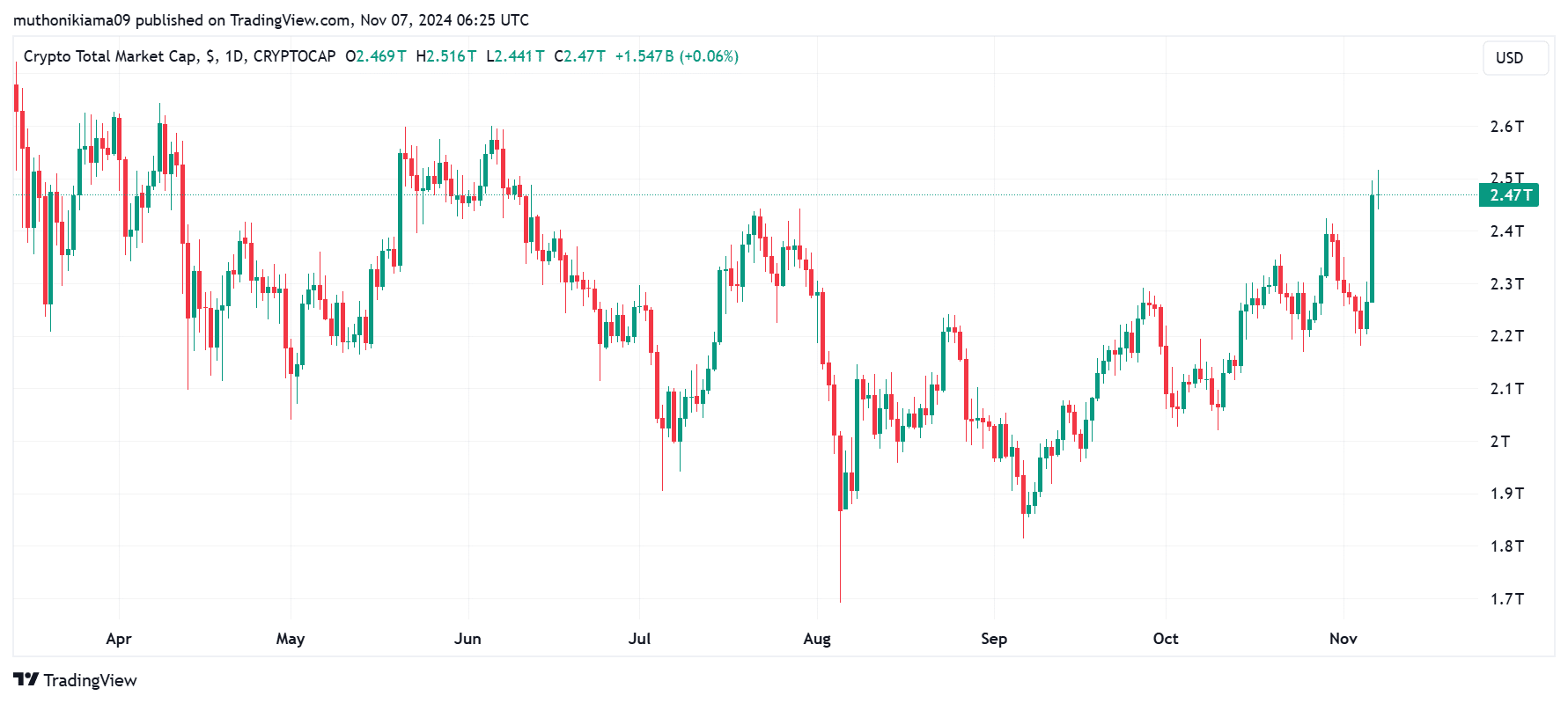

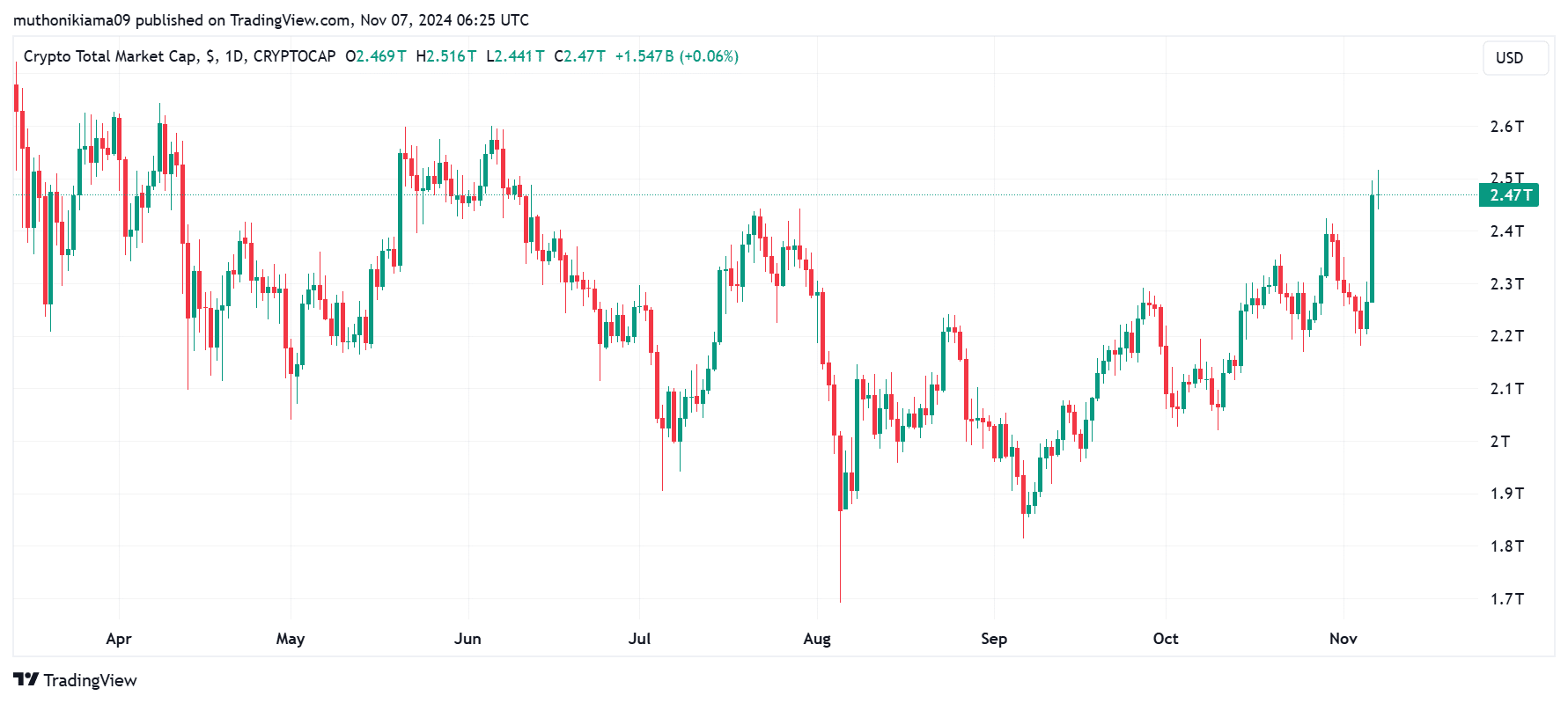

- The total market capitalization of cryptocurrency has risen to a five-month high above $2.47 trillion.

- The recent gains came as traders believed in Trump’s election victory.

The cryptocurrency market continues to post significant gains this week as the total market capitalization increased by more than $231 billion in just 24 hours.

At the time of writing, the market capitalization stood at $2.47 trillion, the highest level since June Bitcoin [BTC] and most altcoins went higher.

Source: TradingView

The widespread gains were accompanied by increasing volatility that caused massive liquidations in the derivatives market Mint glass. In the past 24 hours, more than $380 million was liquidated from the cryptocurrency market, with short sellers taking the biggest hit.

Of these liquidations, $234 million consisted of short positions, while $169 million consisted of long positions. Bitcoin had the highest liquidations at $150 million, followed by Ethereum [ETH] with $64 million in liquidated positions.

The cryptocurrency fear and greed index has also risen to 77, showing ‘extreme greed’. What is driving this renewed investor confidence, and will the momentum continue?

American election pump

The US presidential election is the main factor fueling these gains. Pro-crypto candidate Donald Trump won in a landslide and he is now the president-elect.

Trump has made many promises to the US crypto community, including setting up a strategic Bitcoin reserve and firing US Securities and Exchange Commission (SEC) Chairman Gary Gensler.

The community is already counting on these promises to be kept. Ripple CEO Brad Garlinghouse has done just that thought that Trump must change the leadership of the SEC during his first 100 days, push for a pro-crypto law and clarify Ethereum’s status as a non-security commodity.

