This article is available in Spanish.

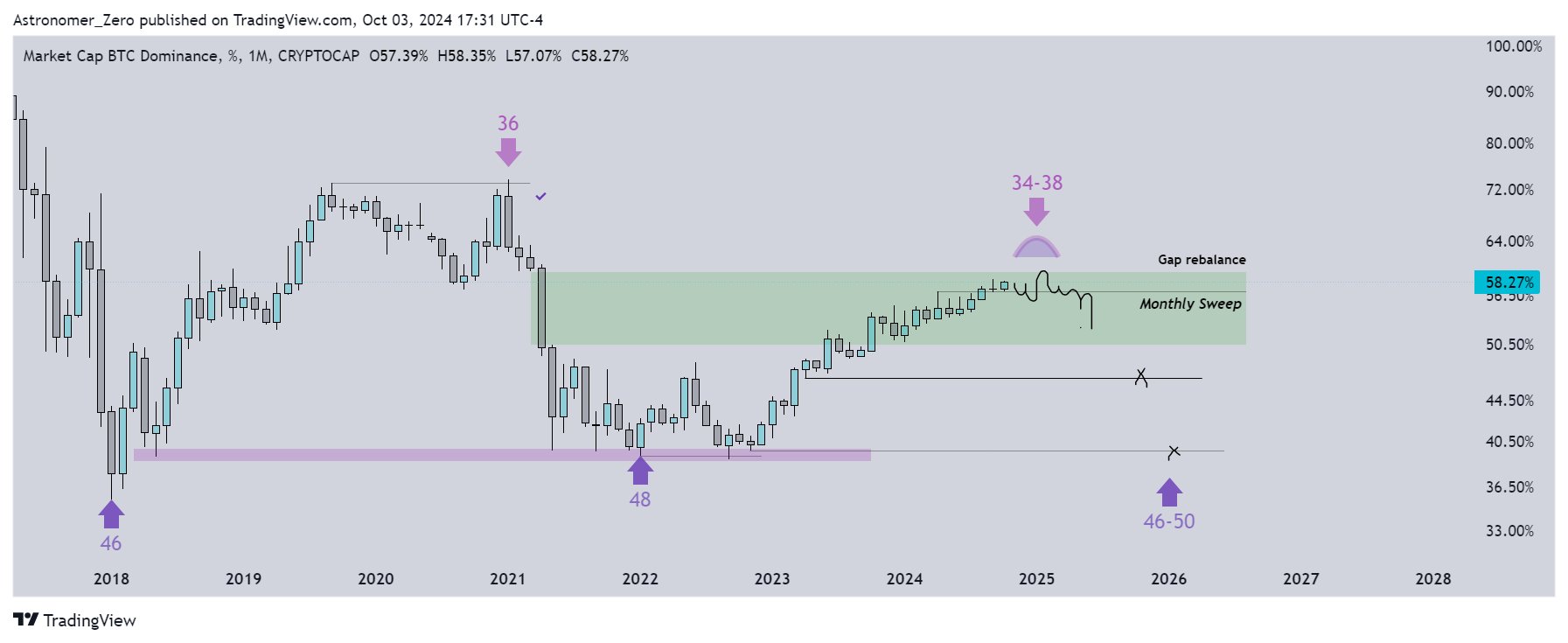

In one analysis shared on As Bitcoin’s (BTC.D) dominance continues to rise and altcoins struggle to keep pace, Astronomer offers a data-driven perspective that challenges prevailing narratives that suggest the era of altcoin seasons may be over.

Astronomer begins by acknowledging the difficulties altcoin holders face in the current market environment. “Alts are still at low prices and BTC.D is booming, and yes, ETH (and altcoin) holders are having a hard time,” he notes.

He notes a growing sense of disbelief among investors that Bitcoin’s dominance could wane again, casting doubt on the potential for a new altcoin season. “You hear things like ‘BTC ETF changed everything’, ‘Boomers won’t buy altcoins and therefore they won’t rise’, ‘BTC is at ATH and alts haven’t done anything.’ These are all things that are easy to say and understand because they fit perfectly with the current chart,” Astronomer explains.

However, he warns against accepting these stories at face value. “They give you a sense of comfort and a reason not to hold alts, which is usually difficult during accumulation phases, especially when the BTC chart ‘looks’ a lot better,” he adds.

Related reading

To provide clarity, Astronomer offers its own definition of an altcoin season: “A true altcoin season is one in which liquidity flows from the most dominant asset (BTC) to the other assets (ETH and altcoins). As a result, BTC.D is falling and almost all altcoins are rising.”

The arguments for an impending Altcoin season

Astronomer lays out a series of facts to support his argument that an altcoin season is still on the horizon:

#1 Historical priority

“First fact: we had the big altcoin season every cycle (four-year rotation) like clockwork,” he claims. This pattern is visible not only in historical charts, but also in the collective memory of those who were active during previous cycles. Astronomer warns against adopting a “this time is different” mentality, which inherently puts investors at a disadvantage. “History rhymes/repeats itself,” he reminds readers.

#2 Bitcoin dominance chart corresponds to a four-year cycle

“The BTC.D chart is on track with its four-year cycle,” notes Astronomer. He previously predicted that a peak in Bitcoin dominance would occur around months 34 to 38 of the cycle. “We are now in month 33 of the four-year cycle, which means the tides will change within a few months,” he points out. Believing that Bitcoin’s dominance will continue to rise unchecked is essentially gambling against established cyclical patterns, according to the analyst.

#3 The great crypto rotation

“The ‘first Grand Altcoin rotation’ typically occurs once per cycle: around the fourth quarter of year 3 of the cycle, and has again been running smoothly so far,” says Astronomer. He explains that in previous cycles, certain altcoins (a minority) perform strongly early, driven by specific narratives, while the majority see significant gains later, fueled by the liquidity flowing out of Bitcoin.

