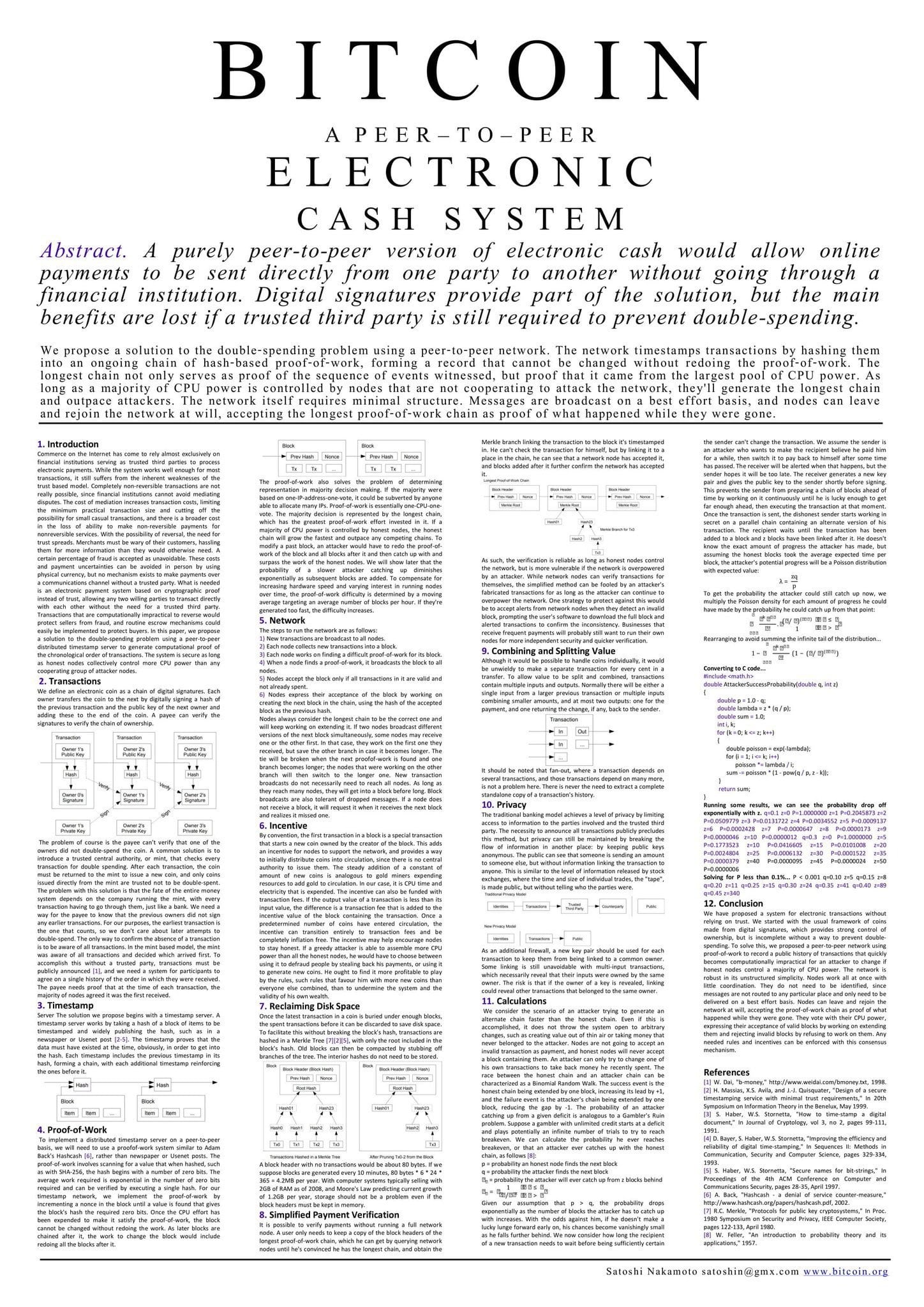

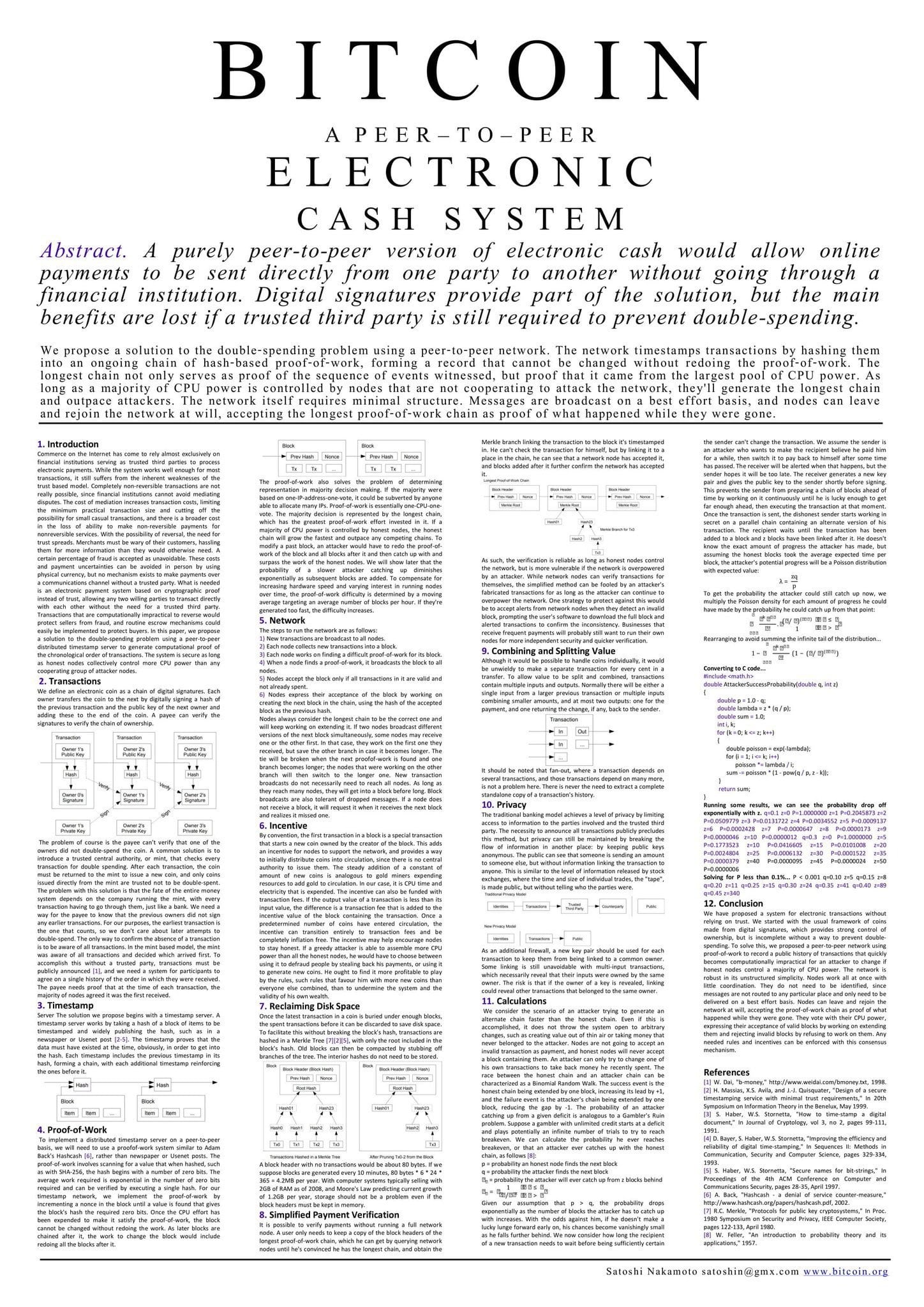

- The Bitcoin whitepaper was released in 2008 by the pseudonym Satoshi Nakamoto

- Whitepaper has had a huge impact on the global economy and enabled a paradigm shift

Sixteen years ago, Bitcoin’s (BTC) whitepaper, published by pseudonymous creator Satoshi Nakamoto, introduced the world to a revolutionary concept: a decentralized, peer-to-peer digital currency.

This groundbreaking document laid the foundation for blockchain technology and led to the creation of Bitcoin (BTC), the first cryptocurrency.

Bitcoin’s whitepaper didn’t just propose a new kind of money; it introduced a vision of financial freedom, allowing people to control their money outside of traditional banking systems.

Source:

Privacy and ownership

Since its inception, Bitcoin has reshaped the financial landscape by promoting privacy and ownership.

Unlike traditional banking, where institutions control the funds, BTC has given individuals the ability to own and manage their assets directly, without intermediaries.

This shift has led to a revolution in financial sovereignty, inspiring people around the world to explore the possibilities of decentralized money.

The idea of self-control and privacy resonated with users, sparking a movement toward a more transparent and accessible financial ecosystem.

Bitcoin laid the foundation for crypto and DeFi

In addition to privacy, Bitcoin’s whitepaper laid the foundation for the entire cryptocurrency ecosystem.

Bitcoin’s success spurred the development of more than 20,000 cryptocurrencies, each exploring new applications of blockchain technology.

Bitcoin, often referred to as “digital gold,” remains the most valuable crypto asset and has become a symbol of this digital economic shift. Its impact goes beyond finance, driving industries to focus on blockchain applications, from decentralized finance (DeFi) to tokenized assets.

