- Bitcoin is approaching record highs, just 1.8% away from its previous ATH, indicating strong bullish momentum.

- Increased accumulation by long-term holders and rising whale transactions indicate the potential for a further rally.

Bitcoin [BTC] has continued its impressive climb, now just 1.8% down from the all-time high (ATH) of $73,737 reached in March 2024.

BTC was trading above $72,000 at the time of writing, has gained almost 10% in the past week and is up 0.2% in the past day. This consistent uptrend reflects renewed investor confidence, reinforced by numbers pointing to the strength of Bitcoin’s fundamentals.

Furthermore, this recent price increase appears to be largely driven by long-term holders (LTH) who are actively accumulating Bitcoin, because marked by CryptoQuant analyst Darkfost.

Whales are piling up like never before

According to the CryptoQuant analyst, the LTH 30-Day Net Position Change (a metric that tracks the monthly growth or decline of Bitcoin in the hands of long-term holders) shows that despite BTC approaching its ATH, there has only been a slight decline in its net position . change.

Source: CryptoQuant

Darkfost explains that this small dip in net position change is “approximately 2.5 times smaller than the decline observed at the previous ATH,” indicating that the current sell-off is more muted.

This trend suggests that long-term holders are showing confidence in Bitcoin’s short-term potential by holding it rather than selling.