Gemini co-founder Cameron Winklevoss too believes that the crypto industry will have more room for growth over the next four years with friendly policies.

“Imagine how much we will achieve in the next four years now that the crypto industry will not waste billions on legal fees fighting the SEC,” Winklevoss said.

Gemini’s co-founders had donated $2 million to the Trump campaign.

The optimism surrounding a crypto-friendly SEC, the Senate, and the White House is driving bullish sentiment in the crypto industry.

The inflow into crypto ETFs is increasing enormously

Election Day also saw a sudden surge in activity around US-listed crypto exchange-traded funds (ETFs). Data from SoSoValue showed that total traded volumes for Bitcoin ETFs reached $6.07 billion, the highest level since March.

Total inflows into Bitcoin ETFs during the day also reached $621 million, marking the highest level in a week.

Ethereum ETFs also had their best day since September with inflows of $52 million. The positive data saw ETH jump to a two-month high above $2,800.

An increase in ETF inflows helps drive demand for the underlying product. If the strong inflows continue, Bitcoin and Ethereum could rise.

Crypto stocks are also rising

The bullish wave in the cryptocurrency market also bodes well for crypto stocks. On Wednesday, Coinbase (COIN) rose 31% to $254, its highest level since July.

MicroStrategy also posted a 13% gain and was trading at $257 at market close. MSTR has been one of the best performing crypto stocks this year with a gain of 276% since the beginning of the year.

Jack Dorsey’s Block also saw its share price rise to a six-month high after a 7% gain, while Bitcoin mining company MARA Holdings posted an 18% share gain.