- The OP token is up 19% in the last 30 days, but is down 53% since the beginning of the year.

- Optimism completed its fifth airdrop last week, with approximately 10 million OP distributed.

Optimism [OP] is a notable Ethereum-compatible Layer 2 scaling solution since launching its public mainnet in December 2021. On DeFiLlama’s dashboard, it ranks as the fourth largest L2 chain, with a total of $688 million locked in its smart contracts on that moment of writing.

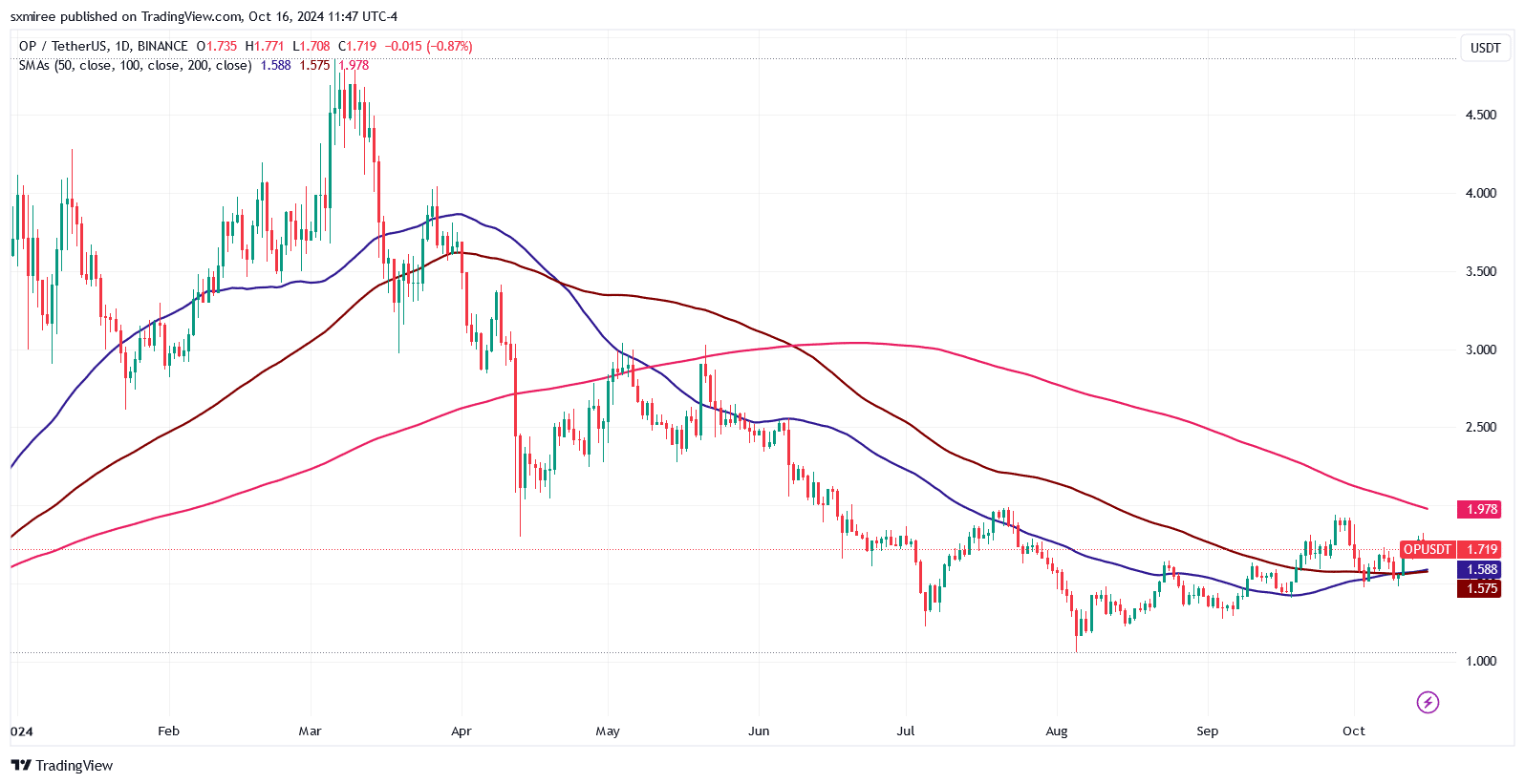

