- Analysts predict that Trump could push Bitcoin towards $100,000, while Harris could change the crypto landscape.

- Historical trends show Bitcoin’s post-election resilience.

This year’s election cycle has sparked significant discussions about cryptocurrency, leading to intense debates within the crypto community.

Some analysts believe that a Trump victory could give Bitcoin a boost [BTC] towards $100,000. Others think a Harris victory could bring significant changes to the digital asset ecosystem.

Tom Lee sees Bitcoin growth regardless…

Tom Lee of Fundstrat Global Advisors expected a strong market trajectory as we approach 2025, regardless of the outcome of the US presidential election.

Lee foresees a broad market rally across sectors.

Discuss Based on these insights on CNBC, Lee emphasized that solid economic fundamentals and a dovish Federal Reserve support the potential for a year-end market rally.

He noted that once election uncertainties subside, significant cash reserves on the sidelines could come back into the market.

He noted that once uncertainties surrounding the election subside, significant cash reserves that have been on the sidelines could come back into the market.

Furthermore, he added,

“I’m only optimistic in the sense that election uncertainty has caused people to lower their risks and money has been left on the sidelines, but the fundamentals have been good.”

Other analysts share similar sentiments

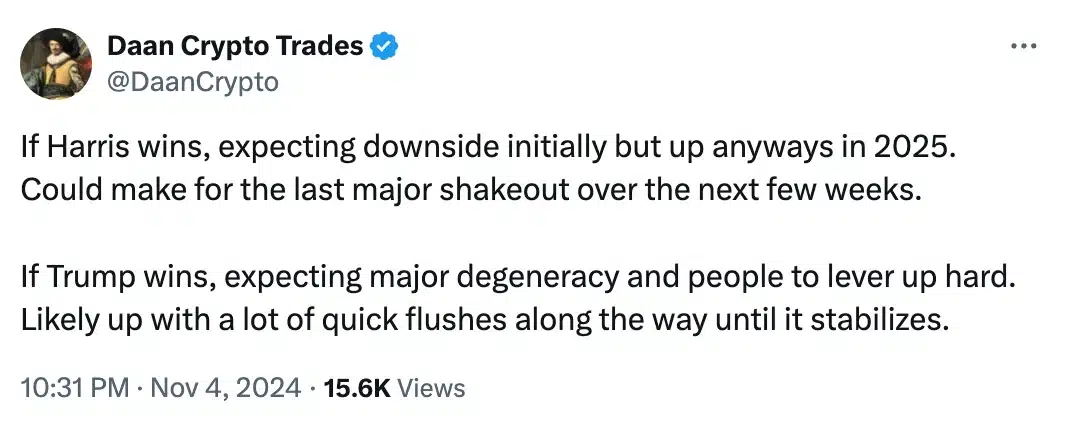

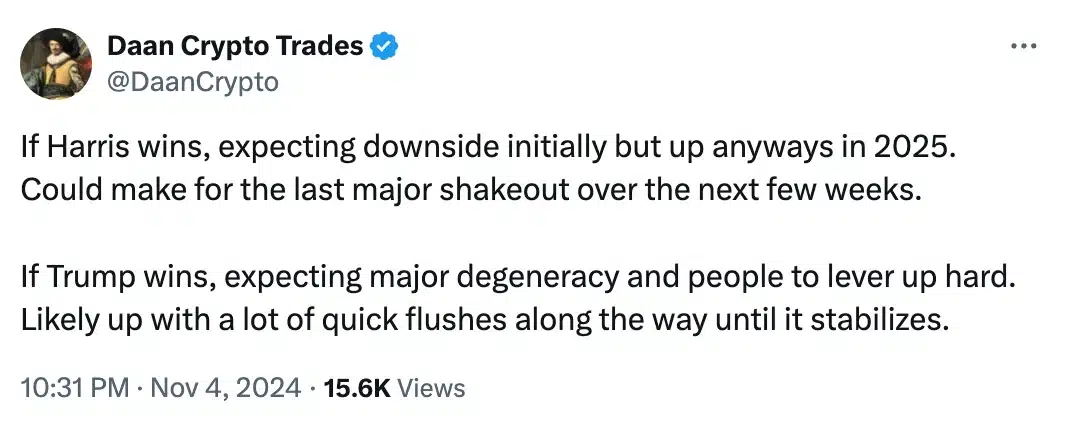

As expected, Lee was not the only one who held such views. Daan Crypto Trades also joined the fray, taking to X (formerly Twitter) and commenting:

“I think there’s a good chance the price will see a move of at least 10% in either direction, depending on who wins the election this week.”

In a follow-up tweet, Daan highlighted how different presidential candidates could lead to different outcomes for the cryptocurrency market.

Source: Dann Crypto Trades/X

Additionally, Bernstein analysts highlighted in a note published on November 4 that:

“Bitcoin remains the most resilient within crypto.”

With this, Bernstein underlined BTC’s ability to withstand political turbulence.

They recognized that the election results could cause significant price movements.

A Trump victory could propel Bitcoin to new heights, potentially reaching $80,000 to $90,000.

However, they warned that a Harris win could lead to an initial decline, potentially pushing BTC’s price down to around $50,000.

What lessons can we learn from Bitcoin’s history?

That said, historical trends indicate that Bitcoin has shown resilience following the US presidential election.

After the 2012 elections, BTC rose almost 12,000% from $11 to over $1,100 in November 2013.

In 2016, the price started around $700 and peaked at around $18,000 in December 2017, indicating an increase of 3,600%.

After the 2020 election, Bitcoin rose 478%, reaching around $69,000 within a year and reaching over $73,000 in March 2024.

While post-election price gains have slowed to 70% and 87% in the past two cycles, an expected 90% drop could imply a rally of around 47.8%. This could bring BTC to around $103,500 by the end of 2025.

At the time of writing, Bitcoin was priced at $68,804.11, reflecting a modest increase of 0.43% in the past 24 hours.

However, it has an experienced reject from 3.18% last week, after the recent peak around $73,000.