- BTC’s market structure showed signs of a potential shift for the better.

- Users who opted for the BTC holding strategy reached new highs.

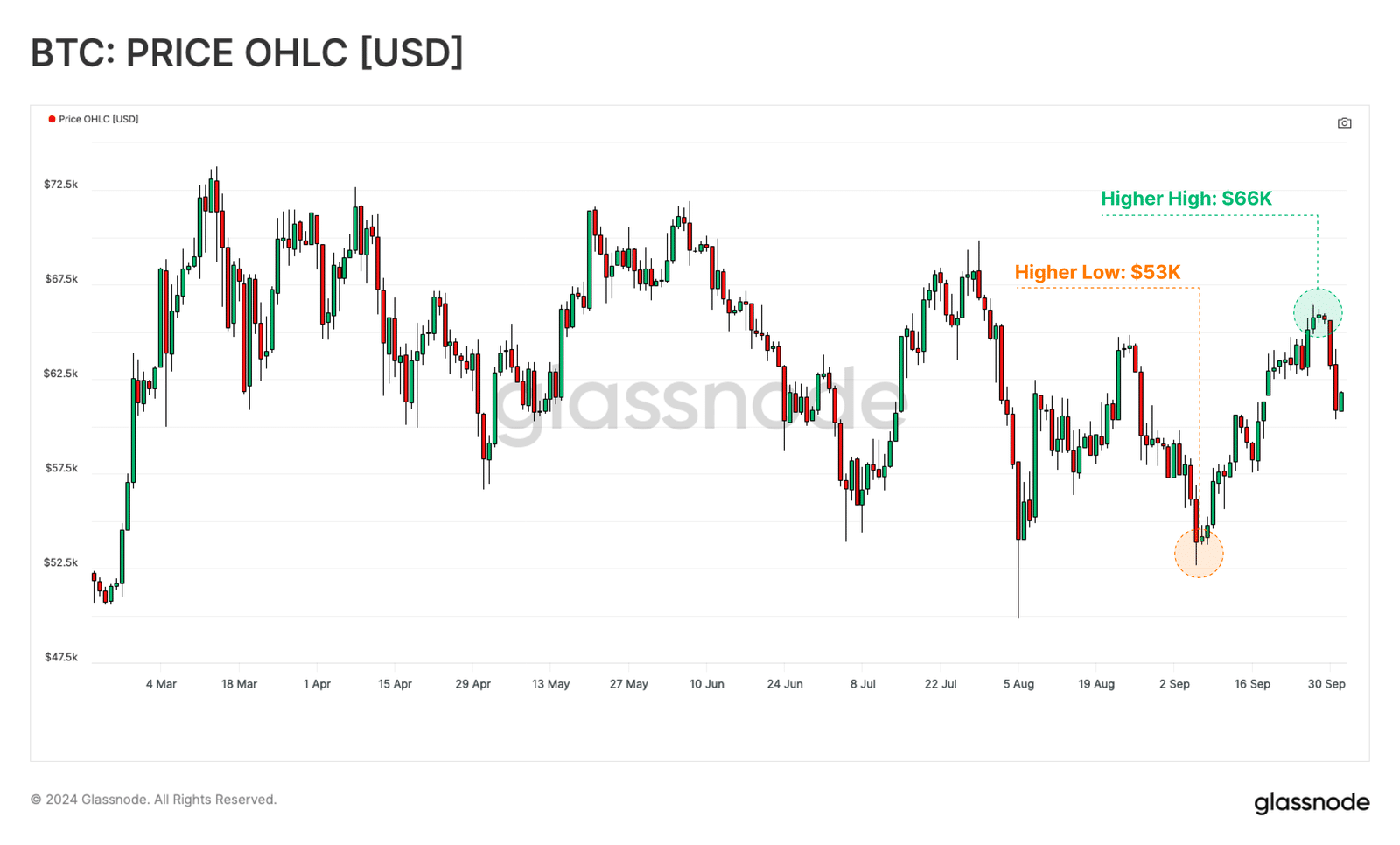

Bitcoins [BTC] The downward trend and subsequent consolidation since the March peak could end soon.

According to blockchain analytics firm Glassnode, last week’s relief rally to $66K presented a first higher high since June.

