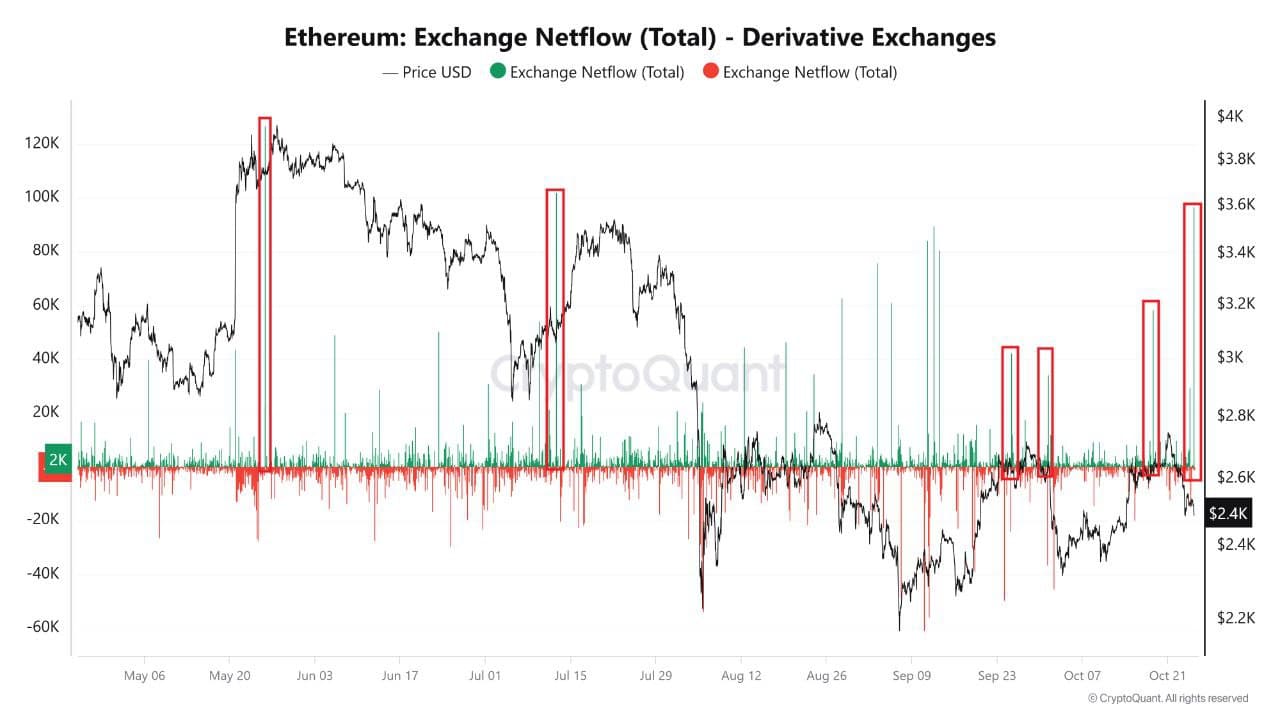

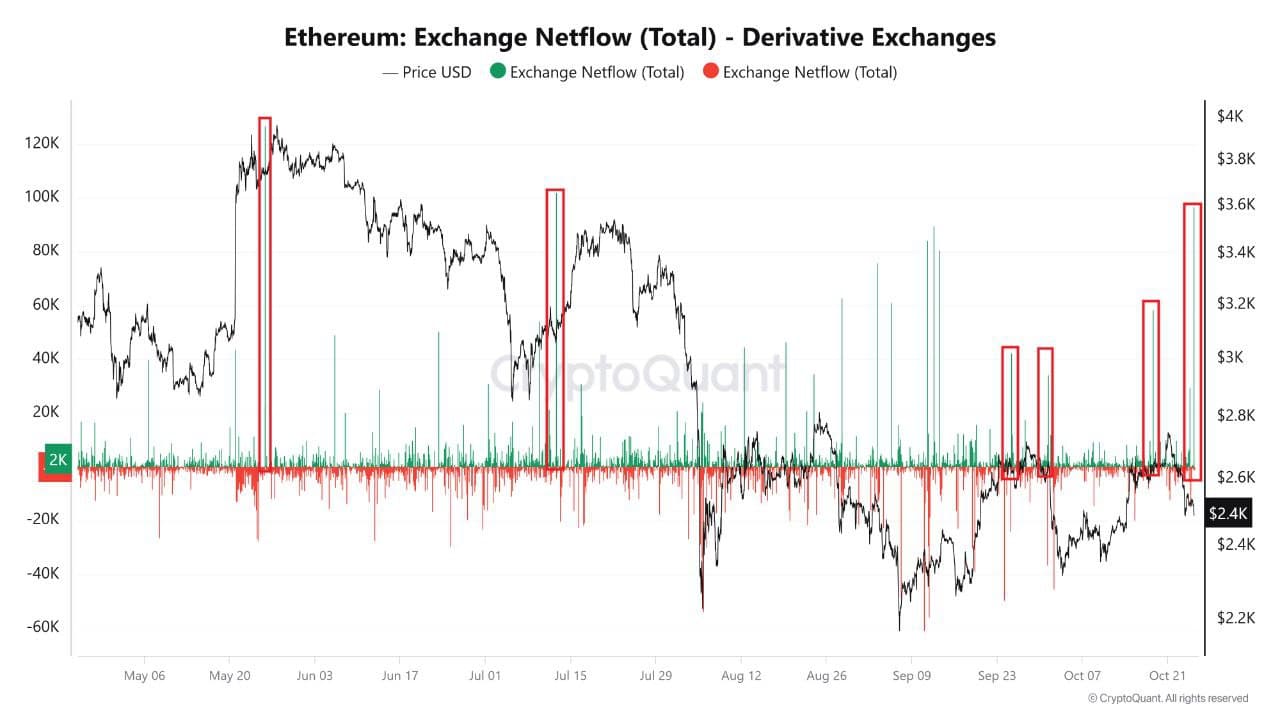

- The markets saw an influx of Ethereum into derivatives exchanges.

