- Ethereum recently saw a spike in positive net flows, with approximately 82,000 net flows to derivatives exchanges.

- ETH is up over 8% in the last 24 hours.

Ethereum’s recent rise [ETH] the exchange netflow, in addition to Bitcoin’s climb to a new all-time high (ATH), has generated renewed interest in the crypto market.

Ethereum has seen a notable increase in net flows on derivatives exchanges, a shift that could indicate changing investor sentiment. Meanwhile, Bitcoin’s break above $75,000 has fueled optimism across the board.

Let’s take a closer look at what these developments mean for ETH and when ETH could follow BTC’s lead.

Ethereum’s net flow spike reflects rising interest

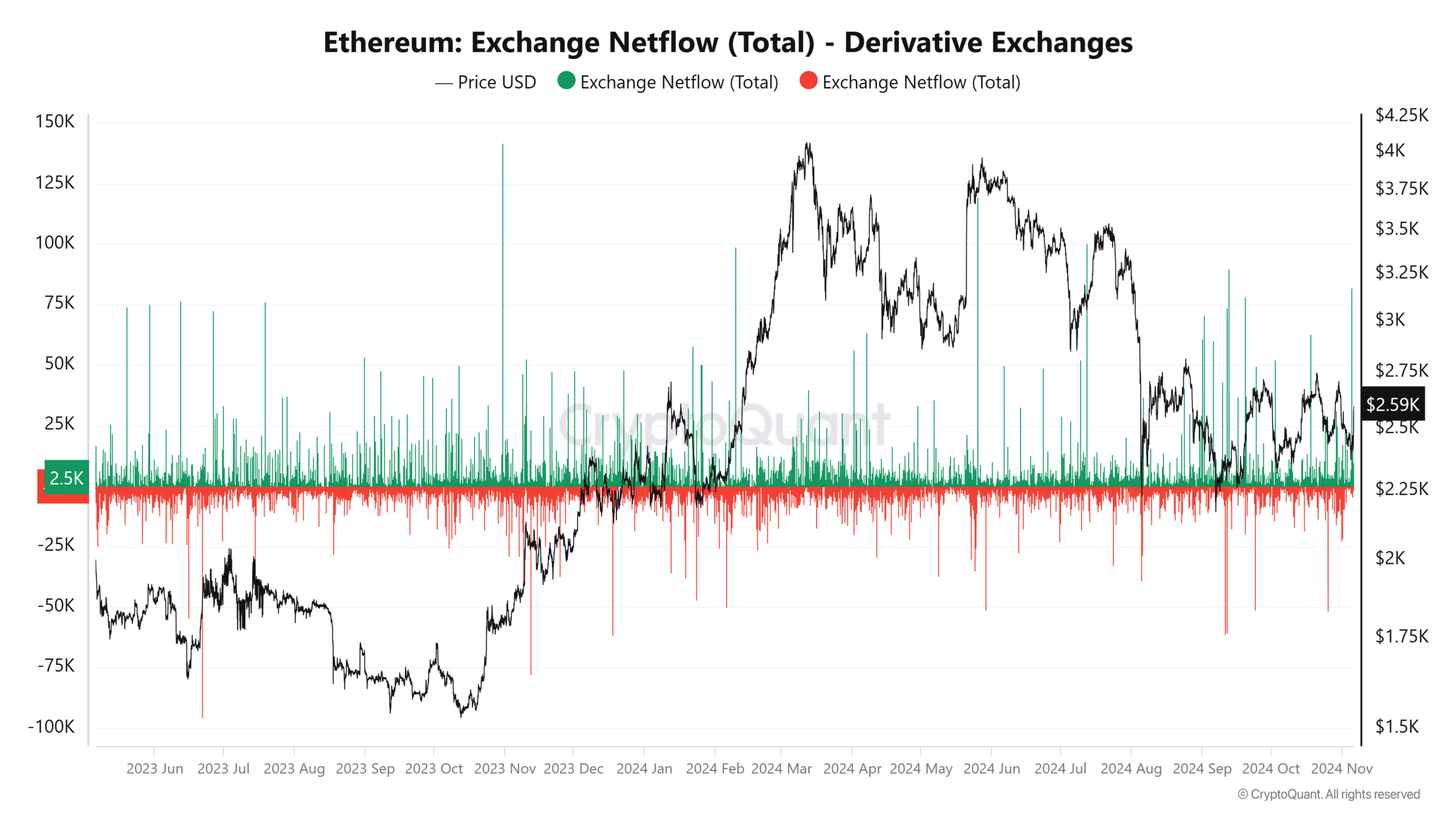

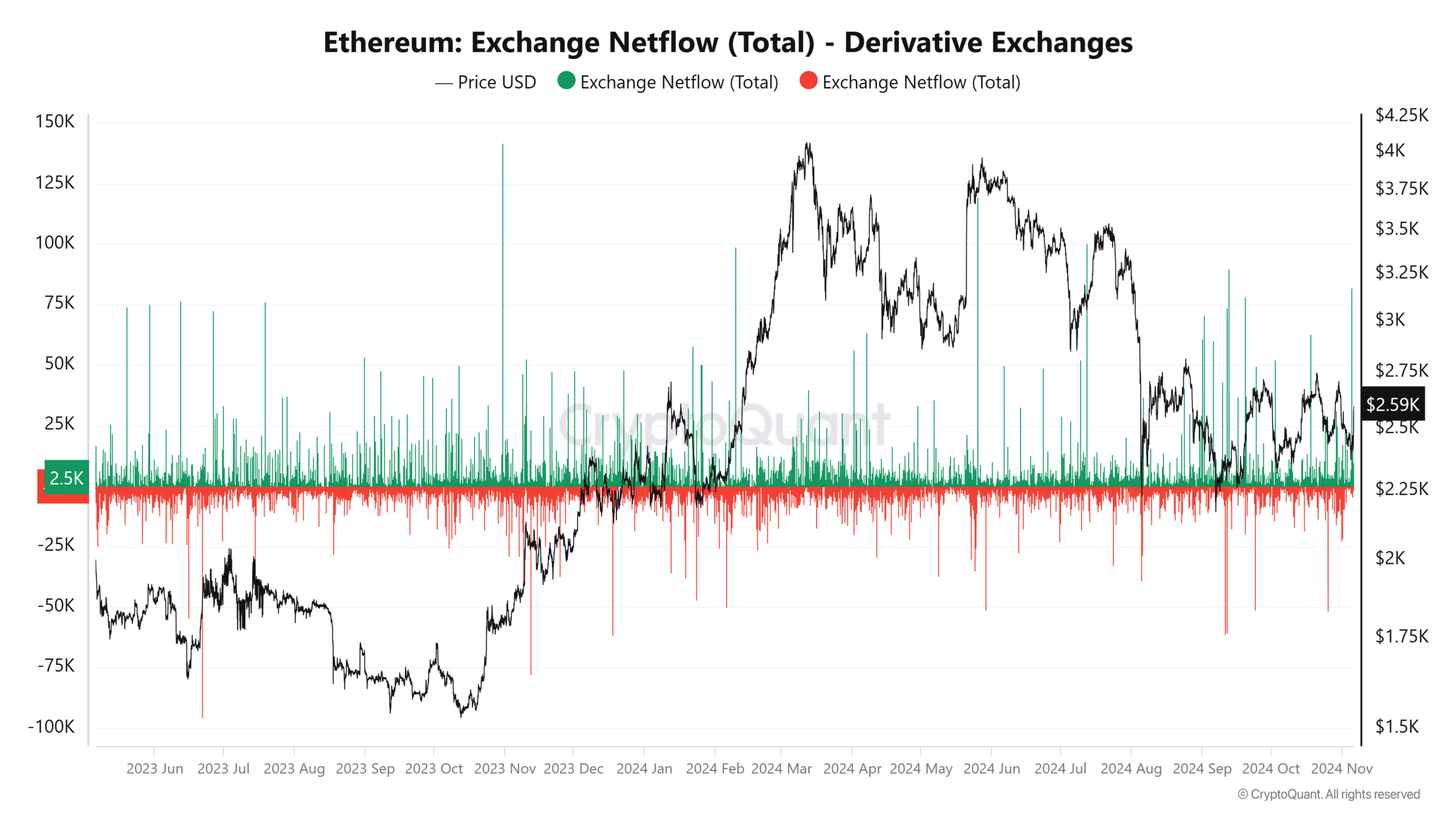

In recent days, Ethereum’s net flow on derivatives exchanges has seen a significant spike. Netflow, which measures the balance of assets flowing into and out of exchanges, serves as an important gauge of investor sentiment.

Positive net flows generally indicate accumulation, which indicates that investors are moving assets to exchanges for the purpose of trading or leveraging positions.

On the other hand, negative net flows often indicate long-term ownership, transferring assets from the exchanges.

Source: CryptoQuant

Net flows recently spiked, with approximately 82,000 positive net flows recorded per data CryptoQuant. The recent spike coincides with increased price volatility.

Historically, such spikes have led to short-term price changes, as larger currency deposits often signal that traders are preparing for big moves.

This behavior suggests that investors are positioning themselves for possible shifts in Ethereum’s price, and possibly bracing for bigger swings.

Ethereum’s price reaction to previous netflow increases

A look back at Ethereum’s net flow patterns reveals an interesting trend: spikes in currency inflows are often accompanied by significant price shifts.

For example, during previous rallies this year, periods of increased net flows were accompanied by sharp price increases as traders positioned themselves to capture profits or limit risk.

However, netflow spikes do not always indicate bullish sentiment; they can also create volatility as traders prepare for price swings in either direction.

