- Bitcoin has hit its March high, pushing it towards a new ATH on the charts

- Statistics suggested that the crypto could potentially reach as high as $80,000

Bitcoin [BTC] is in the news today after briefly hitting a new all-time high (ATH) of over $75,116 on election night in the United States. Despite some depreciation, the cryptocurrency was still trading just below the aforementioned level at the time of writing, valued at $74,791.

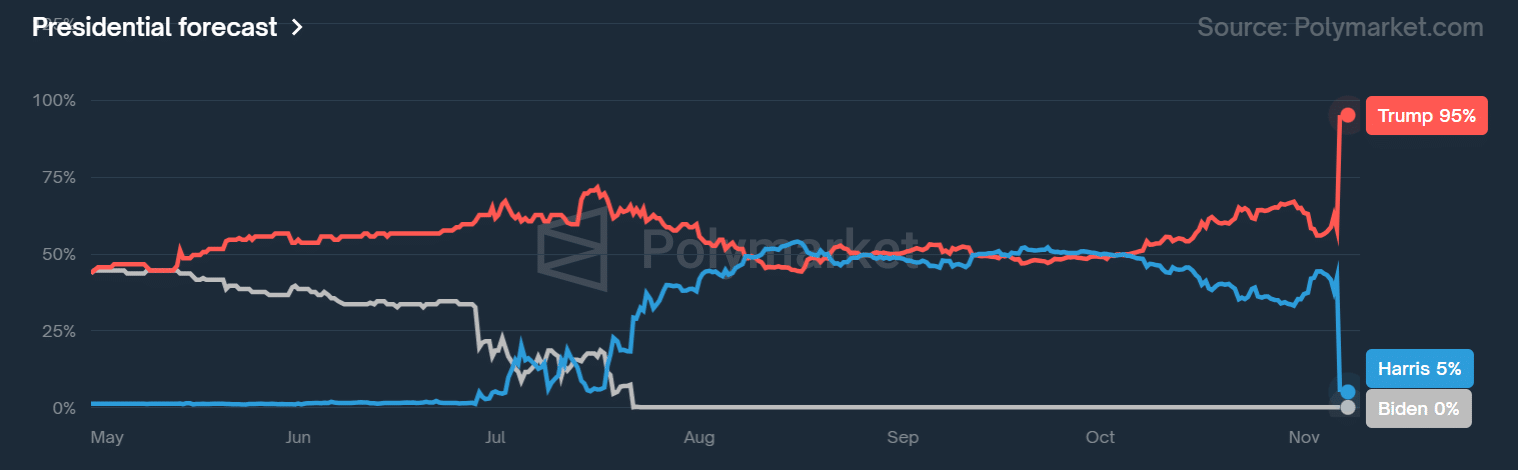

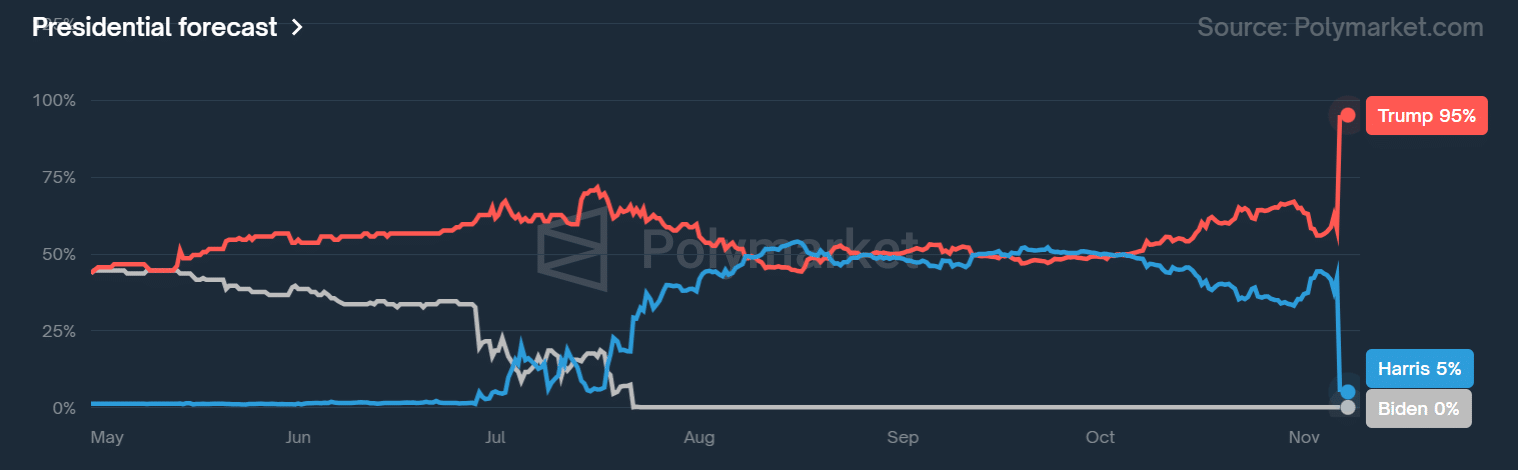

That’s not all, because the chances of a likely Donald Trump victory rose above 90% on Polymarket. This confirmed some of AMBCrypto’s election goals projected based on the results of the American elections.

