This article is available in Spanish.

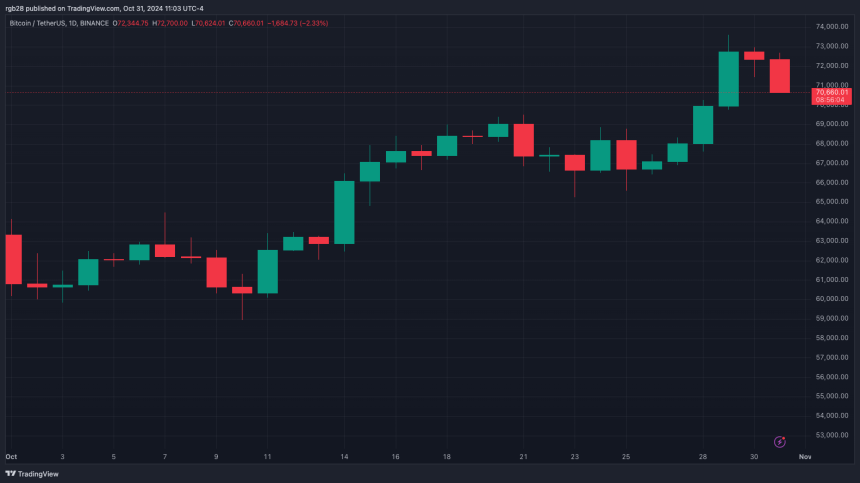

Ahead of the monthly close, Bitcoin (BTC) has seen another failed attempt to regain the $72,000 resistance as its support level. Despite the decline, some analysts believe the cryptocurrency is still in a strong position for an impending breakout, keeping an eye on the next levels.

Related reading

BTC’s Sweet 16 party is going to be spooky

Bitcoin, the largest cryptocurrency by market capitalization, staged an impressive rally in ‘Uptober’, up about 13% in the past 30 days. The price of BTC has risen from its monthly low of $58,900 to near its all-time high (ATH) of $73,737, hitting the $73,300 mark on Wednesday.

After September’s green close, the flagship crypto will see its best monthly close since March, with a potential monthly return of around $13 to 14% despite the most recent price action.

On the 16th anniversary of its whitepaper, Bitcoin registered a ghostly 2% decline, driving the rest of the market into a red Halloween party. The price of BTC fell below the $71,000 mark and reached an intraday low of $70,600. Meanwhile, the second-largest cryptocurrency by market cap, Ethereum (ETH), retreated around 5.1%, missing the $2,600 support zone.

Crypto analyst Ali Martinez pointed out that today’s decline marks the fifth straight rejection BTC is facing at $72,000. Since its ATH, Bitcoin has bounced off this resistance level five times, falling between 8.2% and 18% the four previous times.

Analyst Altcoin Sherpa suggested that BTC could see a 4% to 5% dip if the largest cryptocurrency fails to stay within the $70,000 support zone. Nevertheless, Sherpa believes that the cryptocurrency should see “some kind of recovery” from the $70,800-$71,400 area in the near term.

BTC is expected to have an extremely volatile week ahead of the US presidential elections. Bitfinex analysts predicted that Bitcoin volatility will peak between November 6 and 8 as speculation and anticipation over the election outcome impacts the cryptocurrency’s performance.

Is Bitcoin Gearing Up for the Year-End Breakout?

Cryptoinsightuk weighed in on Bitcoin’s performance, noticing that BTC is still at ATH according to Open Interest (OI). The crypto investor believes that the Daily Relative Strength Index (RSI) could potentially cross “bearish” today.

He also emphasized that $69,600 should work as a key support level for Bitcoin bulls, but warned that losing the $66,500 range could be “messy” as BTC open interest would “flush.”

Meanwhile, Crypto Kaleo posted a more bullish outlook for BTC price action. The analyst emphasized that the flagship crypto did not break above its ATH when it reached the $20,000 mark again in 2020.

Related reading

Instead, Bitcoin initially retreated nearly 20% over Thanksgiving, from $19,400 to $16,100. Furthermore, the price of BTC accumulated within that range for 30 days before the outbreak, seeing its next increase in late December 2020.

The analyst pointed out that the breakout occurred 219 days after the May 2020 halving. Since Bitcoin is currently 194 days post-halving, the analyst believes that “a small pullback here is not a cause for concern.”

At the time of writing, Bitcoin has held the $70,000 support level and is currently trading at $70,522.

Featured image from Unsplash.com, chart from TradingView.com