- Simon Dedic accused Binance of charging high listing fees

- Industry leaders have made similar claims against Coinbase in the past

A recent revelation from Simon Dedic, CEO of Moonrock Capital, has sparked a debate about the cost and accessibility of centralized exchange listings (CEX).

In one after about Binance. The project received a listing offer, but with a catch: Binance asked for 15% of the total token supply in return.

Demand, Dedic explained, was as much as $50 to $100 million. He stated,

“Not only is this prohibitively expensive for projects, but these tokens are also the biggest reason for bleeding charts.”

Binance Response – A Defense Against Allegations

Binance co-founder Yi He was quick to respond, refuting Dedic’s claims and emphasizing that the platform’s screening process is uncompromising. She went to X and said,

“If a project does not pass the screening process, it cannot be listed on Binance, regardless of the amount of money or tokens involved.”

The director urged the community to investigate token distributions for projects listed on Binance to understand the transparency behind their policies.

While Binance’s Launchpool and other listing mechanisms have clear airdrop rules, they clarified that willingness to offer airdrops does not guarantee a project’s approval.

The co-founder acknowledged that fear, uncertainty and doubt (FUD) are constant in crypto and encouraged users to think critically. According to the director, rumors often arise from gossip and competition.

Binance’s listing fees

AMBCrypto too investigated Binance’s 2018 policy change regarding listing fees. The exchange promised to make all listing fees fully transparent and pledged to donate 100% of them to charity.

Under this policy, project teams are responsible for proposing their own “listing fee,” now called a “donation.” This, without a certain minimum or specific amount dictated by Binance.

