Amid this price correction, Popcat (POPCAT), a popular Solana-based meme coin, appears bullish and represents a perfect buying opportunity with an excellent risk-reward ratio. The possible reason for this bullish outlook is the meme coin’s daily chart pattern and bullish price action.

POPCAT technical analysis and upcoming levels

According to expert technical analysis, POPCAT appears bullish and is currently heading towards the lower limit of the bullish channel pattern, which has served as strong support for the meme coin since early October 2024.

Based on the recent price action, when POPCAT price approaches this support level, it tends to experience buying pressure and an upward rally. This time, traders and investors expect a similar upward rally.

If POPCAT holds itself above the lower bound of the bullish channel pattern, there is a good chance that the meme coin could rise 30% in the coming days to reach the $1.84 level. Moreover, the current level offers a potential buying opportunity with a risk-reward ratio of 1:4.

Bullish statistics in the chain

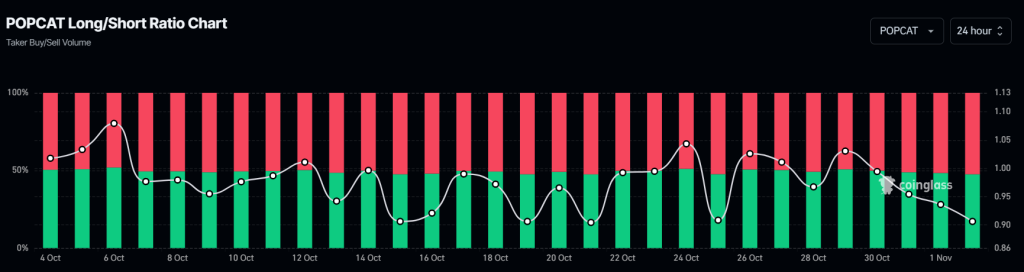

Despite this positive outlook, POPCATs Statistics on the chain indicate mixed sentiment. According to on-chain analytics firm Coinglass, the Long/Short ratio currently stands at 0.90, indicating bearish sentiment among traders. Moreover, POPCAT’s open interest has fallen by 12% in the past 24 hours, reflecting the liquidation of traders’ positions, which is relatively higher than the day before.

The combination of falling open interest and a long/short ratio below one indicates weak bearish sentiment among traders as new positions are not being built.

Current price momentum

Currently, POPCAT is trading around $1.44 and has registered a price drop of over 11% in the last 24 hours. During the same period, trading volume fell by 30%, indicating lower participation from traders and investors amid the continued price decline.