- Kaspa’s price has fallen by double digits in the last 30 days

- Several metrics pointed to a trend reversal towards $0.12

The past 30 days have been disastrous for… Kaspa [KAS] because it lost a significant part of its value. This could have caused some panic among investors.

However, a few of the on-chain metrics and technical indicators pointed to a trend reversal. Therefore, AMBCrypto has conducted further research to determine the viability of acquiring bulls.

Kaspa’s latest massacre

KAS investors have been struggling as the token’s price fell by more than 25% in the last 30 days. In the last seven days alone, the token’s value plummeted by more than 8%. At the time of writing, Kaspa was trade at $0.11 with a market cap of over $2.7 billion.

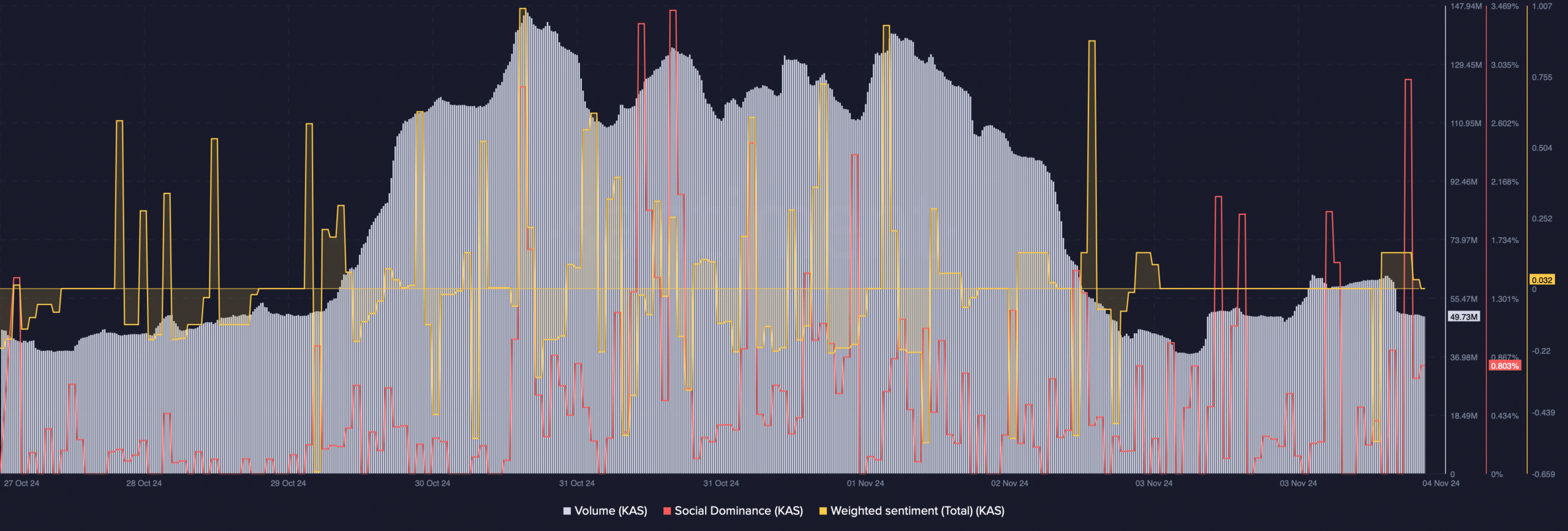

However, after this huge drop, some of the on-chain metrics pointed to a bullish trend reversal. AMBCrypto’s analysis of Santiment’s data found that KAS’s social dominance increased, reflecting its popularity in the crypto space.

After a sharp decline, KAS’s weighted sentiment entered the positive zone – a sign that bullish sentiment around the token has increased.

Source: Santiment

After a sharp increase, Kaspa’s trading volume started to decline. A drop in the metric usually means a trend reversal.

