- Shiba Inu bulls struggled to secure dominance in October, but things could turn out differently this month

- SHIB could see a big increase in the coming weeks

Shiba Inu’s performance in October was decent, but better news could follow in November. At the time of writing, the memecoin appeared to be moving in a similar pattern to its larger counterpart a few weeks ago.

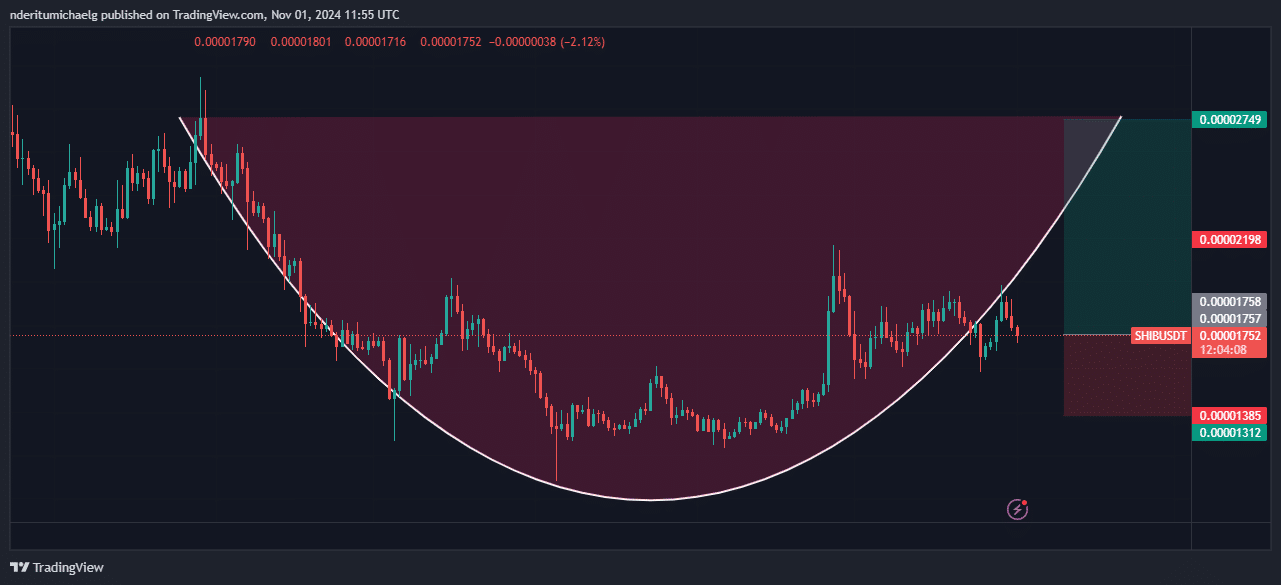

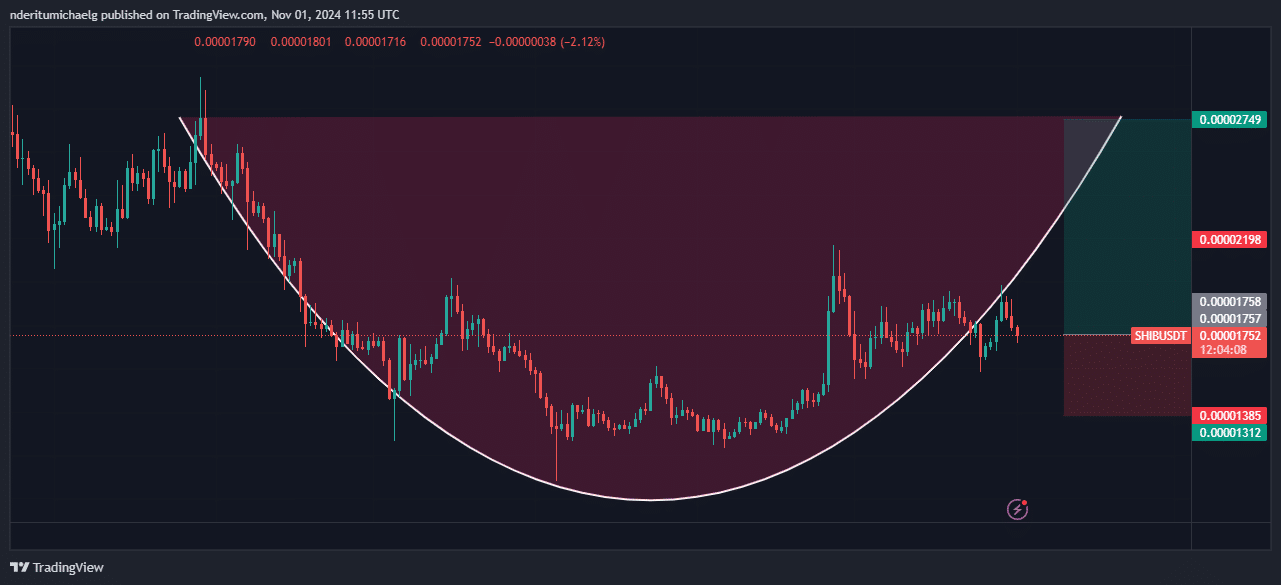

Shiba Inu price action since May appeared to form a cup-and-handle pattern, which bottomed out between August and September. This was an important observation as Dogecoin just completed October after a strong rebound, completing the second half of the curve.

SHIB’s value rose significantly between September and October, with the memecoin also showing a lot of volatility during the period. However, it is worth noting that SHIB averaged less than 3% gain between the October opening price and the closing price.

Source: TradingView

Although October was ultimately uneventful, the memecoin’s cup and handle pattern suggested that the bulls could emerge strongly in November. SHIB was trading at $0.0000175 at the time of writing, but the curve will be complete when it rises to $0.000027.

This implied that a 56% increase is possible in the next four weeks.

