- The recent increase in transaction volume and price breakout of Pyth Network’s $36 billion valuation indicate a possible bullish trend.

- Rising open interest and social dominance strengthen market confidence and position Pyth for further price appreciation.

Pyth network [PYTH] its recent performance of $36 billion in transaction volume in the last 30 days positions it as a formidable player, Chain link [LINK].

This impressive growth highlights the increasing adoption of Pyth’s innovative pull-based Oracle model, especially within the decentralized finance (DeFi) sector.

At the time of writing, Pyth is trading at $0.4038, reflecting a 5.63% increase in the last 24 hours. Therefore, such momentum suggests that Pyth could capture more market share and attract new investors.

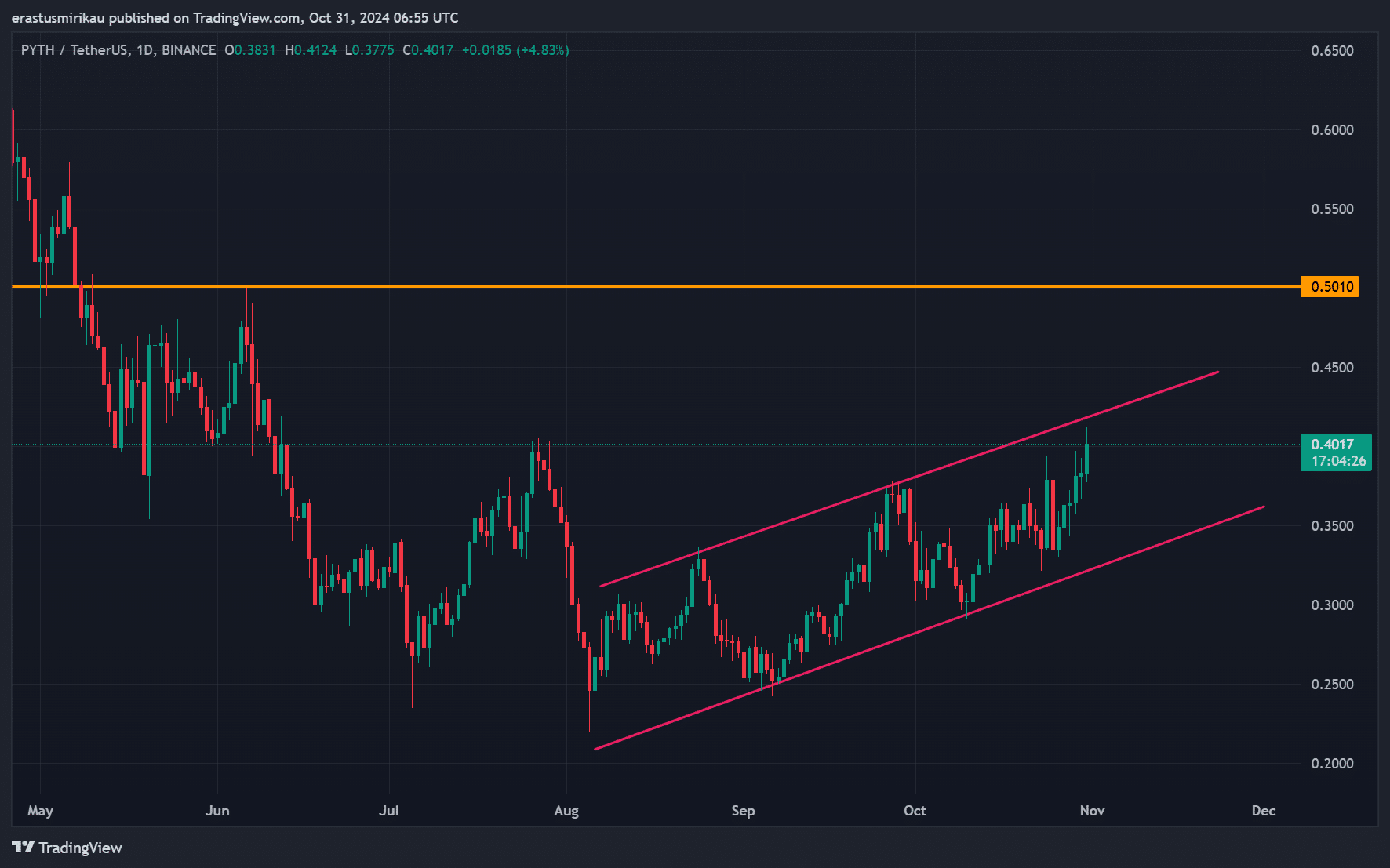

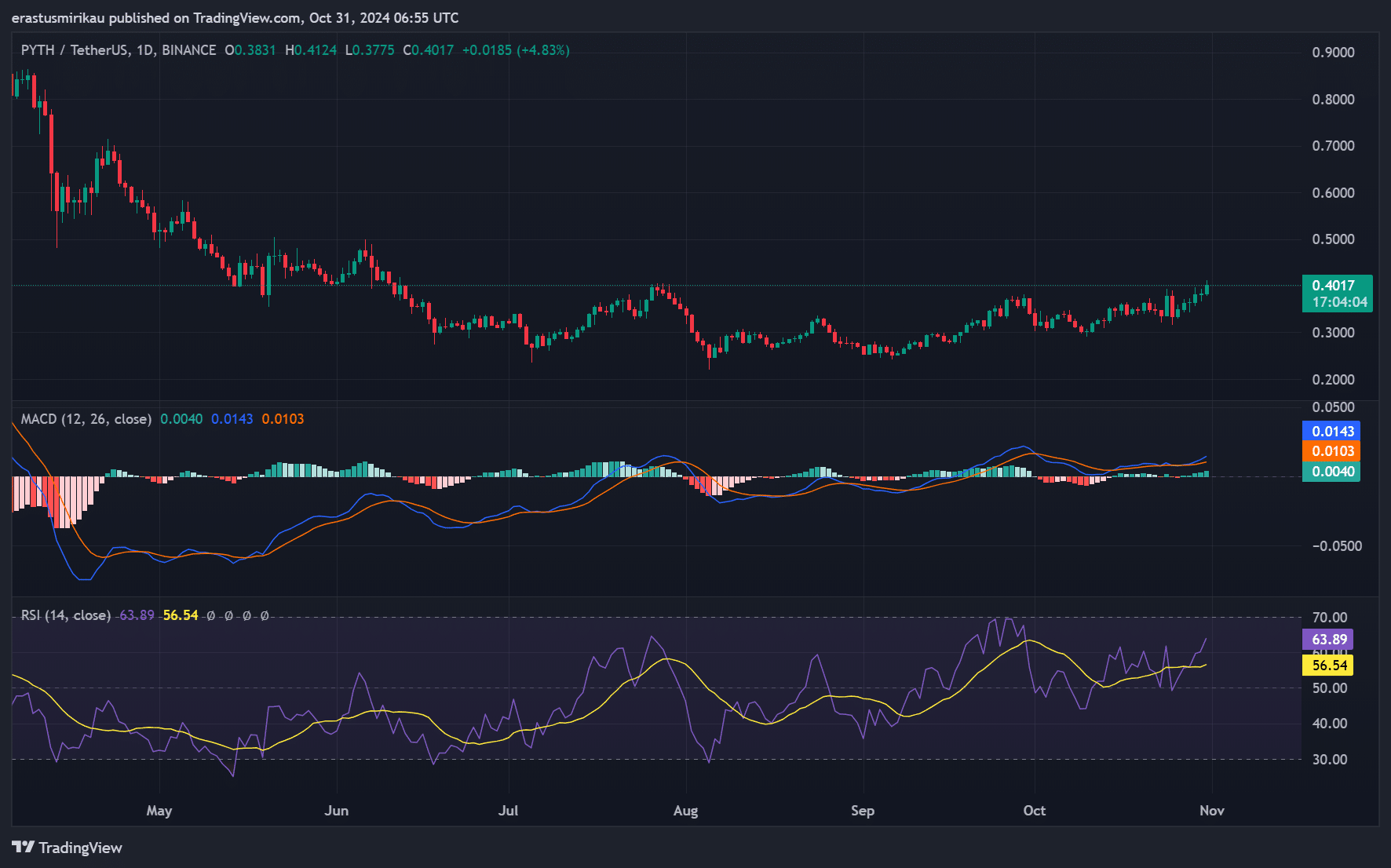

Are we witnessing an outbreak? Graph Analysis from Pyth Network

The current price action indicates that Pyth has broken out of a well-defined rising channel. This breakout signals a shift in momentum and suggests that upward pressure could continue. Analysts identify $0.5010 as a crucial resistance level.

If this barrier is broken, it could lead to further bullish sentiment. Consequently, observing price movement within this channel enhances the potential for sustained upward movement in the short term.

