- Bitcoin has experienced its largest single-day outflow since mid-September.

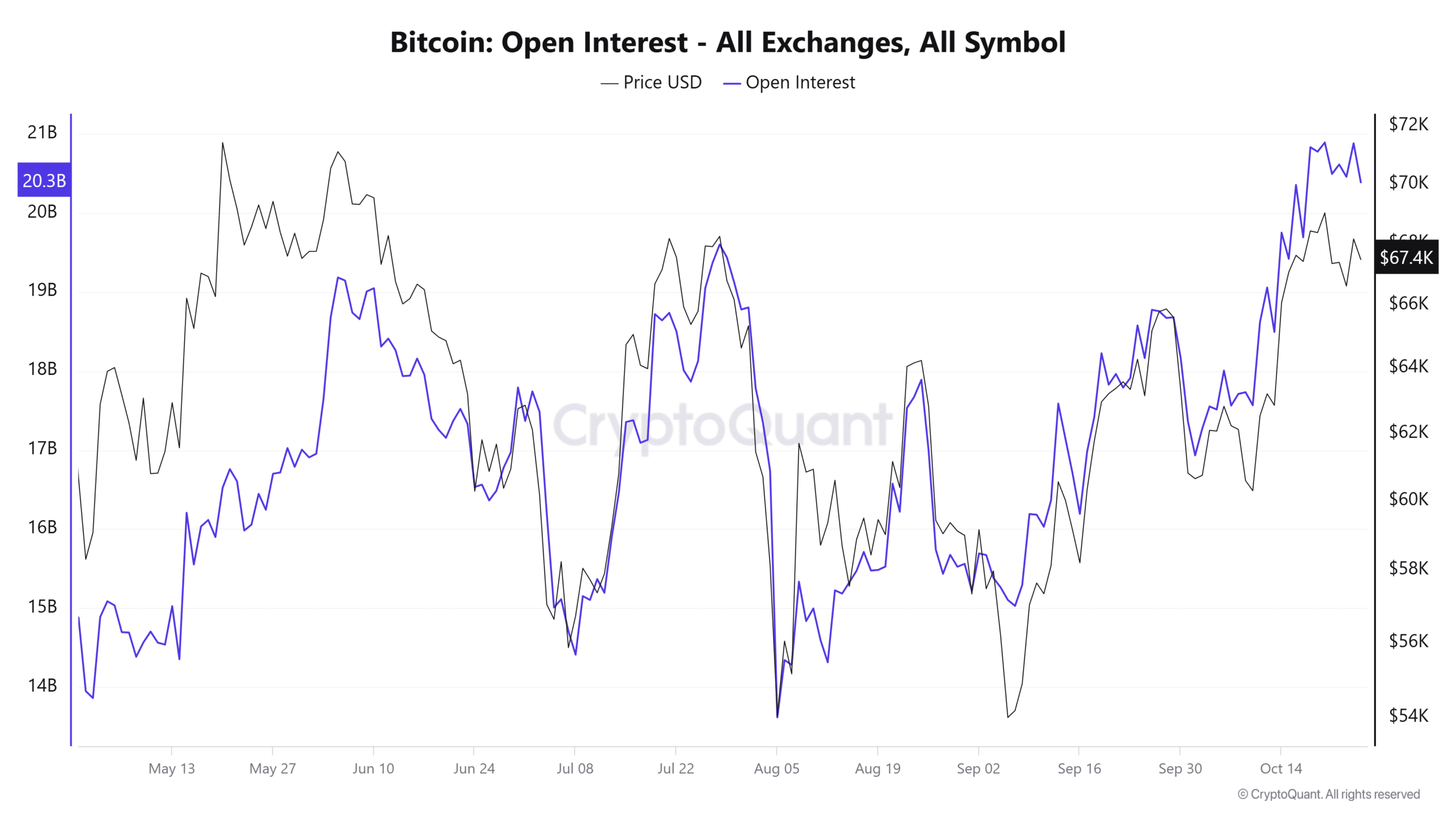