He cites the 2018-2022 cycle as a good example. “In this cycle, in the first three years, LINK is a good example because it was one of the strongest top 100 altcoins and put up a 100x, while ETH (and all of BTC’s other liquidity-driven altcoins) put up a measly 3x,” explains he out. In the last year of that cycle, the dynamics changed: “ETH is up 10x, and LINK has only gained about 3x.”

Related reading

#4 Overestimated impact of Bitcoin ETF

Astronomer is skeptical of the idea that the adoption of a Bitcoin ETF has fundamentally changed market dynamics. “The BTC ETF story of canceling alt season is way overrated,” he argues. He points out that total ETF flows have reached $40 billion since their launch, while Bitcoin’s centralized exchange (CEX) volumes average $20 billion per day. “ETF flows are negligible, which is why you’ve never heard me talk about it, because I like to filter out noise,” he claims.

#5 Favorable monetary policy looms

Astronomer also points to macroeconomic factors that could benefit altcoins. “Interest rates are falling, the US money supply is increasing dramatically (with China now following suit). All we are waiting for is QE, which is usually a natural consequence of the rise in M2 (with a lag),” he explains. Historically, such monetary conditions have been conducive to the appreciation of altcoins. “Monetary policy shifting in our favor also usually means altcoins do well,” he notes.

#6 Bitcoin’s record high is an arbitrary indicator

He disputes the idea that Bitcoin reaching an all-time high (ATH) without a concurrent altcoin season, signaling a permanent disconnect. “BTC’s presence at ATH is an arbitrary measure of when alt season starts and the fact that it has reached ATH but altcoin season has not yet started, in my opinion, is not valid to call it canceled,” argues Astronomer. He emphasizes that time and cyclical patterns are more important factors than price milestones.

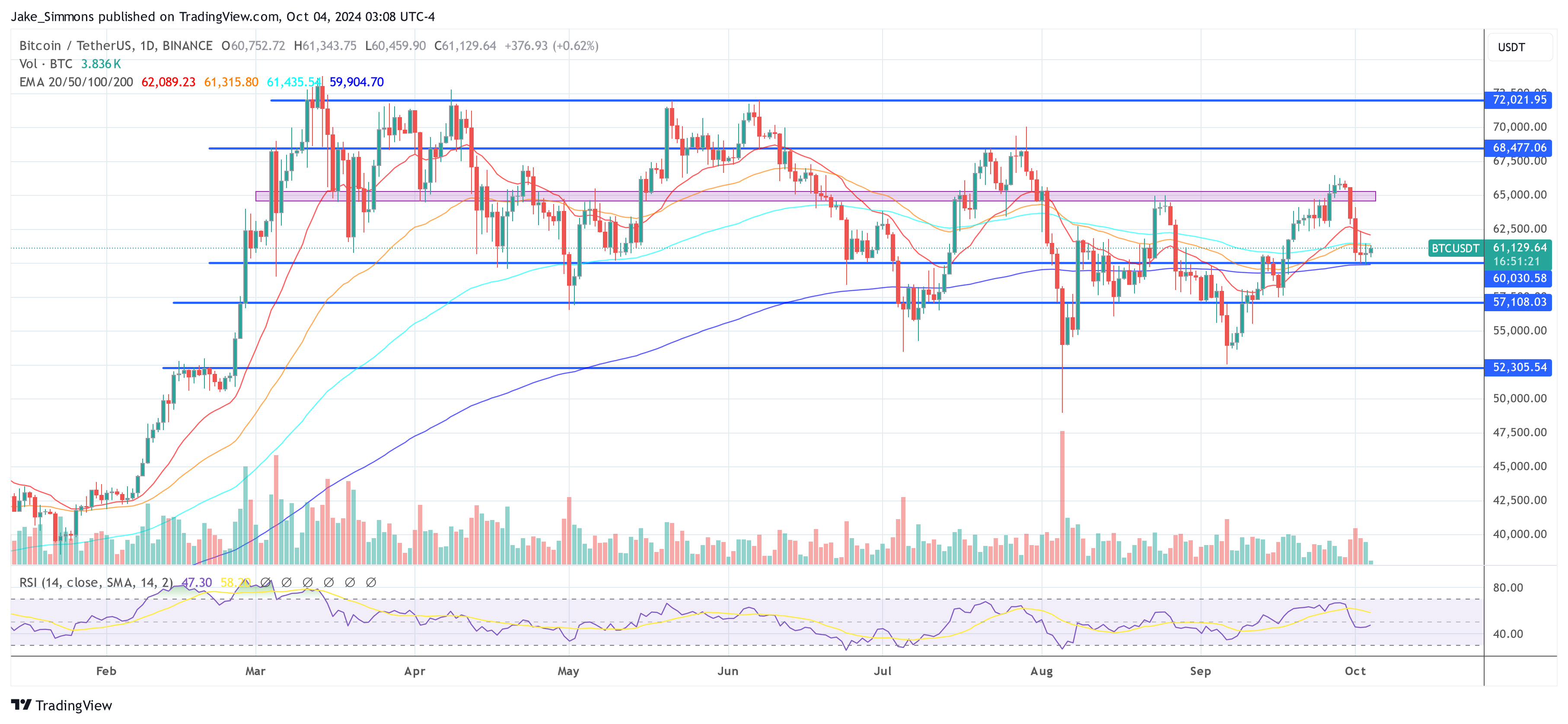

At the time of writing, Bitcoin was trading at $61,129.

Featured image created with DALL.E, chart from TradingView.com