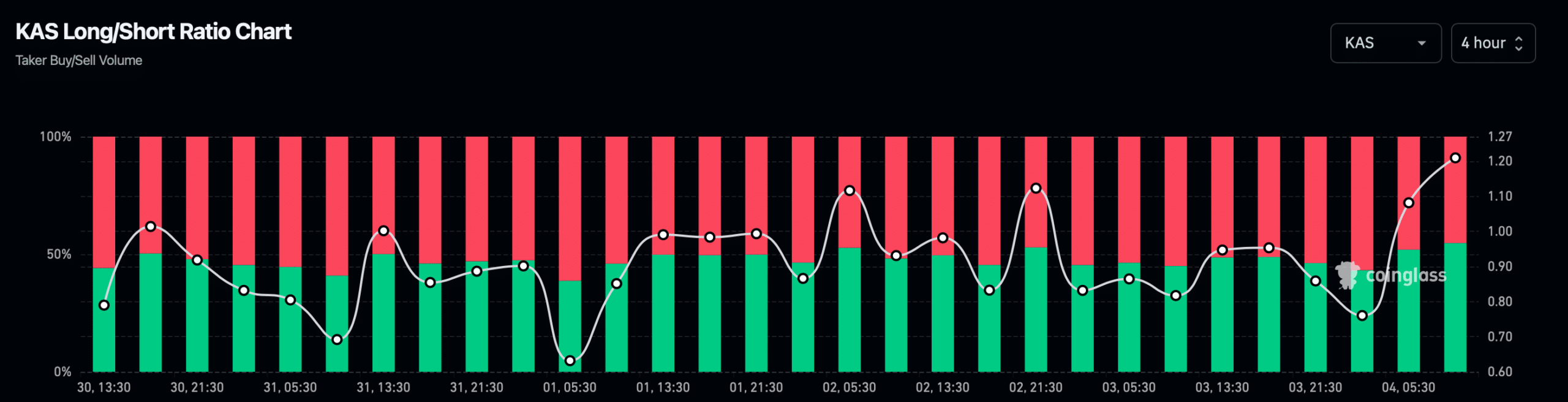

AMBCrypto’s review of Coinglass’ facts also revealed quite a few other optimistic benchmarks. For example, KAS’s Open Interest fell. When the benchmark falls, it means that the probability of a change in the prevailing price is high.

In addition, we noticed that KAS’s long/short ratio started to increase. This suggested that there were more long positions in the market than short positions – a bullish signal.

Source: Coinglass

Where is KAS going?

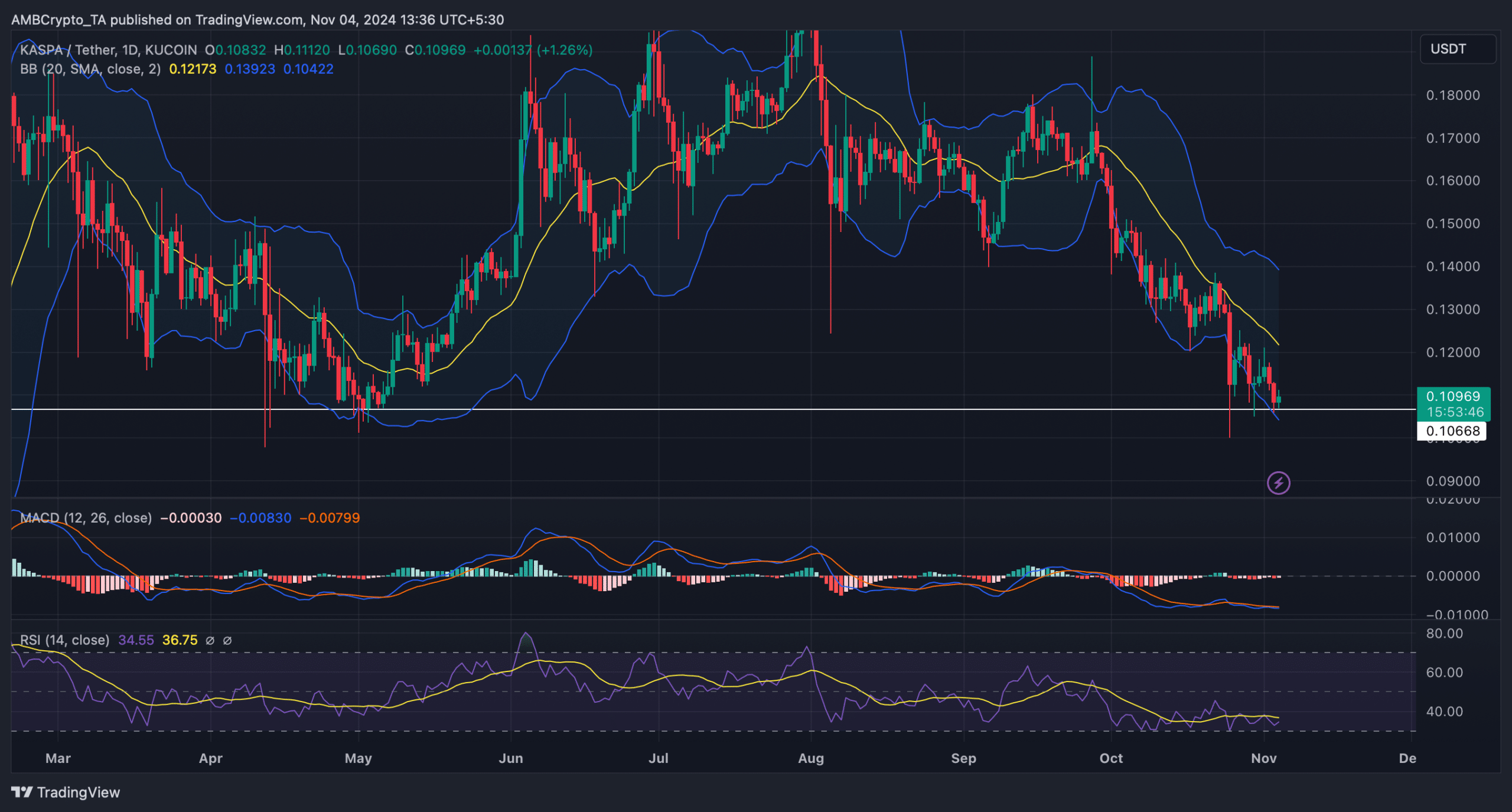

Finally, AMBCrypto checked the daily chart of KAS to find out if technical indicators also pointed to a trend reversal. We found that Kaspa’s price reached the lower limit of the Bollinger Bands. In fact, at the time of writing, the token was testing critical support. Such incidents are often followed by price increases.

