- ETF analysts expect Bitcoin ETFs to surpass gold ETFs in the coming years.

- BTC ETFs see outflows for the third day in a row.

In a recent one interview Together with Natalie Brunell, Eric Balchunas, senior ETF analyst at Bloomberg, predicted an impressive future Bitcoin [BTC] ETFs.

The analyst predicted a substantial growth trajectory, stating:

‘They are [BTC ETFs] Over the years we will pass gold ETFs and perhaps triple gold ETFs.”

The lead of Bitcoin ETFs over gold ETFs

Gold has traditionally been the asset of choice for investors looking for a safe haven in times of economic uncertainty. It provides stability as a hedge against inflation and currency devaluation.

However, Balchunas explained that Bitcoin adds a completely different dimension to this space. Gold’s stable but slow-moving value, while attractive to some, lacks the “spice” that many modern investors crave.

While Bitcoin’s volatility is often seen as a drawback, it is actually part of its appeal in today’s market, the analyst noted. It serves as a high-beta, high-risk investment that is attractive to investors looking for potential growth beyond what gold has to offer.

Bitcoin: The ‘Second Amendment of Money’

Another intriguing concept Balchunas discussed was Bitcoin as the “Second Amendment of money,” a phrase borrowed from author Benjamin Hart.

The analyst explained that just as the Second Amendment in the United States provides a measure of protection for citizens, Bitcoin provides a form of financial sovereignty.

It protects users from government monetary policies and the potential for inflation through excessive money printing.

Balchunas also compared the current state of Bitcoin to a “teenager” with a rebellious nature, a teenager who could eventually grow up, but currently brings energy, volatility and a bit of unpredictability. He joked,

“It’s teen gold. If you could take the 4,000-year-old gold and go back to when it was 16 years old, it probably behaved the same way.”

How are Bitcoin ETFs doing?

Meanwhile, Balchunas noted that while he and fellow analyst James Seyffart forecast $10 to $15 billion in net flows for the first year, the total has already reached nearly $24 billion.

He acknowledged that Bitcoin ETFs,

“It certainly exceeded our expectations.”

Balchunas highlighted that this growth rate was remarkable, especially compared to gold ETFs, which took four to five years to reach a similar level of return. inflow.

The analyst also stated that while inflow numbers could change, especially if external factors such as the upcoming US election or an economic downturn were to impact the market, Bitcoin ETFs have shown resilience.

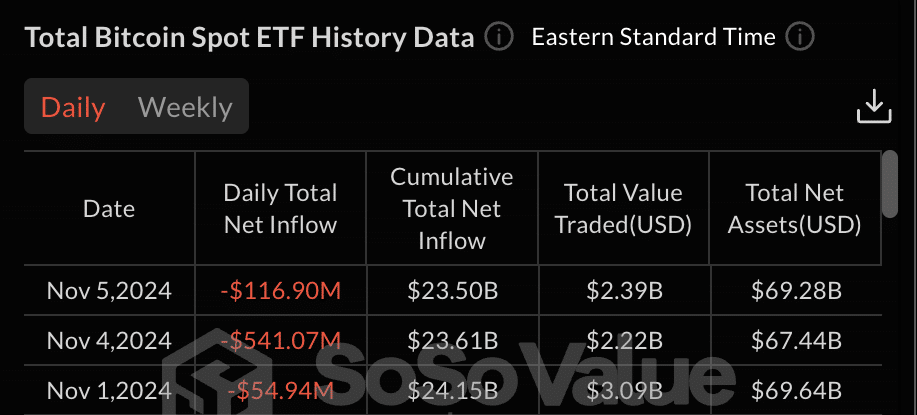

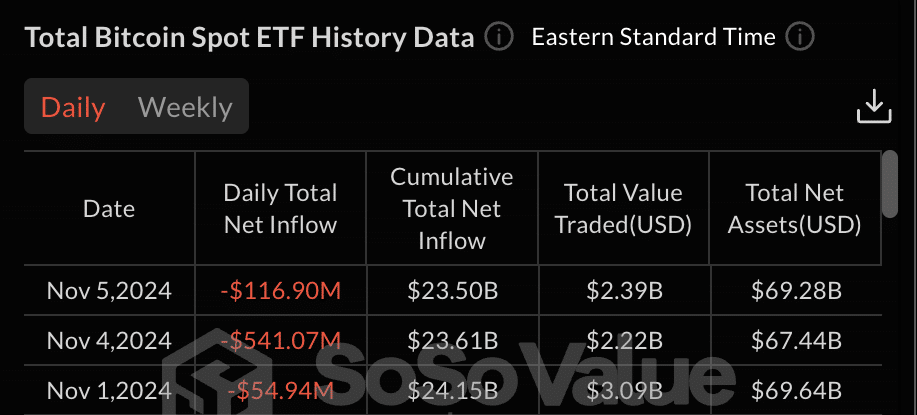

Despite this growth, BTC ETFs are not immune to fluctuations. Facts of SoSo Value revealed that ETFs have seen three straight days of outflows since November.

On November 5, total daily net outflows were $116.90 million.

Source: SoSo value

It is worth noting that total assets under management of BTC ETFs remain robust at $69.28 billion, which represents approximately 5.04% of Bitcoin’s total market capitalization.