Blockchain infrastructure has evolved to include an ecosystem of layer 1 and layer 2 networks.

In this article, we explore the difference between the two, and how layer 2 networks and other scaling methods such as sidechains attempt to address the scalability challenges of layer 1 blockchains.

What are Layer 2 Networks?

Simply put, layer 2 networks are blockchain networks that live on top of a layer 1 network, such as Ethereumwhere the layer 1 network provides the foundational layer of infrastructure and security for networks that build on it, validate transactions and reach consensus.

The layer 2 networks use a variety of technologies to address scalability bottlenecks on the layer 1 blockchain caused by throughput and transaction costs.

For example, Ethereum currently processes around 14 transactions per second (TPS) per blockchain explorer Etherscan. By comparison, Visa processes about 65,000 transactions per second.

Scalability issues are most pronounced during periods of high network activity, when blockchain networks experience higher transaction fees (also called gas fees), along with network congestion and shorter transaction times.

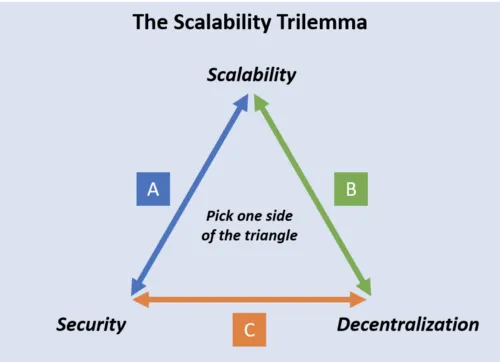

In 2017, Ethereum creator Vitalik Buterin identified the ‘scalability trilemma’ for blockchains, arguing that they face the challenge of processing thousands of transactions per second while remaining secure and adhering to the ethos of being decentralized, which i.e. running without the need for centralized control.

The ‘scalability trilemma’.

The theory, taken from computer science, is that a network can focus on only two of these principles by making concessions at the expense of the third.

Ethereum’s solution to the scalability problem is to focus on making its own layer-1 blockchain network as secure and decentralized as possible, while outsourcing scaling to layer-2 networks built on top of its infrastructure.

How do scale networks work?

Scalable networks employ a variety of different solutions to address the scalability challenges of the layer 1 network.

These networks involve bundling transactions or processing transactions off-chain, using sidechains or layer 2 rollups.

Side chains

Sidechains are blockchains that run independently of the layer 1 chain, with their own consensus mechanism and token.

They connect to the layer 1 blockchain through a bridge, which uses a smart contract to ‘lock’ assets from the layer 1 chain and create a mirror image of those tokens on the sidechain, where the value of those tokens are tied to the locked asset.

These mirrored tokens are then used to perform transactions, after which they can be destroyed, releasing the locked tokens on the layer 1 chain.

Rollups

Rollups take a different approach, aggregating multiple transactions (hence the name) and presenting them to the layer 1 blockchain as a single transaction that can be processed much faster than the individual transactions.

There are two main types of rollups: optimistic rollups and zero-knowledge (zk) rollups.

Optimistic roll-ups assume that all data collected is valid, allowing people to dispute transactions afterwards to determine whether they are legitimate or not. The disputed transaction is submitted directly to the layer 1 network to resolve the dispute, with both parties risking losing the resident tokens if proven wrong.

Zero-knowledge rollups use zero-knowledge proofs, a cryptographic technique that can be used to prove that something is known without directly revealing the known information. Transactions are merged into batches that are executed off-chain, with the completed batch submitted to the layer 1 chain using a zk-proof showing that the proposed state changes are correct.

Ethereum Scalers You Need to Know

There are a number of different Layer-2 and sidechain networks being built on top of or alongside Ethereum, each with their own preferred technology solution to scale the Layer-1. According to CoinGecko data, the following are the largest Ethereum chains by total value locked (TVL), as of November 2024.

Base

Base was incubated by crypto exchange Coinbase and is built on top of the Ethereum scaling solution Optimism. After launching in August 2023, it quickly established itself as a leading player in the layer-2 space, rising to over a million addresses in just eleven days. According to Coinbase CEO Brian Armstrong, the exchange has no plans to launch a token for Base and is trying to make Base “something much broader” than a Coinbase-led project.

Arbitration

Created by Offchain Labs, Arbitrum uses optimistic rollups to scale Ethereum, with a claimed 40,000 tps versus Ethereum’s stately 14 tps. In March 2023, Arbitrum launched its own ARB token for governance, transferring control of the project to a decentralized autonomous organization (DAO) made up of community members.

Polygon

Formerly known as Matic Network, Polygon takes a multi-pronged approach to scaling, deploying multiple solutions including the main POS chain (sidechain), plasma chains, zk rollups, and optimistic rollups. It aims to be more than just a scaling solution and establish itself as a platform for launching interoperable blockchains. In September 2024, it completed the migration from its original native token MATIC to a new token, POL.

Optimism

Optimism was launched on Mainnet in January 2021 and – as the name suggests – uses optimistic rollups, which assume that all transactions in the rollup are valid. Optimism further compresses the data in the rollups using a sequencer, before sending transaction data to the main Ethereum chain. Validators for each update package will have one week to search the update package if they believe it contains fraudulent data.

Role

A relative newcomer to the layer 2 space, Scroll launched on Mainnet in October 2023. The platform uses zkEVM technology for batch proofs, utilizing “bytecode-level compatibility” with Ethereum Virtual Machine support to ensure EVM applications and tools are compatible “out of the box.” Scroll launched its SCR token during an airdrop in October 2024.

Explosion

Launched in February 2024 by a team led by Tieshun “Pacman” Roquerre – founder of NFT marketplace Blur – Blast stands out from other layer 2 networks with features such as native yield for ETH and stablecoins. The layer-2 conducted an airdrop of its native token BLAST in June 2024

The future of layer 2 networks

Layer-2 networks are a key part of Ethereum’s “rollup-centric roadmap,” according to Ethereum co-founder Vitalik Buterin, who hopes to use Layer-2 solutions to increase the blockchain’s capacity to handle more than 100,000 transactions processed per second.

Buterin has outlined plans to bring together Ethereum’s two scaling strategies, sharding and layer-2 protocols, in what he described as “The Surge.” With this roadmap, layer 2 blockchains would implement cryptographic solutions such as SNARKs (Succinct Non-interactive Argument of Knowledge) to ensure the integrity of transactions. Buterin is also trying to ensure that layer 2 networks adopt Ethereum’s core principles: trustlessness, openness, and resistance to censorship.

Layer-2 networks are not just limited to Ethereum. In June 2024, programmers at BitcoinOS claimed to have verified zk-proof on the Bitcoin mainnet for the first time, opening the possibility of using rollups to scale Bitcoin. Solana is also seeing increasing layer 2 activity, for example through the gaming-focused Sonic SVM network.

Meanwhile, new layer 2 networks continue to emerge on Ethereum. In October 2024, decentralized exchange Uniswap announced plans to develop its own layer-2 network, Unichain, using Optimism technology, and centralized exchange Kraken will launch its own Optimism-based layer-2 called Ink.

Edited by Andrew Hayward