- The Bitcoin MVRV ratio suggested potential market shifts, with a crucial support level at 1.75.

- Retail and whaling activity showed mixed signals: the number of active addresses increased, but large transactions fell slightly.

Bitcoin [BTC] recently rose above $66,000, marking a brief rally that excited investors and analysts about a potential bullish trend for October, dubbed “Uptober.”

However, this price increase was short-lived as Bitcoin experienced a significant correction shortly afterwards.

Over the past week, the leading cryptocurrency has been on a downward trajectory, down 6.6% and falling below $62,000 at the time of writing, with an additional 0.4% dip in the past 24 hours.

Amid these fluctuations, a well-known CryptoQuant analyst has done just that shed light on a critical trend occurring in the background. According to the analyst, this emerging pattern could potentially have notable implications for Bitcoin’s future market behavior.

The MVRV ratio indicates an important move for BTC

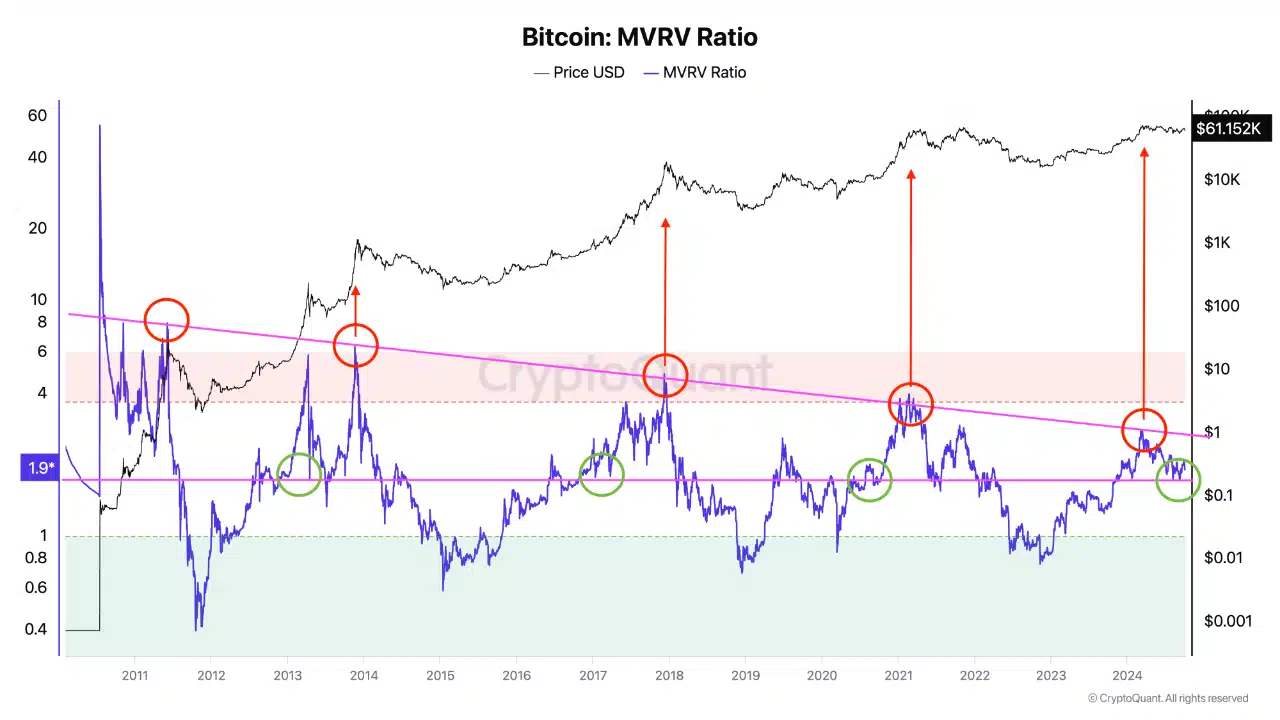

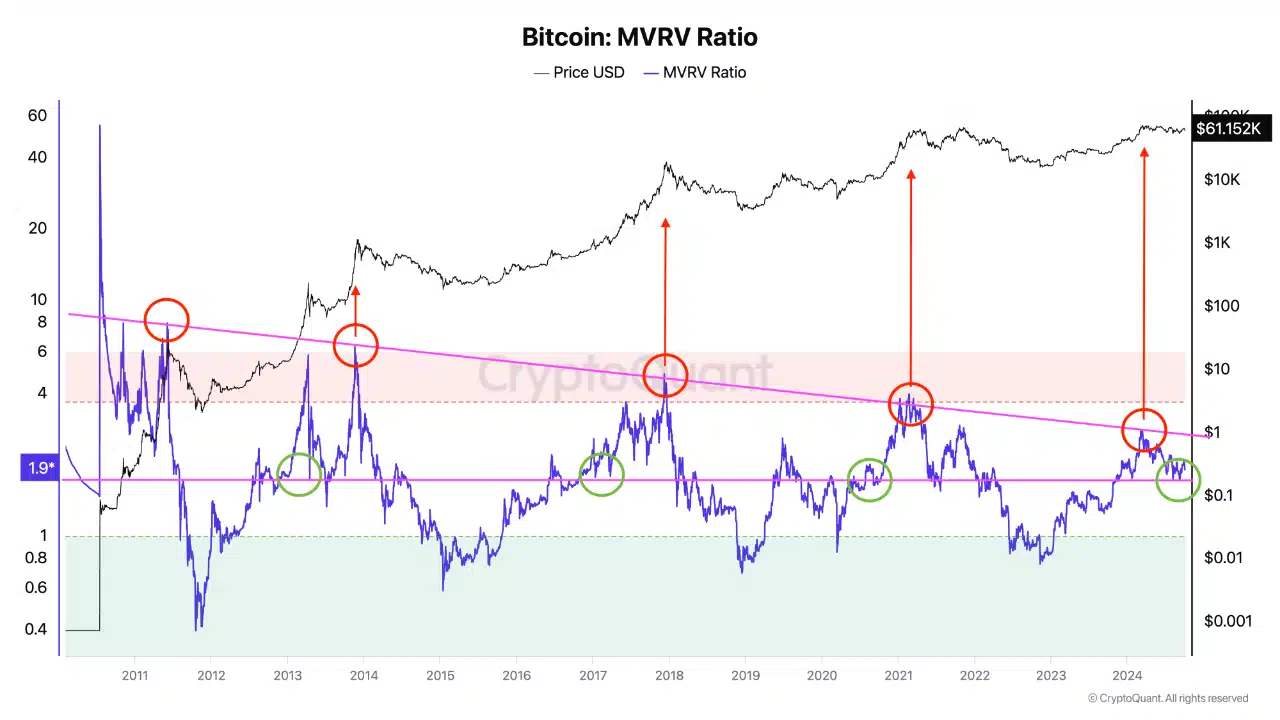

The CryptoQuant analyst’s focus was on Bitcoin’s market value to realized value (MVRV) ratio. This is an important metric that assesses whether BTC is currently overvalued or undervalued by comparing its market value to the price at which all coins last moved.

The MVRV ratio has historically been useful in identification major market highs and lows during Bitcoin’s halving cycles.

The MVRV ratio, as explained by the analyst, is in a downtrend, with a crucial support level of 1.75.

Currently the ratio is 1.9. This raises a crucial question: if the MVRV ratio breaks out of this historical downtrend and changes direction, could it rise to a range between 4 and 6?

Source: CryptoQuant

Such a range has historically indicated a market peak for Bitcoin, as observed in previous cycles. The analyst’s focus on the MVRV measure underlines its importance as a gauge of potential market sentiment and future price movements.

Other statistics show mixed trends

Given this potential shift in market conditions, it is worth examining other indicators that could provide insight into Bitcoin’s future trajectory.

