- More than $238 million was liquidated from the crypto market within 24 hours after prices fell.

- Next week’s US elections and the upcoming FOMC meeting could cause a rise in market volatility.

The cryptocurrency market is heading into one of the most crucial weeks this year. Speculation about the week’s events has led to price drops. At the time of writing, all of the top 50 cryptos by market cap are listed with the exception of Celestia [TIA] were trading in the red.

On weekends, Bitcoin [BTC] dropped from $71,000 to $68,380 at the time of writing. Ethereum [ETH] also traded at $2,440, after a 2% dip.

The falling prices resulted in massive liquidations in the derivatives market. Data from Mint glass showed that over $238 million was liquidated from the market in the past 24 hours.

The liquidations affected more than 104,000 traders, with the largest liquidation order of $9.9 million taking place on the OKX exchange.

In addition to the typical weekend volatility, US election polls continue Polymarkt could have triggered the recent price movements. The election is now less than two days away and former US President Donald Trump has fallen 6% in the polls in three days.

A Trump victory is expected to have a net positive impact on the crypto market due to his pro-crypto campaign policies.

Upcoming FOMC meeting

The Federal Open Market Committee (FOMC) will hold its next meeting on November 7. At the previous meeting, the committee cut rates by 50 basis points, paving the way for a recovery in risky assets such as crypto.

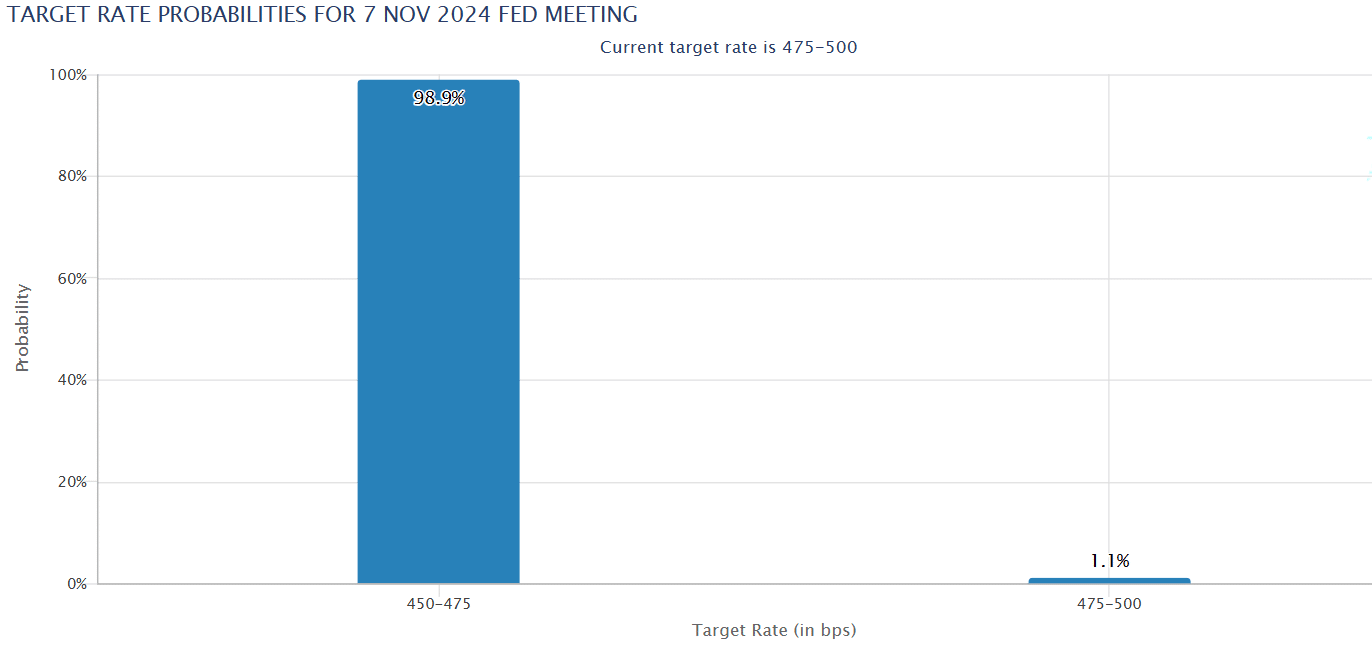

Data from the CME FedWatch Tool shows that 98% of investors expect another 25 basis point rate cut at the November meeting.

Source: CME FedWatch Tool

If the Federal Reserve cuts interest rates based on market expectations, crypto prices are poised for an upward trend. This is because accommodative monetary policy increases investors’ risk appetite, increasing demand for assets such as cryptocurrencies.

As AMBCrypto reportedUS inflation in September stood at 2.1%, moving closer to the Federal Reserve’s target of 2%. This supports the argument for further interest rate cuts.

After the September meeting, Bitcoin gained about 8% within a week. A similar upward move could propel BTC to record highs, as it is 7% below its all-time high at the current price.

The sentiment in the crypto market is still bullish

Despite the recent price drop and increasing volatility, sentiment in the crypto market remains positive, as evidenced by the Fear and Greed Indexwhich had a value of 74 at the time of writing.

At its current value, this index shows that the market is in a state of greed. This sentiment tends to drive buying activity, which in turn leads to price gains.

This shows that crypto traders are still looking for more profits after the recent pullback. Some catalysts for this positive sentiment include the FOMC meeting and expectations that the fourth quarter has historically boded well for crypto prices.