- Polkadot continued its long-term downward trend, hovering around its multi-year lows

- For DOT to regain a bullish outlook, it must find a decisive close above the 20-day and 50-day EMAs

From Polkadot [DOT] recent price movements showed a steep bearish trend. The altcoin approached its long-term support level and returned to 2020 levels.

DOT was trading around $3.85 at the time of writing, up almost 2% in the past 24 hours. However, the overall trend remained bearish. Given continued selling pressure, can buyers find the momentum to reclaim key resistance levels?

DOT’s fight is approaching a major level of support

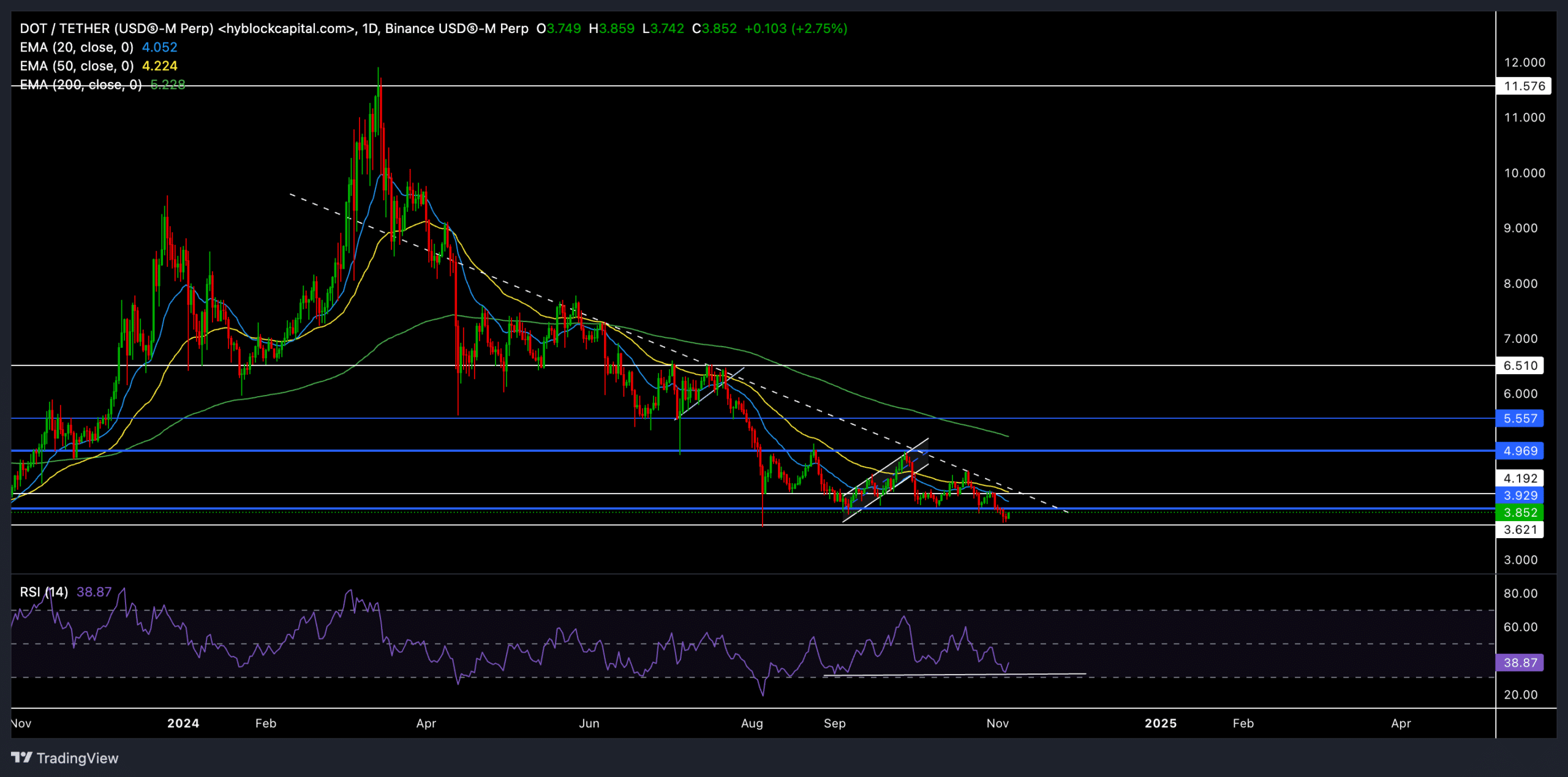

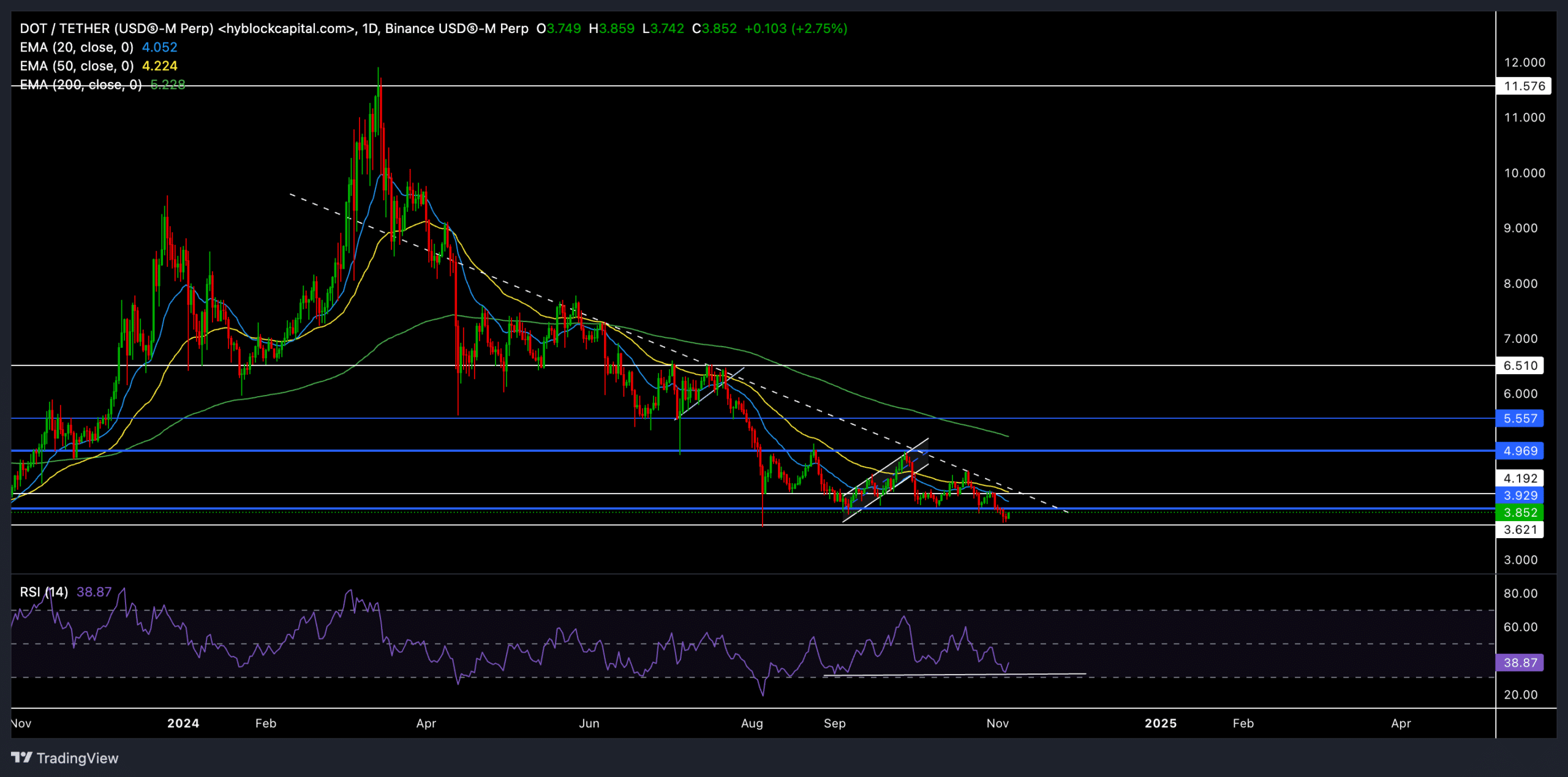

Source: TradingView, DOT/USDT

DOT has fallen steeply in recent months, consistently failing to break above the $4.9 resistance level. At the time of writing, the altcoin was trading well below the 20-day EMA ($4.05), 50-day EMA ($4.22), and 200-day EMA ($5.23).

The repeated rejections of these moving averages and the inability to break the 6-month trendline resistance (white, dotted) have intensified the selling pressure. DOT’s recent decline below the $3.9 support level (now resistance) brought it closer to the multi-year low of around $3.6 – a crucial level to watch.

DOT’s price movements indicated high volatility in the near future. If the altcoin can gather enough bullish momentum to jump back above the $3.9 resistance level, it could test the 20/50-day EMAs. Regaining these EMAs is crucial for buyers to gain a near-term advantage and could potentially open the way to test higher resistance at $4.9.

However, the bearish outlook remained strong due to the overall downward trend. A decline below the key support at $3.6 could accelerate the decline and push DOT to explore new lows.

Moreover, at the time of writing, the RSI was reading 40. Here it is worth noting that the recent higher lows of the RSI indicated a bullish divergence with the lower lows of the price action.

Important levels to watch

Support: The immediate support level was found at $3.6 – a multi-year low that is psychologically crucial. If this level becomes lower, it could lead to a further decline.

Resistance: The first resistance level to watch was $3.9, followed by the 20-day EMA of $4.05 and the 50-day EMA of $4.22. A decisive move above these levels could give DOT buyers a chance to regain some market control.

