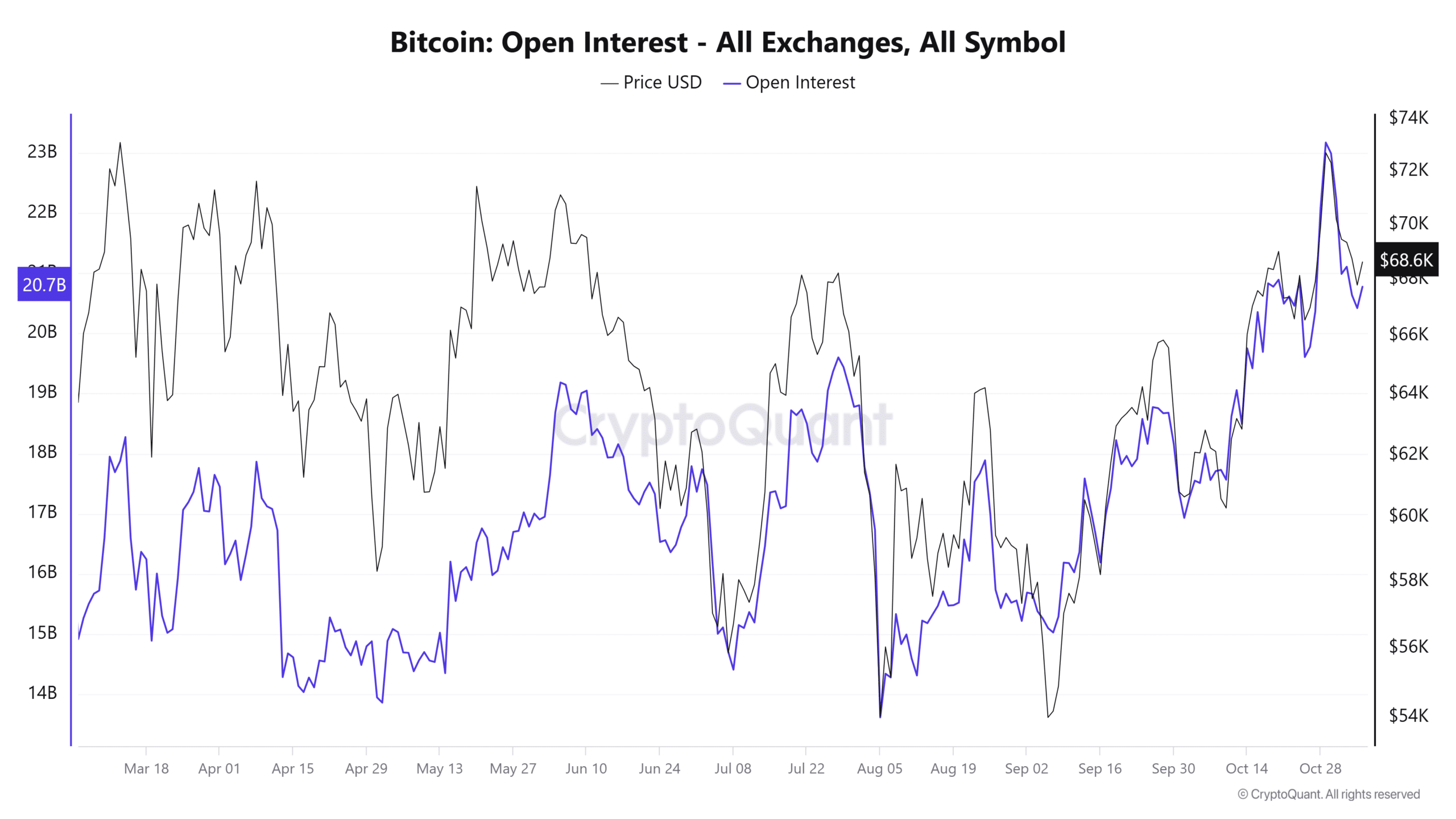

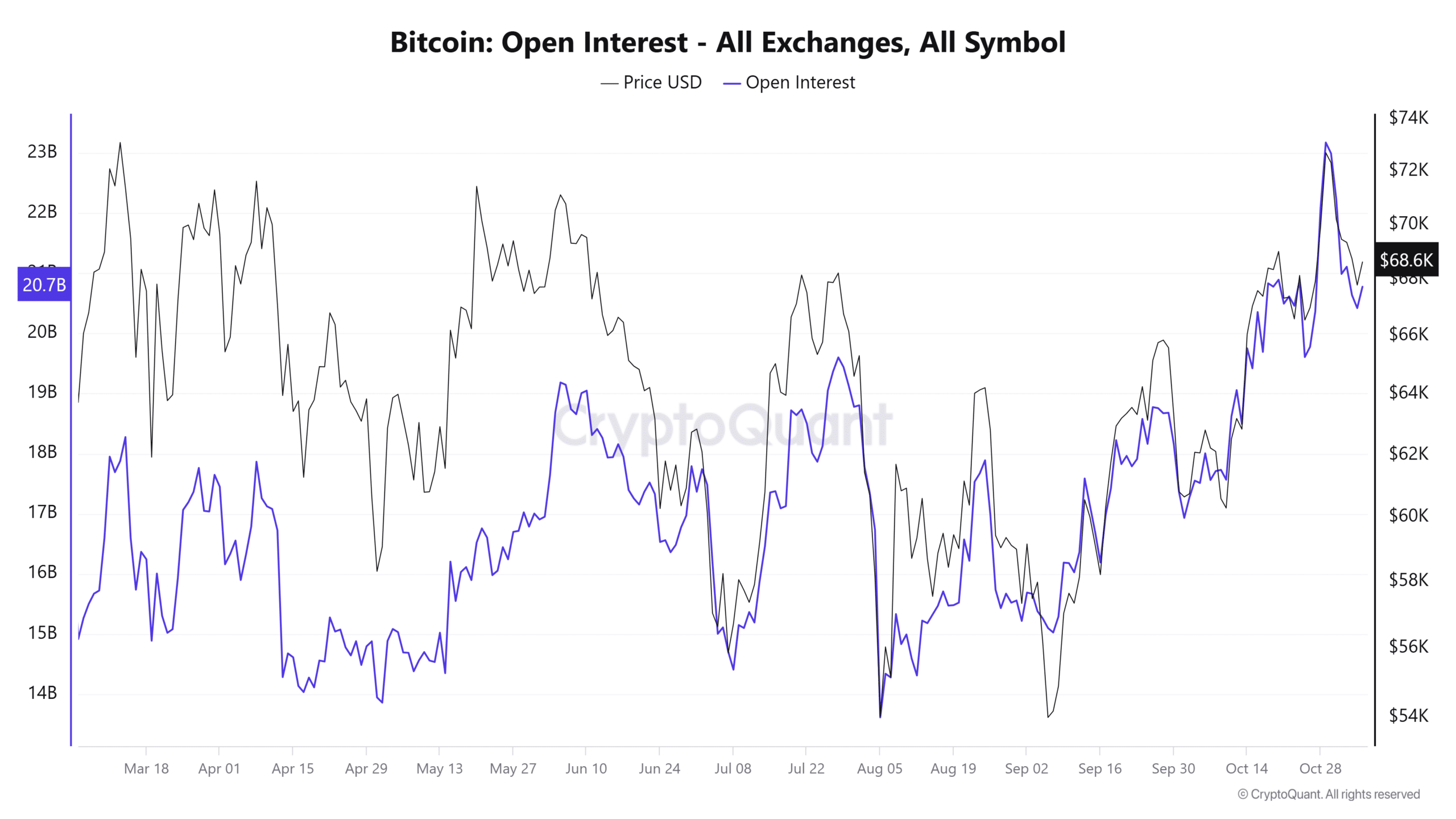

- Bitcoin’s open interest recently fell from $23 billion to $20.7 billion.

- Despite the drop in open interest, the price of BTC remains above $68,000.

The Bitcoin [BTC] open interest and price action are showing notable shifts as market volatility increases ahead of US election week. Data indicates a sharp decline in BTC open interest across all exchanges, indicating traders are becoming more cautious amid uncertain market conditions.

The current landscape reflects a cautious but speculative environment, coupled with rising volatility in the S&P 500 (followed by the VIX Index) and high numbers on the Crypto Fear & Greed Index.

Bitcoin Open Rate Drop: A Sign of Caution or an Opportunity?

Bitcoin’s open interest recently fell from over $23 billion to $20.7 billion, reflecting a shift as traders unwind their leveraged positions.

Historically, reduced open interest indicates less market leverage, indicating traders may be pulling back from riskier bets. This trend could be influenced by the approaching US elections, as political events often bring additional uncertainty and volatility to financial markets.