Source: TradingView

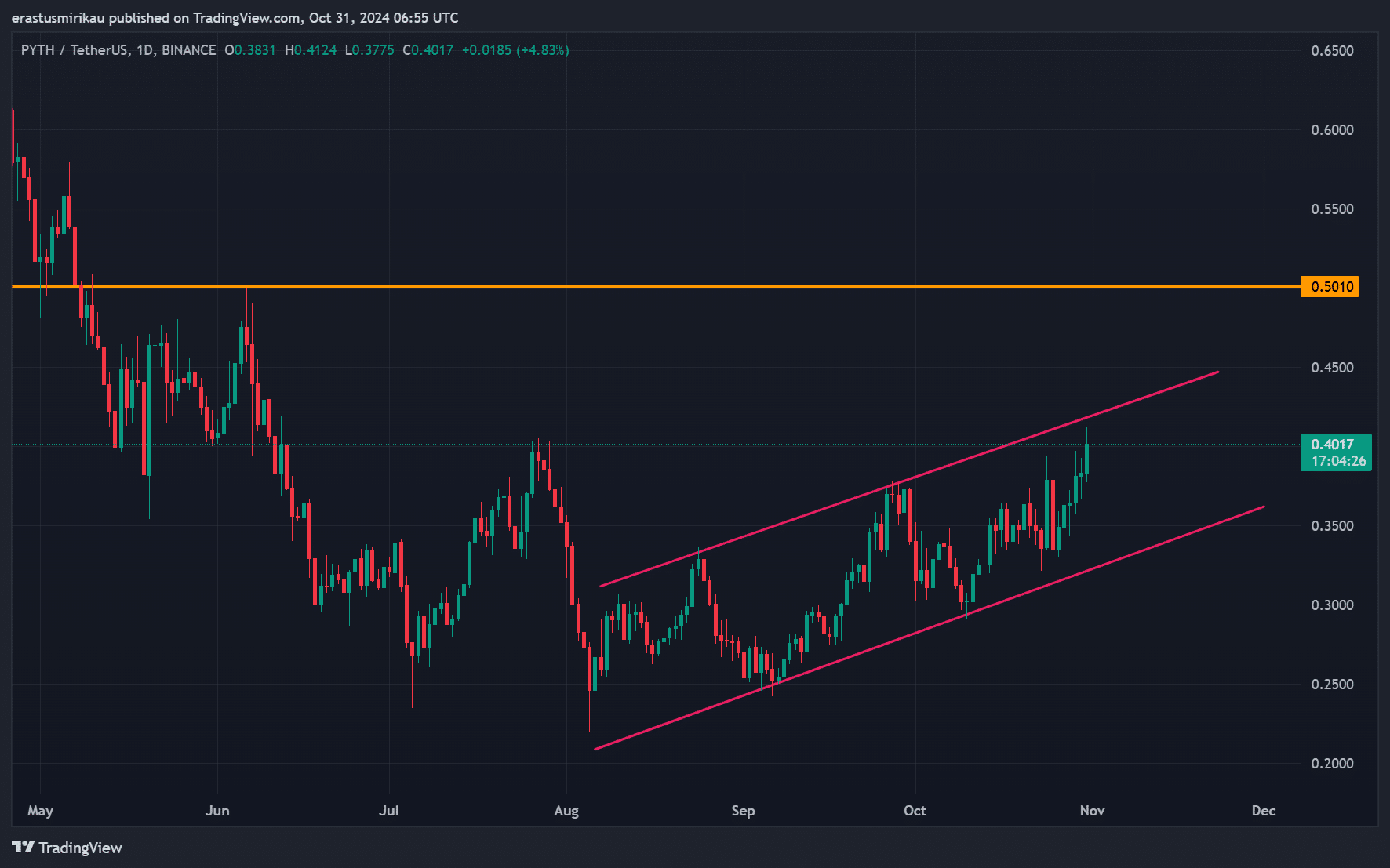

What do the indicators say? Analyze RSI and MACD

As for technical indicators, the Relative Strength Index (RSI) stands at 63.89, indicating that Pyth is approaching the overbought area, which could lead to a price correction. However, there is still enough momentum to push prices higher.

Furthermore, the MACD indicator is showing bullish convergence, indicating that the recent price action is in line with the ongoing upward momentum. Both indicators present a balanced picture, indicating that caution is warranted, but the overall trend remains bullish.