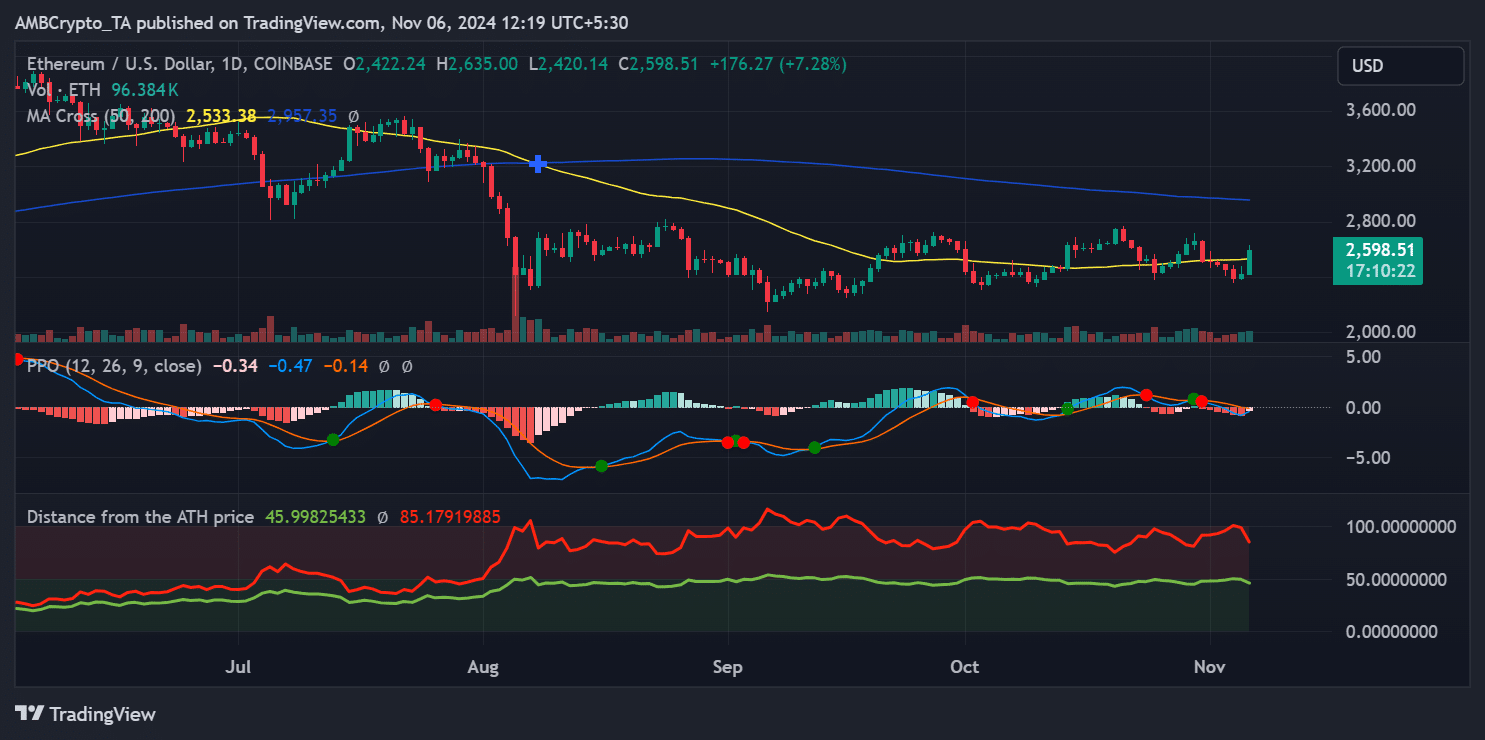

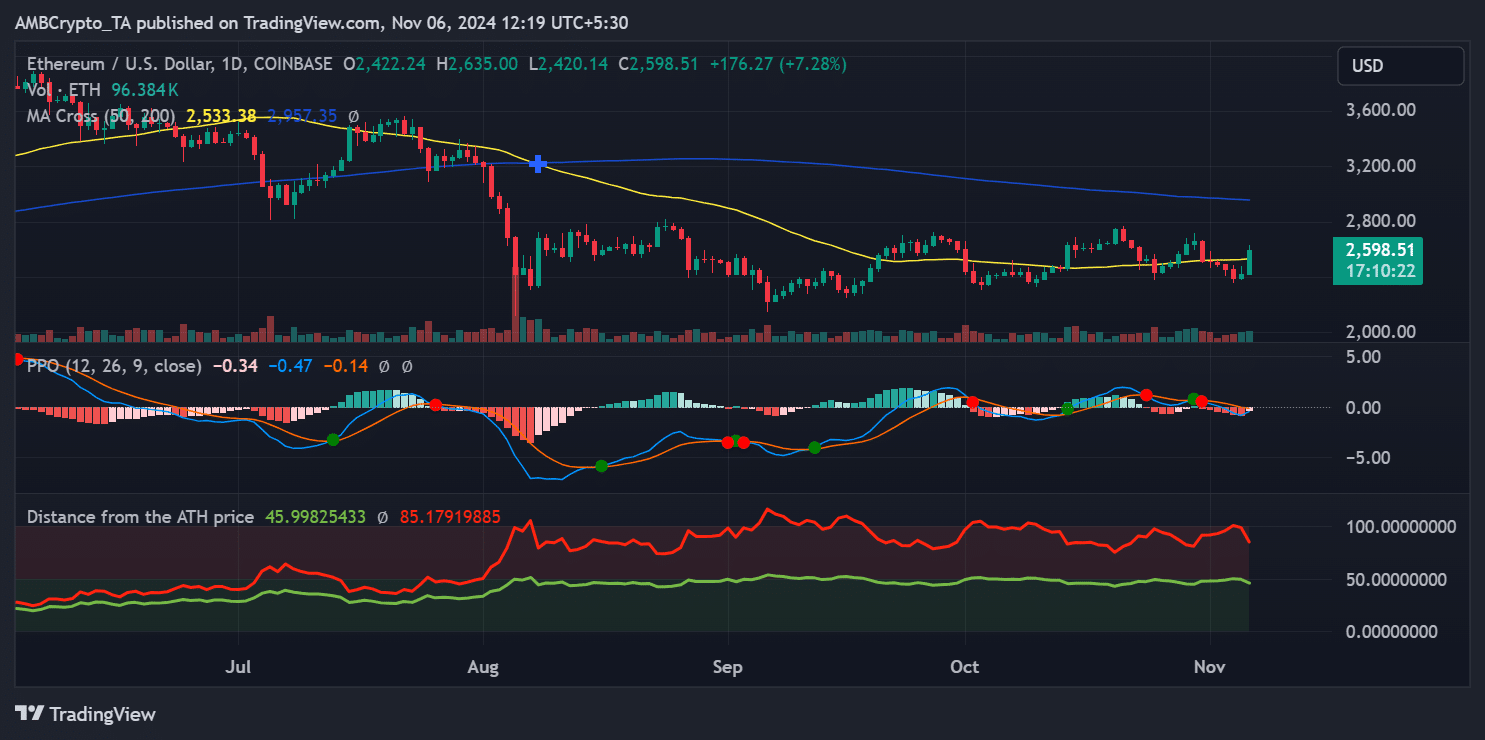

Currently, Ethereum is trading around $2,600, well below its ATH of around $4,800. Despite Bitcoin’s recent rally, Ethereum has yet to reach its all-time highs again.

However, the positive net flow may indicate growing optimism among investors expecting a broader market rally. Whether ETH can maintain buyer interest in current conditions will be critical to its near-term trajectory.

Bitcoin’s ATH and implications for Ethereum

Bitcoin’s recent surge above $75,000 has created a new ATH, fueling excitement across the market. This performance has led to a ripple effect with potential implications for Ethereum’s price direction.

While ETH remains at $2,600, well below its ATH, technical indicators point to paths that could support an uptrend.

To better understand ETH’s position, the Distance from ATH indicator shows that ETH is still about 45% below its peak. This significant gap suggests that ETH has room for growth if market sentiment remains positive.

Historically, BTC’s ATH has often paved the way for altcoin rallies as investors look to diversify their gains from BTC into other key assets such as ETH. Given ETH’s tendency to follow Bitcoin’s lead, it could close this gap if favorable conditions persist.

Source: TradingView

Additionally, the Percentage Price Oscillator (PPO) also provides insight into Ethereum’s momentum relative to its historical price.

The PPO is currently just below zero, indicating a decline in bearish momentum. Should the PPO enter positive territory, it would strengthen the case for a bullish trend, suggesting that ETH could regain strength and face upward price pressure.

Ethereum/BTC pair stability and independent strength

The Ethereum/Bitcoin (ETH/BTC) pair is another valuable benchmark for assessing ETH’s performance. Currently, the ETH/BTC ratio remains stable, implying that ETH retains its value against BTC even as BTC reaches new highs.

If the ETH/BTC pair strengthens, it could indicate that ETH is attracting investors independently of BTC’s moves, potentially paving the way for a more continued rally.

Realistic or not, here is the ETH market cap in terms of BTC

A broader revival of interest in Altcoin?

The combination of increasing Ethereum netflow on derivatives exchanges and Bitcoin’s ATH suggests a renewed interest in altcoins. Given the historical correlation between BTC and ETH, ETH could follow BTC’s upward momentum if BTC’s rally continues.

While Ethereum is still some distance from its ATH, recent net flow data indicates growing market interest and possible volatility ahead.