Source: Polymarkt

Based on these preliminary results, the trend seemed to point to a likely bullish outcome for the markets, should Trump be declared the official winner.

However, now that BTC is above $70,000, is it too expensive to bid at these levels, or can latecomers still benefit? Let’s explore the key rating metrics and network metrics for some answers.

What’s next after BTC’s new ATH?

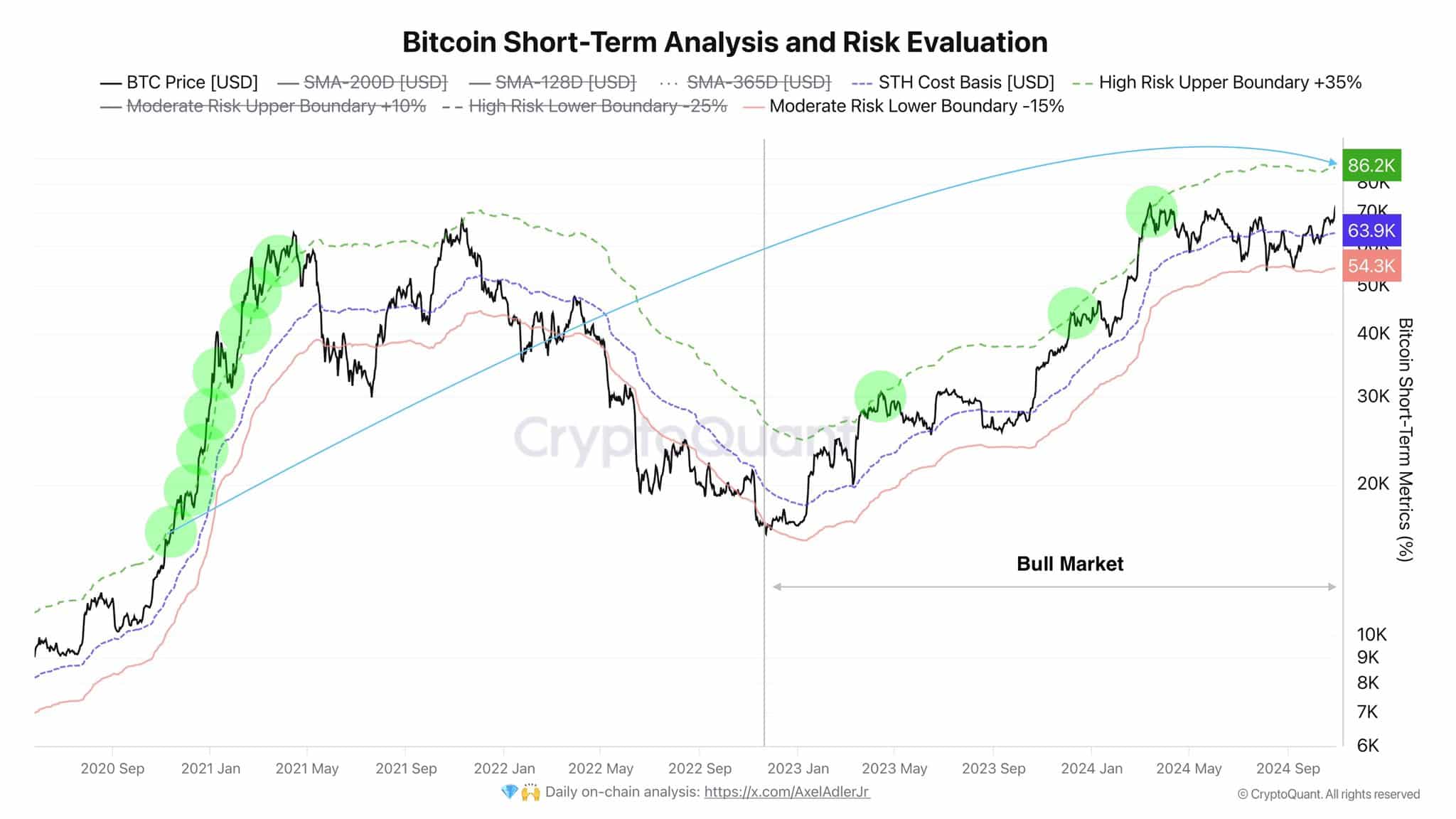

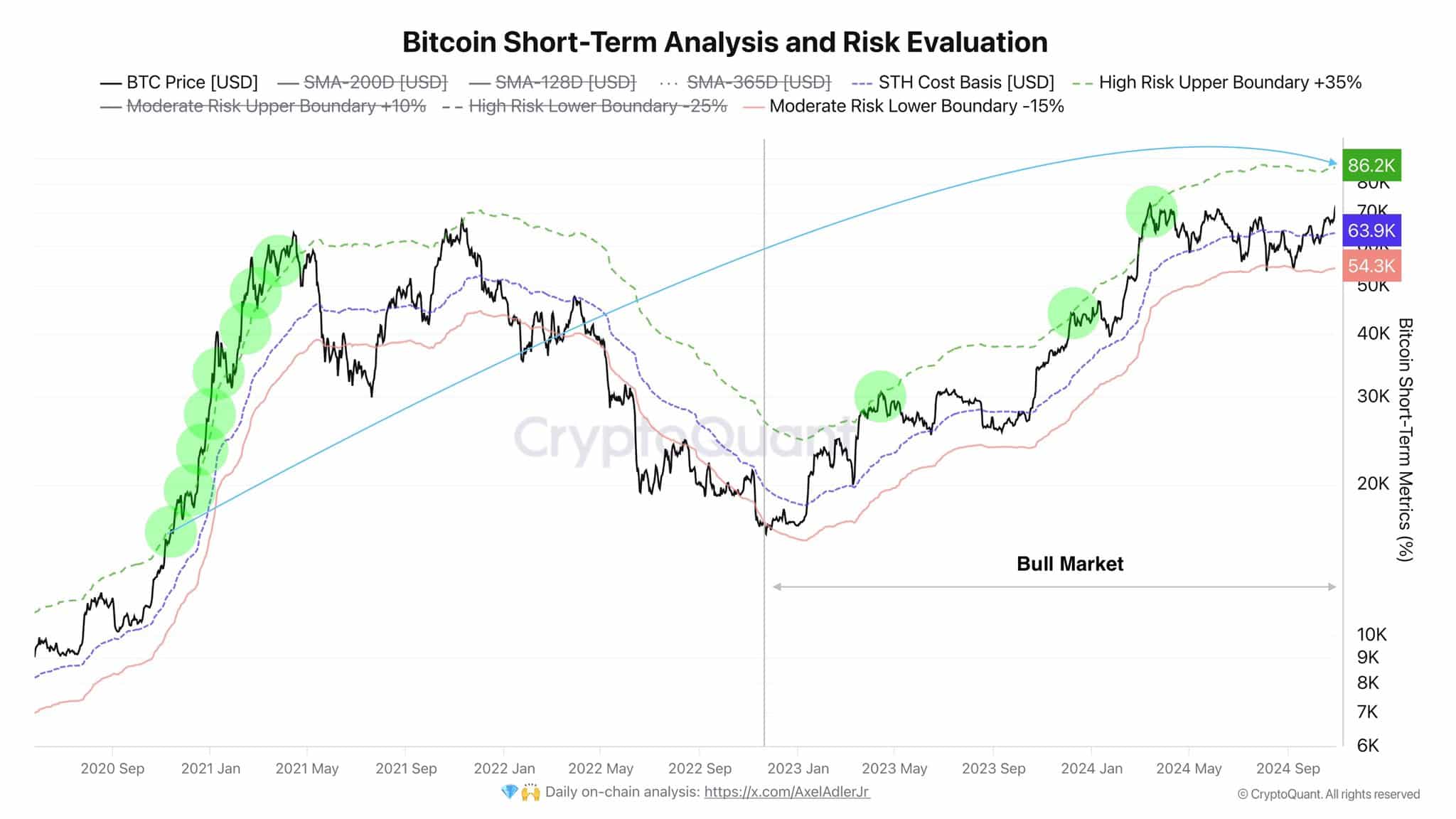

Based on Bitcoin’s short-term risk assessment, CryptoQuant analyst Axel Adler recently said projected that $86,000 could be the next target. He said,

“At the $86.2K level, the fate of the bull run will be decided. If the price breaks above this point and forms strong bullish momentum, we will finally see what everyone has been waiting for.”

Source: CryptoQuant

In 2020, BTC had a parabolic rally as it broke above the risky upper limit. This could be the most important level to watch and break in 2024.