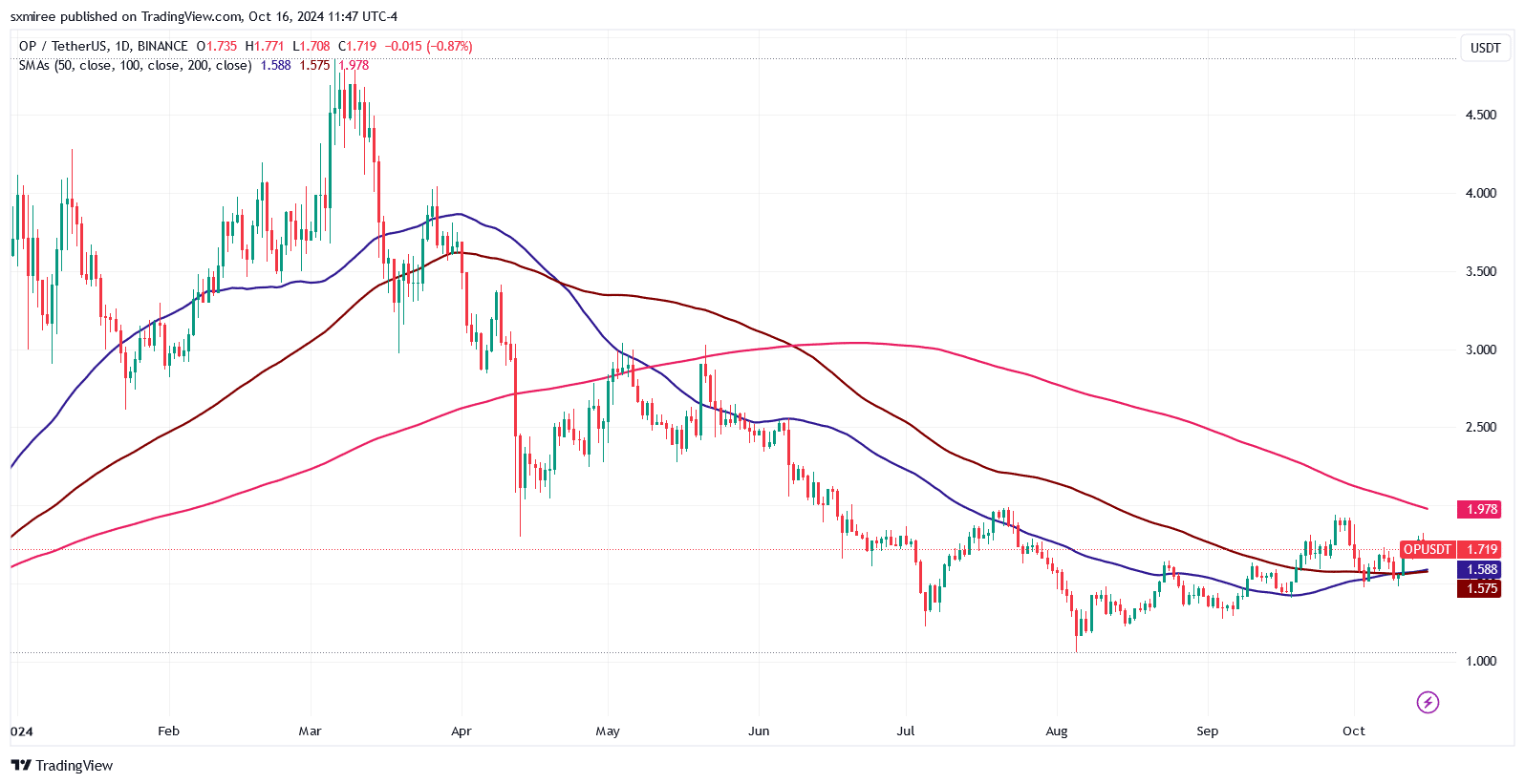

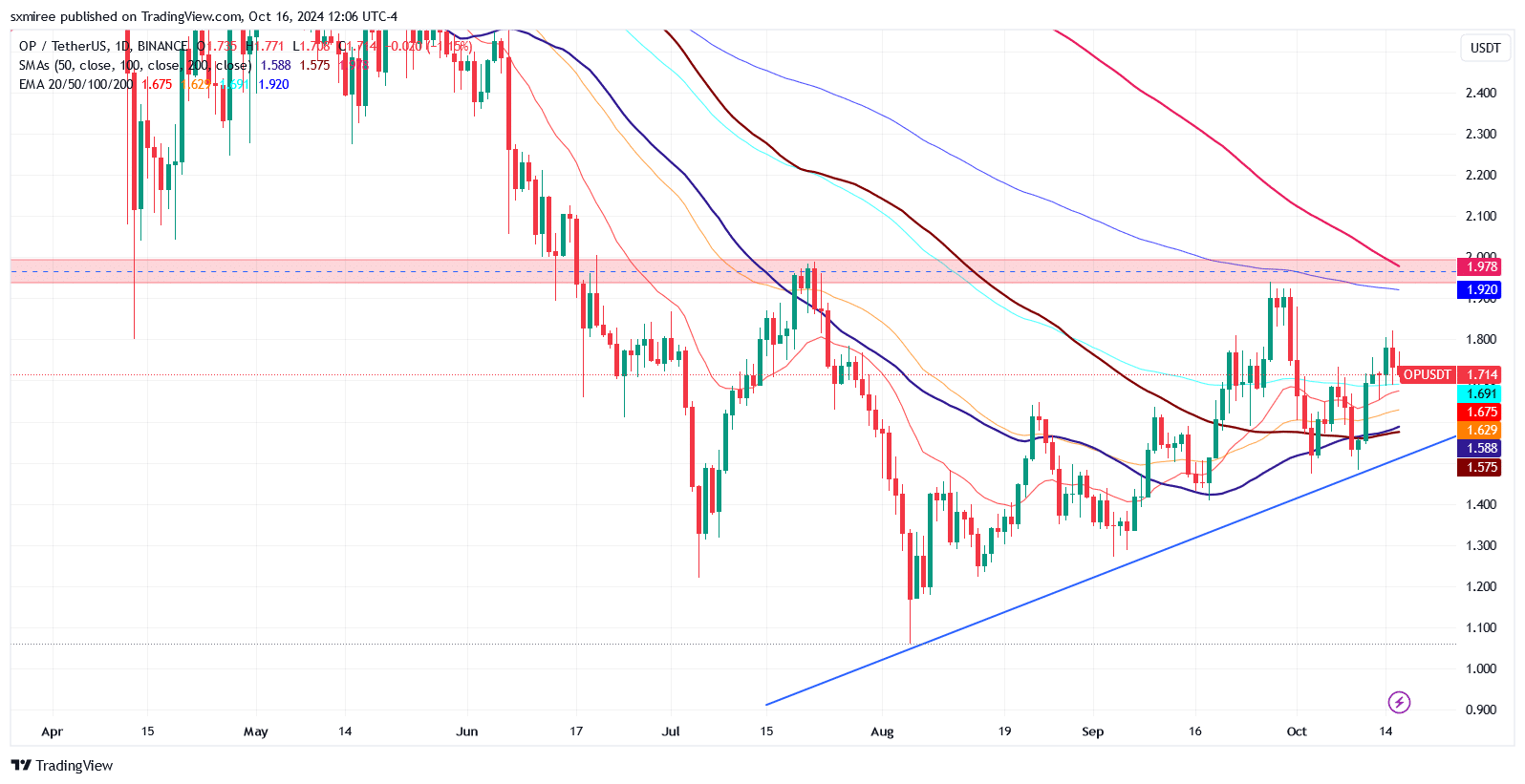

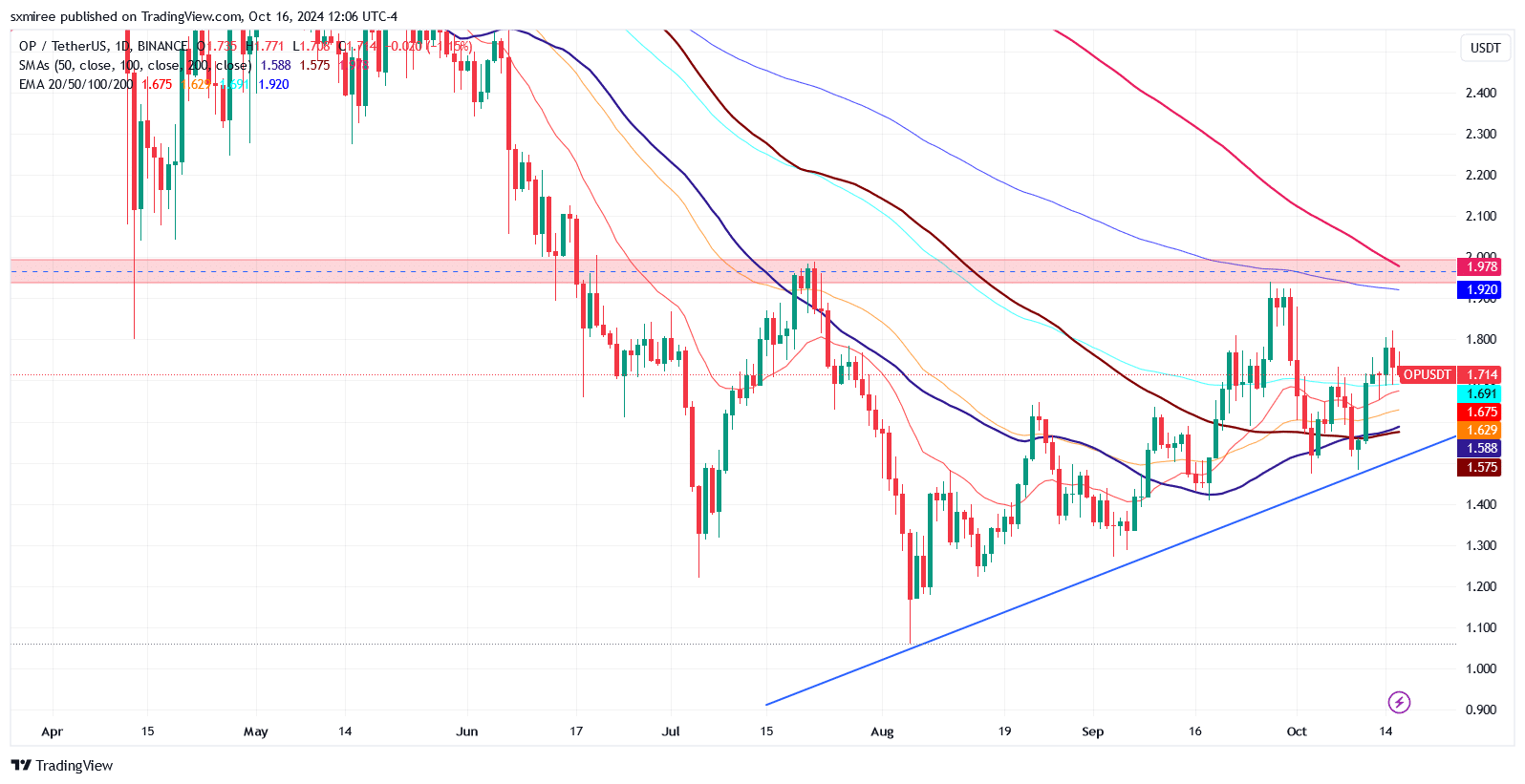

However, the eponymous governance token has shown mediocre performance in the spot market. The OP price has been in an extensive consolidation phase for the past four months.

In the daily time frame, the short-term Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) have consistently remained below their respective 200-day MAs, indicating long-term bearish momentum.