Source: CryptoQuant

Interestingly, despite the drop in open interest, Bitcoin’s price has remained stable above $68,000, indicating underlying strength. This resilience may indicate that while leveraged positions have declined, spot buying remains strong, possibly driven by long-term holdings.

For traders, the reduction in open interest could mean a pause in speculative activity, but for long-term investors it boosts confidence in Bitcoin’s upside potential.

The Impact of the US Elections on Bitcoin Open Interest and Market Volatility

The VIX, or Volatility Index, for the S&P 500 has risen to around 21.97, indicating heightened fear in traditional markets. Historically, high VIX levels correspond to increased caution around riskier assets such as cryptocurrencies.

Investors appear to be preparing for broader market swings as the US election approaches, which will impact both stocks and digital assets like Bitcoin.

Source: TradingView

The Relative Volatility Index (RVI) for Bitcoin, currently around 47.7, indicates potential price swings without a strong directional trend.

With the RVI near 50, Bitcoin could experience further swings, in line with cautious sentiment as the elections approach. A post-election shift in regulations, especially regarding digital assets, could increase Bitcoin’s volatility.

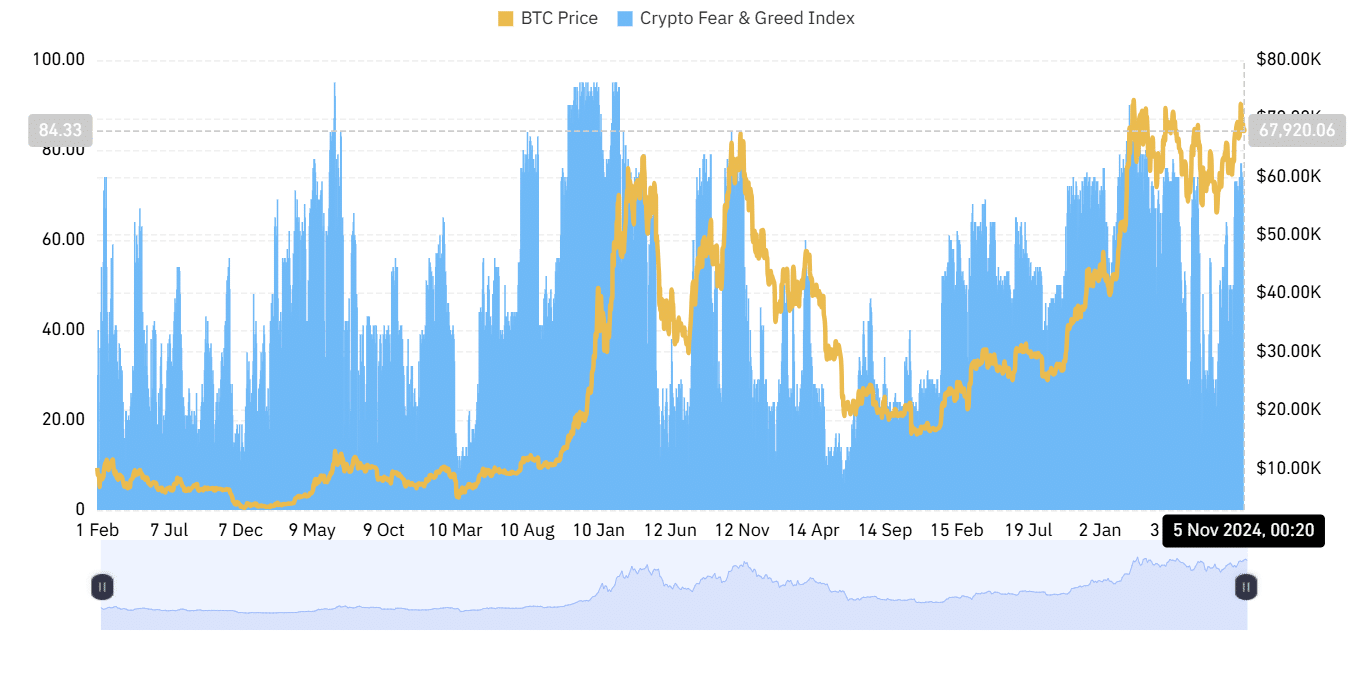

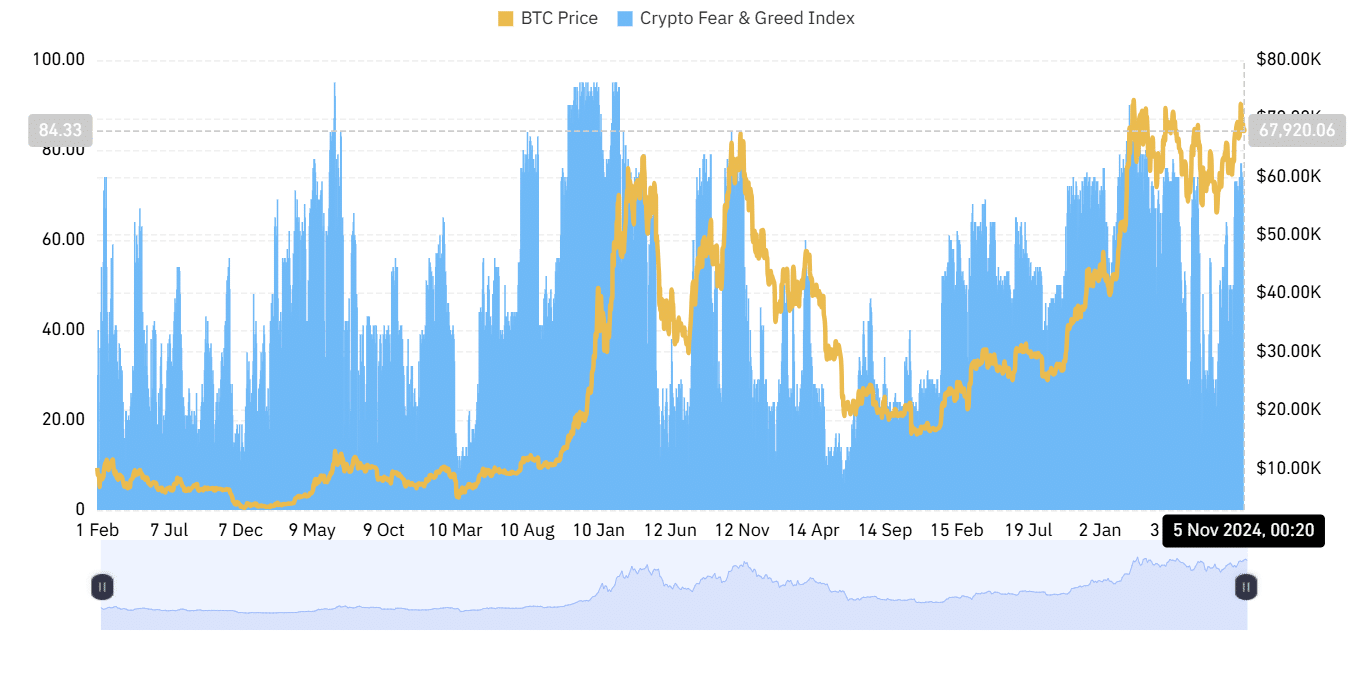

Bitcoin Open Interest and Sentiment Indicators: Optimism Amid Caution