Huge space for an additional BTC rally

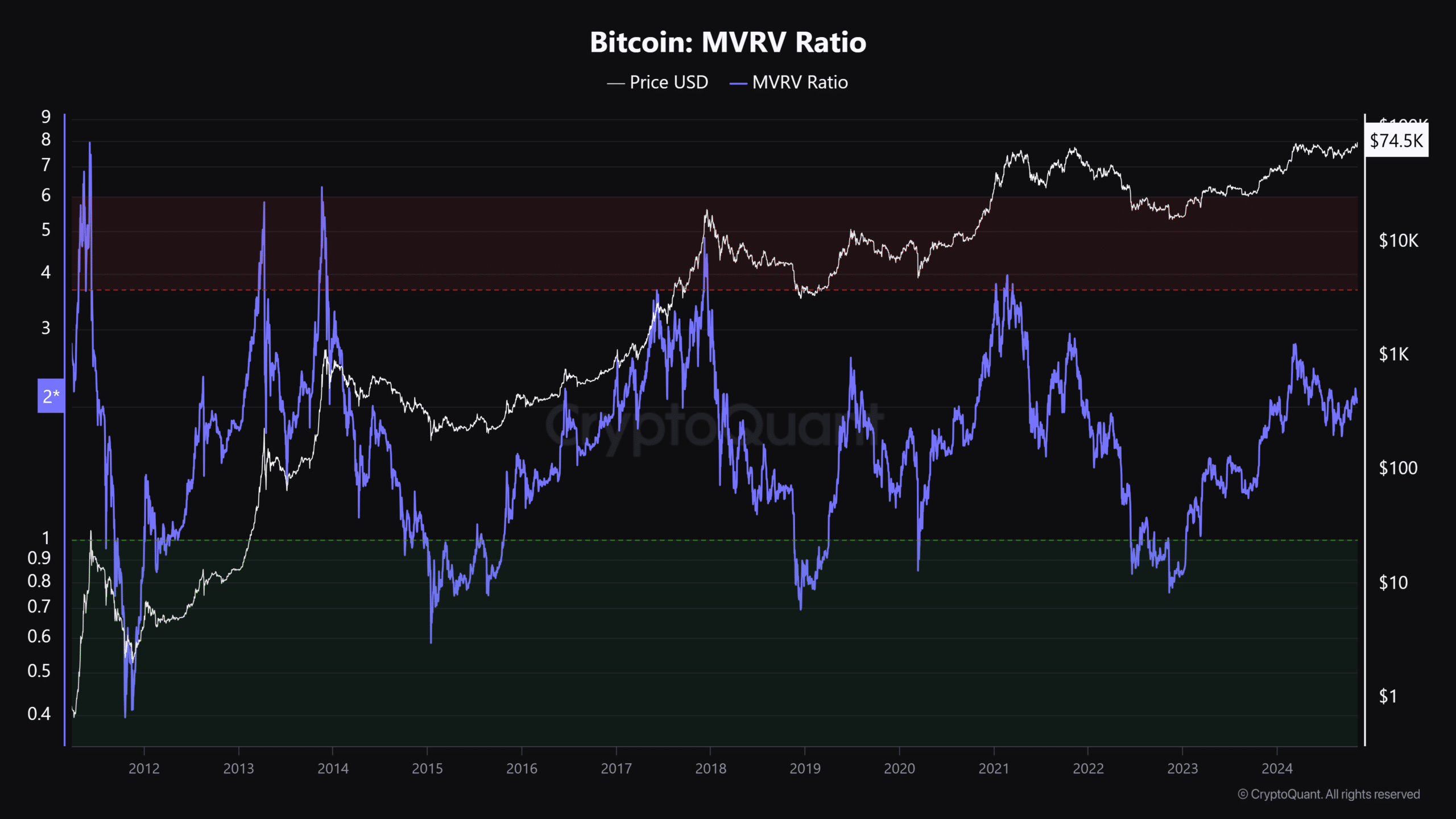

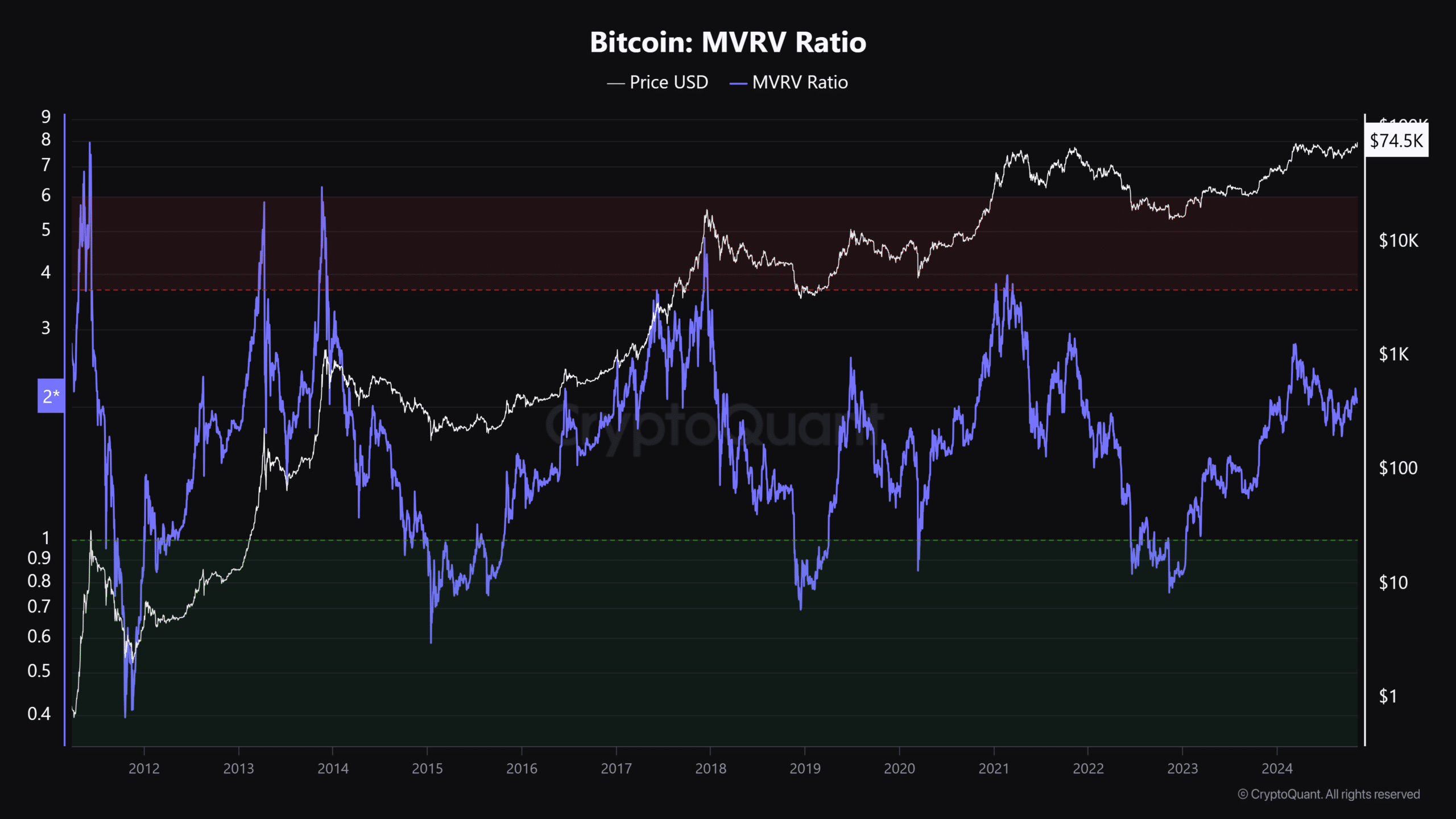

Another valuation metric, the MVRV (market value versus realized value) ratio, also indicated huge growth potential. MVRV tracks whether BTC is cheap (undervalued) or too expensive (overvalued).

Despite its new ATH, BTC was still cheap according to the MVRV and stood at 2. This seemed to mirror the patterns of 2017/2020, just before the explosive runs. In most cases, an MVRV ratio of 4 (red) is considered overheated or overvalued, while 1 and below is considered cheap.

