- Saylor plans to turn MicroStrategy into a Bitcoin bank.

- MSTR rallied and hit an ATH after the reveal.

MicroStrategy’s MSTR stock hit ATH (all-time high) after unveiling its end goal to become a trillion dollar Bitcoin [BTC] bank.

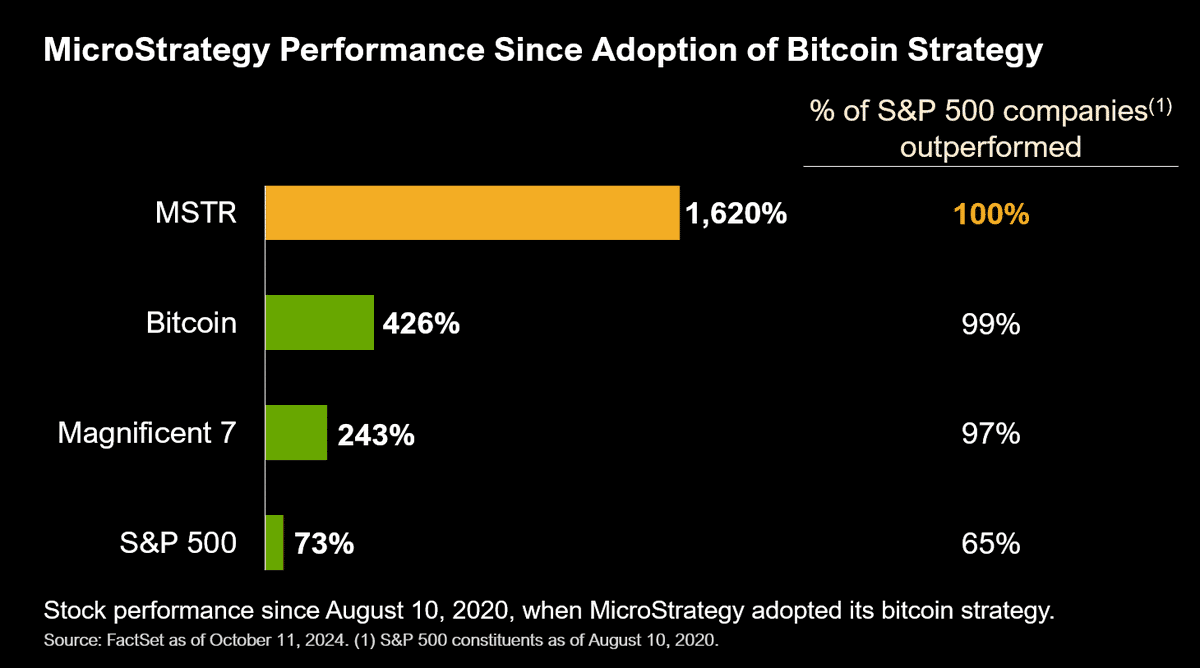

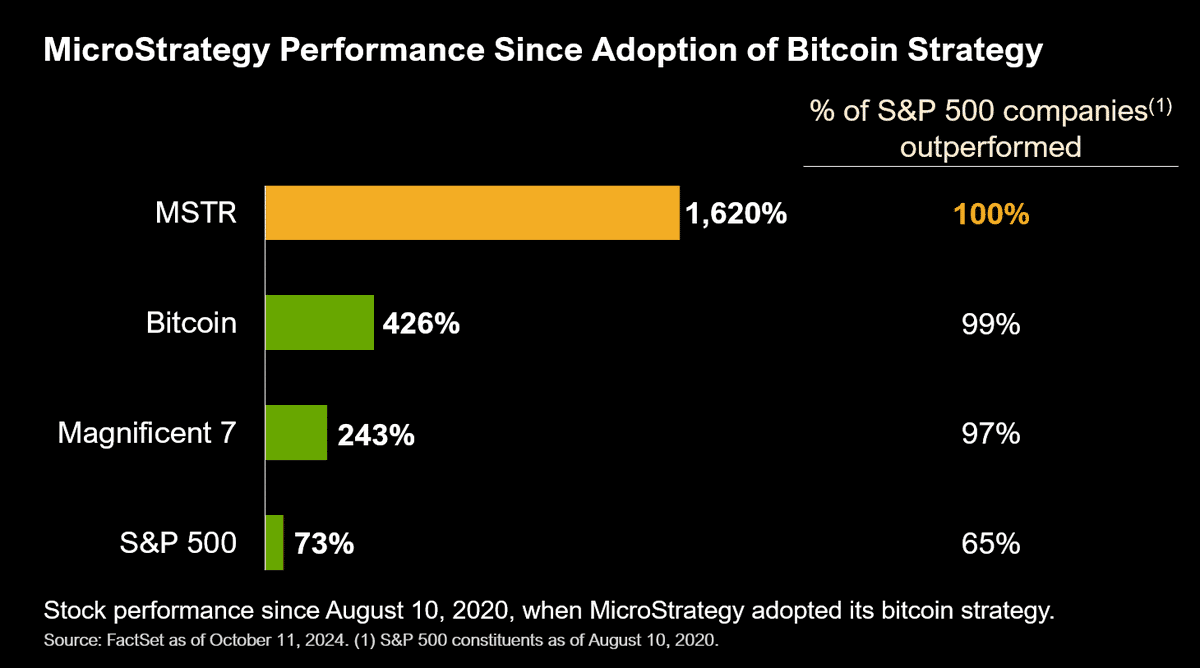

MicroStrategy founder Michael Saylor told Bernstein analysts that his company was eyeing a $1 trillion valuation as the largest BTC bank.

This would be helped in part by the aggressive accumulation of the world’s largest assets, as analysts had forecast a $290 price target for the stock.

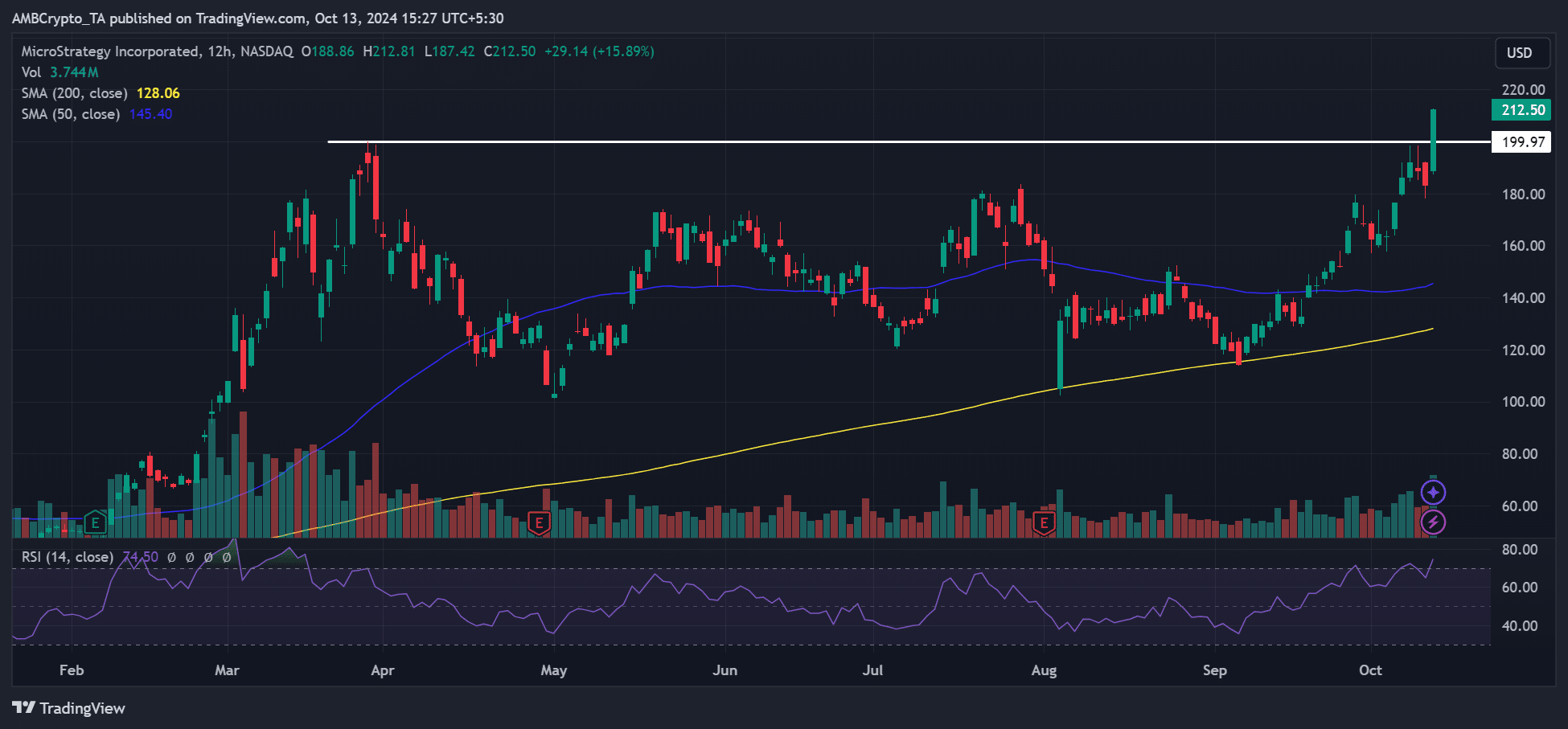

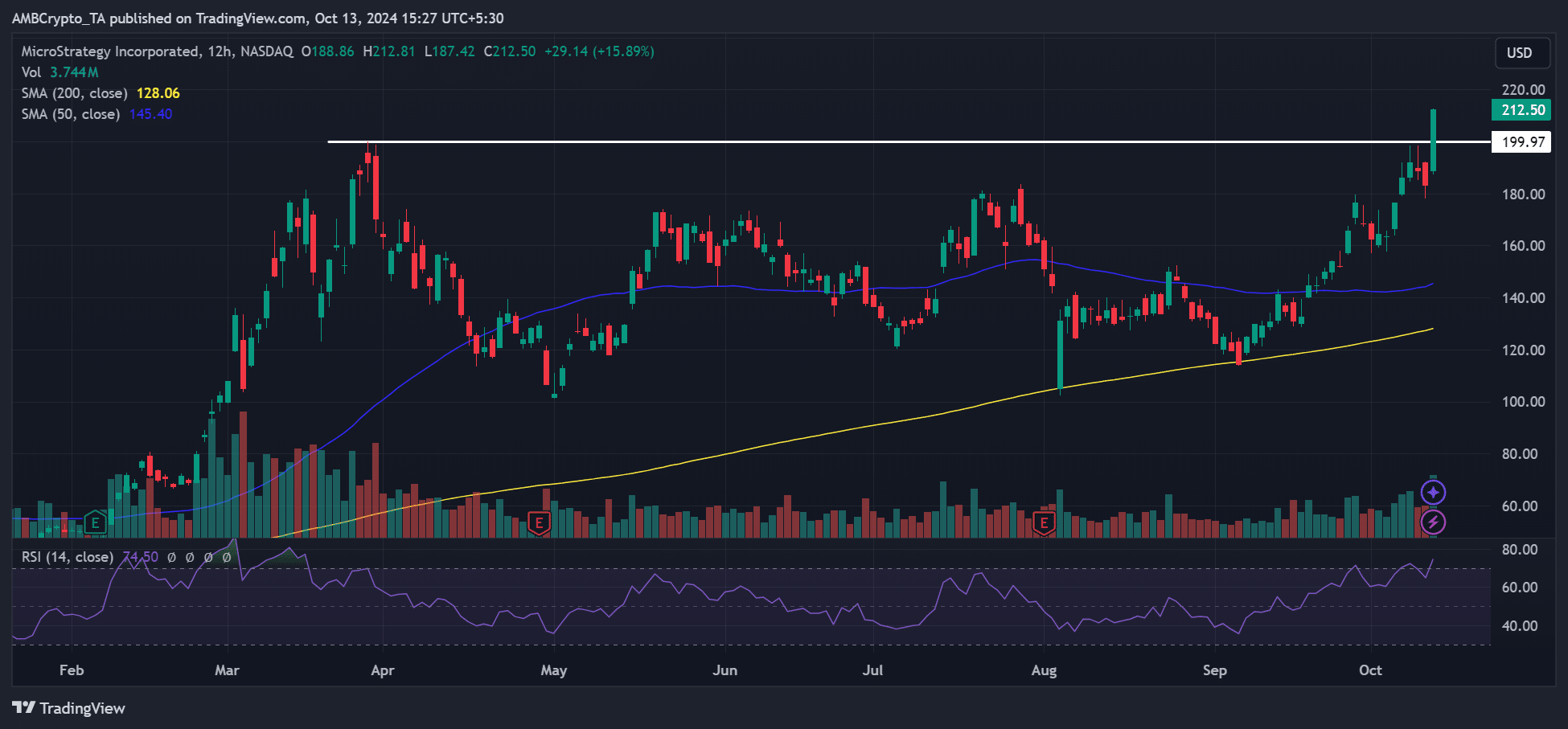

Source: MSTR, TradingView

After the update, MSTR rose to an all-time high of $212.50, up 15% during the intra-day trading session on October 11. It even broke the $200 resistance.

Bitcoin Bank Endgame

In response to the MSTR meeting, Saylor noted that the only thing that outperformed BTC was more BTC.

“The only thing better than #Bitcoin is more Bitcoin.”

Source:

At the time of writing, MicroStrategy owned 252,220 BTC, worth approximately $15.8 billion per year. facts of Bitcoin Treasuries. In most interviews, Saylor has never stated whether the company will sell its BTC stock or its end goal.

But the endgame was made clear last week.

So, what is a Bitcoin bank?

According to Saylor it is BTC bank would behave like other asset classes and build financial entities around them. Part of the Bernstein Report stated:

“Michael believes that MSTR is engaged in the core business of creating Bitcoin capital market instruments for equities, convertible bonds, fixed income and preferred shares etc.”

Saylor had done that before projected that BTC could reach $3 million to $49 million by 2045 as its assets expand as part of global capital.

Thus, the executive predicted that making money by creating BTC-based financial instruments such as bonds or stocks would be easier than lending out coins owned by MicroStrategy.

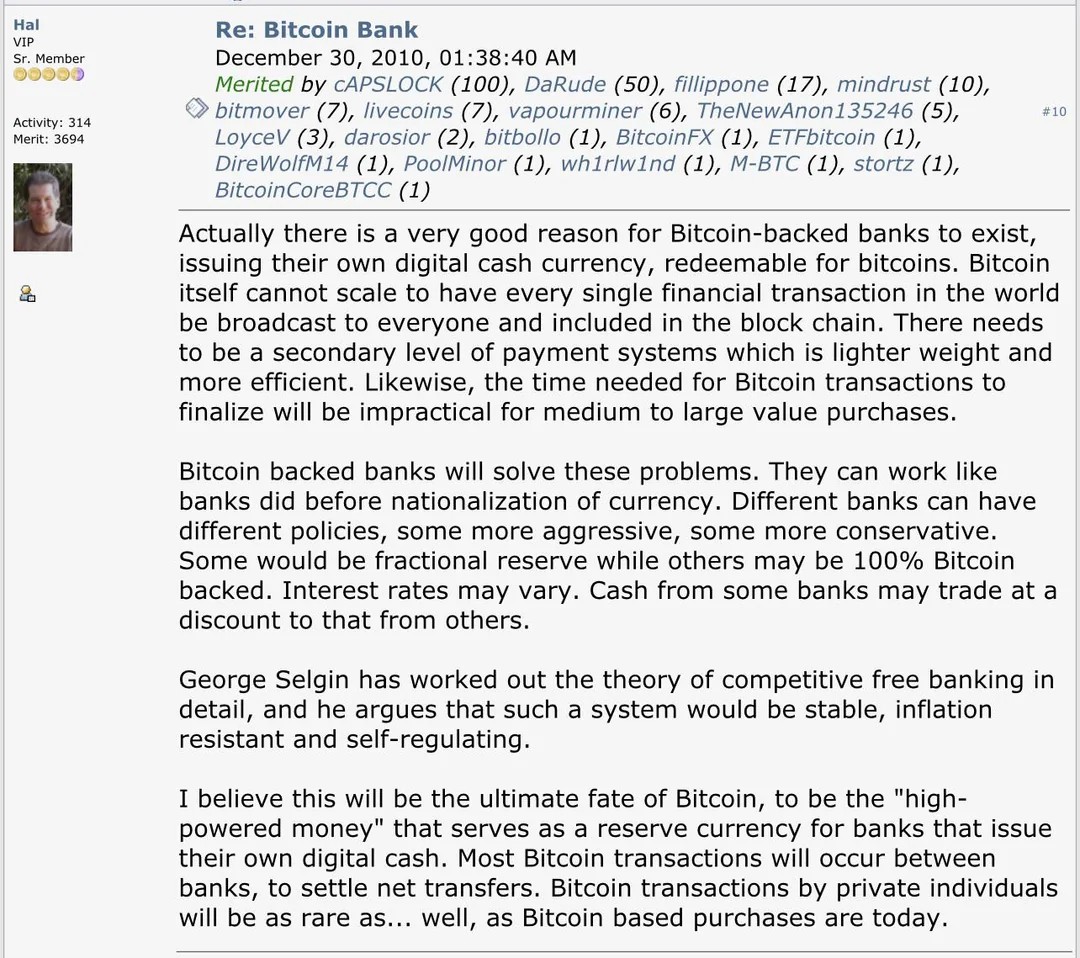

Interestingly, Hal Finney, one of the early contributors to the BTC network, floated a similar idea in 2010.

Source:

But some called for advanced self-policing technology to ensure such a system remains fair.

That said, some market experts anticipated a strong BTC rally as a positive catalyst for MSTR’s value.

According to financial advisor Ben FranklinBased on MicroStrategy’s financial health and BTC’s valuation, MSTR’s value could grow 6x to 10x.