Despite the increased caution, the Crypto Fear & Greed Index stands at 70 (Greed), indicating that while caution is warranted, overall sentiment remains positive. This gap between high sentiment and cautious trading behavior suggests that the market is waiting for more certainty after the elections.

Historically, Bitcoin has shown consolidation patterns or slight pullbacks before resuming trends in response to election results.

Source: Coinglass

The combination of high sentiment and declining interest in Bitcoin Open could imply that traders are hesitant to increase leverage but still anticipate BTC’s price resilience.

This pattern of increased sentiment with lower leverage often leads to a consolidation phase, where optimistic investors wait for volatility to subside before fully re-entering the market.

Outlook for Bitcoin Price and Open Interest After the Election

With the US elections as a potential catalyst, Bitcoin futures movements could depend on both political and macroeconomic developments.

Traders will likely look for a breakout above $70,000 or a stable consolidation above key support levels to confirm a post-election uptrend. Conversely, any unexpected election outcome or new regulatory policy could temporarily disrupt Bitcoin’s path.

Read Bitcoin (BTC) price prediction 2024-25

As the election approaches, Bitcoin appears to be in a holding pattern, supported by long-term confidence, yet tempered by near-term caution.

Metrics such as Bitcoin Open interest and the Fear & Greed Index will be crucial for measuring market sentiment. Depending on the outcome of the election, Bitcoin could consolidate or set its sights on new highs in the coming months.