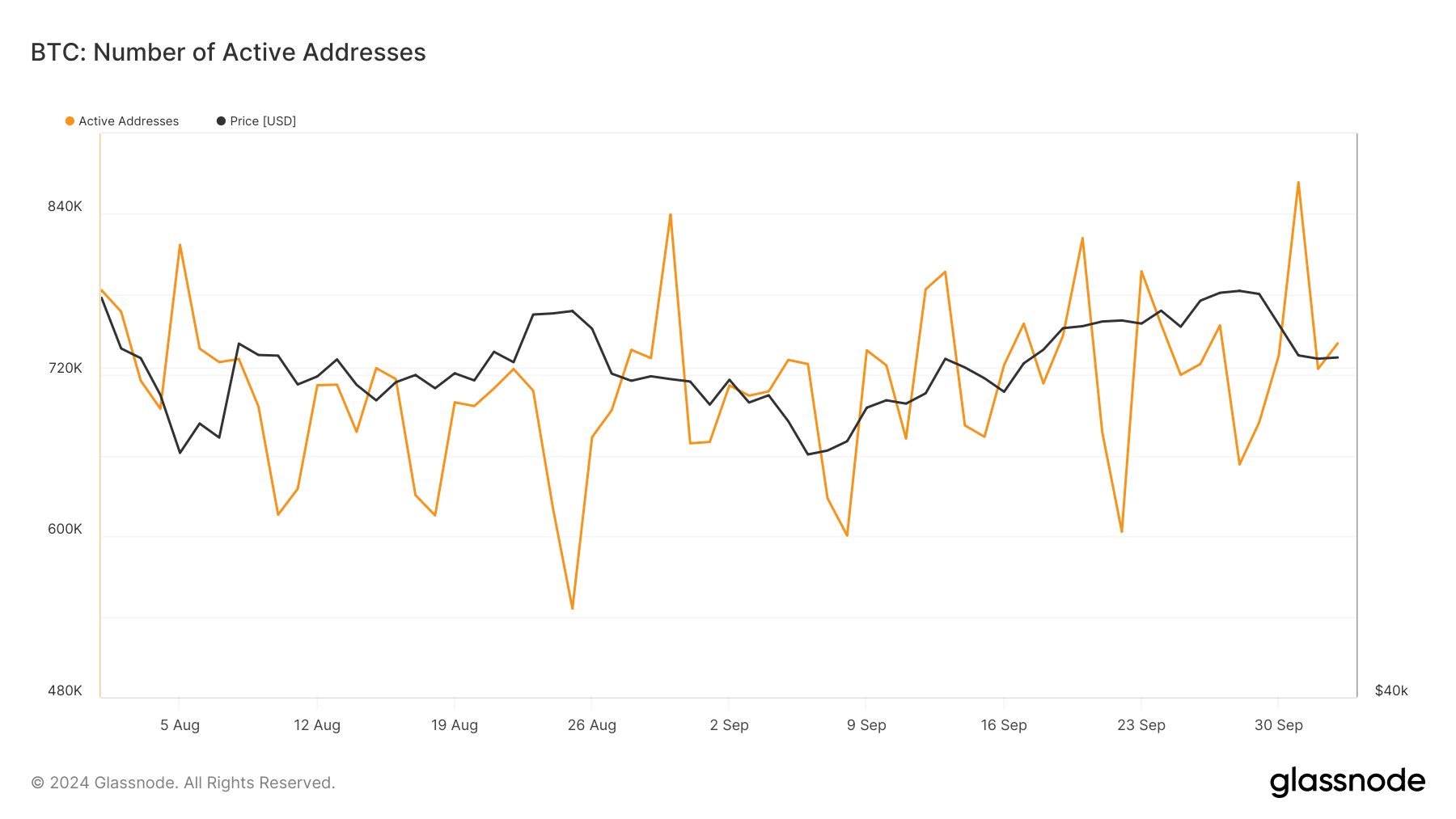

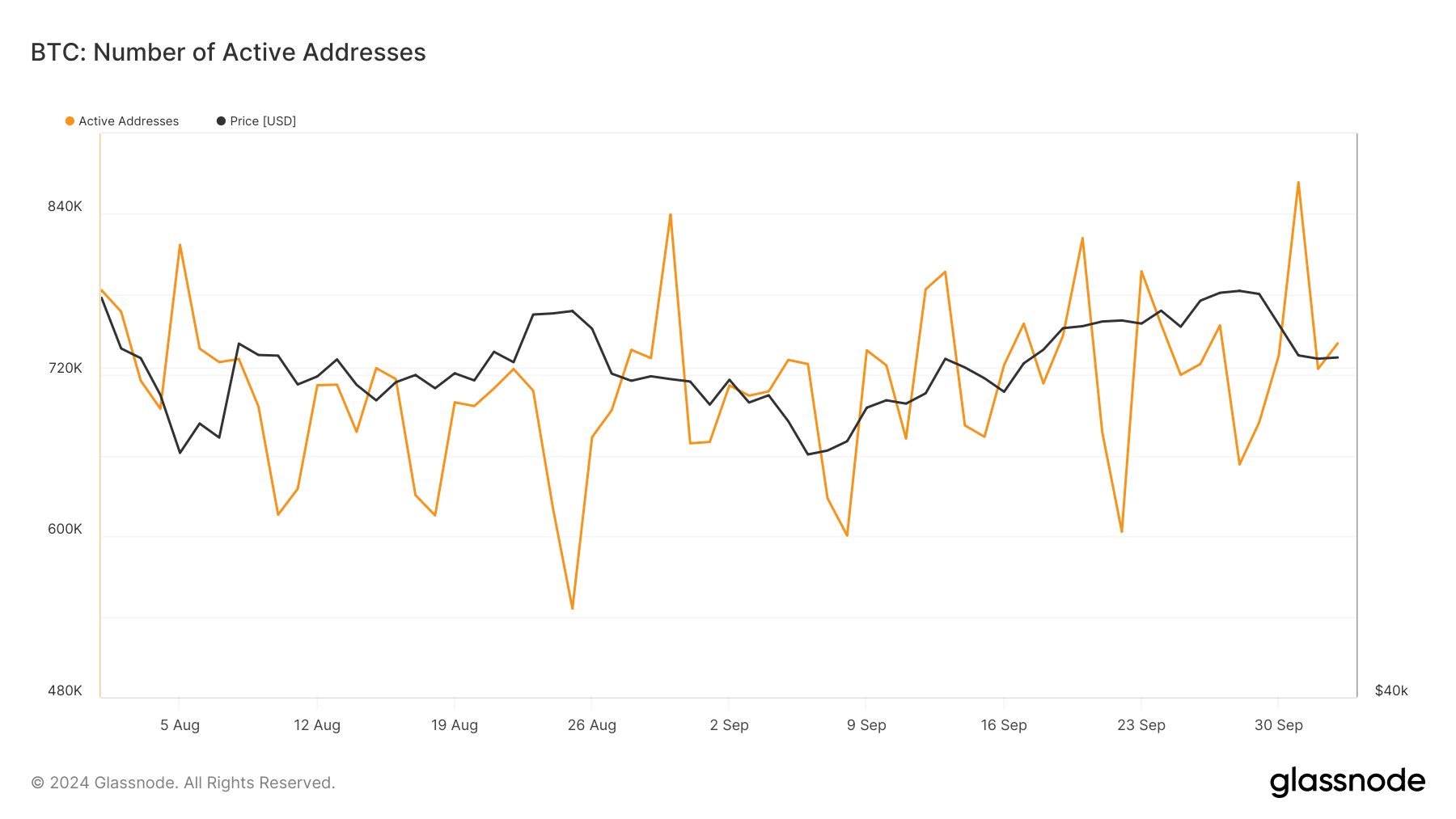

For example, an important metric to keep an eye on is retail investor activity, which is often reflected in the number of active addresses. According to facts from Glassnode, this statistic has been steadily increasing month over month.

Source: Glassnode

After reaching 832,000 addresses in August and dropping slightly to 822,000 in September, Bitcoin’s active addresses have continued to grow and currently stand at over 863,000.

This growing trend signals renewed retail interest and involvement in the Bitcoin market, even amid the recent price volatility.