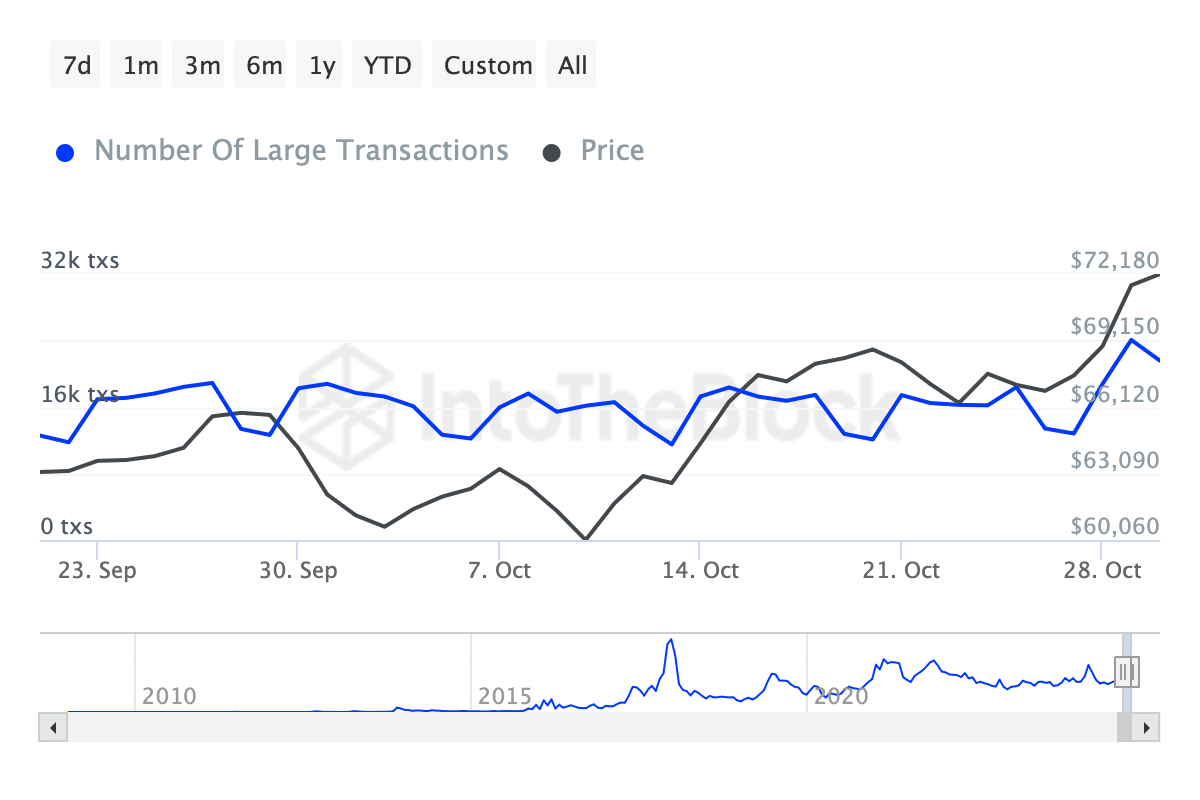

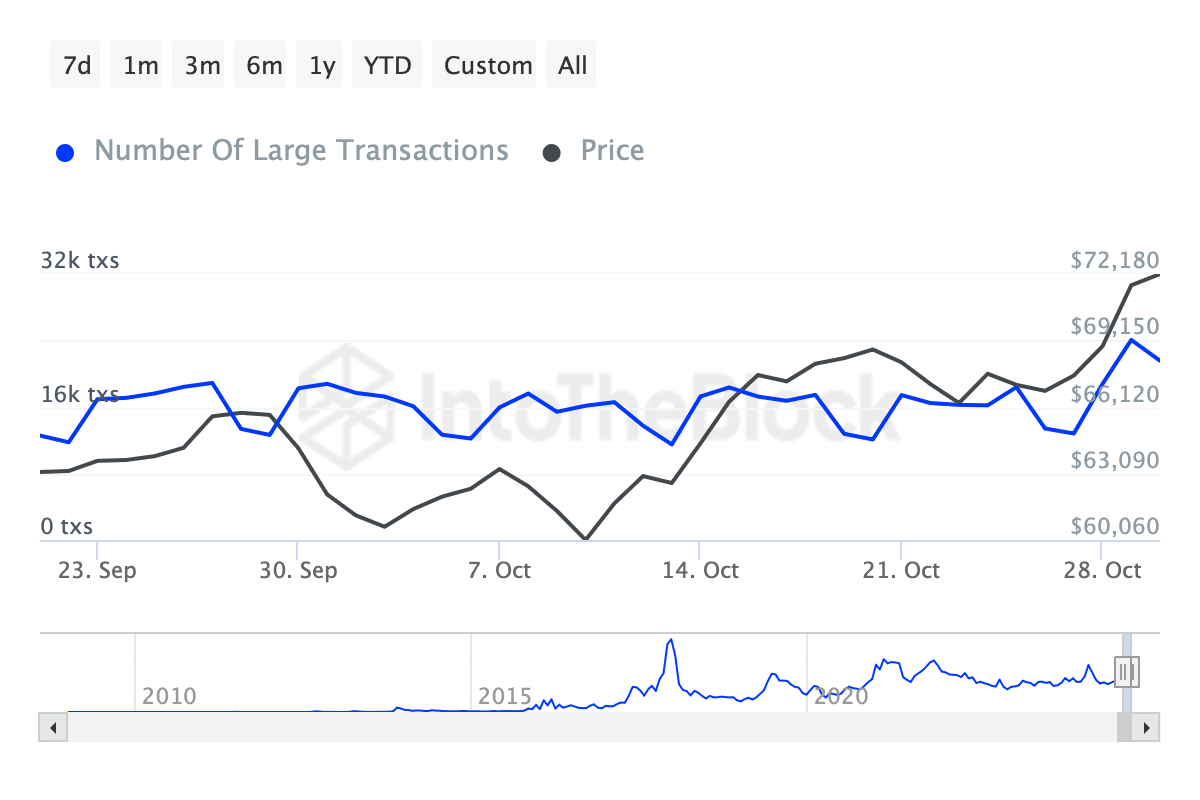

In addition to activity from long-term holders, Bitcoin is witnessing increased interest from large investors, also known as ‘whales’. Data from InTheBlok indicates that whale transactions have seen a noticeable increase, from 15,000 transactions last week to over 20,000 at the time of writing.

Source: IntoTheBlock

Such a spike in whale transactions generally indicates substantial interest in Bitcoin from large investors, who may be positioning themselves for further price gains.

In the crypto markets, whale activity can trigger significant price shifts as their substantial holdings have the potential to influence supply and demand dynamics.

