- Bitcoin maintained its momentum despite falling below $70,000

- Insights using the MVRV indicator pointed to a possible increase

After several attempts to break above $70,000, Bitcoin has once again fallen below this resistance level. This highlighted the potential challenges in maintaining upward momentum in the charts.

At the time of writing, the cryptocurrency was trading at $68,581, having risen slightly by 0.3% in the past 24 hours. What this means is that additional market strength may be needed to consolidate a long-term move above $70,000.

Based on the crypto’s recent price movements, CryptoQuant analyst CoinLupin shared insights in Bitcoin’s MVRV (Market Value to Realized Value) cycle. According to the analyst,

“As we approach key events in November, the MVRV ratio provides a traditional analytical approach to assessing Bitcoin’s value amid broader market factors.”

The MVRV ratio, with a value of around 2 at the time of writing, showed that Bitcoin’s market value was twice as high as its estimated on-chain value. Rather than focusing solely on the current value of the MVRV, CoinLupin highlighted the trend by using tools like the 365-day Bollinger Band for MVRV and the four-year average to better understand Bitcoin’s cycles.

Source; CryptoQuant

At the time of writing, the MVRV ratio had moved above this annual average – a sign that while Bitcoin’s trend continues to head north, there is still potential for a higher cycle peak.

Long-term price indicators and future targets

According to the analyst, the MVRV level in the press suggested a continued upward trajectory, but one that has yet to reach historical peak levels. This is usually between 3 and 3.6 on the MVRV scale.

Assuming a stable Realized Value, the analyst estimated that BTC would need an upside of 43-77% to potentially reach price targets between $95,000 and $120,000.

He also noted that rising market interest and buying momentum could push the Realized Value higher – a sign that future peaks could exceed these levels based on previous cycles.

In addition to the MVRV, CoinLupin highlighted that Bitcoin has risen significantly over the past year. However, it has only recently approached the average level of the MVRV indicator, maintains its positive momentum.

Research key Bitcoin statistics and market interest

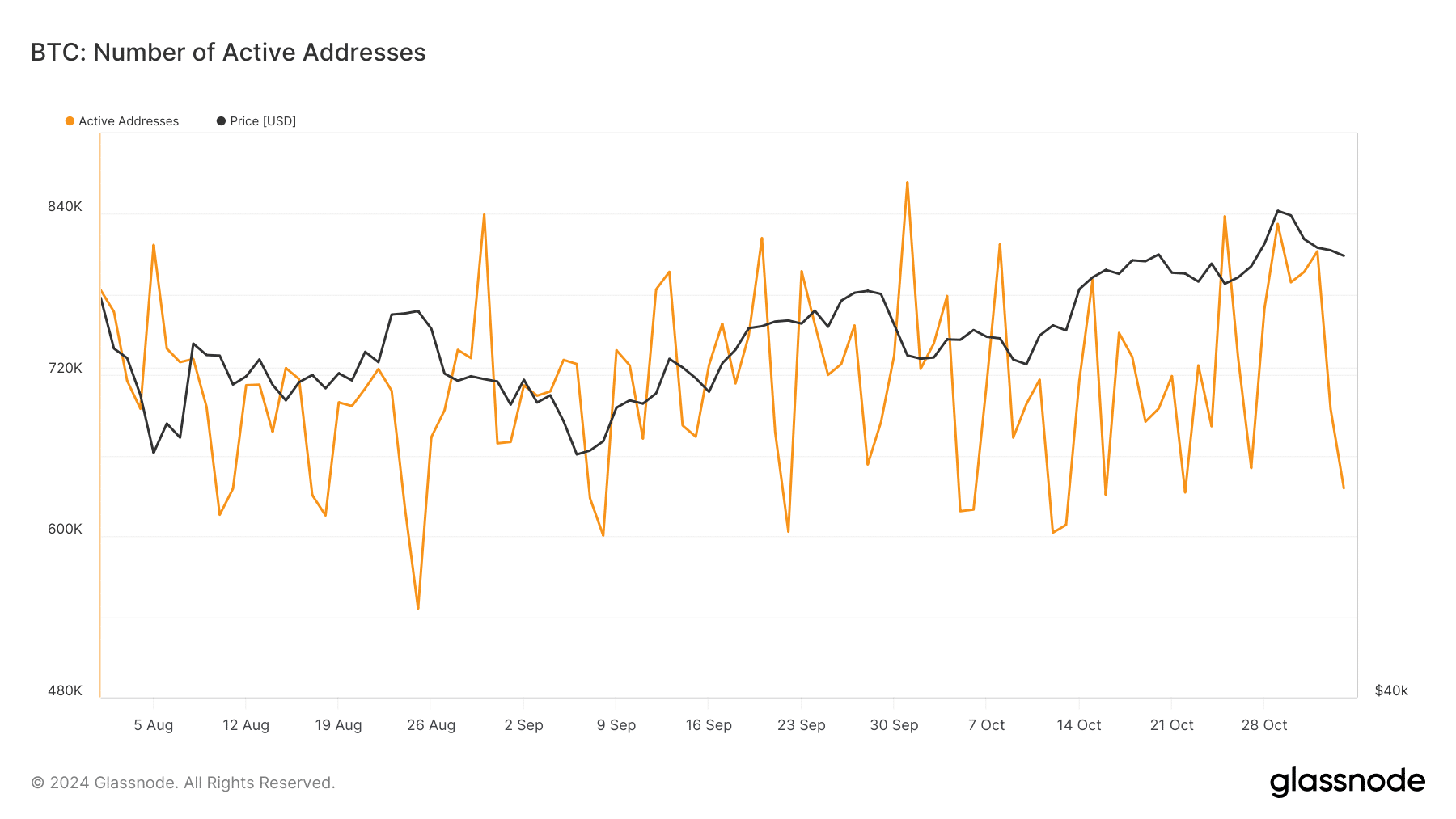

Bitcoin’s continued performance can be further understood by taking a closer look at its on-chain metrics. For example – Retail interest, represented by active address facts from Glassnode revealed that this statistic has been relatively stable since August.

Source: Glassnode

Despite Bitcoin’s recent price movements, the number of active addresses has remained within certain limits. It has fluctuated between 870,000 and 546,000 active addresses in recent months.

This steady activity could indicate that while there is interest in BTC, significant new retail involvement may be limited. The lack of strong directional movement in active addresses may imply that while existing users remain engaged, there has not yet been a large influx of new participants. This could be necessary for BTC to chart a more solid upward trajectory.

Furthermore, examining whale transactions – a key indicator of the actions of larger holders – offers another perspective on Bitcoin’s potential.

Data from InTheBlok revealed that Bitcoin whale transactions recently peaked at 24,070 on October 29, before dropping to 13,300 transactions on November 3.

Source: IntoTheBlock

Such a drop in the number of large-scale transactions points to a temporary reduction in whale activity, which could impact Bitcoin’s momentum in the short term. A decline in whale transactions could indicate that larger holders are temporarily pausing their buying or selling activities. This, in turn, could lead to a cooling of Bitcoin’s price action.

If whale activity rises again, it could mean renewed support for Bitcoin’s price. This will potentially help the asset move past key resistance levels.