- Cardano wandered into the mid-level resistance in October but was unable to win it back as support

- An outbreak outside the peak ranges will likely take more time

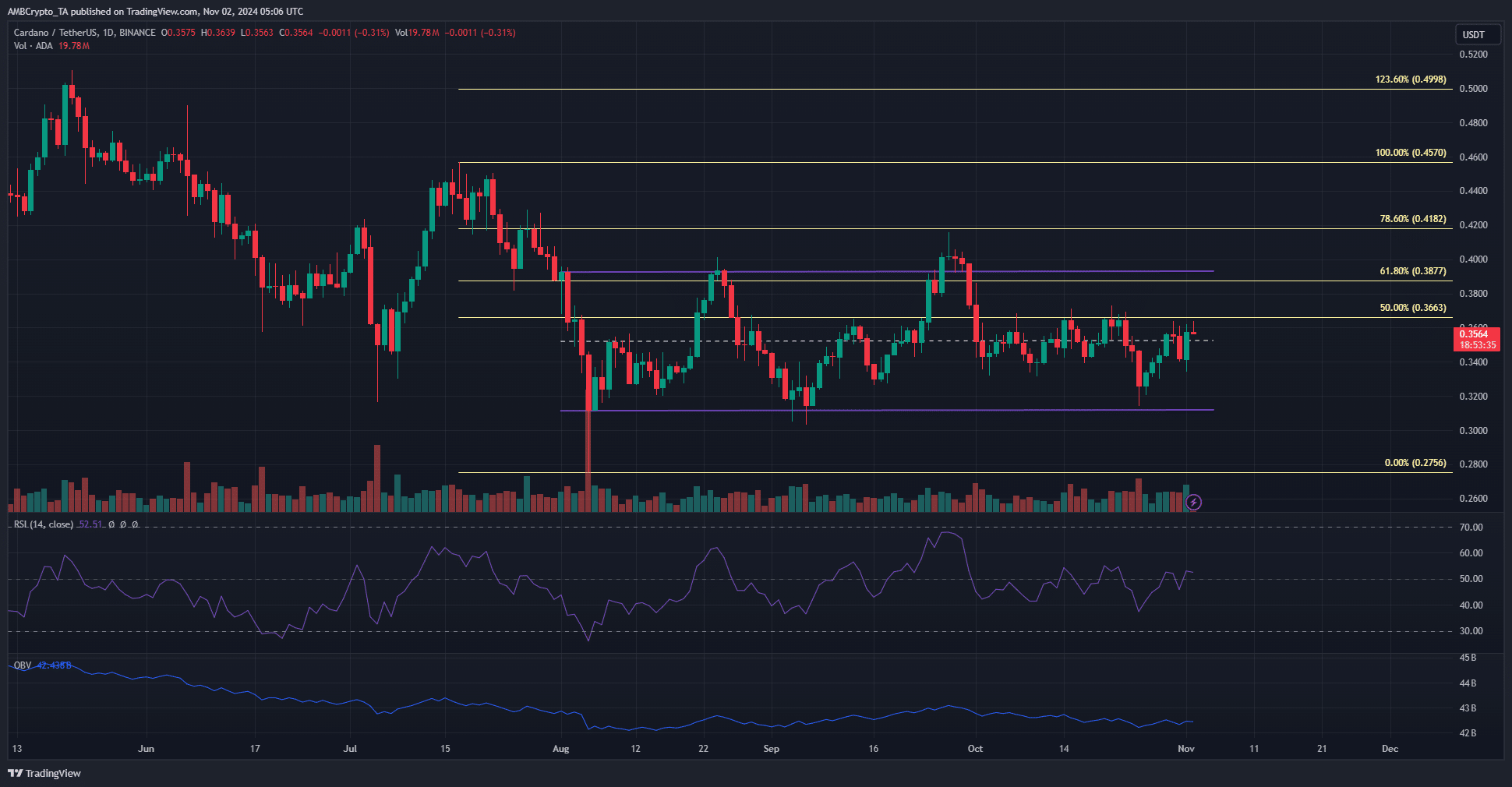

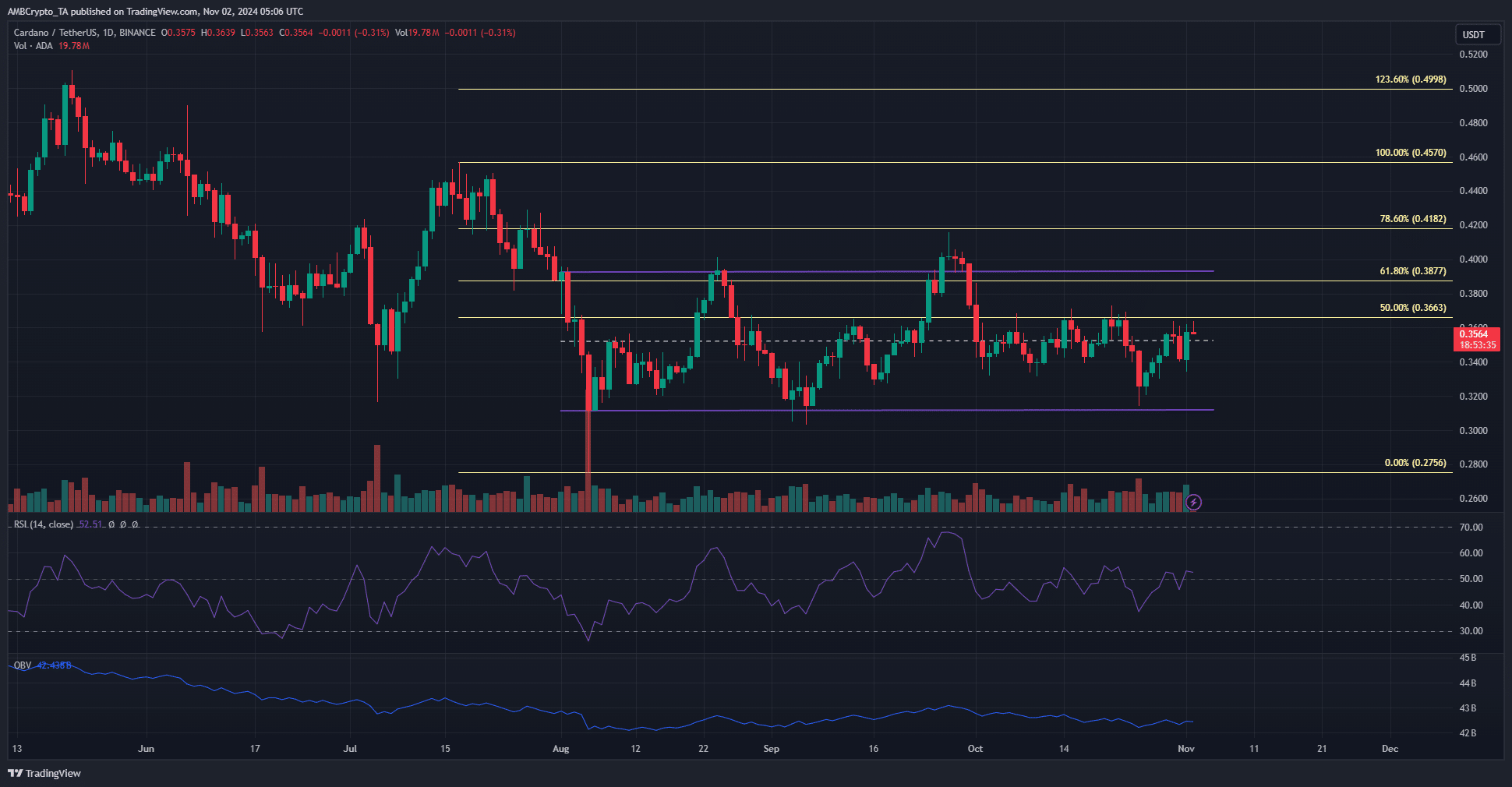

Cardano [ADA]at the time of writing, was trading within a three-month range formation. In fact, a recent report noted that Cardano’s NVT ratio was at a five-month high, meaning the asset may be overvalued.

However, despite the rising NVT ratio, the $0.366 level has sparked strong opposition to the ADA over the past month. Demand for the altcoin was not high enough to push the price above this resistance.

Cardano price action in a swamp

Source: ADA/USDT on TradingView

Cardano has formed a range between $0.393 and $0.311 since July, with a mid-level of $0.352. This came after the downtrend the altcoin witnessed since March. Such bandwidth-related consolidation is a good development. The downtrend is stopped and buyers have the opportunity to accumulate.

Based on the decline in July and early August, a series of Fibonacci retracement levels was plotted. The 50% level at $0.366 was a thorn in the side of the bulls in October and was also close to the mid-level. The steady selling pressure was clearly visible on the OBV, which slowly declined over the past month.

As a result, the RSI also meandered around the neutral 50 level, with no indication of strong momentum in either direction.

