- An unknown wallet transferred BTC worth hundreds of millions to Coinbase

- At the time of writing, BTC appeared to be approaching crucial support, and a retest could change the prevailing market trend

Bitcoin [BTC] investors have been a happy crowd lately, after it managed to surpass $72,000 on the charts in recent days. However, it could not maintain its positive momentum and soon BTC started falling.

That’s why it’s worth taking a closer look at why Bitcoin is down today.

Why did Bitcoin fall below $70,000 again?

Bitcoin bulls gained control of the market on October 27. Since then, BTC has performed very well, reaching $73.4k as of October 30. After this, the cryptocurrency started to consolidate and remained somewhere near $72,000.

However, in the past 24 hours, things have turned around. Bitcoin’s market bears returned, pushing the coin’s price down by more than 4%. At the time of writing this was the case trade at $69,063.85 on the charts.

A possible reason behind this latest price correction could be a large transfer. Whale Alerts, an X-handle that shares updates regarding whale activity, revealed that more than 8,000 BTC, worth over $567 million, were transferred from an unknown wallet to Coinbase.

Such big sales often cause price drops. However, in this scenario, things may be different. However, this was not the case on this occasion as there is a chance that the transfer was made via a CEX cold wallet. These generally do not have much influence on prices.

Lookonchain is even recent tweet suggested that a whale had actually bought the dip.

According to the same story, after the price of Bitcoin fell, a whale bought 550 BTC, worth $38.68 million. Therefore, AMBCrypto checked other data sets to find out whether buying sentiment has increased in the past 24 hours or not.

What next for BTC?

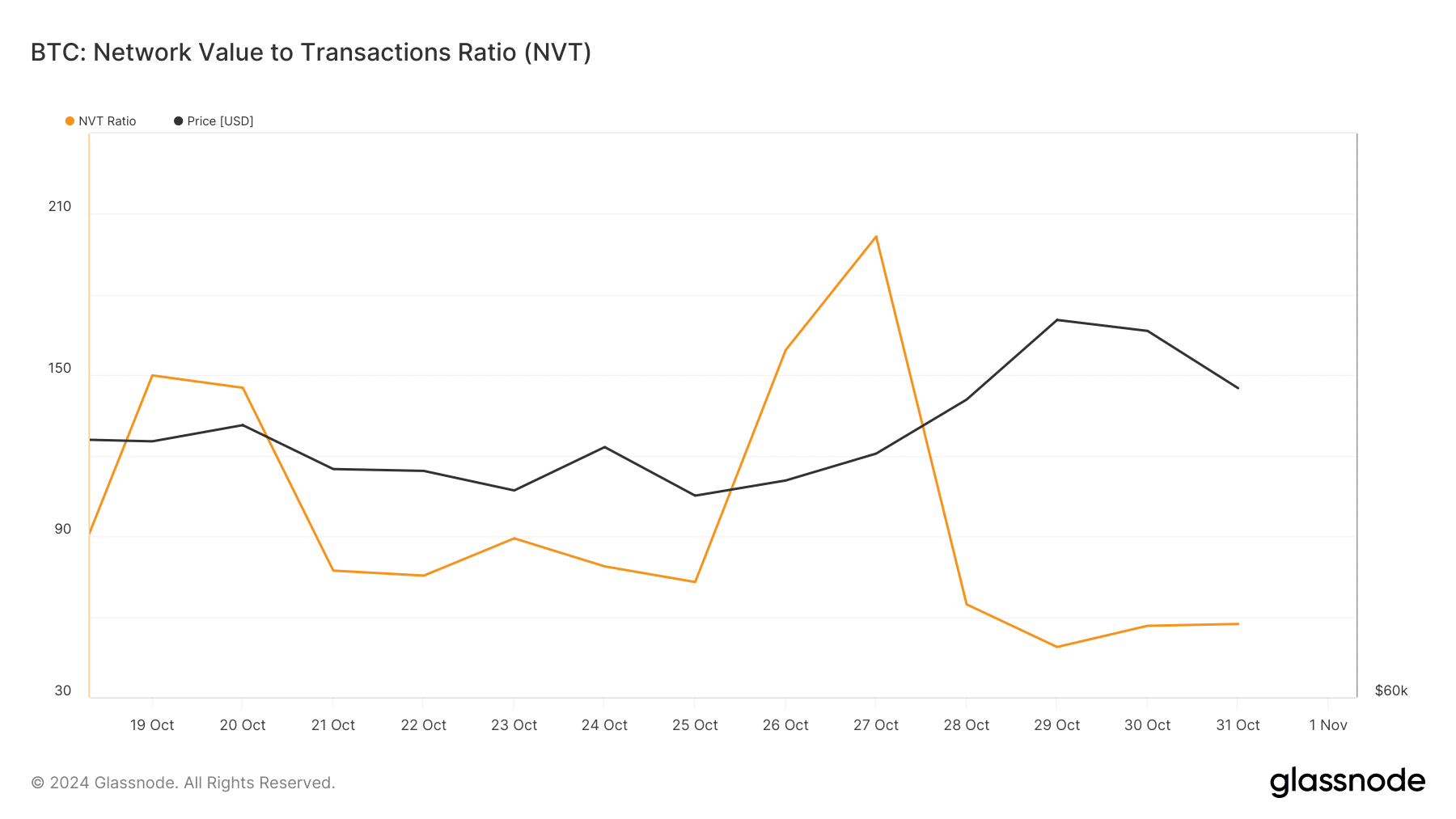

According to our analysis of Glassnode’s data, Bitcoin’s accumulation trend score had a value of 0.88. A number closer to 1 indicates that buying pressure is high. Bitcoin’s NVT ratio has also fallen sharply in recent days.

A decline in the benchmark means an asset is undervalued. This could also have motivated investors to increase their accumulation as the price of BTC fell.

Source: Glassnode

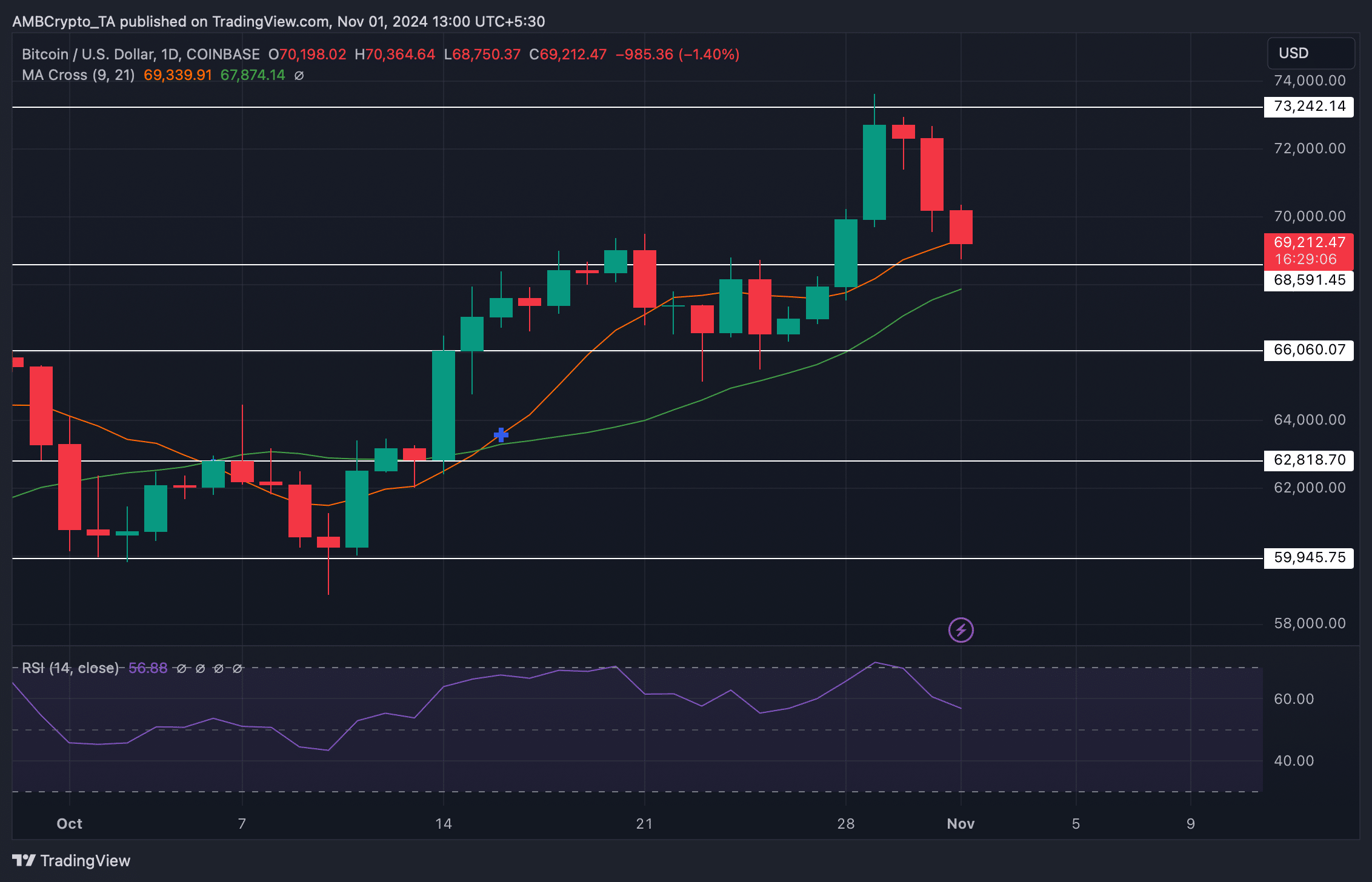

To better understand why Bitcoin is down today, AMBCrypto checked its daily chart. We found that BTC’s Relative Strength Index (RSI) has fallen sharply in recent days.

Read Bitcoins [BTC] Price prediction 2024-25

Nevertheless, the MA cross indicator revealed that the 9-day MA was well above the 21-day MA, which looked bullish. At the time of writing, BTC was approaching its support at $68.59k. A successful test could push BTC towards $73,000 again.

Source: TradingView