This article is available in Spanish.

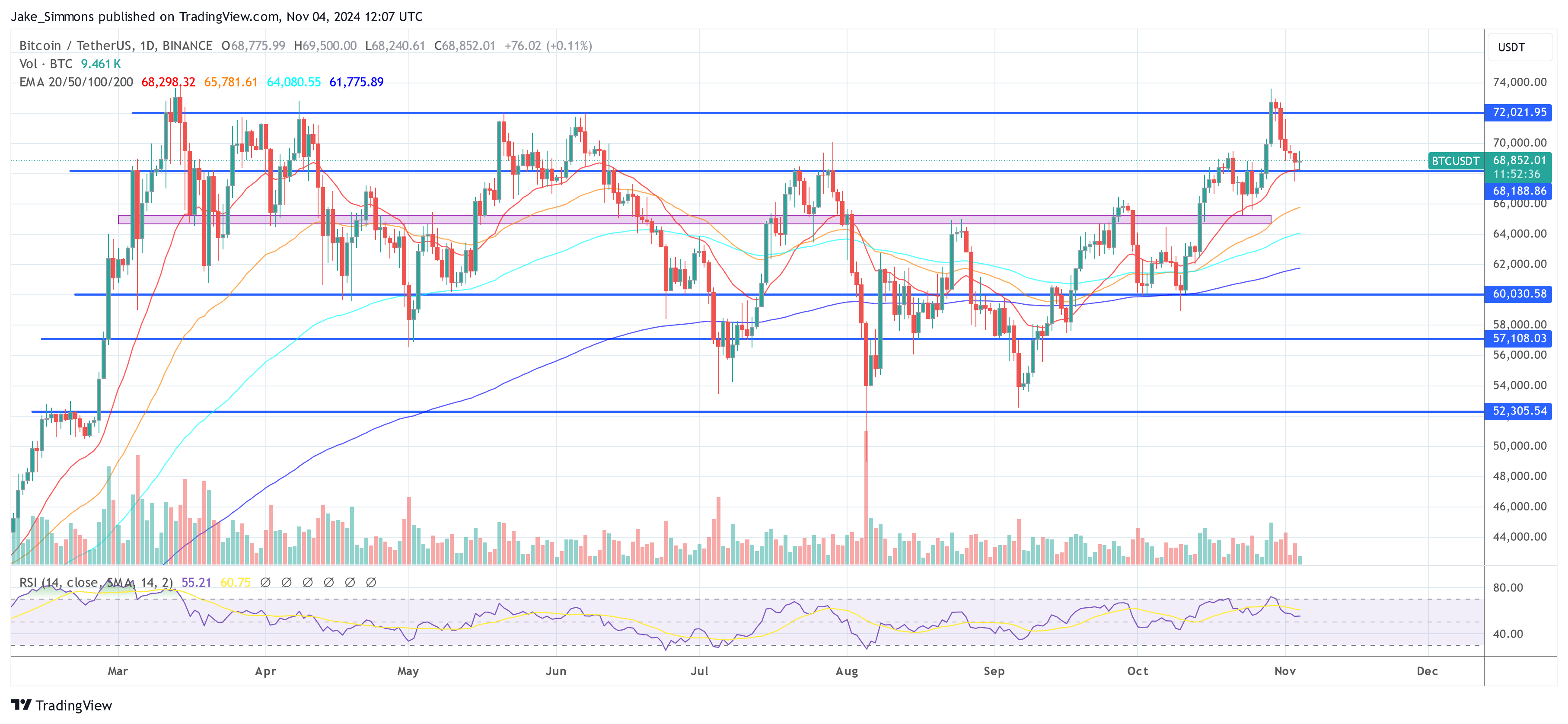

Bitcoin price has posted five consecutive red daily candles since stopping just below its all-time high at $73,620 last Tuesday. As a result, the BTC price has fallen by approximately 7%. This decline is clearly visible on the weekly chart, which shows a large bearish weekly candle: a tombstone doji.

Chartered Market Technician (CMT) Aksel Kibar noted via However, he added: “It is not reliable as an individual candle. It is best to combine it with another weak candle as confirmation of a trend reversal. […] The market story is that the bulls try to make new highs during the session, but the bears push the price action to near the open by the end of the session.

Bitcoin will reach $75,000 by the end of November?

Despite this, Singapore-based crypto trading firm QCP Capital remains optimistic about its latest investor remarkhighlighting significant shifts in both the political prediction markets and the BTC derivatives market.

Related reading

According to QCP Capital, the odds on decentralized prediction market Polymarket have “inched closer to actual polls,” with Vice President Kamala Harris and former President Donald Trump “in a tight race.” While Polymarket still favors Trump at 55%, this marks a decline from 66% a week ago, indicating a narrowing margin that is more in line with mainstream polling.

The company also noted that there is a cautious sentiment in the cryptocurrency market. The “sideways price action this weekend” and a decline in leveraged perpetual futures positioning – from $30 billion to $26 billion on the exchanges – suggest traders are taking a wait-and-see approach. This decline may be due to uncertainties surrounding macroeconomic factors or the upcoming elections.

Despite the current market hesitation, QCP Capital sees potential for significant upside in Bitcoin’s price. The company wondered if this is “the calm before a break from the multi-month range and a push to record highs.” Supporting this outlook, QCP noted an increase in topside positioning since last Friday with substantial purchases of $75,000 call options in late November. This increase in the number of call options at that strike price indicates that traders are positioning themselves for a substantial rally by the end of November.

Related reading

Additionally, the company highlighted increased activity in options related to the election date. “Election date options positions are also rising,” QCP noted, with implied volatility on Friday at over 87% while realized volatility remains at 40%. The increased implied volatility indicates that options traders expect significant price swings during the election period.

Looking ahead, QCP Capital expects Bitcoin’s spot price to remain within a certain range until the US election results provide more clarity. The company stated that they “expect the spotlight to cut around this range until we get more clarity on the election results this week,” adding that “a Trump win will likely trigger a knee-jerk reaction, and vice versa if Kamala wins.” ”

At the time of writing, BTC was trading at $68,852.

Featured image created with DALL.E, chart from TradingView.com