Source: TradingView

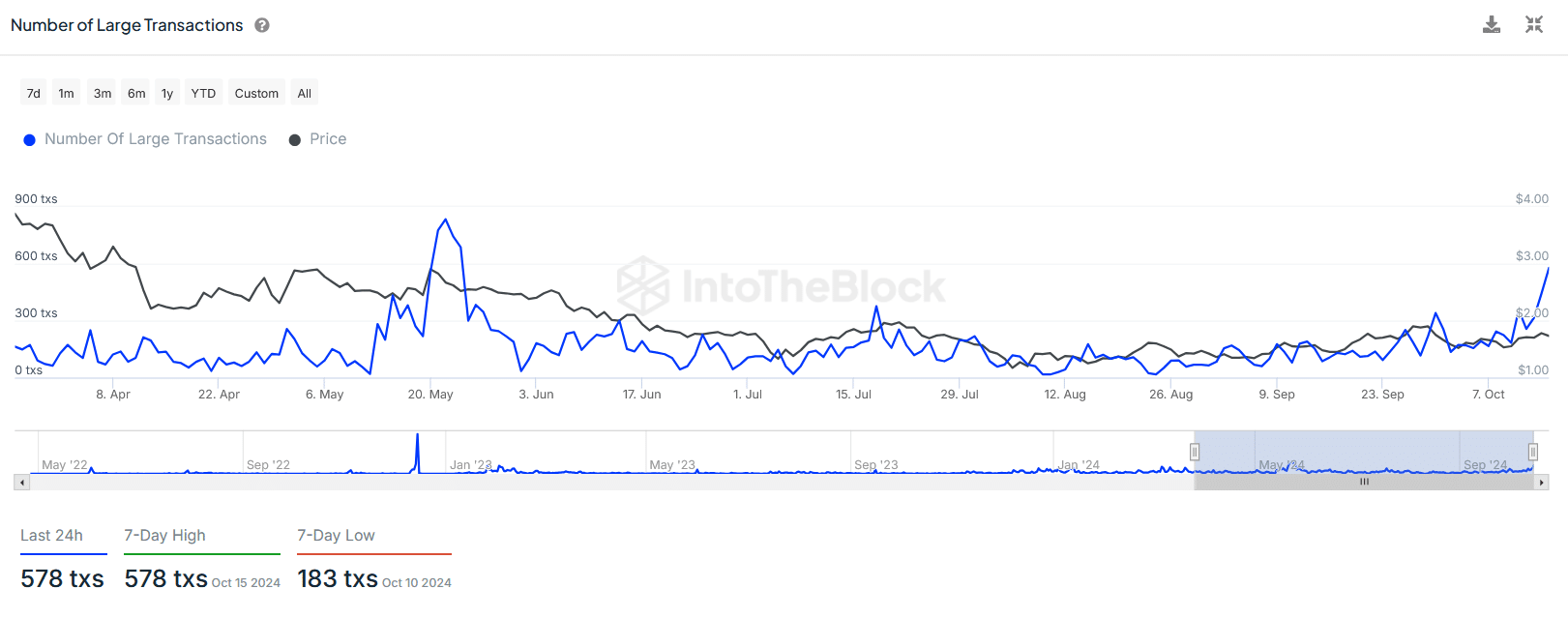

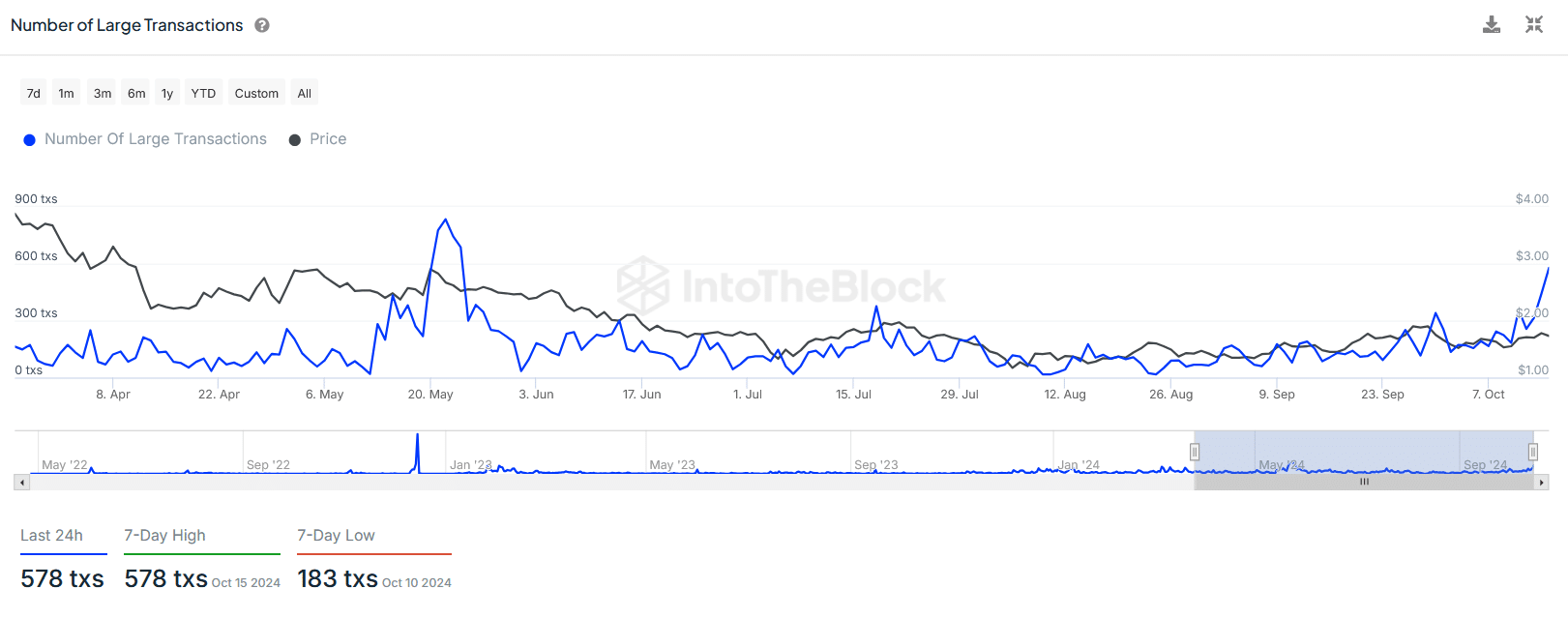

Despite this weakening price action, activity on the chain has increased in recent days. According to IntoTheBlock, the number of large transactions on Optimism reached an almost five-month high on October 15.

