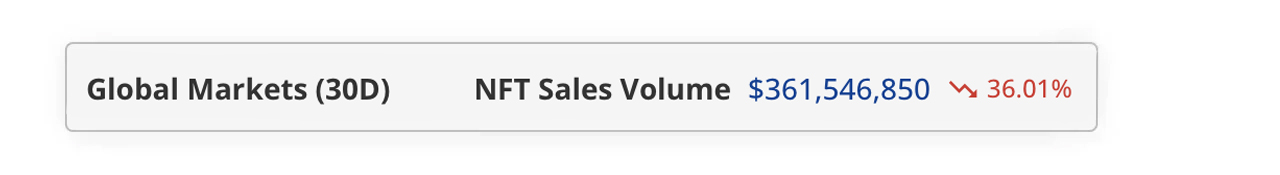

After a downtrodden September, non-fungible token (NFT) sales fell further in October, totaling $361 million – a drop of 36%.

NFT sales fell 36% in October, totaling $361 million

NFT sales didn’t fully recover in October, dropping 36% after September’s 47.9% dip. About $361.5 million in revenue was generated this month, with Ethereum NFTs leading the charge. Ether-based NFTs raised over $120 million, down 34.11% from September. Bitcoin NFTs followed suit, reaching $69.6 million in sales, although this too marked a decline of 27.17%. Solana took third place, posting $66.26 million, down 22.94% from September.

October NFT sales volume from cryptoslam.io.

October’s top digital collectible was Dmarket by Mythos, with sales of $37.1 million, a significant increase of 3,186.16% from September. Meanwhile, Immutable The Bitcoin Puppets NFT Collection raised $10.58 million, reflecting a solid increase of 66.78%. Rounding out the top five, Bored Ape Yacht Club (BAYC) brought in $10.49 million, while Cryptopunks followed closely with $10.18 million.

The most expensive NFT sale in October was an Uncategorized Ordinal, which raised $4.55 million about 16 days ago. Additionally, Ethereum witnessed the sale of BAYC #7,940 for $1.43 million, a Locked USDT collectible on BNB went for $343,310, and a Polygon Mining Pass fetched $205,145. About 7.43 million NFT transactions were recorded in October, a decline of 40.55%. According to data from cryptoslam.io, sellers rose 2.23% and buyers rose 26.52%.

October NFT market data indicates declining interest in digital collectibles, with transaction volumes and sales continuing to decline. Still, buyer activity showed signs of cautious optimism, potentially signaling a bottom in the market. While collections like Mythos’ Dmarket have seen notable growth, the overall trend of the market points to a base of interested buyers – leaving room for potential stability as interest increases across all platforms and assets.