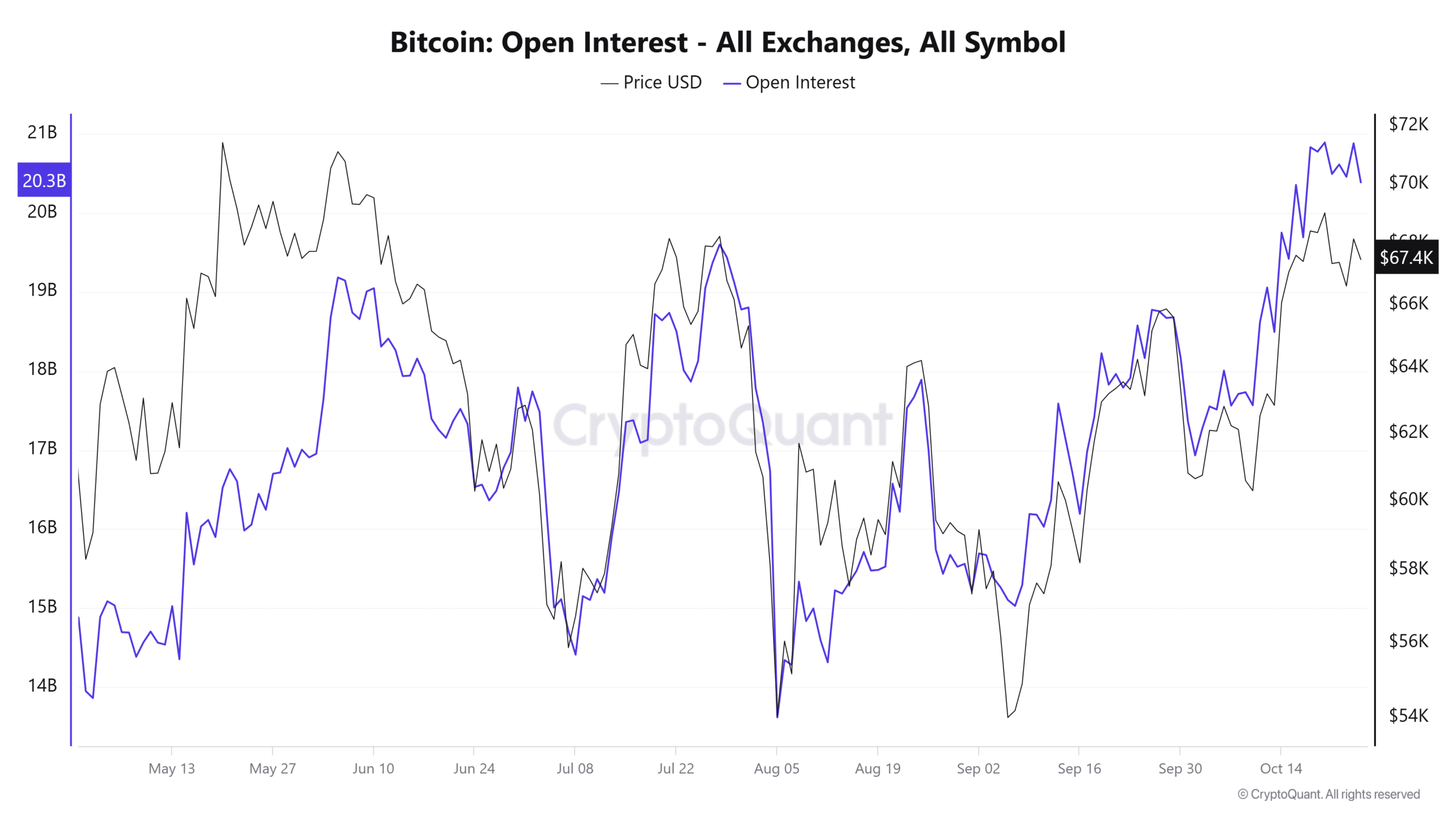

- Open Interest has risen to $20.3 billion, due to increased speculative activity.

