This article is available in Spanish.

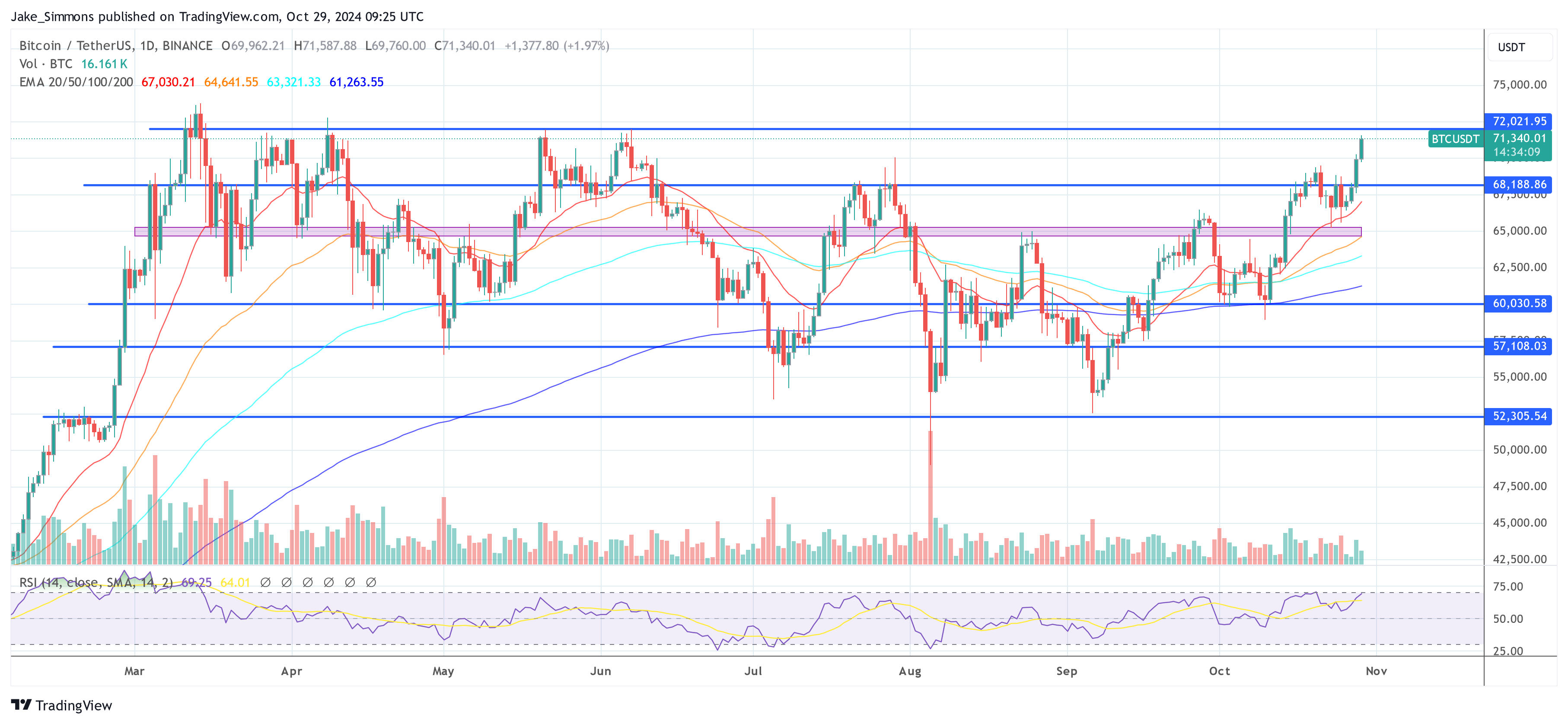

Bitcoin price has surged past the $71,000 mark today. Over the past five days, the price of Bitcoin has risen by more than 8.5%, from $65,600 to $71,118 on October 29. In the last 24 hours alone, the BTC price has increased by 3.8%. This upward momentum can be attributed to four key factors:

#1 Bitcoin ETFs attract massive inflows

The rise in the price of Bitcoin is closely linked to the substantial inflows into Bitcoin Exchange-Traded Funds (ETFs). Yesterday there were huge ETF flows totaling $479.4 million. BlackRock led the inflows with $315.2 million, followed by Fidelity with $44.1 million, Ark with $59.8 million and Bitwise with $38.7 million. These significant investments coincided with Bitcoin’s price movement from $68,000 to over $71,000.