Source: IntoTheBlock

This uptick in activity in the high-value sector suggests that deep-pocketed holders may be anticipating upcoming events, possibly anticipating market shifts in the OP price.

The recent airdrop of Optimism and the upcoming token unlock

Last week Optimism concluded the fifth airdrop, distributing 10.3 million OP tokens to approximately 54,700 addresses. Optimism launched with a supply of 4.294 billion OP tokens and got off to a rocky start as the mainnet experienced reduced performance, overwhelmed by high demand during the initial airdrop.

During this first airdrop in June 2022, the Optimism Foundation distributed 200.1 million OP tokens to 248,699 addresses. The second air raid pulled increased participation, with more than 308,000 eligible addresses receiving a total of 11.7 million OP tokens.

Token unlocking tool Tokenomist shows that optimism is set for a major token unlock scheduled for October 31st. Approximately 31.34 million tokens, representing 2.5% of OP’s circulating supply, will be released in the form of allocations to investors and core contributors.

Can OP break out of its downtrend?

At the time of writing, Optimism was trading at $1.72, above rising lower trendline support. This setup offers OP bulls the opportunity to challenge the resistance between $1.93 and $1.98, which coincides with the 200-day EMA and SMA respectively.

To confirm a breakout from the current range, OP/USDT must definitively break the psychological hurdle at $2.00 and convert it into support.

Source: TradingView

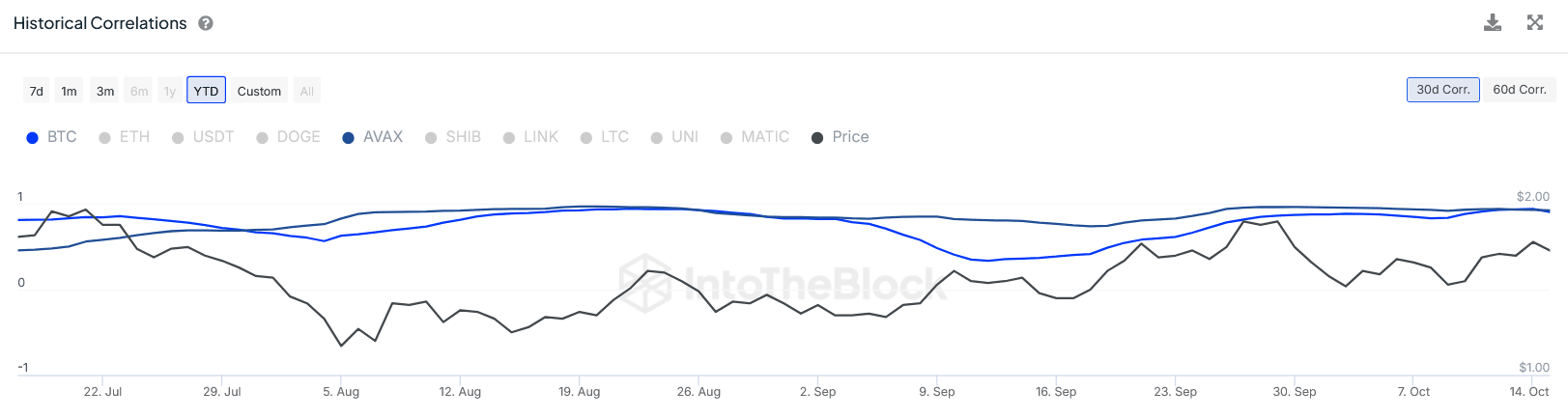

Interestingly, OP’s price shows the strongest 30- and 60-day correlation with Avalanche (AVAX). The correlation with AVAX has remained fairly stable, unlike the correlation with Bitcoin (BTC), which has fluctuated.

Source: IntoTheBlock

Realistic or not, here is OP’s market cap in BTC terms

Both Optimism and Avalanche are Ethereum-compatible blockchain platforms designed to address scalability limitations. However, they differ in their underlying architectures.

Optimism is enabled by optimistic rollups, which bundle volumes of transaction data into a single transaction on the underlying Ethereum mainnet. Avalanche, on the other hand, is a standalone L1 blockchain with its consensus mechanism.