Source: CryptoQuant

Read Bitcoin [BTC] Price forecast 2024-2025

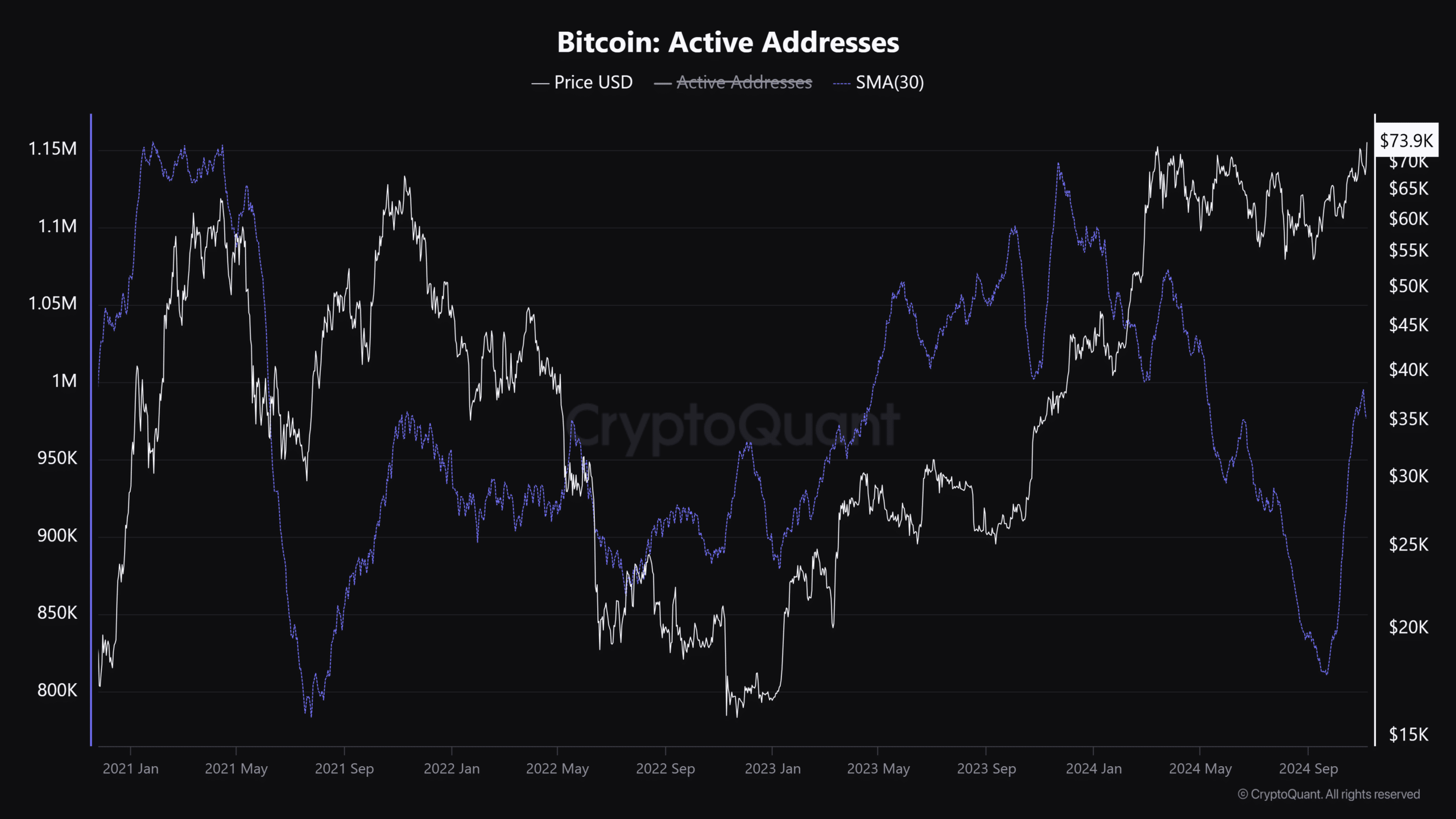

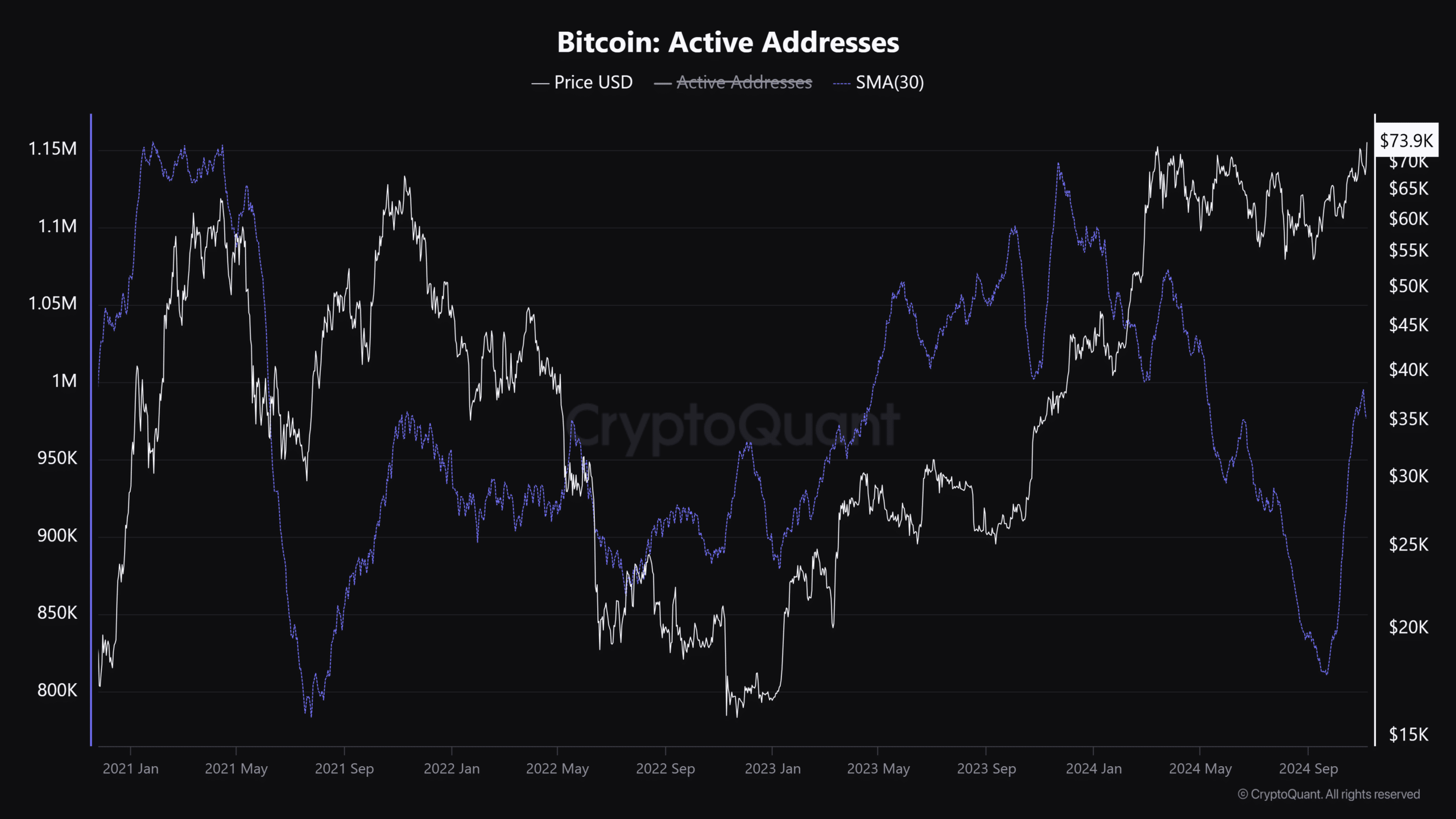

Finally the network growth also looked great for Bitcoin’s additional rally. Daily active addresses returned from their lows since September, with the same increase to the 1 million mark – a sign of increased demand and market interest for BTC.

