- LINK has implemented strategic tools to attract institutional investors

- However, the underlying network can pose challenges

Chain link [LINK] has hit $12 twice in the past two months but has faced resistance each time. The first time led to a solid retracement, while this time the green candles emerged faster.

The next challenge for bulls, which stood at $11.28 at the time of writing, is undoubtedly breaking the $12 barrier. According to analysts, this could happen before the end of the fourth quarter cycle.

While Bitcoin’s retest of the $62,000 resistance is adding to the general optimism – boosted by October’s general hype – there may be more underlying factors pushing investors to bet on LINK’s future value.

LINK deploys strategic partnership

In its effort to strengthen its institutional presence, Chainlink Labs has entered into a partnership Taurus a leading provider of digital asset infrastructure. Tits strategic partnership aims to increase LINK’s transaction bandwidth, a crucial factor in maintaining blockchain’s competitiveness.

If successful, this could generate strong institutional interest, significantly increasing LINK’s visibility and paving the way for significant long-term value growth.

However, despite these initiatives, stakeholders are beginning to withdraw from LINK’s network. The same is evident from the graph below.

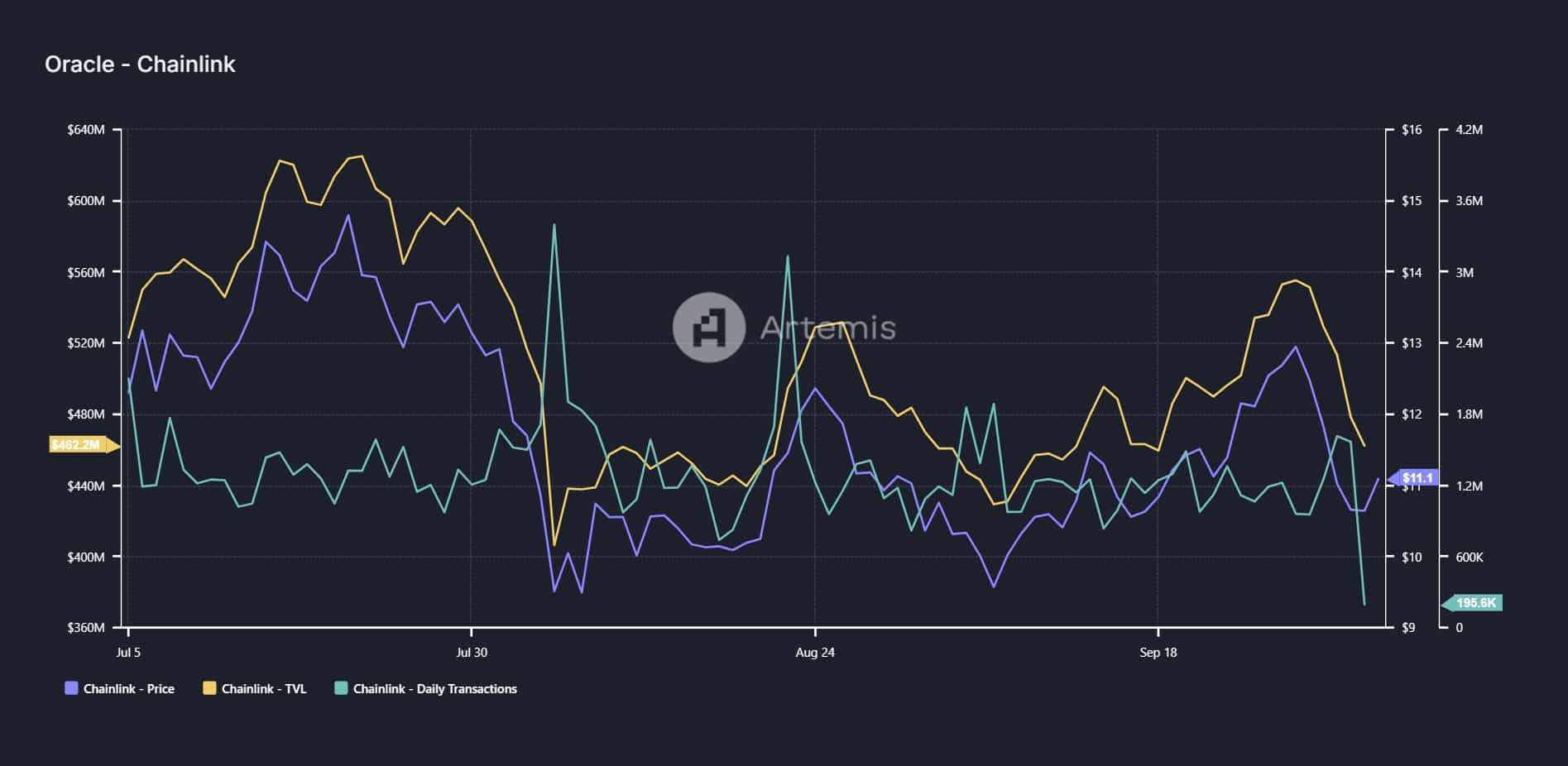

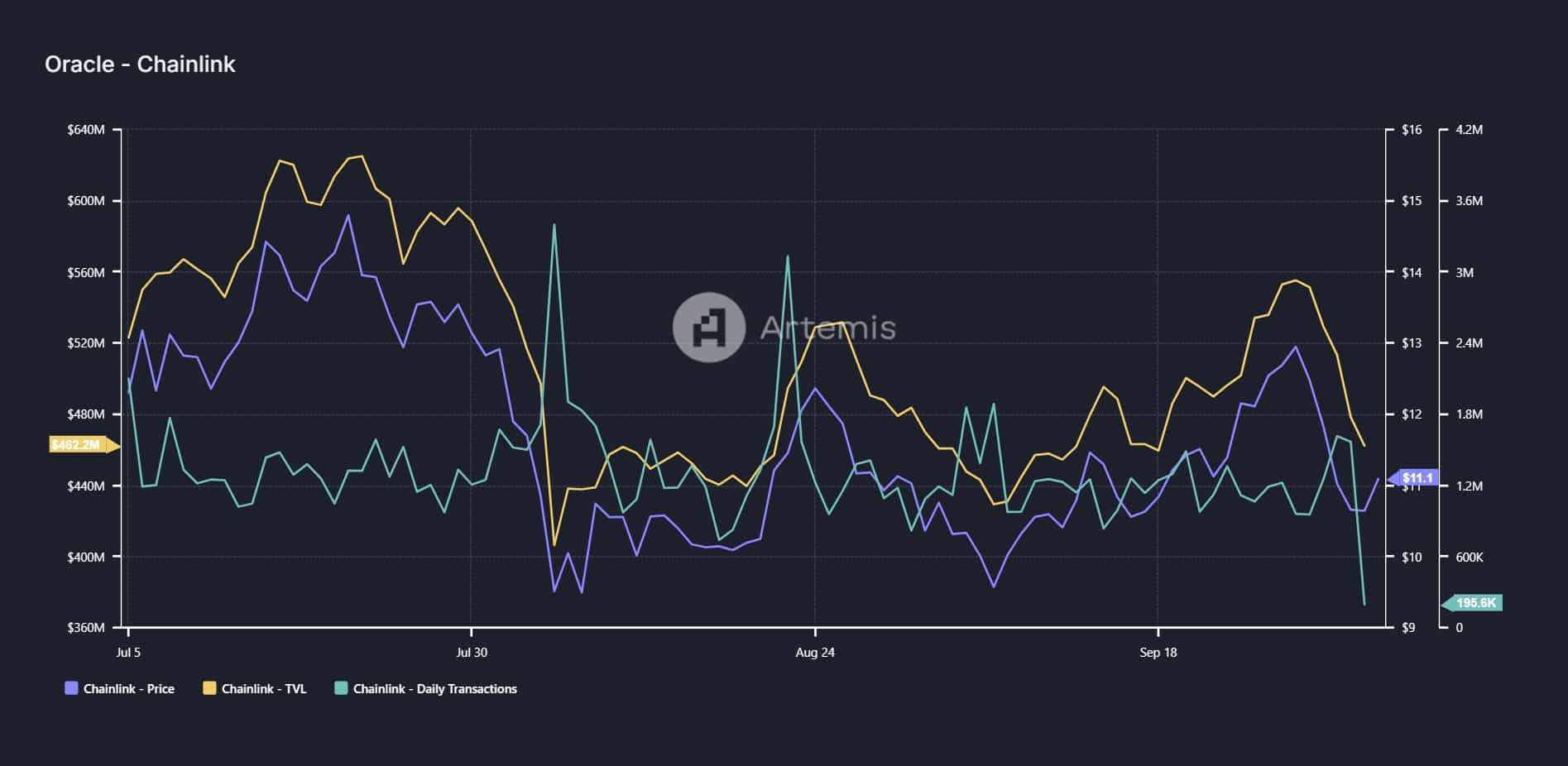

Source: Artemis Terminal

September’s volatility led to LINK’s DeFi platform losing a significant portion of its total value locked (TVL), from a peak of $555 million a week ago to $462 million at the time of writing.