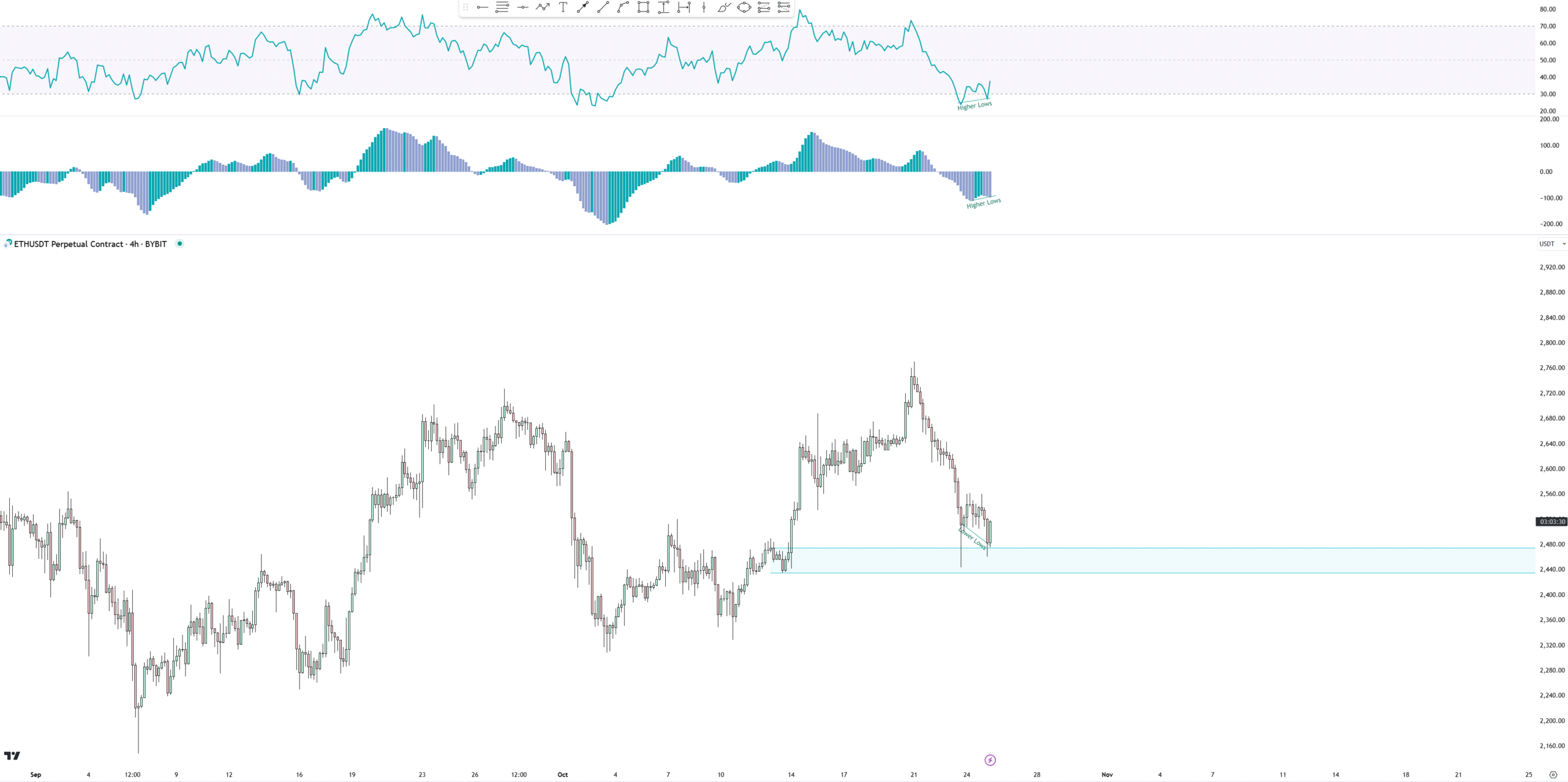

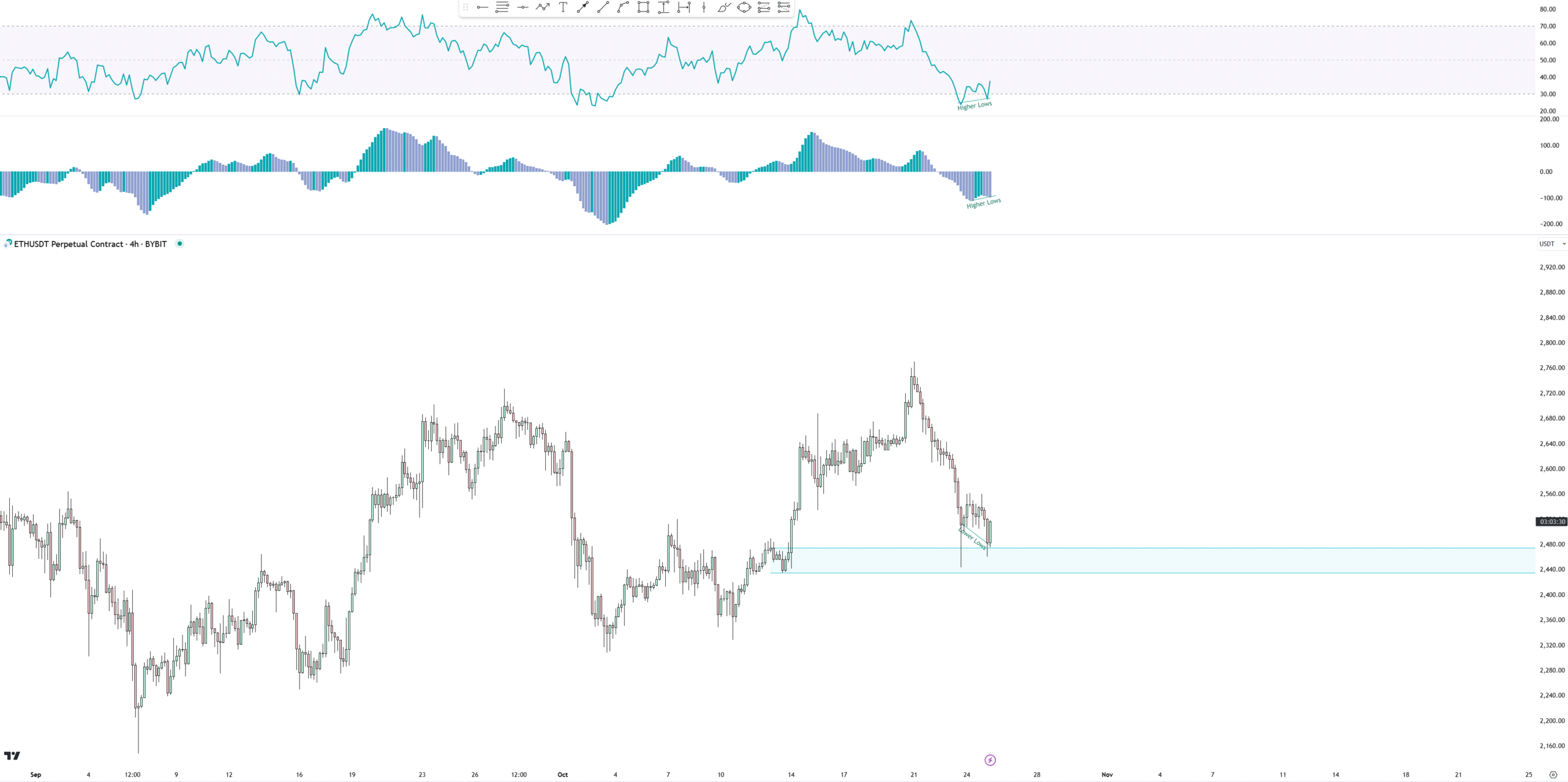

- Recent charts showed a possible four-hour bullish divergence on ETH.

Ethereum [ETH]one of the most important cryptocurrencies, has been a topic of discussion as an inflow of 96,000 ETH into derivatives exchanges recently indicated a notable increase in market activity.

Historically, similar inflows have led to ETH price fluctuations or declines, as we saw in May and July of this year. This increase could signal another price correction or potentially trigger a major market shift.

As the final quarter of the year progresses, Ethereum’s performance could closely follow Bitcoin’s recent breakout from a long-term consolidation, fueling optimism in the crypto markets.

Source: CryptoQuant

US elections accompanied by a divergence signal

Ethereum’s price action during previous US election cycles also supported this trend. During the 2020 elections, ETH soared and broke out of consolidation.