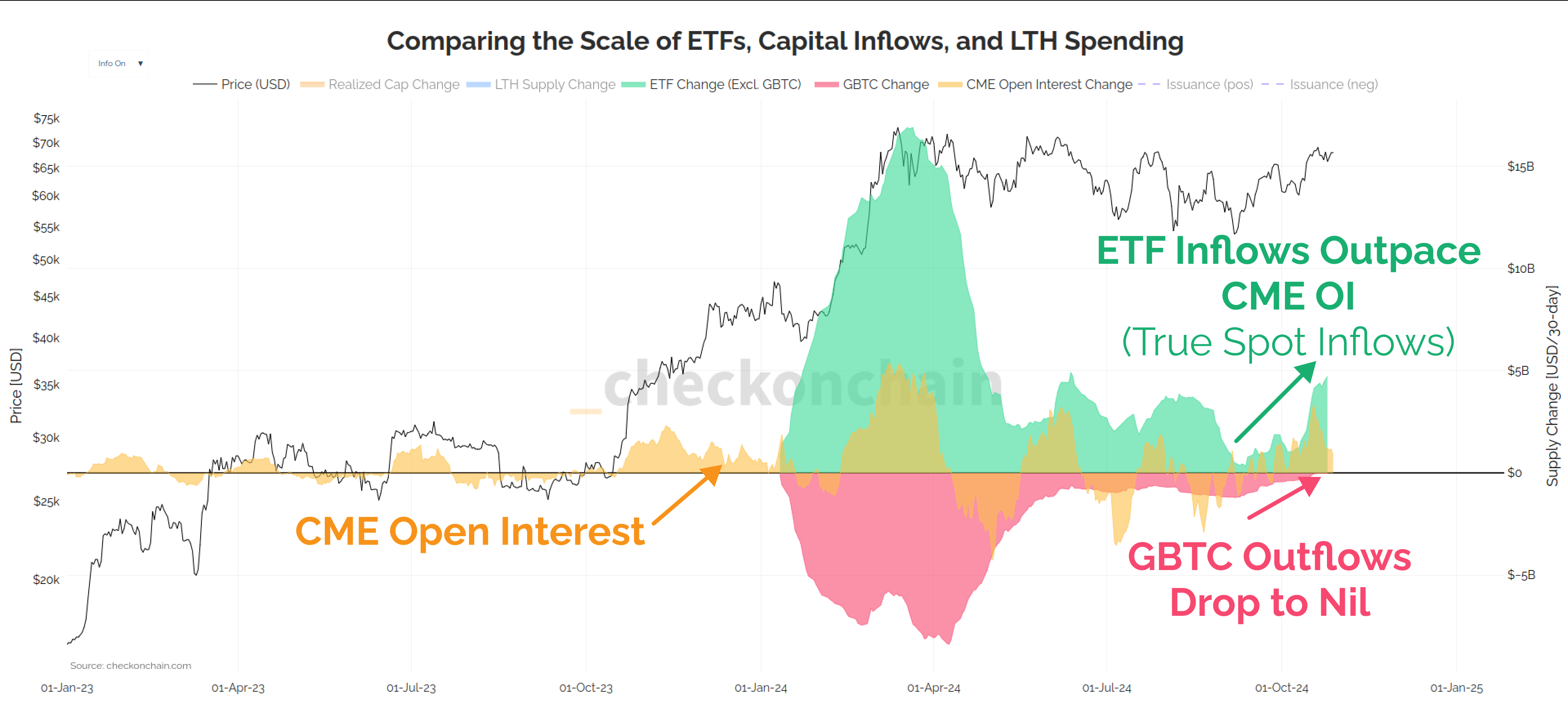

Leading on-chain analyst James “Checkmate” Check highlighted a difference between Bitcoin ETF inflows and CME Open Interest. He noted “We have a difference between Bitcoin ETF Inflows and CME Open Interest. ETF inflows are up significantly, CME Open Interest is up, but GBTC outflows are also minimal. We are seeing real targeted ETF inflows, and fewer cash-and-carry transactions.”

The difference suggests that investors prefer direct exposure to Bitcoin through ETFs rather than engaging in cash-and-carry trades with futures contracts. The carry trade strategy in the context of US spot Bitcoin ETFs and CME futures involves buying the ETF (tracking the spot price of Bitcoin) and simultaneously shorting Bitcoin futures on the CME.

This approach aims to take advantage of price differences when futures trade at a premium to the spot price (contango). The notable shift towards ETFs signals bullish sentiment among investors, who are anticipating further price appreciation.