After a decline, the token’s Relative Strength Index (RSI) registered a slight increase. Moreover, the technical indicator MACD predicted the possibility of a bullish crossover.

Source: TradingView

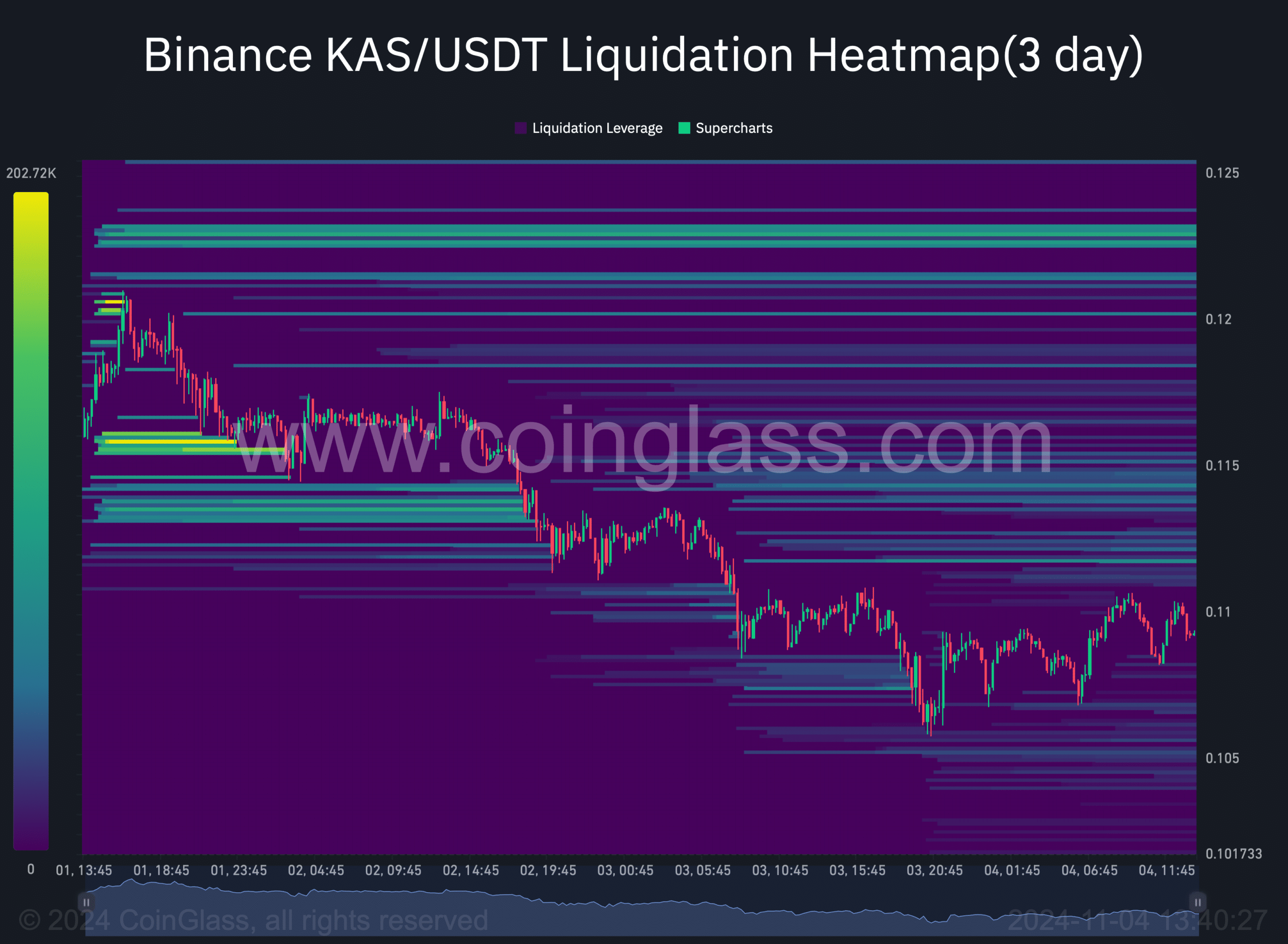

In the event of a bullish trend reversal, it won’t be surprising to see KAS target $0.122 first. This seemed to be the case as Kaspa liquidations will increase sharply at that level.

Read Kaspas [KAS] Price prediction 2024–2025

Typically, an increase in liquidations results in short-term price corrections. A move above this resistance could push KAS to its August high.

Source: Coinglass

![After a price drop of 25%, Kaspa [KAS] crypto rebound to $0.12?](https://free.cc/wp-content/uploads/2024/11/Will-KASs-breakdown-end-1000x600.webp)