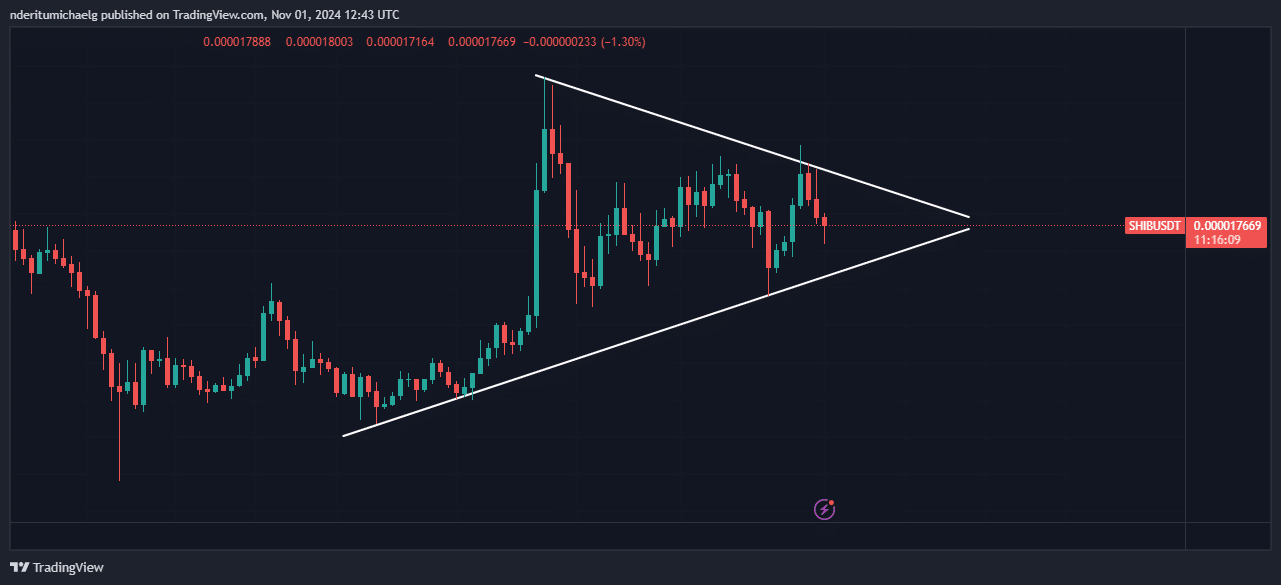

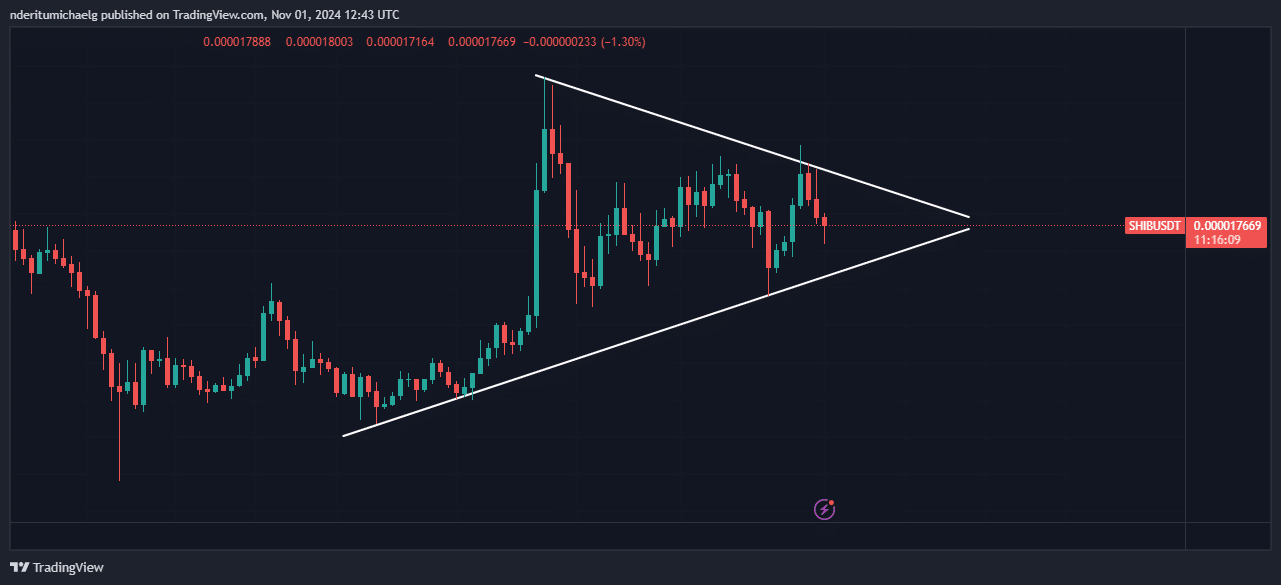

When we zoomed in even further, while we were still on the 1-day chart, it turned out that a different pattern may be happening here. Shiba Inu formed a wedge pattern and quickly approached the escape or breakdown zone. This could explain why it struggled to move higher in October.

Source: TradingView

A pattern break will occur no later than mid-November, after which price will likely resume its broader cup-and-handle pattern. If this occurs, it means accumulation could build over the next two weeks.

Does Shiba Inu experience accumulation at lower prices?

