- WIF rose +20% in 24 hours amid a broader market rally on US Election Day.

- Within twelve hours, almost $2 million worth of short positions were liquidated

Crypto markets rose during US election day Bitcoin [BTC] rising to a new all-time high (ATH), while a Trump victory seemed clear. Memo coins pumped harder, with dog hat [WIF] an increase of 20% in 24 hours.

At the time of writing, there was already a long fuse on the daily candlestick, indicating that the pump could see some cooling on Election Day. But what’s next for one of the top memecoin gems after the US elections?

The next step of WIF

![dog hat [WIF]](https://ambcrypto.com/wp-content/uploads/2024/11/WIFUSDT_2024-11-06_10-03-42.png)

![dog hat [WIF]](https://ambcrypto.com/wp-content/uploads/2024/11/WIFUSDT_2024-11-06_10-03-42.png)

Source: WIF/USDT, TradingView

On the price charts, WIF followed the textbook pullback scenario and eased the gold zone on the Fib retracement tool (50%-61.8% Fib level, highlighted in white). The support zone of $1.2 – $2.0 (white) caused the final +20% pump.

With some traders potentially booking election gains from the rally, a cooldown could drag the WIF towards $2,245 (38.6% Fib level) or back into the gold zone. After that, the memecoin could continue its upward trend.

In such a scenario, sidelined bulls could look for a return to the market at the aforementioned support levels.

That said, a close above $2.5 could accelerate WIF to October highs near $3, provided BTC maintains the bullish streak.

Exposure to WIF whales

![dog hat [WIF]](https://ambcrypto.com/wp-content/uploads/2024/11/Binance-USD%E2%93%88-M-Perp_WIFUSDT_2024-11-06_10-26-17.png)

![dog hat [WIF]](https://ambcrypto.com/wp-content/uploads/2024/11/Binance-USD%E2%93%88-M-Perp_WIFUSDT_2024-11-06_10-26-17.png)

Source: Hyblock

That said, the run-up to the election seemed to be driven by major players. According to Hyblock, whales added huge WIF positions on November 5, as shown by the Whale vs Retail Delta indicator.

This was at odds with the significant reduction in risk before the election, when they reduced their positions and undermined WIF. Should whale interest in the memecoin continue, the rally could rise further.

Read dog hat [WIF] Price prediction 2024-2025

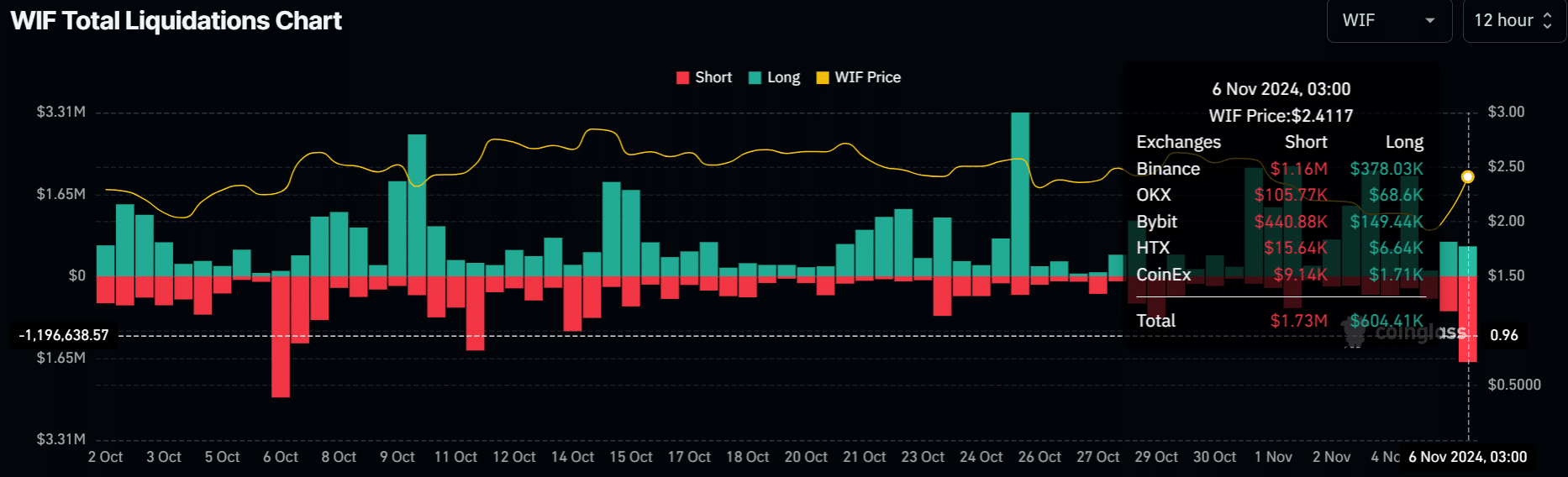

The aforementioned bullish outlook was also supported by the massive liquidation of short positions. In the last 12 hours, before the time of writing, $1.7 million in short positions (bets on WIF price drop) were wiped out.

Source: Coinglass

In short, it seemed like the bears had no edge on the market, at least in the short term, while election enthusiasm was at a fever pitch. If so, any WIF pullback could be a great buying opportunity if the uptrend continues.