#2 The “Trump Trade”

Political developments are also influencing Bitcoin’s recent rally. Singapore-based QCP Capital commented on the impact of former President Donald Trump’s interview on the Joe Rogan Experience podcast, which has been viewed more than 32 million times and pushed his Polymarket odds above 66%. Despite “crypto” being touted as the “Trump Trade,” Bitcoin’s correlation with Trump’s potential election victory appears to be fueling the Bitcoin price rally.

QCP Capital also noted that Bitcoin is up just 8% this “Uptober,” compared to an average of 21% in previous October. They stated: “If the spot holds at these levels, this October would be Bitcoin’s fourth-worst performance in the past decade.” With total open interest for BTC perpetual futures on the exchanges at $27 billion – approaching this year’s peak – a breakout above $70,000 could set new all-time highs, especially if more leveraged longs join in.

#3 Shorts Squeeze amplifies price increases

Market data points to a significant short squeeze contributing to Bitcoin’s price rise. According to Mint glassIn the last 24 hours, 65,622 traders were liquidated, with the total number of liquidations across the entire crypto market reaching $228.51 million. Of this, $169.47 million consisted of short liquidations. Specifically for Bitcoin, $83.61 million worth of shorts were liquidated. The largest liquidation order occurred on Binance’s BTCUSDT pair, worth $18 million.

The substantial liquidation of short positions indicates that many traders were betting on a price drop and were forced to close their positions when the market turned against them. This massive unwinding of short positions could accelerate upward price movements as traders buy back into the market to hedge their positions.

#4 Whales increase purchasing activity

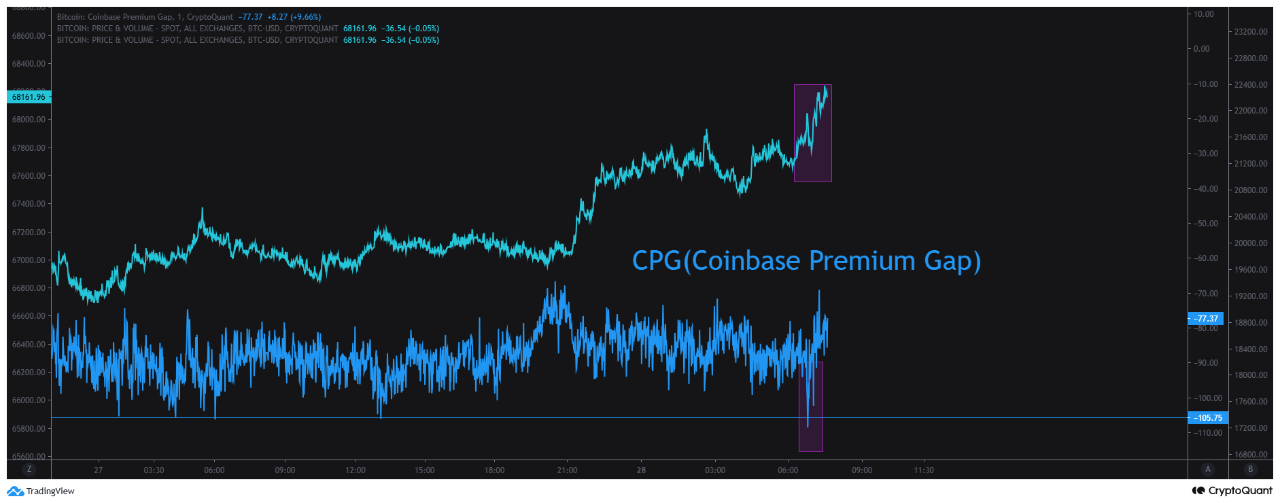

Large-scale investors, often referred to as “whales,” are playing a crucial role in the current rally. CryptoQuant analyst Mignolet observed that Bitcoin’s rally continues, led by activity on the Binance exchange. He pointed out that Binance whales became significantly involved in the market two weeks ago during Asian trading hours, and that the recent declines in the Coinbase Premium Gap (CPG) alongside price increases are “a clear sign of Binance whales intervention.

Mignolet emphasized that this should not be interpreted as a decline in US demand, but as even stronger buying pressure from Binance. Over the past two weeks, demand for US Bitcoin spot ETFs has soared, with a net inflow of approximately 47,000 Bitcoin. Because most ETF products use Coinbase, movements in CPG data are closely tied to ETF demand. He concluded: “The current Bitcoin price is driven by Binance whales, with continued inflows of US capital.”

At the time of writing, BTC was trading at $71,340.

Featured image created with DALL.E, chart from TradingView.com