Bitcoin’s influence has also catalyzed the DeFi revolution, where traditional financial services such as lending and trading occur without intermediaries. Built on blockchain, DeFi has grown into a multi-billion dollar industry, attracting both individual users and large institutions. Leading asset management firms such as Franklin Templeton have even begun to tokenize assets, further bridging traditional finance with blockchain innovation.

The expansion of DeFi reflects Bitcoin’s core principles, offering a decentralized alternative to conventional finance and promoting broader economic participation.

The publication of Bitcoin’s whitepaper not only introduced digital currencies, but also initiated a shift in economic and financial paradigms. As more people adopt BTC and cryptocurrencies, financial models are evolving to embrace digital assets.

Bitcoin’s reputation as a “store of value” has also continued to grow, positioning it as a hedge against inflation and economic instability.

This perspective has attracted significant interest from institutions. Especially because they see Bitcoin and other cryptocurrencies as essential components of modern investment portfolios.

Looking ahead…

In the future, Bitcoin’s fundamental role could drive further transformations in the global financial system.

The white paper has established a legacy of decentralization, privacy and financial autonomy, inspiring new generations to reinvent economic structures.

As blockchain technology matures and integrates further into the everyday financial world, BTC could continue to shape the future of digital money and decentralized finance.

In essence, Bitcoin’s whitepaper laid the foundation stone on a new economic path, with BTC at the forefront of a financial revolution.