This article is available in Spanish.

Crypto analyst Bob Loukas has released a new one video analysis with the title ‘No bull’. In the video, Loukas dives into the current state of the Bitcoin market and addresses growing concerns about the possibility of a canceled bull run.

Loukas begins by acknowledging the prolonged consolidation period for the Bitcoin price. He feels that “there is some fear creeping into the market now,” partly due to factors such as the fact that the Bitcoin ETF has been “out for quite some time” and that the halving “comes and goes,” without leading to any significant upside. price movement.

Is the Bitcoin Bull Over?

Loukas notes that while traditional markets are performing robustly – with “the stock market hitting all-time highs seemingly every week” and “even gold hitting major all-time highs” – Bitcoin continues to “fade away” and altcoins are “virtually extinct.” a slow death.” He notes that “the only thing that really works are the really speculative memecoins,” which contribute to negative sentiment in the crypto space.

However, he sees this development as “somewhat normal” and emphasizes that despite these challenges, Bitcoin remains “close to all-time highs from the previous cycle.” Loukas discusses the eight months of consolidation in Bitcoin’s price and interprets this period as a bullish sign. “Eight months of consolidation is actually quite bullish if the timing is right in the four-year cycle. The sentiment is correct, it has been reset; Fundamentals, macro, I think they all look good,” he says.

Related reading

Loukas further highlights that the market has been “23 months” since the bottom of the last cycle in November 2022, “just shy of a 24-month or 2-year anniversary of this cycle,” which is expected to end around November-December. 2026. He acknowledges the “quite a bit of fear that has crept into this market” after a “very bullish, very frothy period” from the September-October 2023 ETF approval leak to the March 2024 peak.

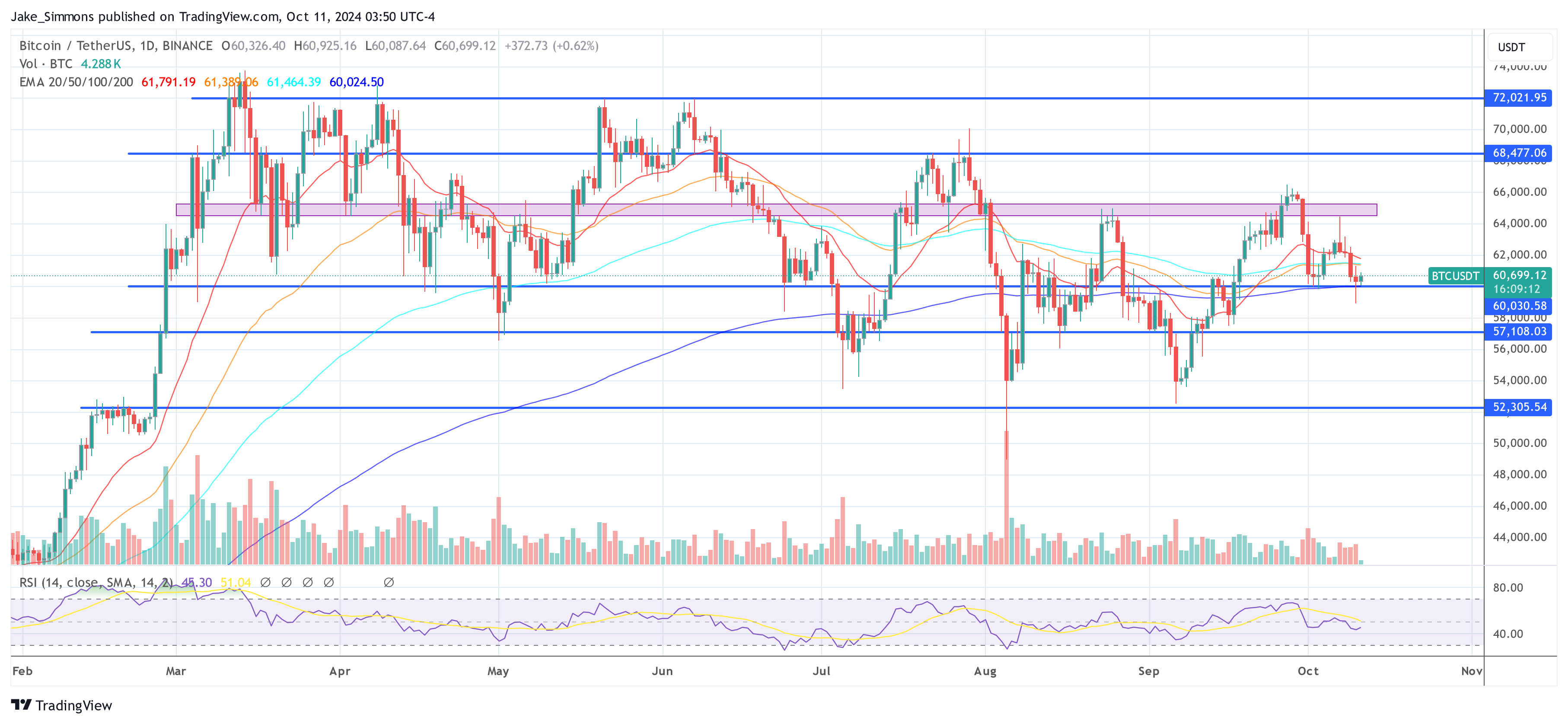

One of the biggest fears, according to Loukas, is that Bitcoin hit its last all-time high seven months ago in March, and since then “we’ve formed these lower highs on a monthly basis and to some extent a lower low as well. structure.” This has caused anxiety among investors who “entered the market far too late, waiting for confirmation,” only to be “locked out when the market continued this move for five consecutive months,” without offering the opportunity to buy dip.

He points out that many investors “in this later period have rolled into a number of altcoins that are now down 50, 60, 70%,” leading to a situation where, despite Bitcoin being “still about 3x above the lows ”, a Many people feel that they ‘didn’t get any value out of this cycle’ or even ‘lost money during this period’. Loukas considers this scenario “very normal from a cycle structure perspective.”

He emphasizes that at no point during this bullish phase has the market experienced a “typical 30% decline,” with the “largest declines” “largely time-based and only around 20% from peak to trough. reaching a new high.” This atypical behavior “turned off a lot of people” and “made it difficult for people to get in,” because they were “looking to make a purchase on a dip that never really materialized.”

Loukas suggests that the current consolidation is a necessary phase to “fully reset sentiment and prepare for the next phase of this four-year cycle.” He thinks it’s significant that Bitcoin is “holding it here for 23 months, down about 20% from the all-time highs of the last four-year cycle high in 2021,” making it feel “more ready for the next phase of the four-year cycle than anything else.” ”

He also draws parallels to previous cycles, noting that from the cycle low in December 2018 to the first point where Bitcoin reached a new high, “it took 23 months for the price to reach the four-year cycle to surpass that.” Similar patterns were observed in previous cycles, with time frames of “around 25 months” and “around 22 months” reaching new all-time highs. In contrast, the current cycle reached this milestone “in just 16 months, much sooner,” which he attributes largely to the ETF news that “forced buyers into the cycle earlier than normal.”

Loukas believes this accelerated timeline has created a dynamic where “we now have to rotate a lot of coins,” allowing “a lot of whales, a lot of vintage cars” to “unlock” and “get out and rotate,” while “institutional players, players with larger accounts have these coins collected during this period.” He sees this as “a matter of time more than anything,” and interprets the current period as a process whereby the market “eventually erases all that bullish sentiment from the previous phase,” causing “a complete separation of one phase from the economy” becomes possible. cycle to this phase of the cycle” – essentially a “mid-cycle drop.”

When will BTC price breakout?

Overall, Loukas remains largely optimistic: “So far in this four-year cycle, I don’t see anything that has changed that trajectory, nothing in the profile or structure that tells me this cycle is different from the previous cycles.”

He cites several factors supporting his bullish outlook, including “huge inflows into Bitcoin, mainly institutional players” and the absorption of major sell-offs by entities like “the German government” and “the US government,” which have had no significant impact on the price of Bitcoin. price. Loukas emphasizes that “the price has only fallen 20%; it has held up well.” He also mentions that “the ETF is still there; it will be pushed through the channels of independent advisors,” and “the timing is there; the macro, the fundamentals are there.”

Loukas is especially excited about the cyclical patterns, noting that “the third year of each of these four cycles is where the magic happens.” He explains that “the first year surprises everyone, which makes a big difference. The second year seems to stand still as it consolidates that first year of gains. And the third year is the mania year. And right now, starting next month, we have the mania year on deck.

Related reading

He predicts that “within the next ninety days… we will break this consolidating range; we are going to break upwards.” Once this happens, he believes Bitcoin “will not look back,” anticipating a period where “we may see only one or two red monthly candles and mainly green candles.” While he doesn’t give specific price targets, he acknowledges that reaching “somewhere between $120,000 and $180,000 also seems very reasonable.”

Loukas emphasizes that the focus should be on “time and sentiment,” aiming for a move “in the range where previous cycles have peaked,” which has been “very consistent around month 35 since the last low.” This timing would put the projected peak around “October 2025,” which would take “another 12 months to an expected or projected peak.” He notes that this is not set in stone and that the peak could come “three, four, five months earlier” as market movements “can come in many different flavors.”

As for the immediate future, Loukas admits that the next two months are “a bit murky,” and that “a lot of factors are still in play right now.” He brings up the upcoming US elections on November 4 and mentions that “Trump and the Republican Party have really pushed crypto and Bitcoin,” and that “the market will certainly react very, very favorably to an election victory by the Republican Party, merely and just because of their stance on crypto.” However, he clarifies that he doesn’t think it “matters one bit” who wins, as Bitcoin has flourished even when “governments have been very hostile to it.”

Loukas speculates that the market could make a “sideways trend into that November period,” and that there might not be a significant move until after the election ends. He suggests that “we still have about three to four weeks of trending sideways action,” and he would be “very surprised if this market can reach $70,000 before the election here in the US.”

At the time of writing, BTC was trading at $60,699.

Featured image created with DALL.E, chart from TradingView.com