Derivatives data revealed THIS

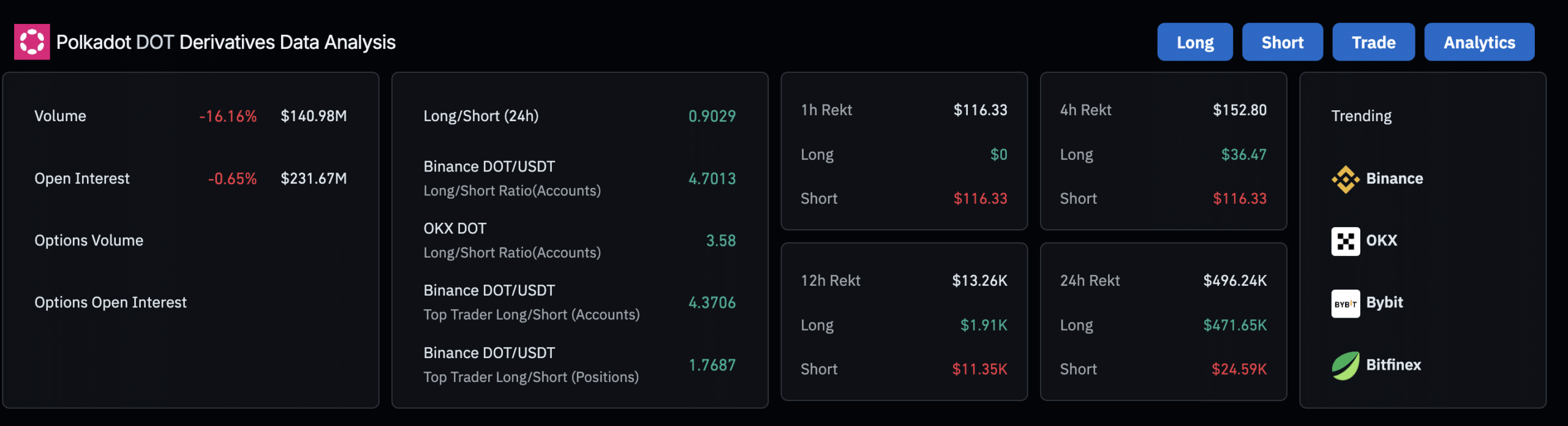

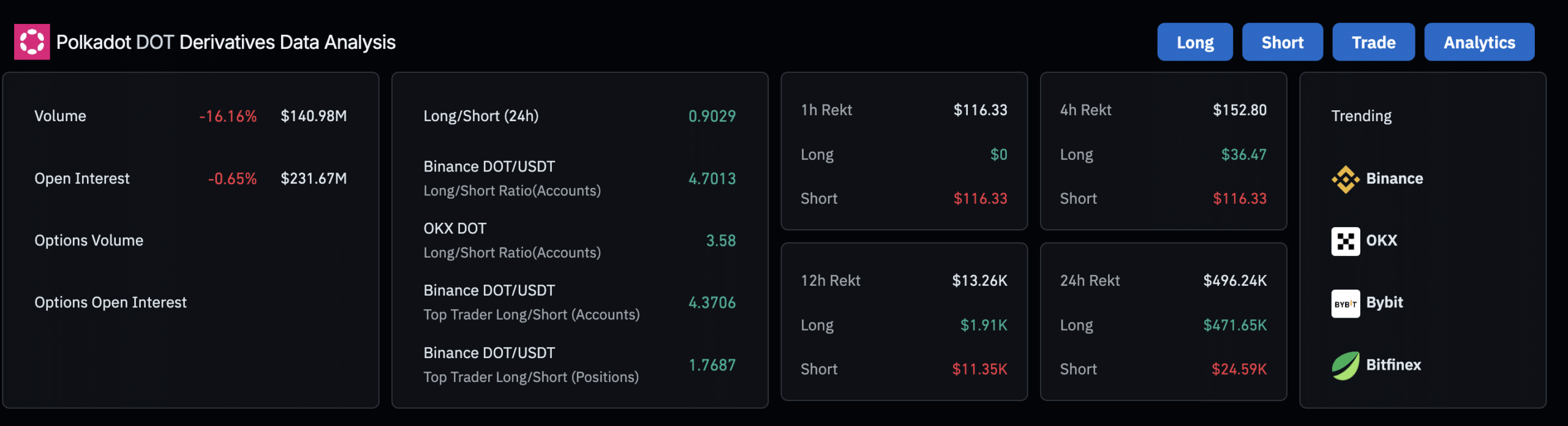

Source: Coinglass

Derivatives data showed mixed feelings among DOT traders. The 24-hour long/short ratio was 0.9029, which is slightly in favor of short positions and indicates some caution among traders. However, Binance and OKX’s long/short ratios were significantly bullish, with Binance at 4.7013 and OKX at 3.58 – a sign that traders on these platforms may be hopeful of a recovery.

Traders should keep a close eye on broader market trends, especially Bitcoin’s movements.

![Polka dot [DOT] traders can use THIS strategy to navigate DOT’s downturn](https://free.cc/wp-content/uploads/2024/11/DOT-1-1000x600.webp)