Source: Glassnode

Additionally, a number of on-chain metrics also printed new highs. The analytics firm noted that these are increasing signs of a shift in market structure, which could spell the potential end of the ongoing Bitcoin reaccumulation phase since March.

“This price action provides the first indications that the structured downtrend is approaching a phase shift.”

The Bitcoin cycle is in line with past trends

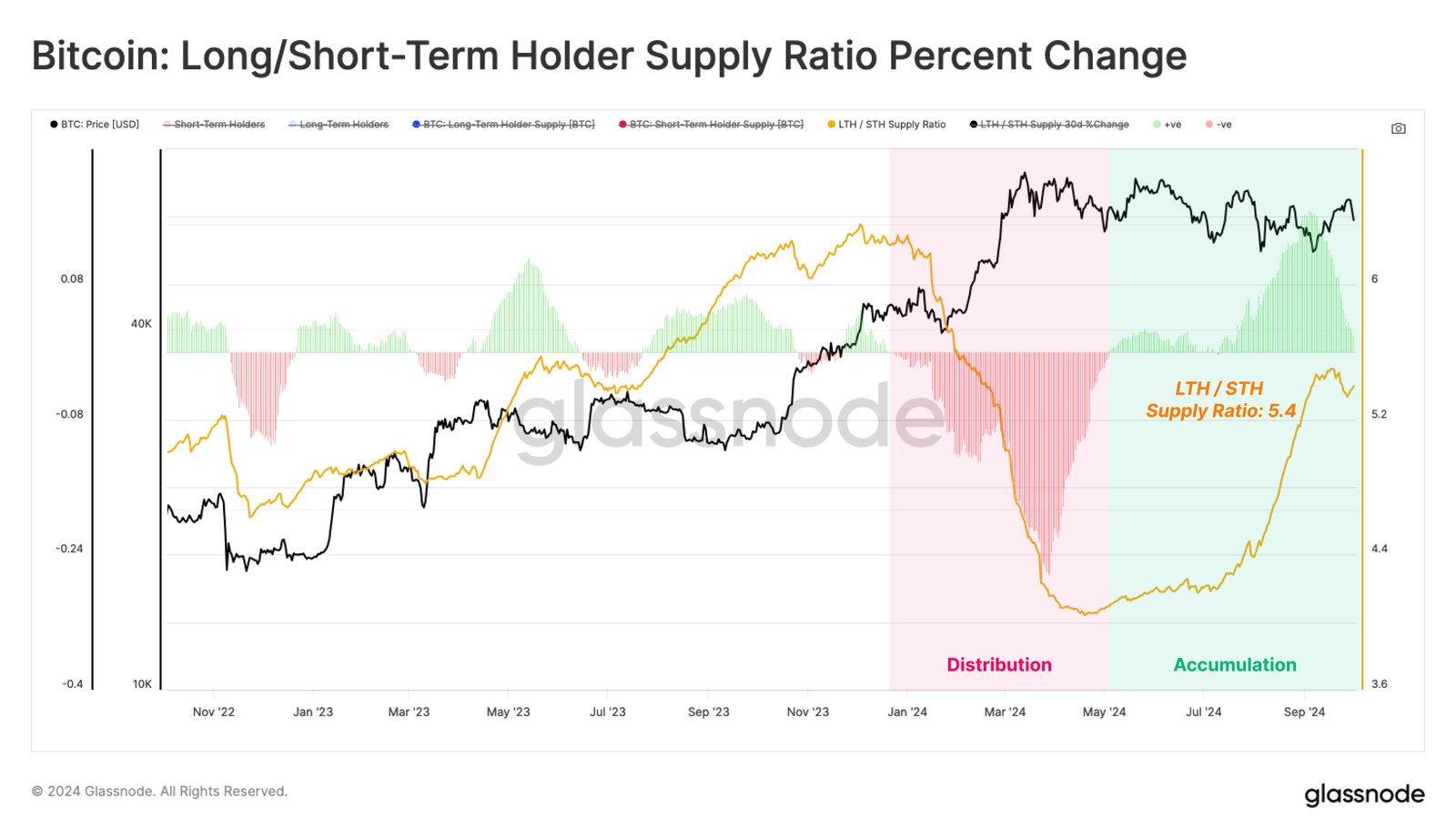

Source: Glassnode

Despite the prolonged consolidation, BTC found itself at the same levels after cycle lows as in previous market cycles. It was up over 300% from the cycle low, further reinforcing that BTC price still had more room to grow.