However, the rejection of the 78.6% level in September was a warning sign for the higher futures. The $0.393 and $0.418 levels would be key resistances that need to be regained as support before a sizeable rally can begin.

ADA bulls must be aware of a bull trap

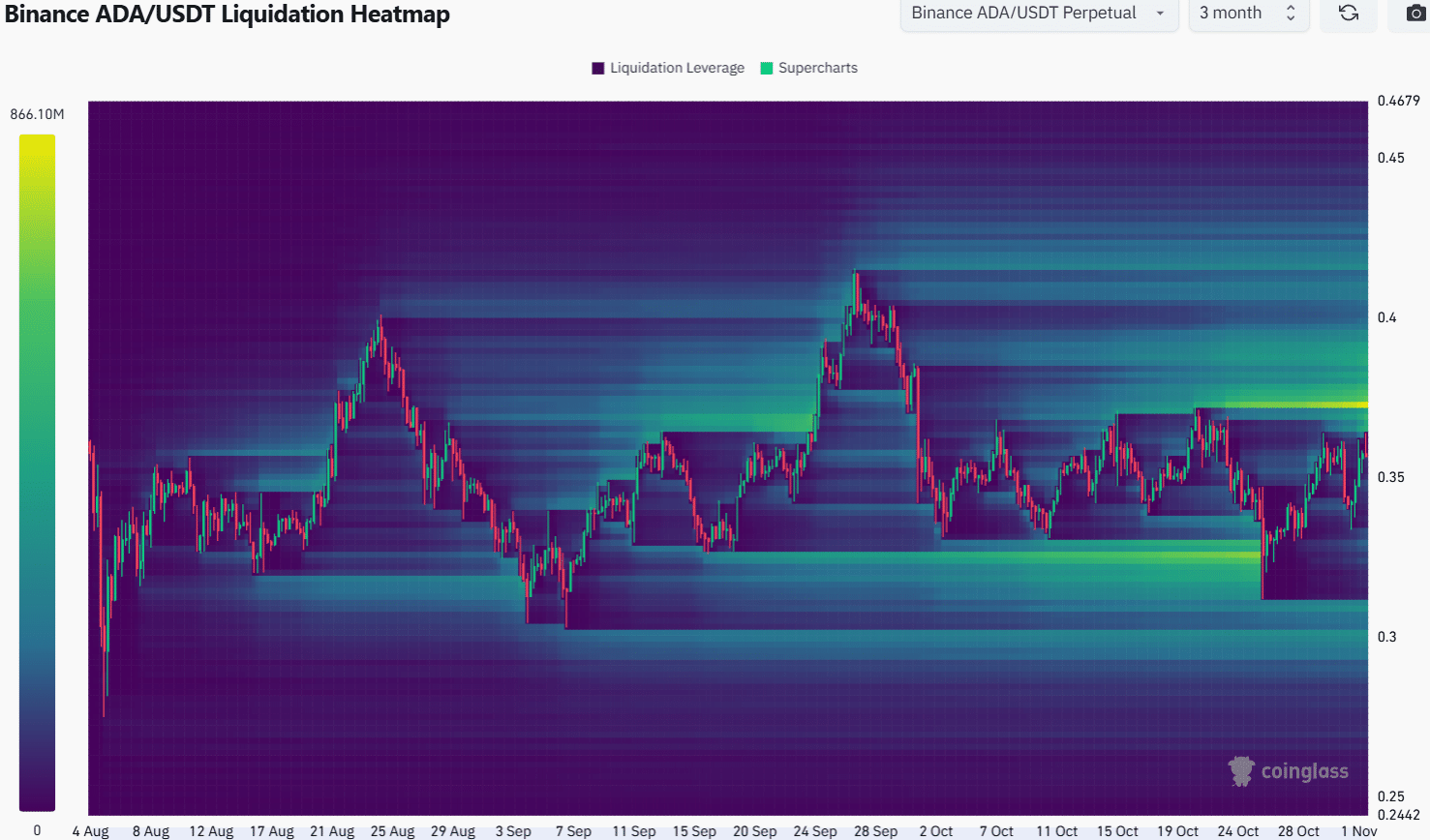

AMBCrypto found a significant amount of liquidity in the $0.371-$0.377 zone. It is likely that this magnetic zone will attract prices. It is unclear whether buyers can continue this and make further gains, but weak demand in recent weeks meant a rejection from $0.375 may have been more likely.

Read Cardanos [ADA] Price forecast 2024-25

An impulse move from Bitcoin [BTC] may be necessary before Cardano can break out of his range and go higher. At the time of writing, a breakout beyond $0.4 seemed unlikely.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer