- Gox FUD Threatens to Lower Bitcoin Prices Despite Latest Recovery Efforts.

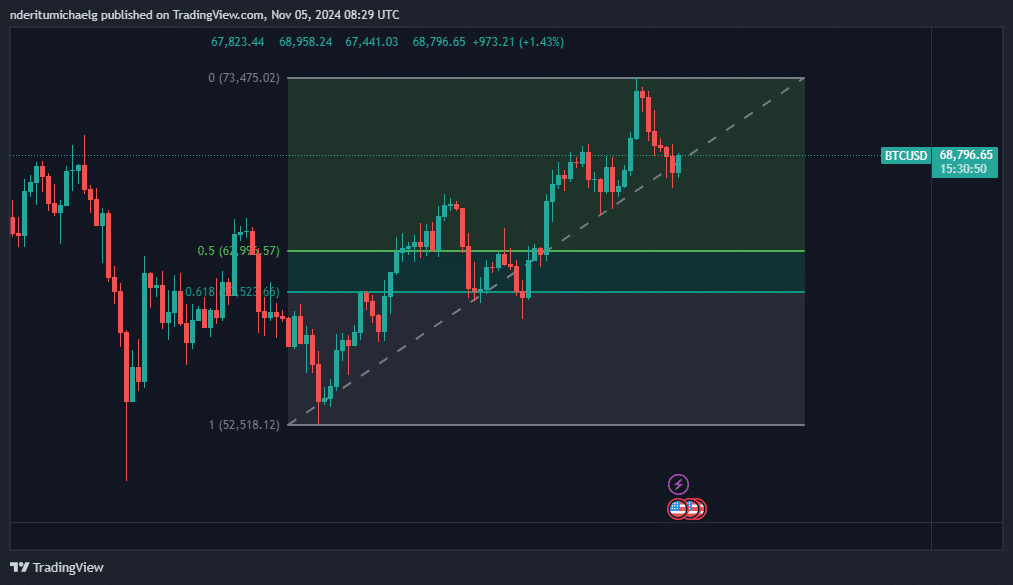

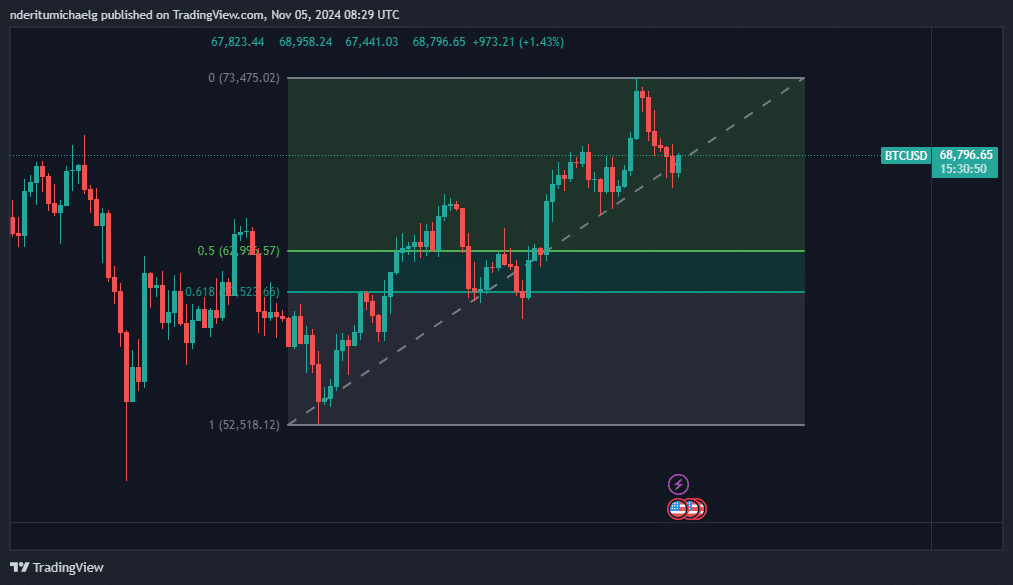

- A look at the next potential Fibonacci price bottom, if BTC continues to expand its dominance.

Bitcoin [BTC] experienced six days of consecutive downside. This performance reflected the prevailing cautious sentiment following the US elections, but another FUD event could cause more downside in the coming days.

The wallet with Mount Gox Bitcoin has reportedly transferred 32,371 BTC to an unknown wallet. The value of the transferred coins was estimated at approximately $2.9 billion.

Many analysts had expected a bearish outcome when Mount Gox’s payout would eventually occur.

The bearish expectations are mainly due to the fact that the holders waiting for payment have been waiting for years and are deep in profits.

So they could be incentivized to sell, potentially causing another big price drop for Bitcoin.

Will Mount Gox FUD Add More Fuel to the Bitcoin Bears?

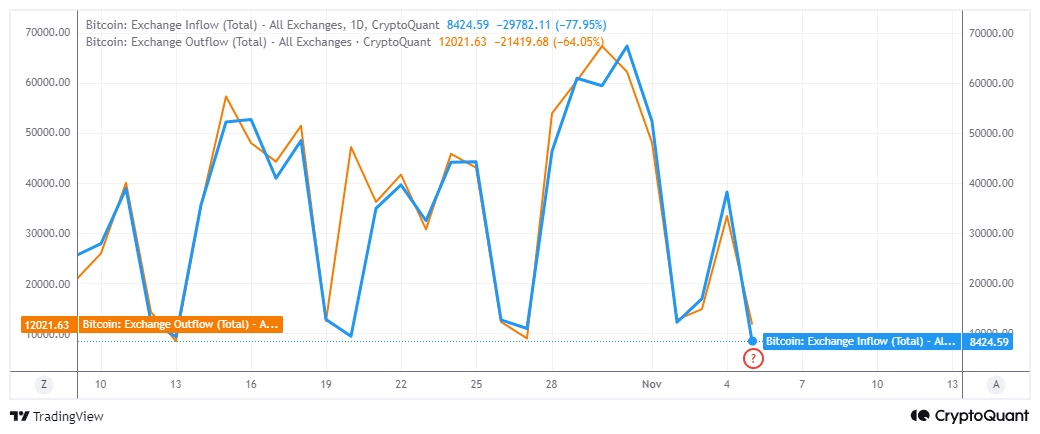

Currency flows have been easing since late October and have since fallen to historically relevant levels.

A pivot could be on the horizon, meaning the battle between BTC’s bulls and bears is about to intensify.

However, the chances of a strong bullish recovery are lower, especially as the Mount Gox FUD increases selling pressure previously fueled by US election concerns.

Bitcoin exchange inflows have recently slowed to 8,424 BTC in the last 24 hours, at the time of writing.

Currency outflows were significantly higher at 12,021 BTC, suggesting the wave of selling pressure was cooling, allowing for some buying at discounted prices.

Source: CryptoQuant

The higher outflows in the currency markets versus inflows were reflected in the form of some recovery in the last 24 hours.

At the time of writing, BTC rebounded to $68,778 after hitting a low of $66,813 the day before. This revival occurred before the Mt. Gox news, hence the possibility that the news could erase the slight confidence returning to the market.

But what should traders expect if the bears resume dominance?

Fibonacci retracement indicated that Bitcoin could find the next major support between $60,000 and $63,000. This is based on the upward trend from the low in September to the last local high in October.

Source: TradingView

Read Bitcoin (BTC) price prediction 2024-25

While it is possible that Bitcoin may retreat towards $60,000, the US election outcome could protect the price from further negative impacts.

A favorable outcome could push BTC back above the $70,000 mark, but that remains to be seen.