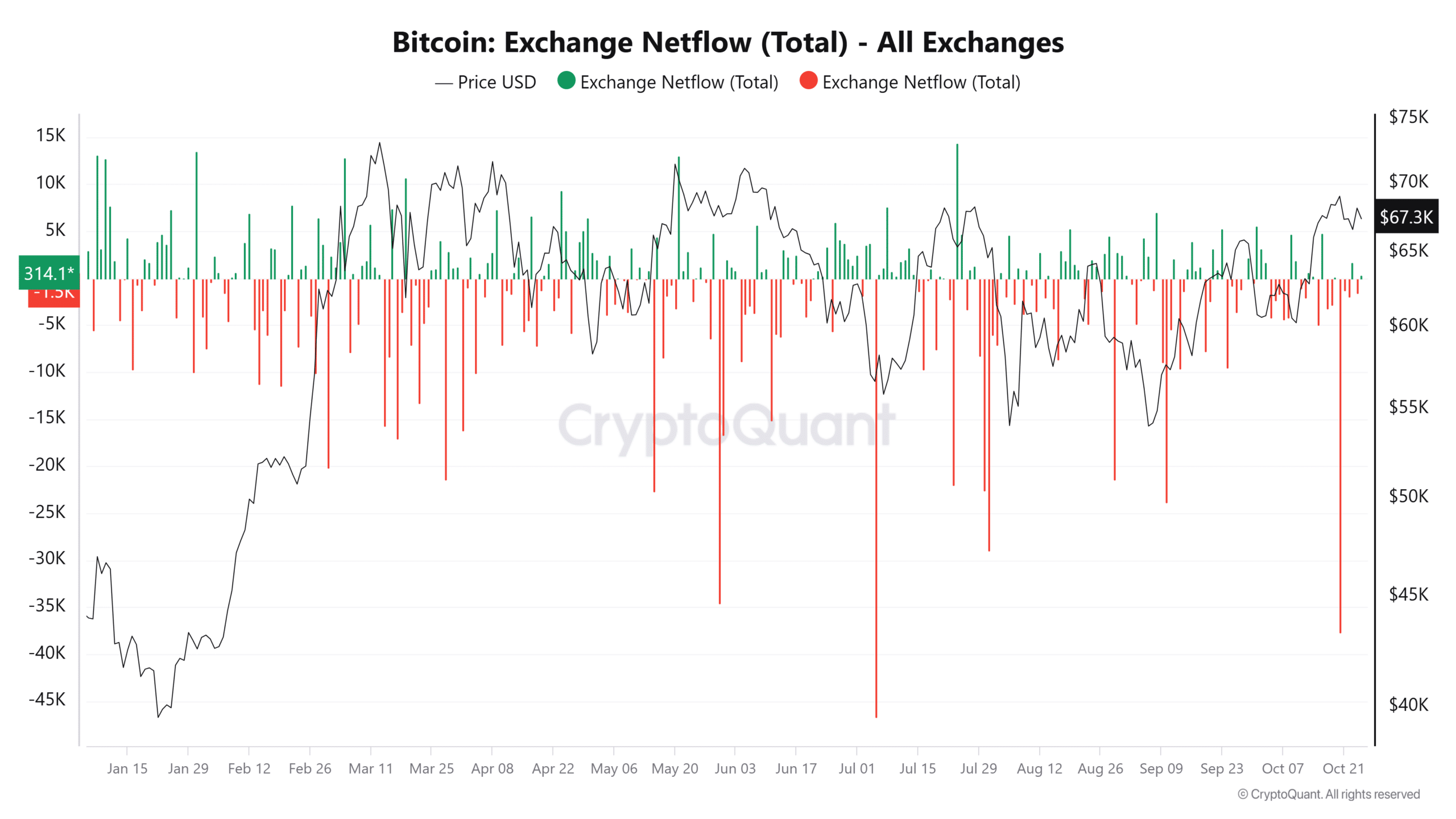

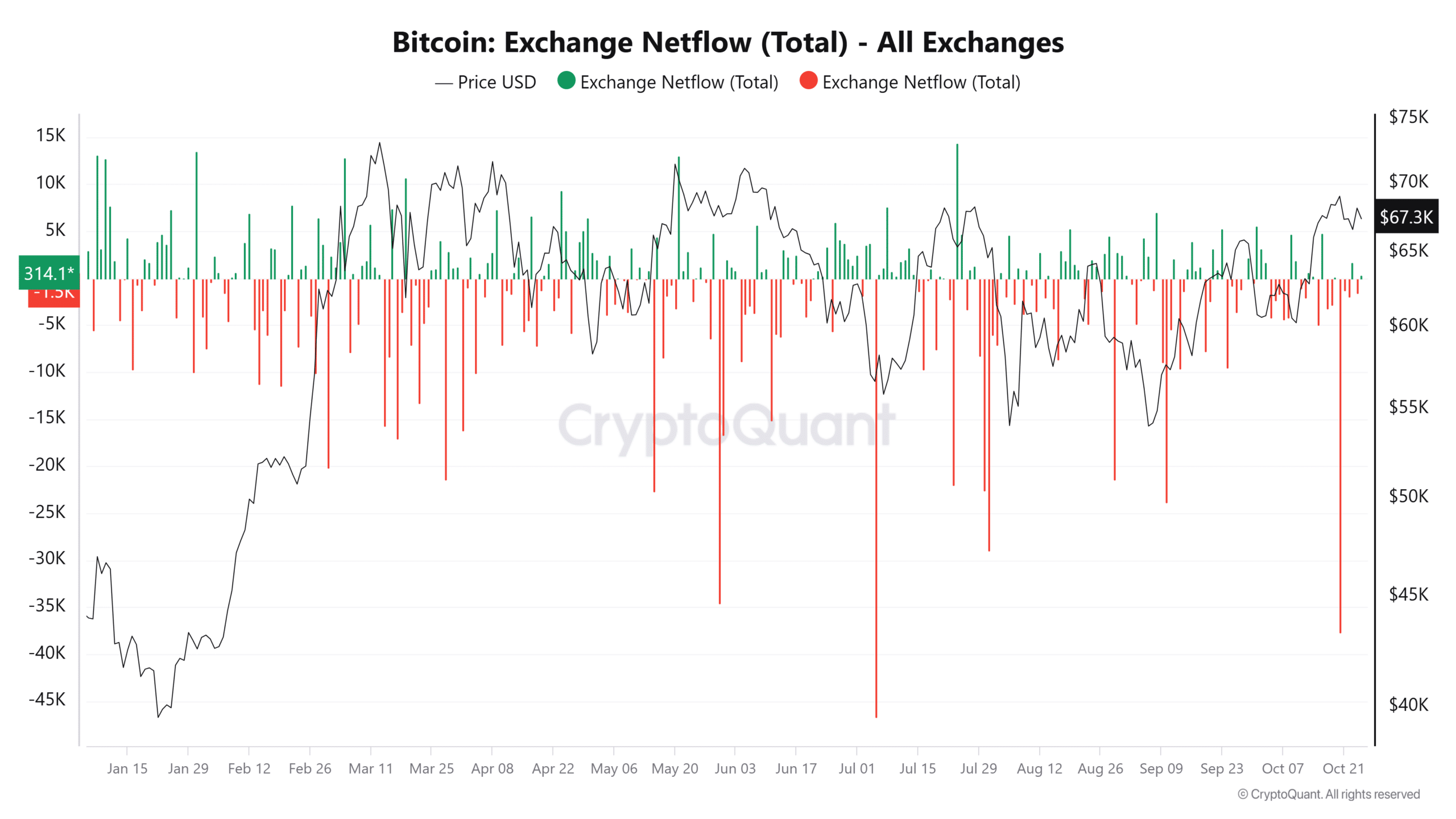

Bitcoin [BTC] has experienced the largest currency outflows since mid-September, a major signal of increased buying activity as investors withdraw their BTC from exchanges and into private wallets.

The data comes at a time when BTC is hovering less than 10% below its all-time high, sparking optimism in the market. Currency outflows are often seen as a bullish indicator.

The outflow from Bitcoin exchanges signals accumulation

According to data from CryptoQuantOn October 22, more than 15,000 Bitcoins were withdrawn from the exchanges, marking the largest single-day outflow in more than a month.

When significant amounts of BTC are withdrawn from exchanges, it usually signals investor confidence in future price movements.

This shift reflects the desire to hold assets for the long term as BTC approaches key resistance points near its all-time highs.

Source: CryptoQuant

The pattern of foreign exchange outflows increased as the price of BTC steadily rose above $67,000.

With the drawdowns in line with rising prices, there is a clear indication that bullish sentiment is taking shape in the market.

This accumulation trend often precedes rallies, as less BTC on the exchanges can reduce pressure on the sell side, supporting a potential price breakout.

Open Interest shows increased speculative activity

In addition to the currency outflows, Bitcoin open interest in futures contracts has risen to $20.3 billion, indicating an increase in speculative activity.

Open Interest represents the total value of active derivative contracts. When it rises along with outflows, it often signals both long-term investor accumulation and short-term speculative positioning.

This trend indicates that traders are preparing for possible price swings, either by hedging positions or betting on further increases.

Source: CryptoQuant

However, a high Open Interest can also indicate impending volatility. Any rapid price movement could lead to liquidations of leveraged positions, creating a ripple effect on the market.

Such activities often lead to short-term price fluctuations, even when there is an overarching bullish sentiment.

Bitcoin price action is approaching key resistance levels

Bitcoin was trading around $66,900 at the time of writing, approaching a resistance level that, if broken, could pave the way for further gains.

The Chaikin Money Flow (CMF) indicator, which measures capital inflows and outflows, stood at 0.13, indicating positive momentum as capital flows into Bitcoin increase.

Source: TradingView

Read Bitcoin’s [BTC] Price forecast 2024-25

Traders are closely watching for a breakout of this resistance level as it could potentially trigger a strong rally.

The increased Open Interest serves as a warning sign and suggests that greater volatility could be on the horizon. If Bitcoin manages to surpass this resistance, it could lead to a significant uptrend.