Positive indicators are converging as Bitcoin approaches key price milestone

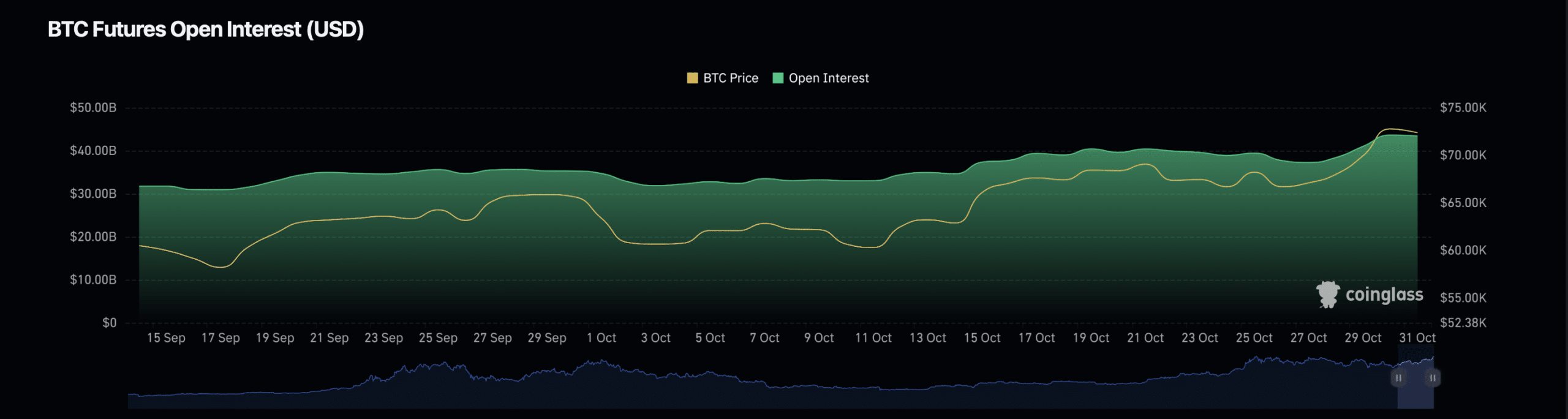

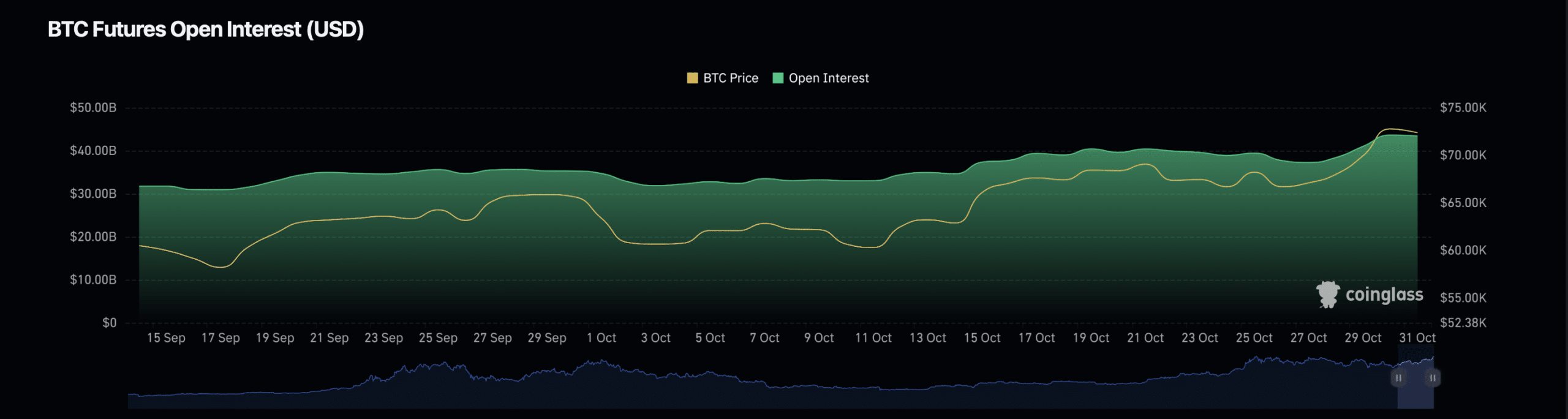

Another key indicator of strong investor sentiment is Bitcoin’s open interest, which measures the total number of outstanding derivative contracts tied to the asset.

Facts from Coinglass reveals that BTC open interest has seen a slight increase, rising 0.33% to reach a valuation of $43.59 billion.

Source: Coinglass

However, Bitcoin’s open interest volume has shown a contrasting trend, declining 37.63% to a valuation of $56.13 billion.

A rise in open interest generally indicates that traders are actively engaged in the asset, while a drop in volume can indicate caution among some investors, who may be waiting for additional price signals before making substantial trades.

The convergence of these factors – long-term shareholder accumulation, increased interest in whales, and increased open interest – has created a favorable backdrop for Bitcoin’s continued upward momentum.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Long-term holders showing resilience and restraint in selling at near ATH levels indicate an overriding sentiment of optimism within the Bitcoin community.

Darkfost concludes that this cautious but steady accumulation by long-term investors could pave the way for a potential rally in the near future.