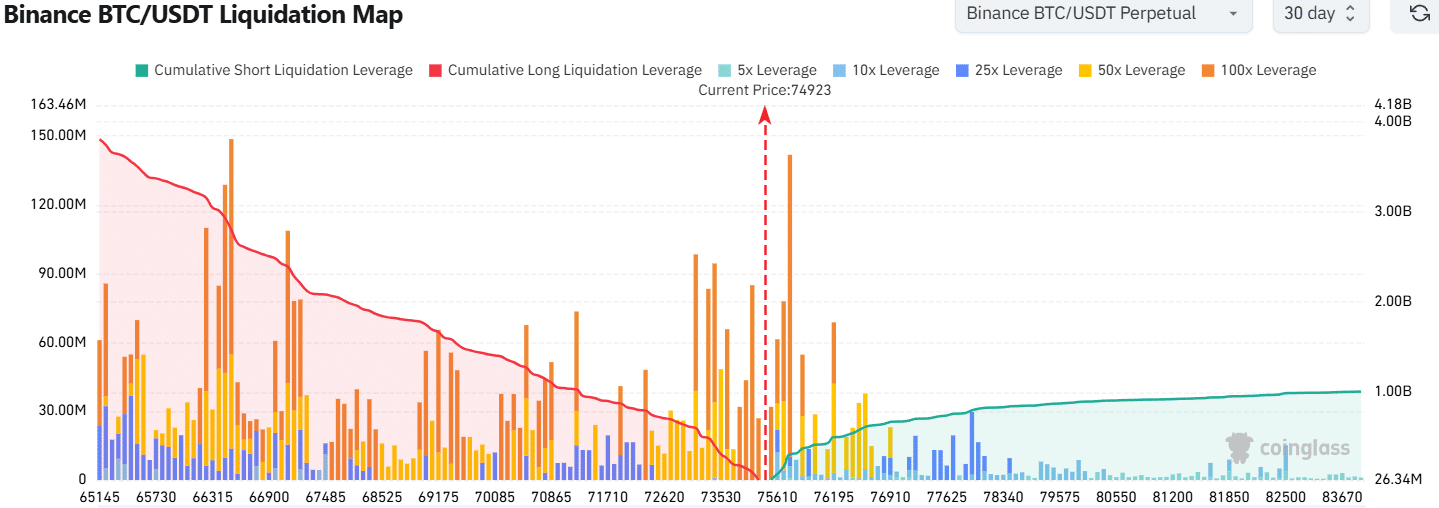

As things stand now, some short sellers appear eager to trade against BTC’s bullish momentum over the past three weeks. The liquidation map showed that there was a cluster of liquidations with a high debt burden of $75,740.

Long liquidations of similar size were also present at $73,205, but as things stand now a drop towards $70,000 would be much more painful than a sustained uptrend.

NUPL reflects the early bull run phase of previous cycles

The net unrealized gain and loss (NUPL) at the time of writing was 0.559. It was at a similar level in December 2016, when Bitcoin was valued at $900, and in November 2020, when BTC was trading at $15.4k.

Read Bitcoin’s [BTC] Price forecast 2024-25

The NUPL has reached highs of 0.793 and 0.748 in the last two cycles. A reading of around 0.7 would be a strong sign that a large portion of investors are making profits and that the bull run is probably over.

At this point, there is still a long way to go before that can happen, leaving the question whether BTC will top after only a 30%-40% increase.