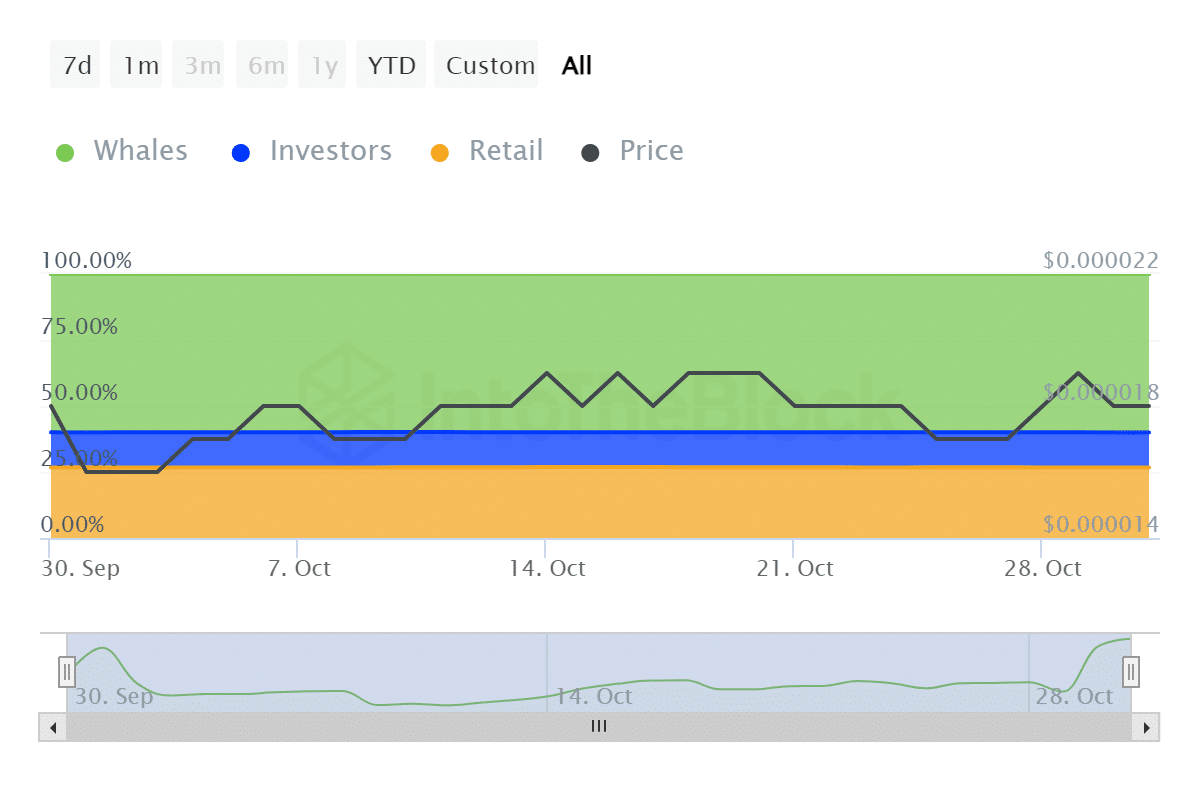

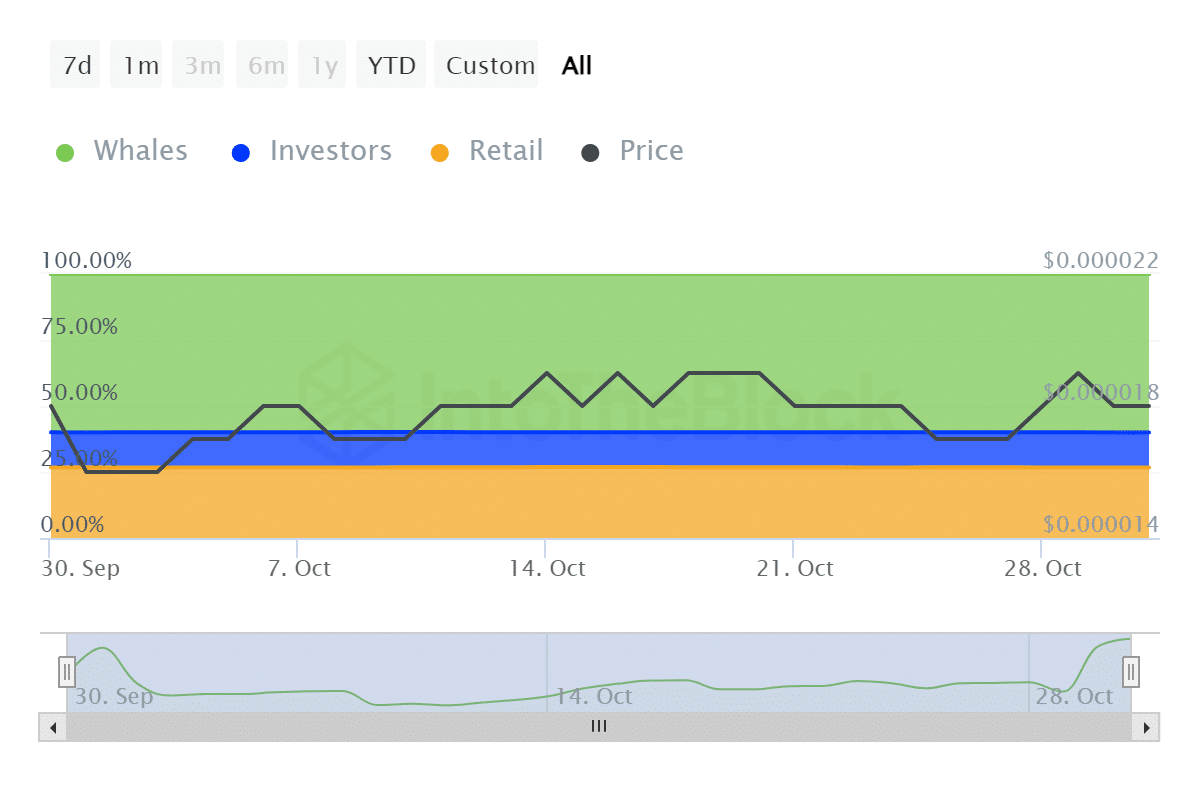

Data from the chain shows that whale activity has increased over the past four weeks. Whale balances grew from SHIB 590 trillion at the end of September to SHIB 591.01 trillion at the end of October.

Source: IntoTheBlock

Investor balances had a negative result in the same period. Their balance has fallen from SHIB 130.76 trillion to SHIB 129.4 trillion in the past four weeks. Retail holdings also fell from 262.99 trillion coins to 262.88 trillion coins.

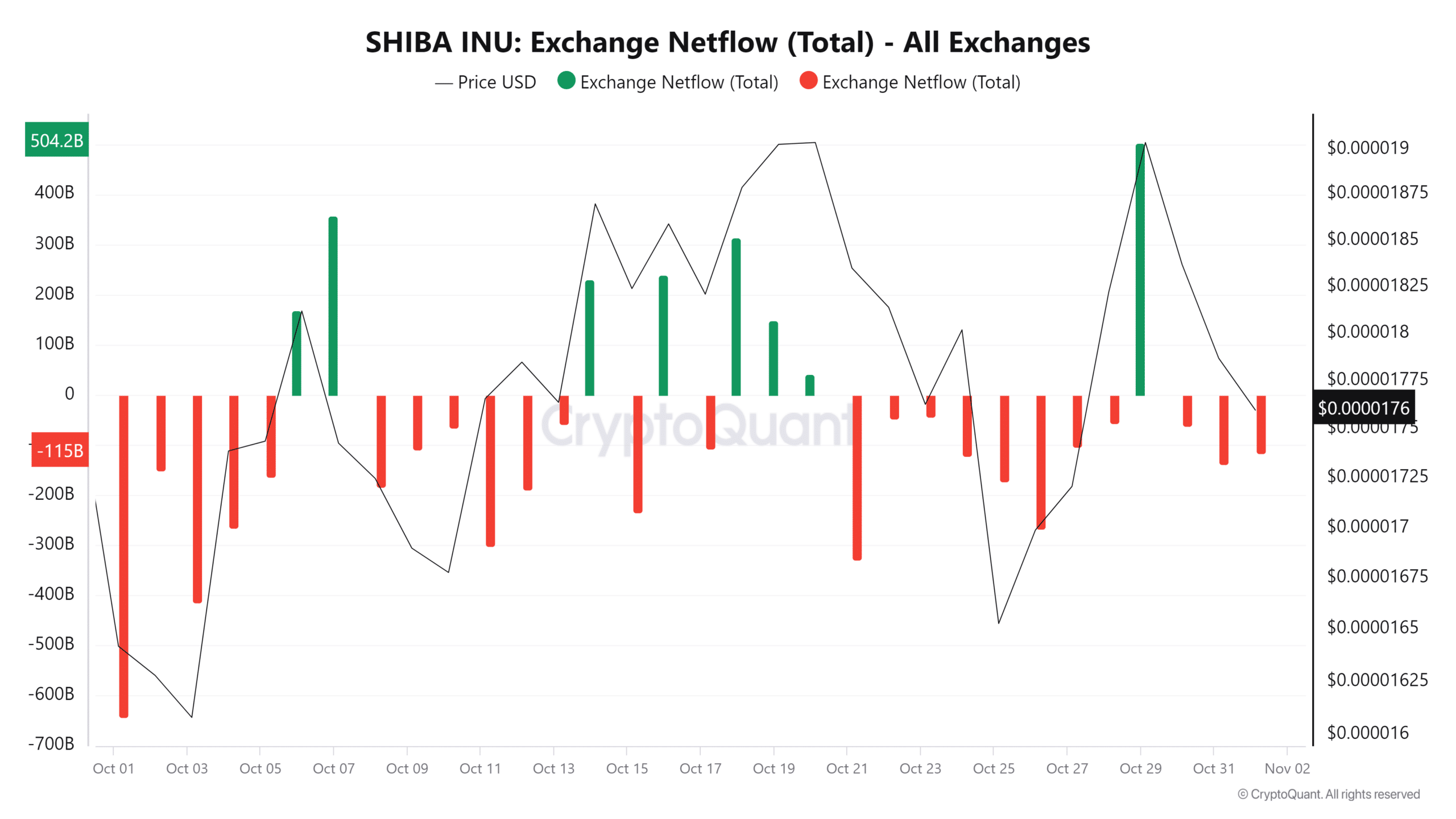

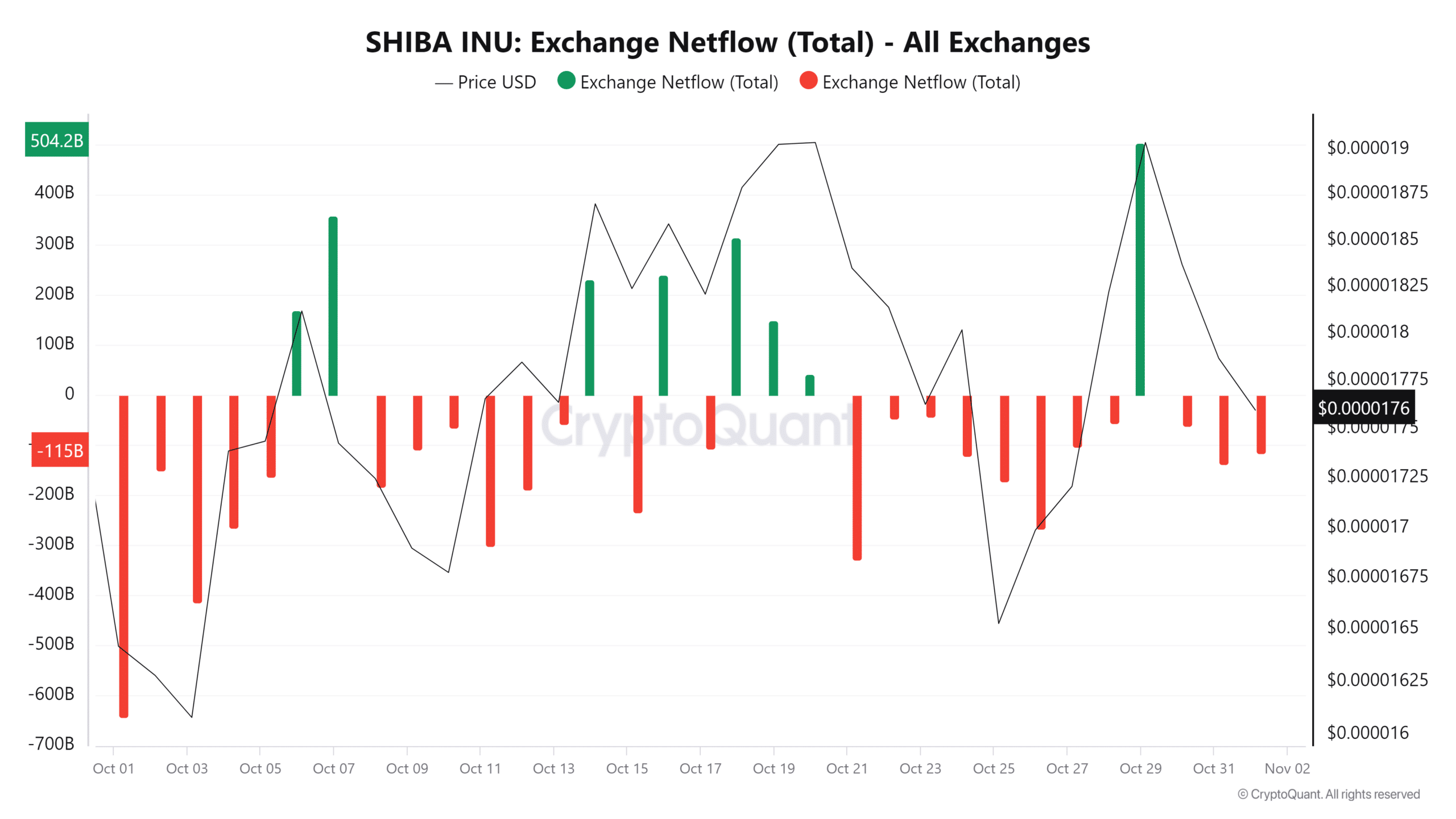

Finally, exchange data showed that the influx of Shiba Inu has been more dominant over the past four weeks. This aligned with the price action’s struggle to produce a significant rally.

Source: CryptoQuant

A bullish outcome will be characterized by more outflows than inflows. As well as strong growth in addresses of different classes, especially whales.