- THORChain had fallen below last month’s demand zone at $4.5.

- The quick recovery showed that sellers were not dominant.

THORChain [RUNE] rose 17.15% in 24 hours and the bullish belief has taken over the crypto world after Bitcoin [BTC] made a new all-time high against the US dollar, reaching $75.4k.

Volatility on Monday prompted an intense bearish reaction from the market, but bulls were quick to quell fears of a bearish reversal.

The price was above the $4.76 level and was a good sign for the short term, but can the bulls build on this?

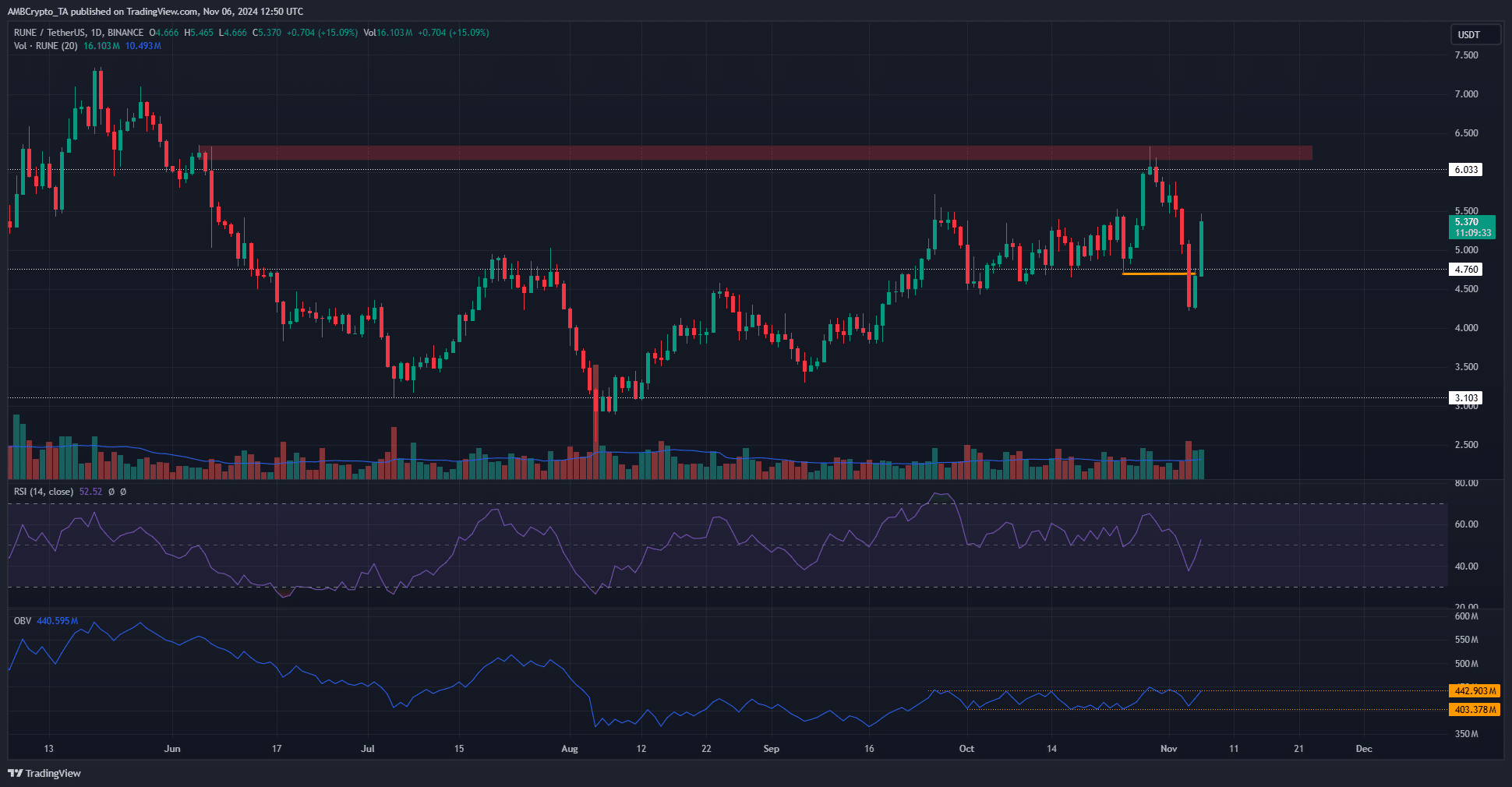

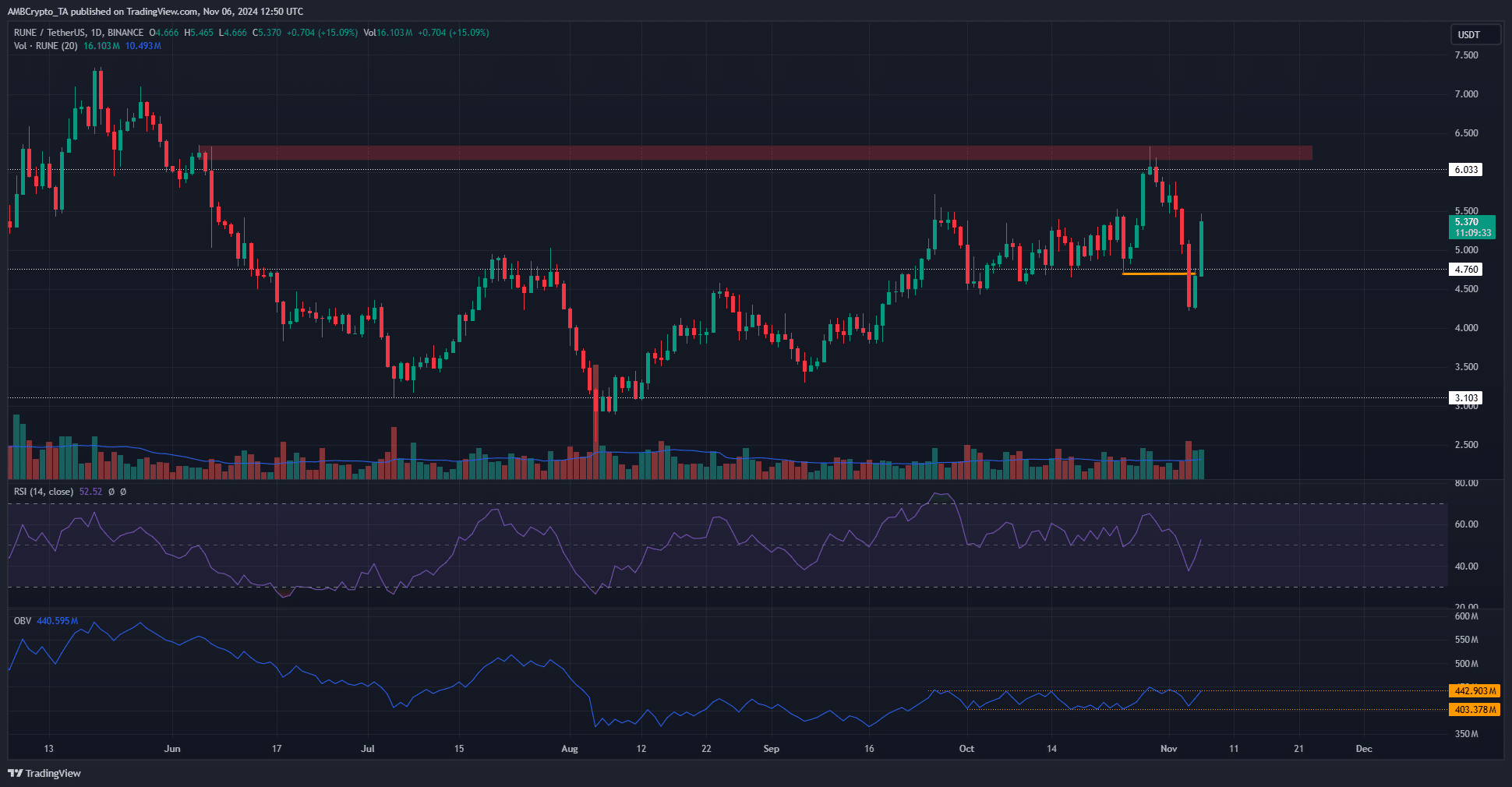

Bearish Market Structure Break for THORChain

Source: RUNE/USDT on TradingView

On a daily basis, RUNE has been steadily moving higher since August’s sharp losses. It maintained that trend and bullish market structure until November 4.

Bitcoin [BTC] There was some turbulence, dropping to $66.8k after being rejected from $73.6k six days earlier.

This rejection was followed by heavy selling pressure on RUNE, sending prices down from $6.3 to $4.22 within a week from the bearish June order block.

It marked a drop of 33.3% and put a bearish spin on the market structure.

More worryingly, the support base that THORChain has built in the $4.5 region over the past month has been breached. One mitigating factor was that the OBV was stuck within a miniature range.