Source: TradingView

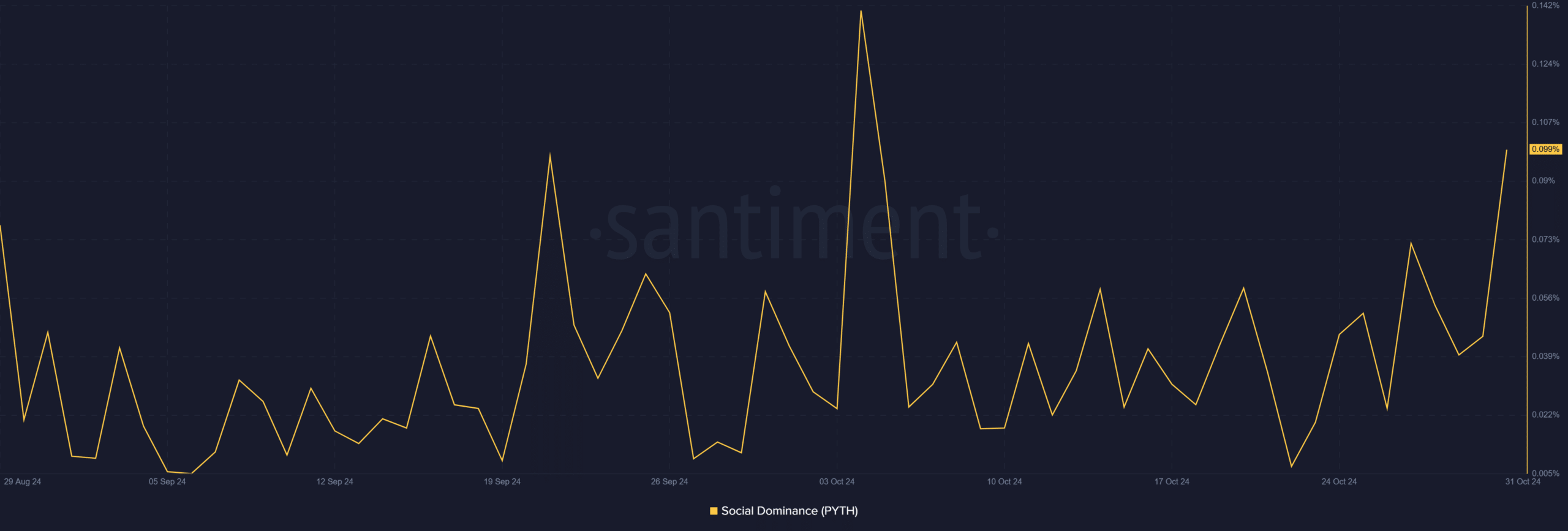

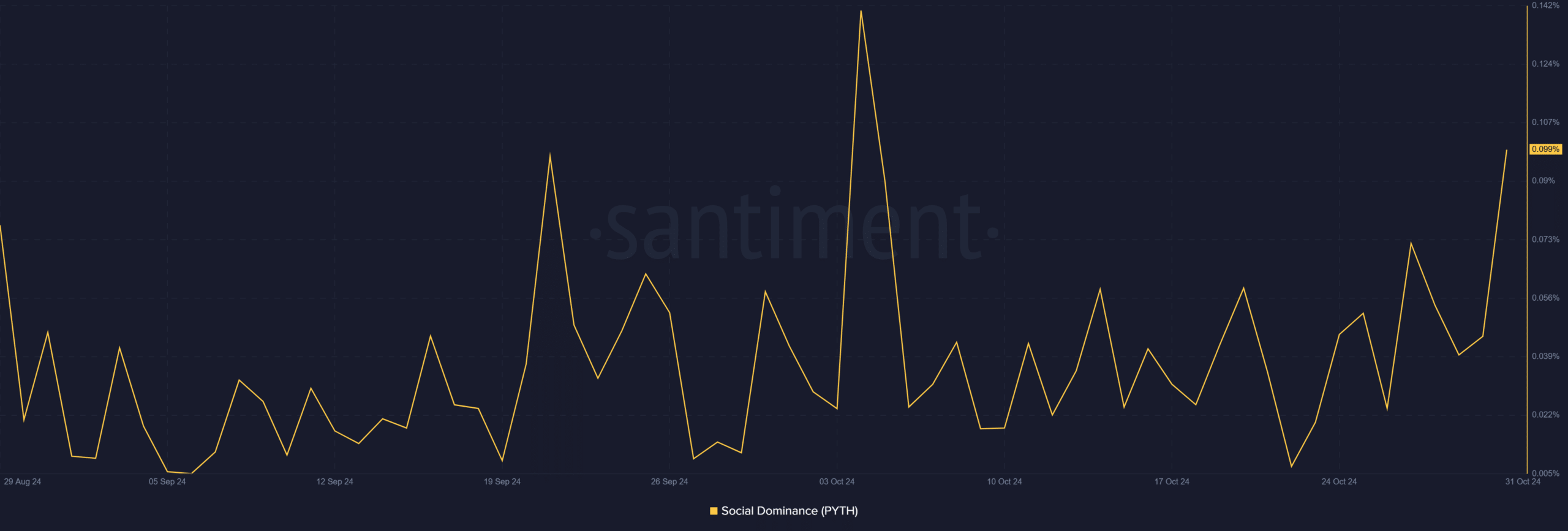

Pythian social dominance: how does it compare?

Social dominance currently stands at 0.0994%. This metric reflects growing community interest and engagement, which is proving crucial for driving future price action.

Greater social dominance often correlates with greater trading volume, strengthening Pyth’s position in the market. As engagement continues to increase, it may therefore attract more investors looking to capitalize on the recent momentum.