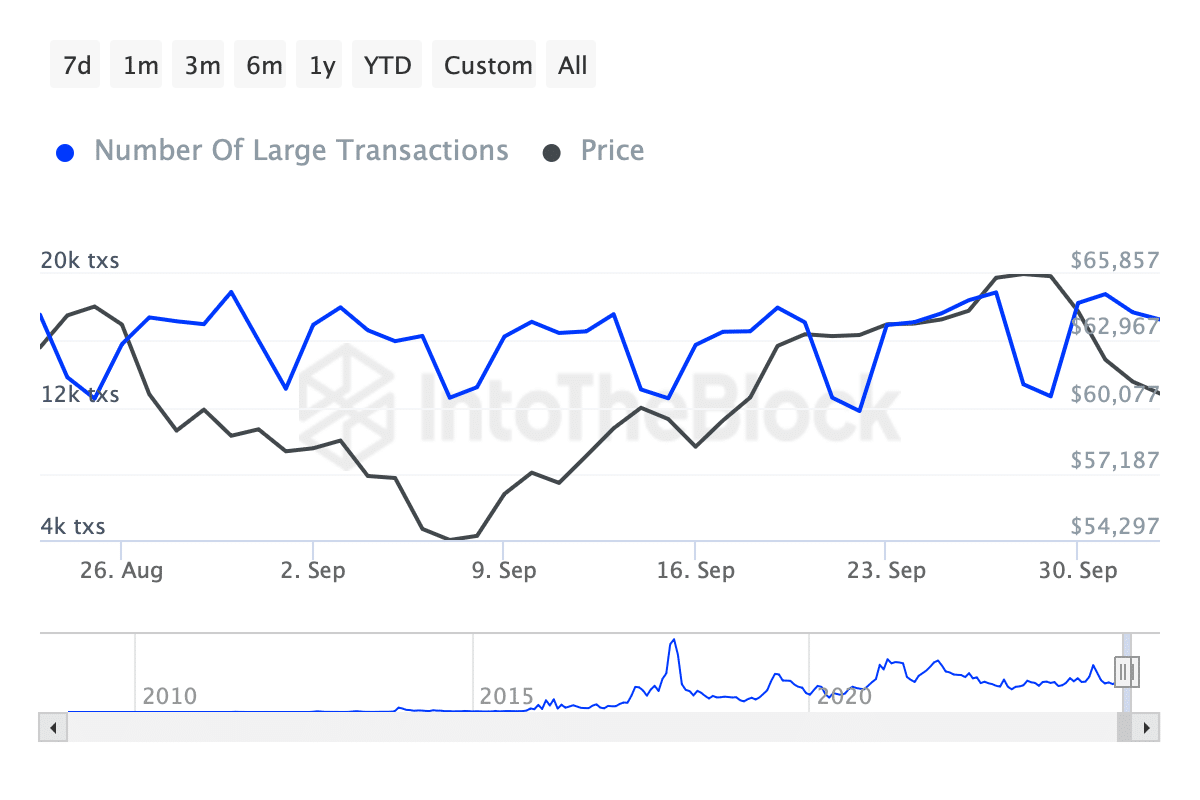

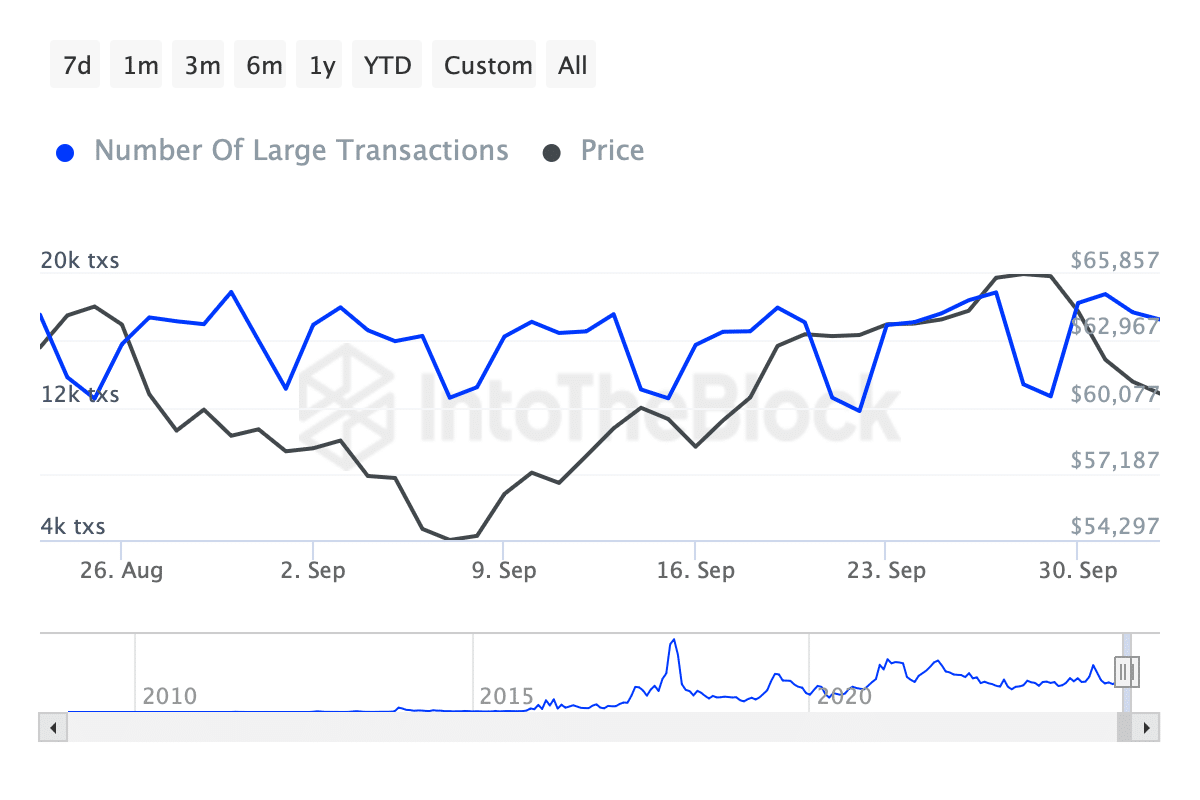

While private sector interest provides only one side of the picture, understanding the activities of larger investors, often called “whales,” is just as crucial. An important indicator in this regard is the volume of transactions above $100,000, as shown by data from InTheBlok.

Source: IntoTheBlock

Read Bitcoin’s [BTC] Price forecast 2024-25

This statistic saw a noticeable increase between August and September, from less than 14,000 transactions to more than 18,000.

Since that surge, however, there has been a gradual wind-down, with whale transactions recently falling to around 17,700.