This was a sign that RUNE is more likely to trade within the $4.5-$6.3 range as long as the OBV remains within the outlined range.

Further clues to a range formation

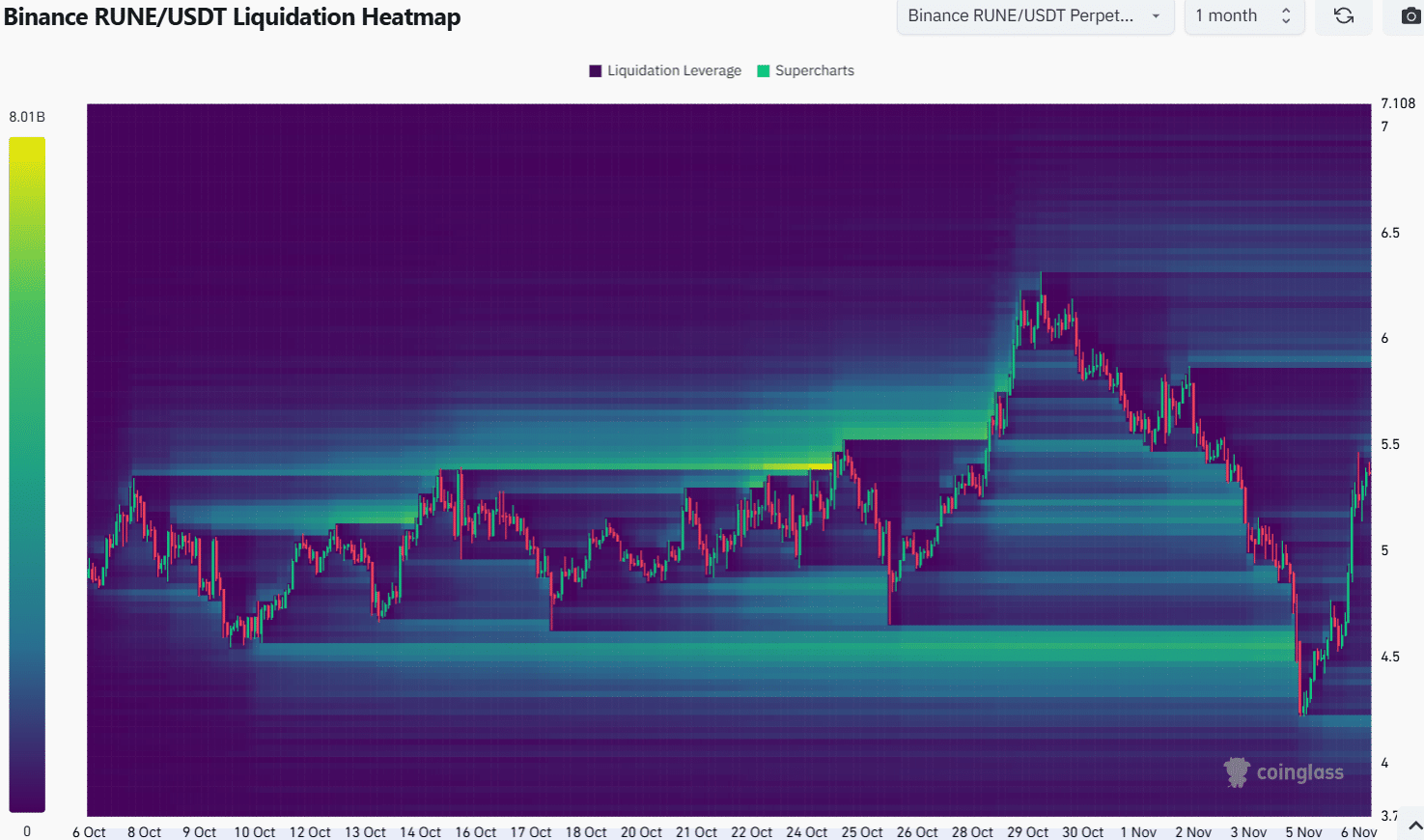

The liquidation heatmap showed that the liquidity cluster that had built up around $4.5 was wiped out during the recent pullback.

The sharp recovery from this region was a sign that this move was likely driven by liquidity and not a wave of high sales volumes on the spot market.

Read THORChain’s [RUNE] Price forecast 2024-25

At this point, there was no clear liquidity pool that RUNE could attract. The $5.8-$6.2 region was interesting and could push prices higher, but probably not immediately.

It seemed more likely that RUNE would consolidate below $6, allowing time for short liquidations before pushing higher.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer