- Bitcoin Holders Shift Their Watch in Favor of Short-Term Profit Taking, Contrary to Recent Market Expectations

- Such a transition could have a major impact on the price of BTC

Bitcoin market sentiment has changed significantly in recent weeks. There were even expectations that BTC would maintain its bullish momentum from September and October as well. However, these expectations were far from reality.

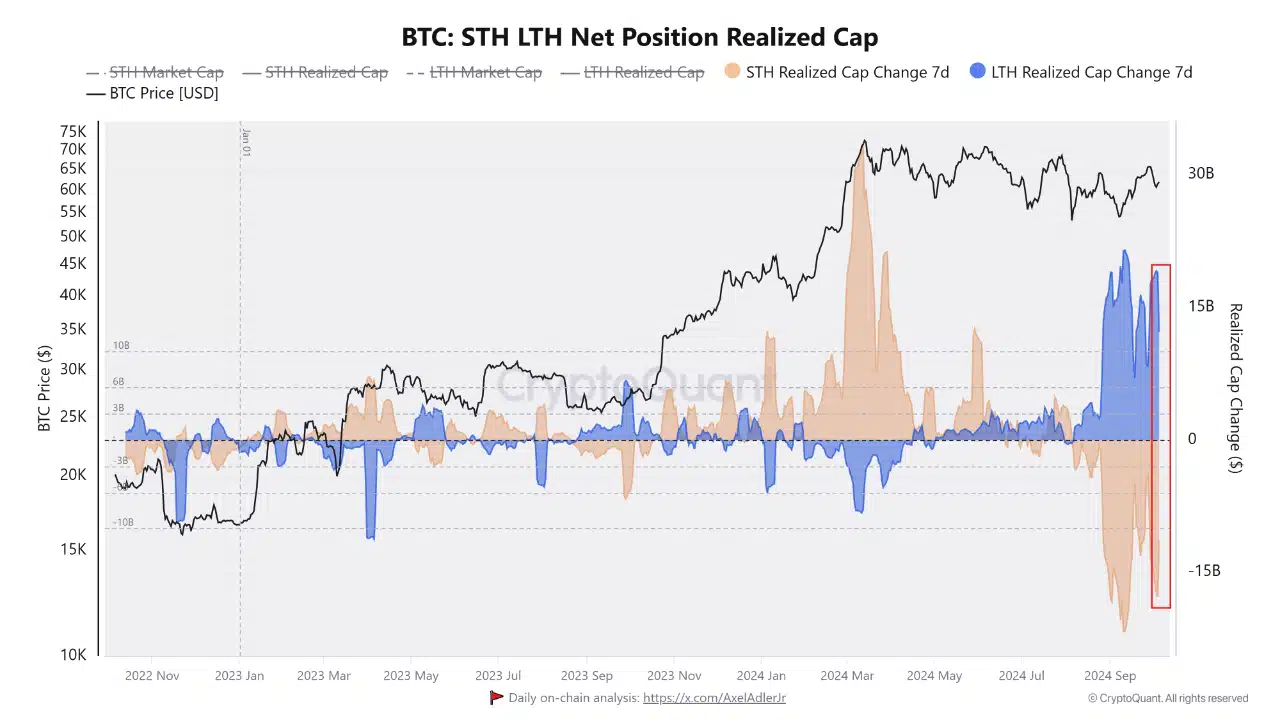

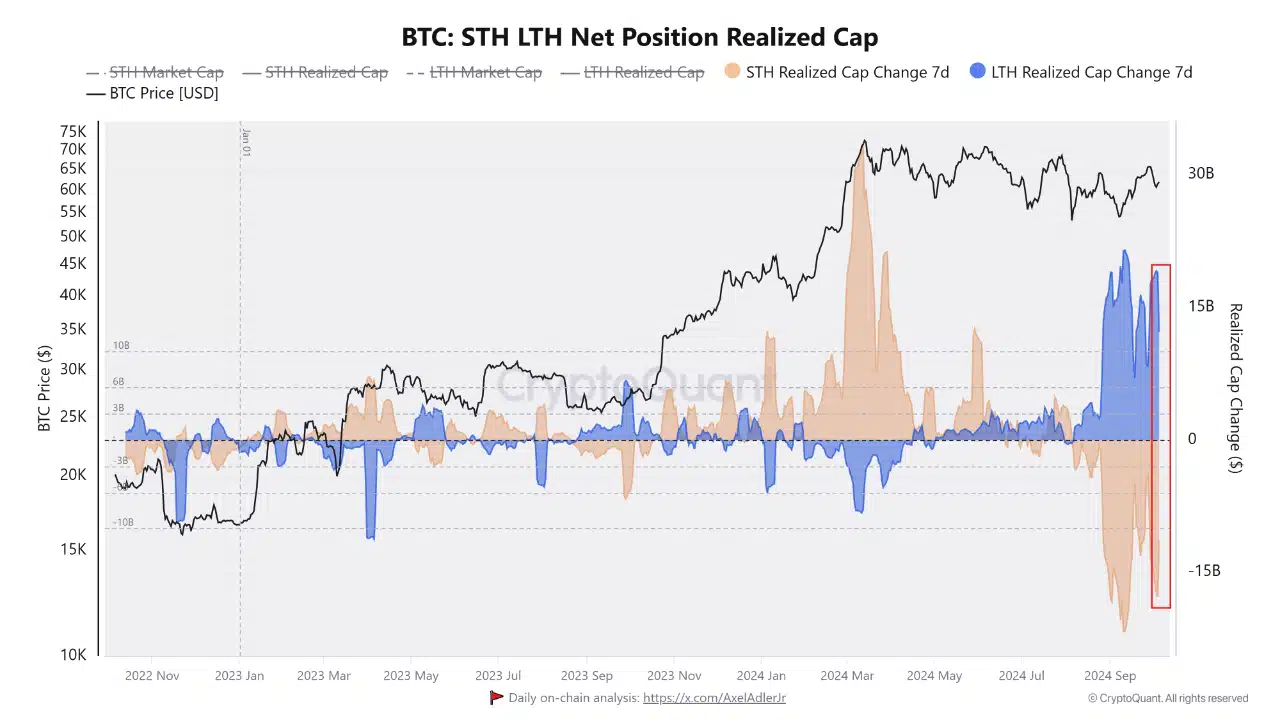

According to data, there is a growing trend that could limit the cryptocurrency’s ability to soar to new highs, at least in the short term. A recent CryptoQuant analysis underlined the same, highlighting the changes in the dynamics of long-term holders (LTH) and short-term holders (STH).

According to the analysis, LTH’s realized cap recently fell by $6 billion. This suggested that LTHs have taken profits. By extension, it also implied that they don’t expect the price to reach new highs, at least in the short term.

Source: CryptoQuant

The same analysis found that the realized short-term limit by holders was approximately the same amount ($6 billion). According to the analysis, this shift in STHs could mean they are accumulating, but with a focus on short-term gains.

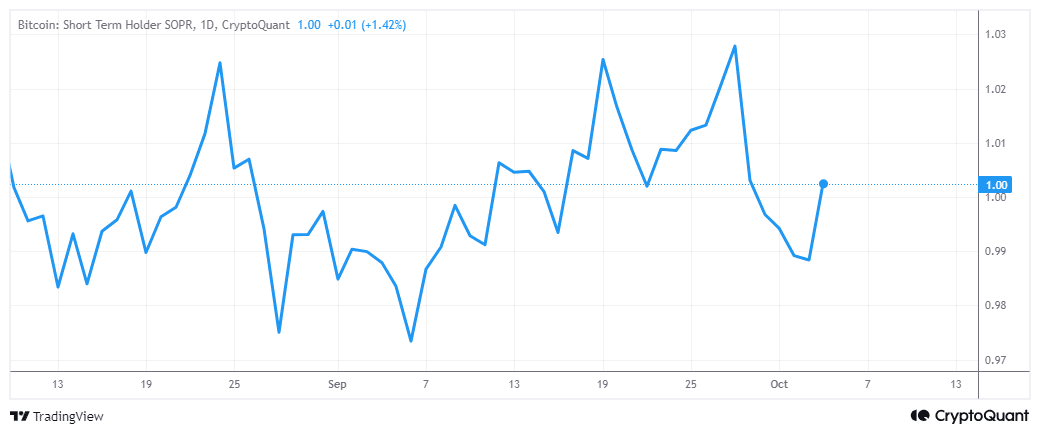

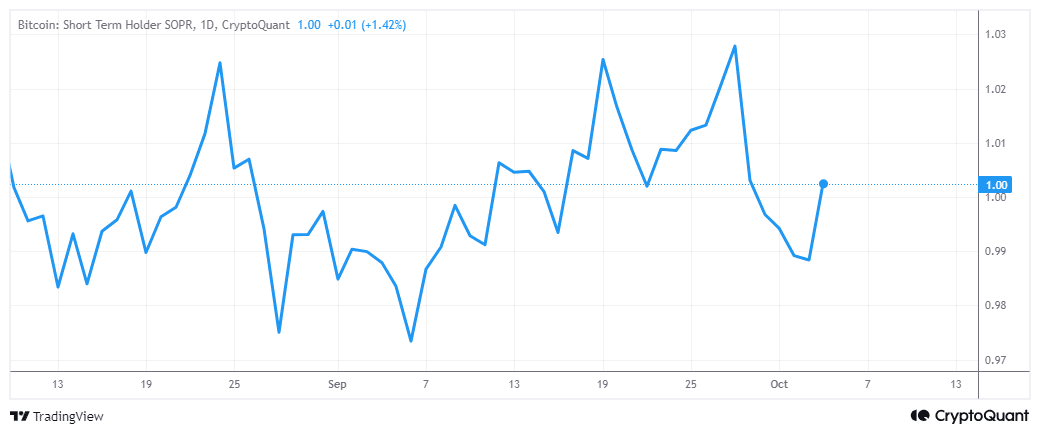

The analysis was consistent with Bitcoin’s latest price action, which was characterized by short-term fluctuations. In other words, it could be a while before Bitcoin experiences a major breakout. This is also consistent with recent observations in BTC’s short-term holding SOPR.

Source: CryptoQuant

The gains in short-term holder SOPR confirmed the shift in favor of short-term profit-taking. This is historically consistent with any shorter-term top.

How long will this short-term focus of Bitcoin last?

The shift in favor of short-term profit-taking largely depends on prevailing market sentiment. This has been driven by market events lately. Right now, the most important upcoming event that could have a major impact on Bitcoin is the US election cycle.

Uncertainties tend to support a short-term focus, which could explain why investors have switched to their current short-term profit-taking approach. The outcome of the US elections could also trigger a major reaction, one that could be enough to push BTC out of its current range. Keep in mind that this could be bullish or bearish depending on the outcome.

As for short-term expectations, Bitcoin traders should be wary of liquidations. A short-term profit-taking approach encourages greater leverage, which in turn can lead to greater exposure to liquidation events.