Source: Santiment

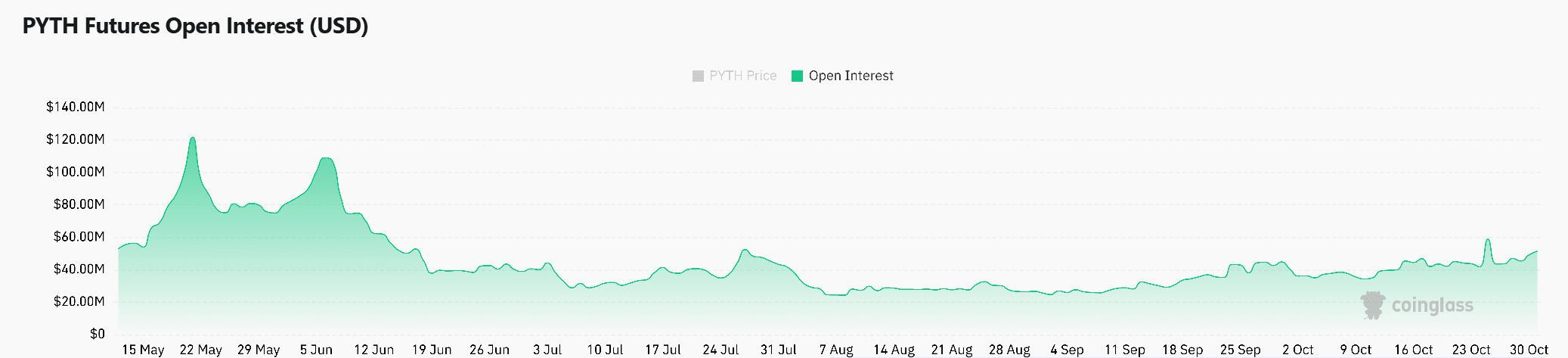

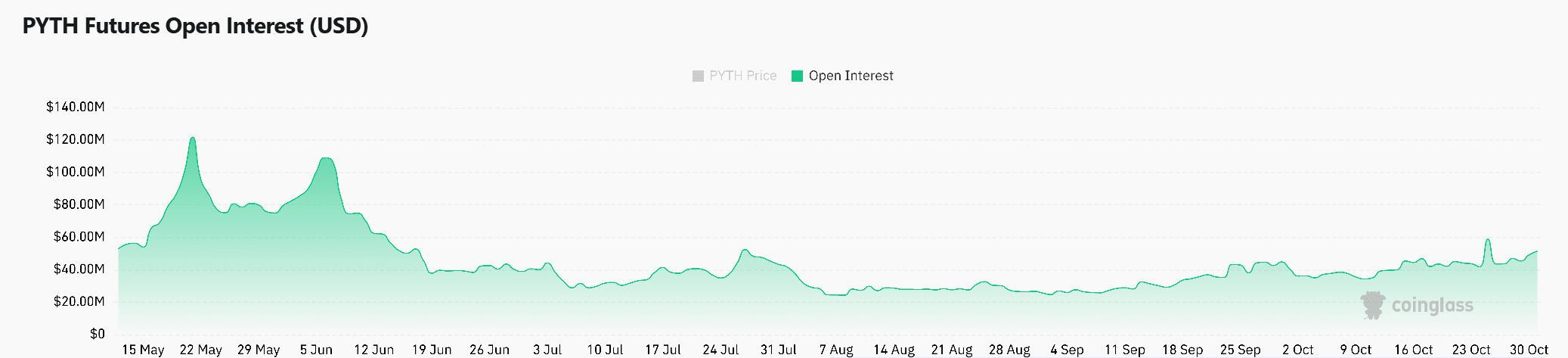

Market sentiment: is open interest growing?

Open interest rose 30.77% to reach $66.39 million. This increase in open interest indicates that traders remain bullish on the price action and are likely positioning themselves for potential profits.

As a result, rising open interest generally signals more traders entering the market, which helps price stability and growth.

Source: Coinglass

Realistic or not, here is PYTH’s market cap in BTC terms

PYTH poised for significant upside trajectory

Pyth Network’s recent performance and technical indicators indicate a strong bullish trend. With a significant increase in transaction volume, a breakout from the rising channel and increasing social dominance, the country is well positioned for further price increases.

Therefore, traders and investors should keep a close eye on Pyth as the company looks to breach key resistance levels, which could solidify its position as a leading Oracle provider.