With the election just days away, a similar pattern could emerge.

Ethereum could see a recovery if history repeats itself, especially as many anticipate positive policies towards crypto under potential changes in the US government.

However, this outcome remains speculative as the overall economic and crypto landscape has evolved since 2020.

Source: TradingView

Recent charts supported a potential bullish turn for ETH and showed a possible four-hour bullish divergence, signaling a shift in demand.

Although the structure of this demand level appeared irregular, Ethereum showed responses that could indicate strength.

The divergence structure was clear and showed a double divergence with a clean arc formation, giving a positive picture.

Source: TradingView

Most of the negative delta occurred during the first leg of this pattern, which generally indicates less selling pressure on the second leg.

However, analysts urged caution and advised traders to wait for a strong green candle confirming a reversal before assuming it would negate the bearish outlook.

ETH/BTC tests its 2016 highs

In another major development, Ethereum tested its 2016 highs against Bitcoin. Currently, ETH is trading below a long-standing falling wedge pattern, which represents a high timeframe support level.

Many traders expect ETH to continue correcting against Bitcoin, especially if it struggles to break above this level.

Although Ethereum has shown resilience in the recent market, investor interest has remained subdued, leaving future price movement uncertain.

Source: TradingView

If ETH were to respect this support, it could attract new market interest, potentially causing a market shift in the remaining months of the year or early next year.

Read Ethereum’s [ETH] Price forecast 2024–2025

However, until ETH confirms a breakout, a cautious outlook remains cautious for investors.

While significant inflows, election year trends, and a possible bullish divergence have fueled hopes for a rally, ETH must navigate key resistance levels against Bitcoin.