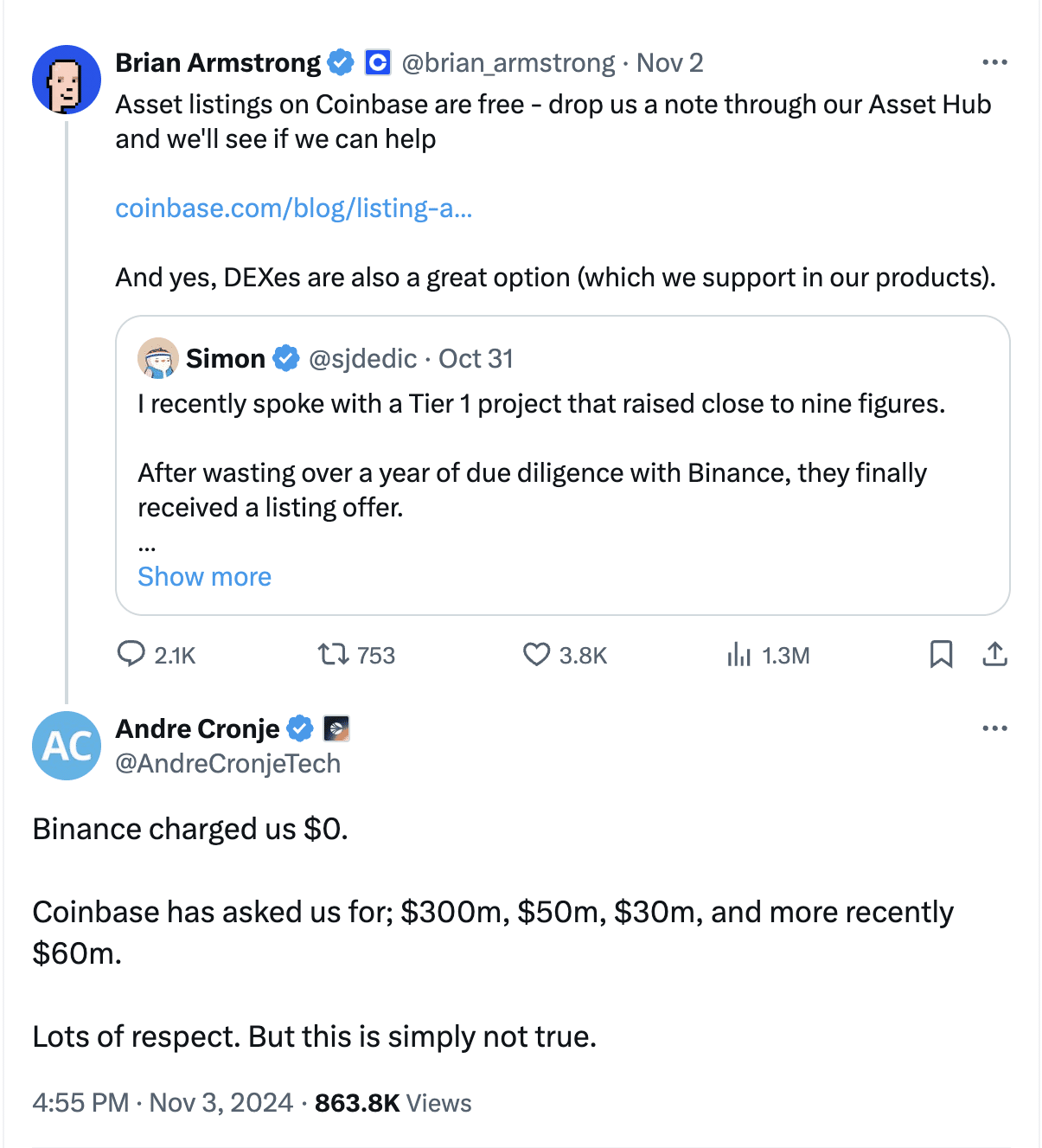

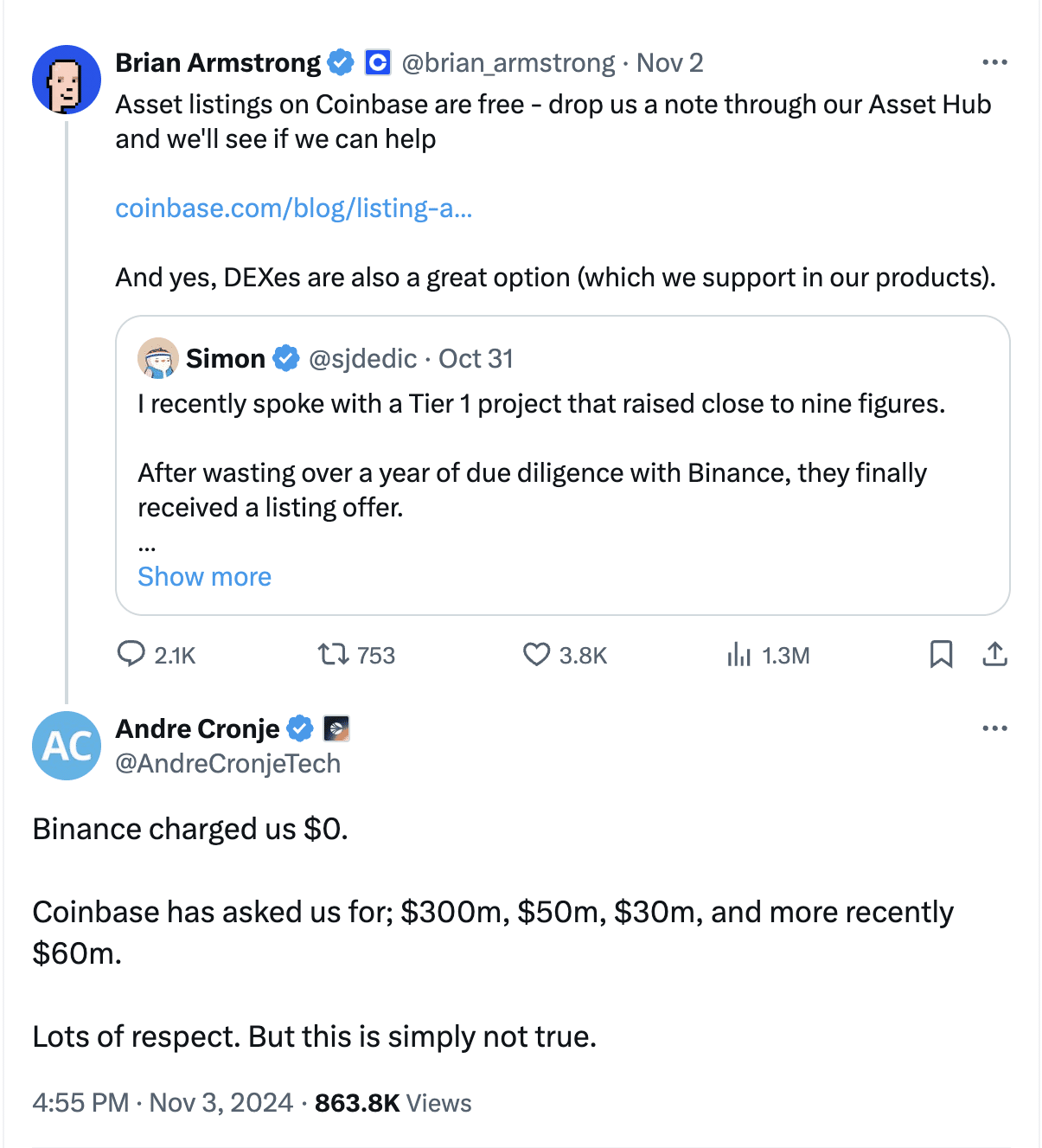

Claims arise against Coinbase

After Dedic’s message, Coinbase CEO Brian Armstrong joined the discussion insured the community listed on Coinbase remains free. He added that Coin base also supports decentralized exchanges (DEXs) as an alternative option for projects.

However, Andre Cronje, co-founder and developer of Sonic Labs, seemed to disagree with Armstrong. He added his own concerns – this time regarding Coinbase.

Source:

Cronje revealed that while Binance did not charge his project anything for the listing, Coinbase asked for amounts ranging from $30 million to $300 million.

Justin Sun, founder of Tron [TRX]Also so-called that Coinbase demanded a payment of 500 million TRX (worth $80 million) and a payment of $250 million Bitcoin [BTC] deposit into Coinbase Custody to improve their performance.

CEXs vs. DEXs

Despite this recent criticism, CEXs continue to dominate the trading landscape. According to Messari factsFor example, these exchanges account for approximately 90-95% of the total volume.

Source: Messari

At the time of writing, CEXs had a share of $17.27 billion, representing 94.52% of the total volume of $18.27 billion. Meanwhile, DEXs contributed $1 billion, or 5.48%.

With the crypto community calling for more transparency and fairness, the ongoing debate between CEXs and DEXs could greatly impact the future of digital asset trading.