Adding to the concerns, the number of daily transactions, which reached one million in mid-July, has fallen to a three-month low of 195,000.

Simply put, these collaborative projects come about during a period of internal crisis for LINK. If this strategy works as intended, LINK could be on the verge of a near-term price correction.

Backed by major players

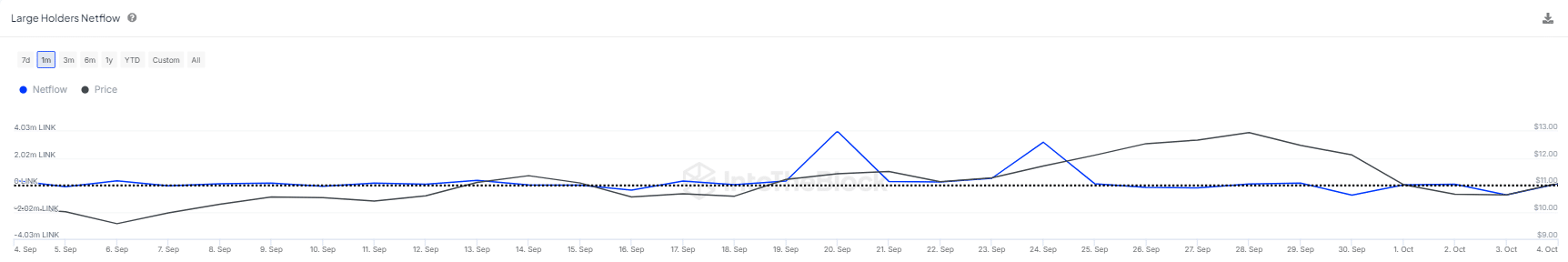

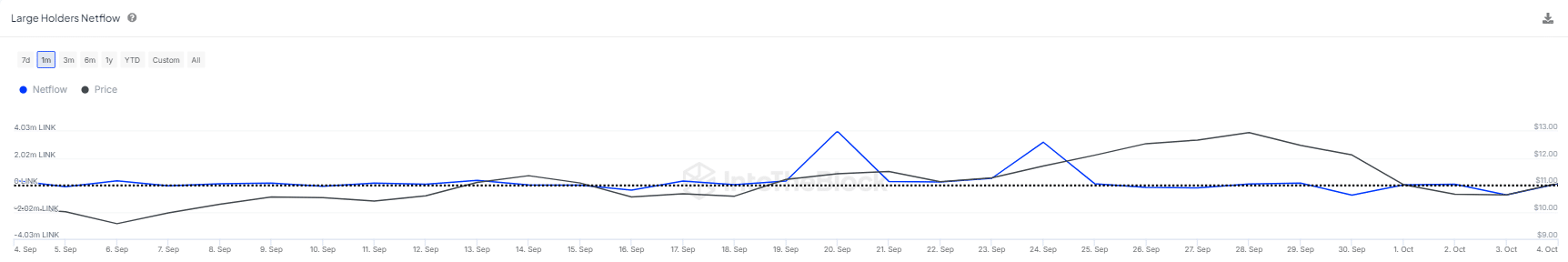

Whale wallets, which make up 49% of the large cohort of holders, contain 489 million LINK coins. They actively influenced LINK’s value throughout September.

Earlier this month, these whales lost their belongings. However, in recent days there has been a notable shift, with large holders beginning to accumulate tokens again.

Source: IntoTheBlock

The revival of whale accumulation has helped LINK turn key resistance at $10 into support. Now that this critical reversal has been achieved, breaking the $12 barrier seems feasible.

Is your portfolio green? View the LINK Profit Calculator

However, the internal challenges within the LINK network – reflected in declining user activity – are in stark contrast speculation that LINK could rise to $40 by the end of the next bull cycle.

Overall, the current situation appears somewhat bullish. If partnerships can rebuild trust between institutional players, a breakout could quickly follow – something the Chainlink network currently lacks.