Source: CryptoQuant

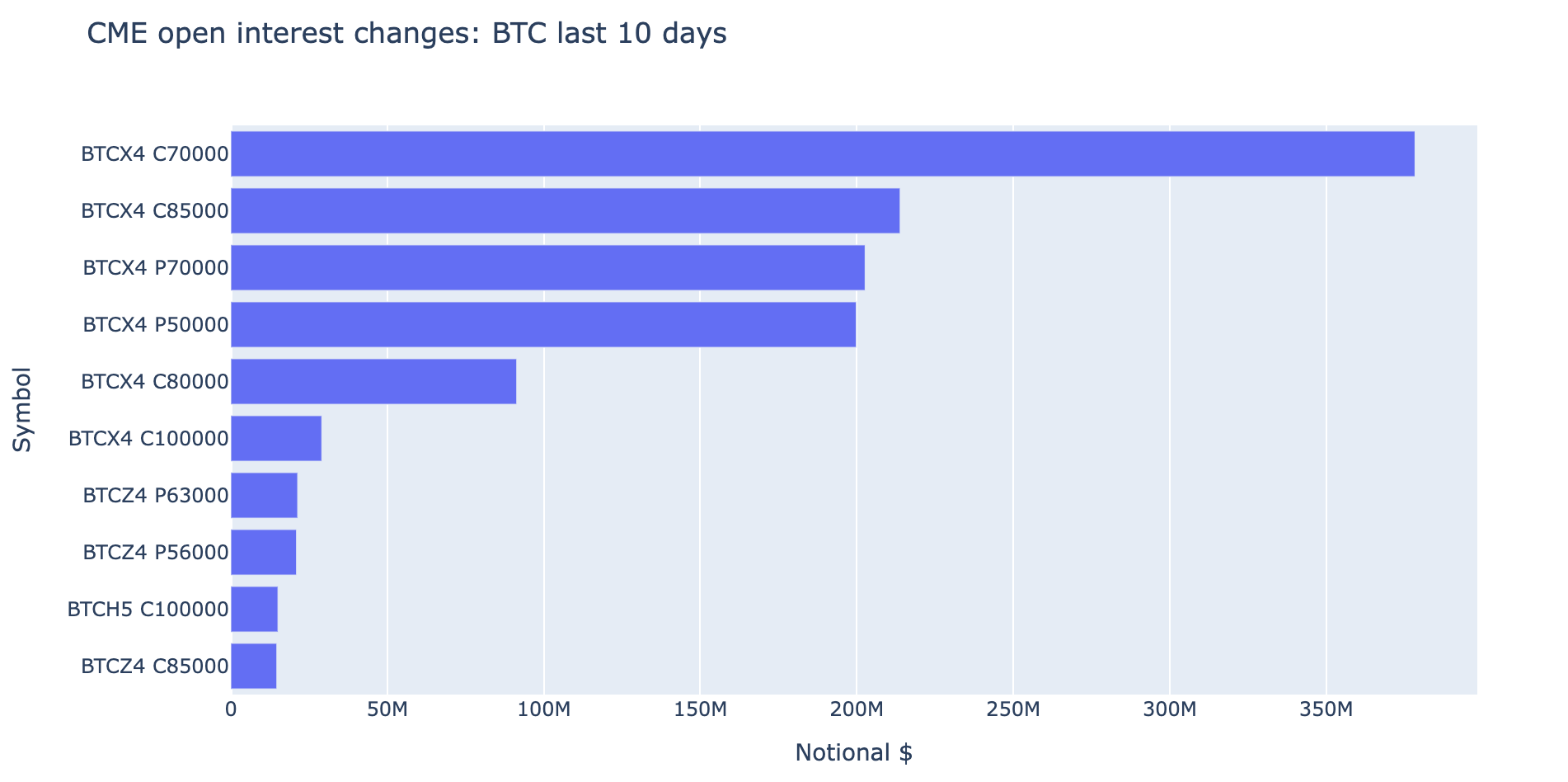

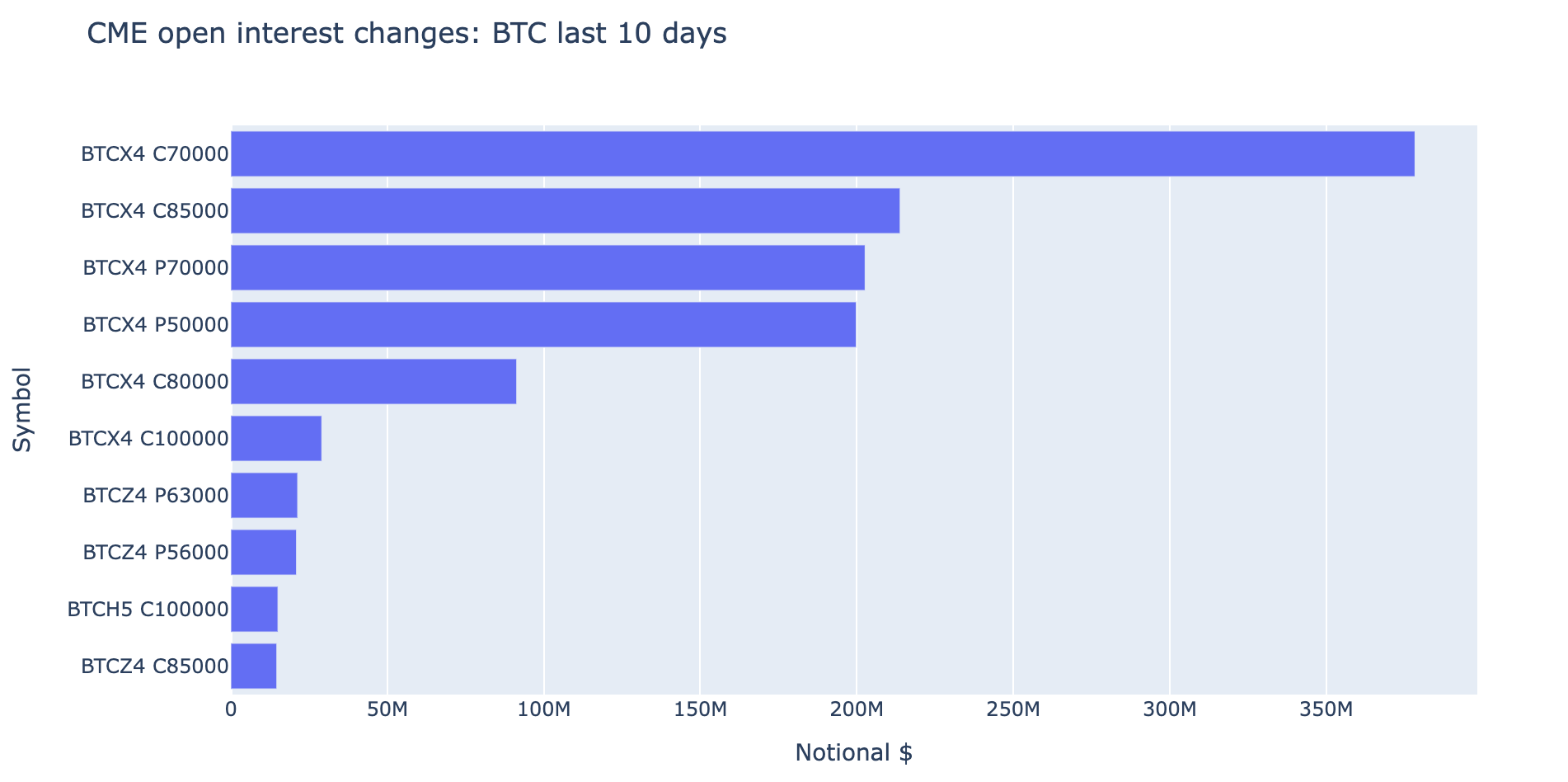

In the options market, after the $70,000 level had already been reached, major players placed big bets on $80,000 and $85,000 targets for November, based on the recent inflows on CME BTC Futures.

However, at the time of writing, there were still protective bets (downside protection) at $50,000, probably if Kamala wins, as noted options trader Peter Stewart says. noted. He said,

“CME added a similar fictitious clip (but a lower premium) to 85k calls from November 29, and also a clip from 80k calls from November 29. On the protective side, $200 million worth of Nov 29 70k-50k Put spreads were purchased.”

Source: CME Futures

In conclusion, statistics and options data indicated that the +$80,000 target could be likely in the medium term. However, any negative macroeconomic developments or a Kamala Harris victory could dent or delay these bullish projections.