The bullish outlook was also illustrated by the rising number of users whales by adopting BTC’s holding strategy. Since May, the supply ratio for long-term holders has increased to 5.4, highlighting that users were holding their BTC rather than selling it.

“This suggests that HODLing is still the dominant behavior of Bitcoin investors.”

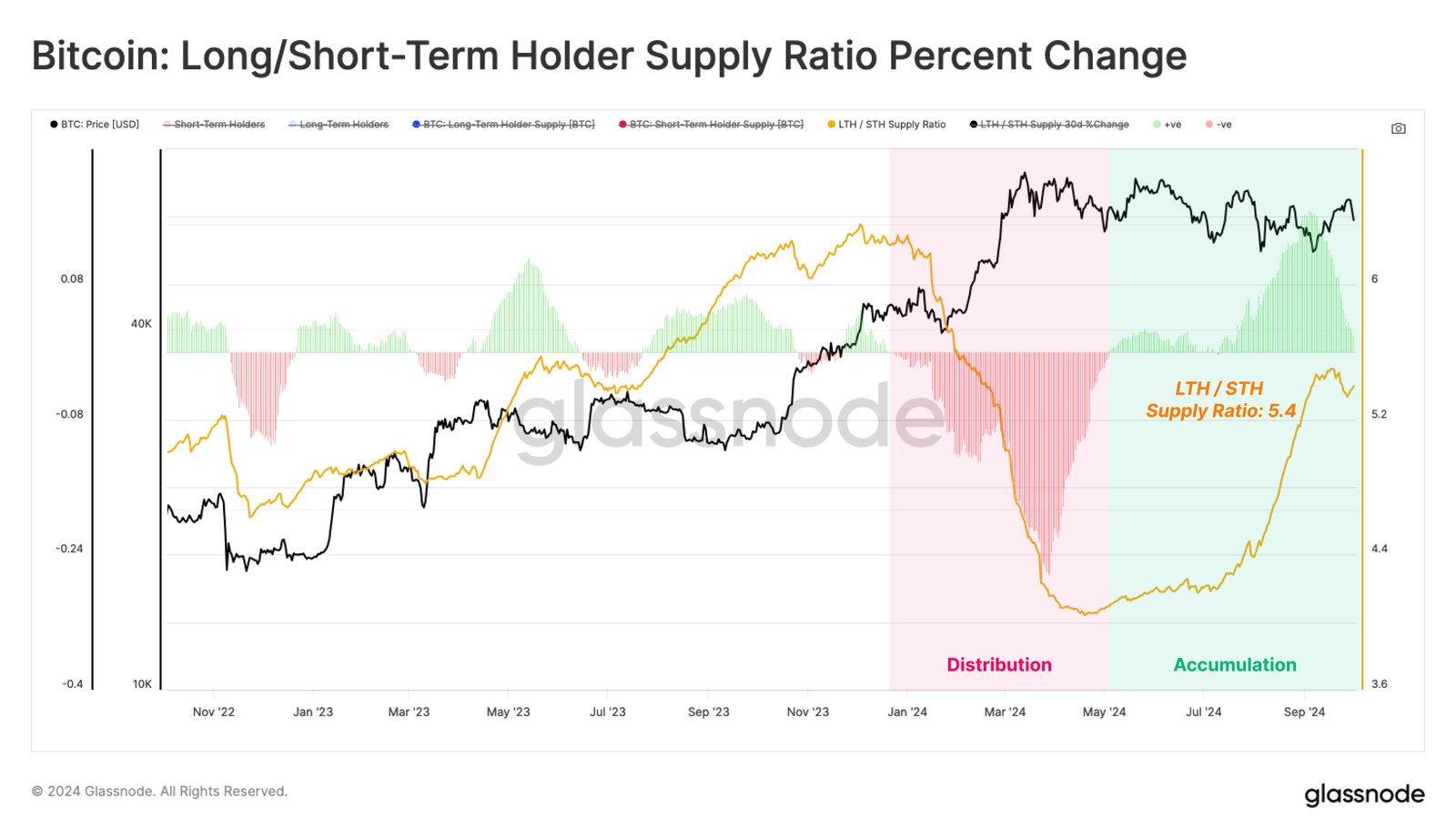

Source: Glassnode

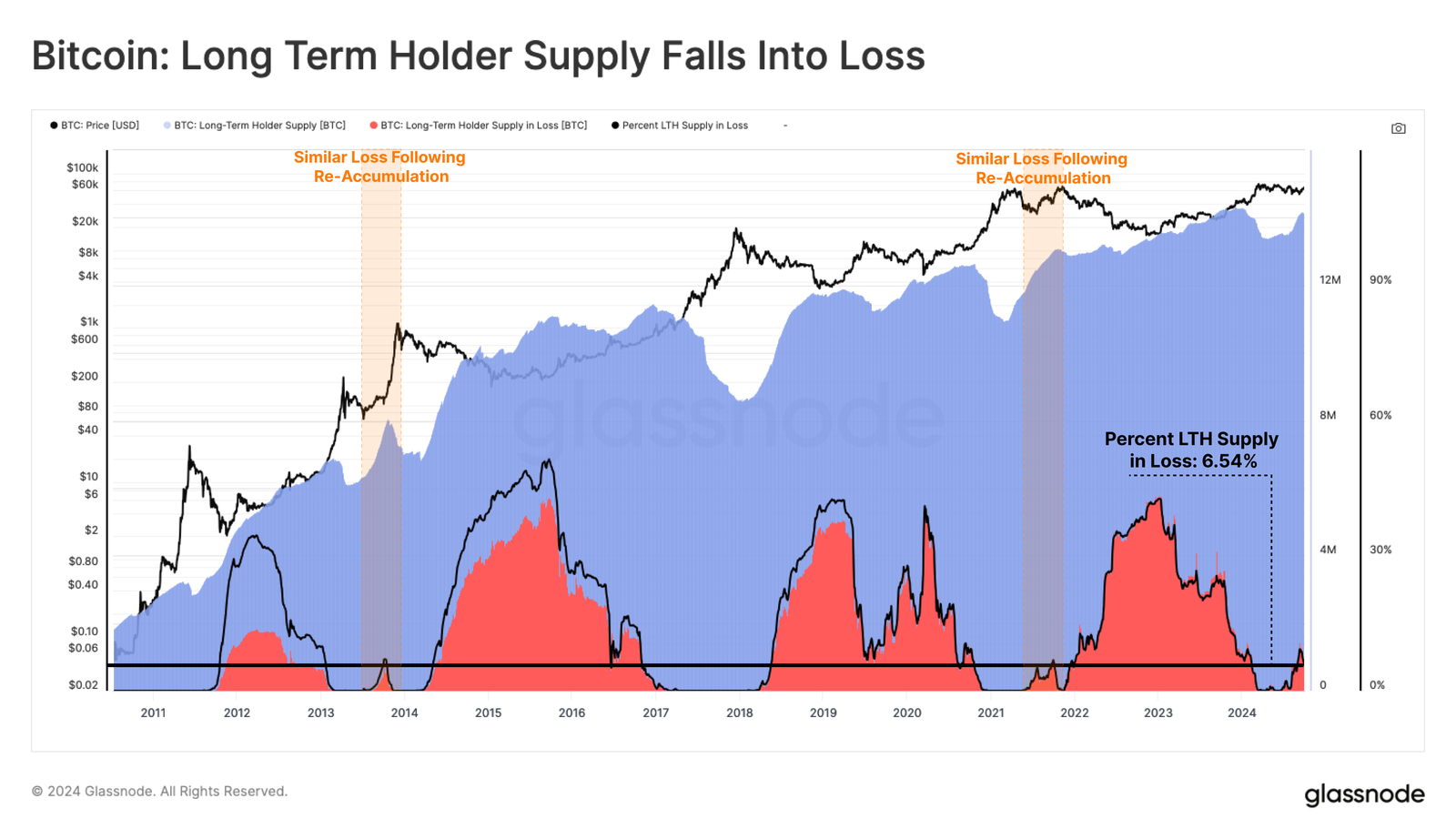

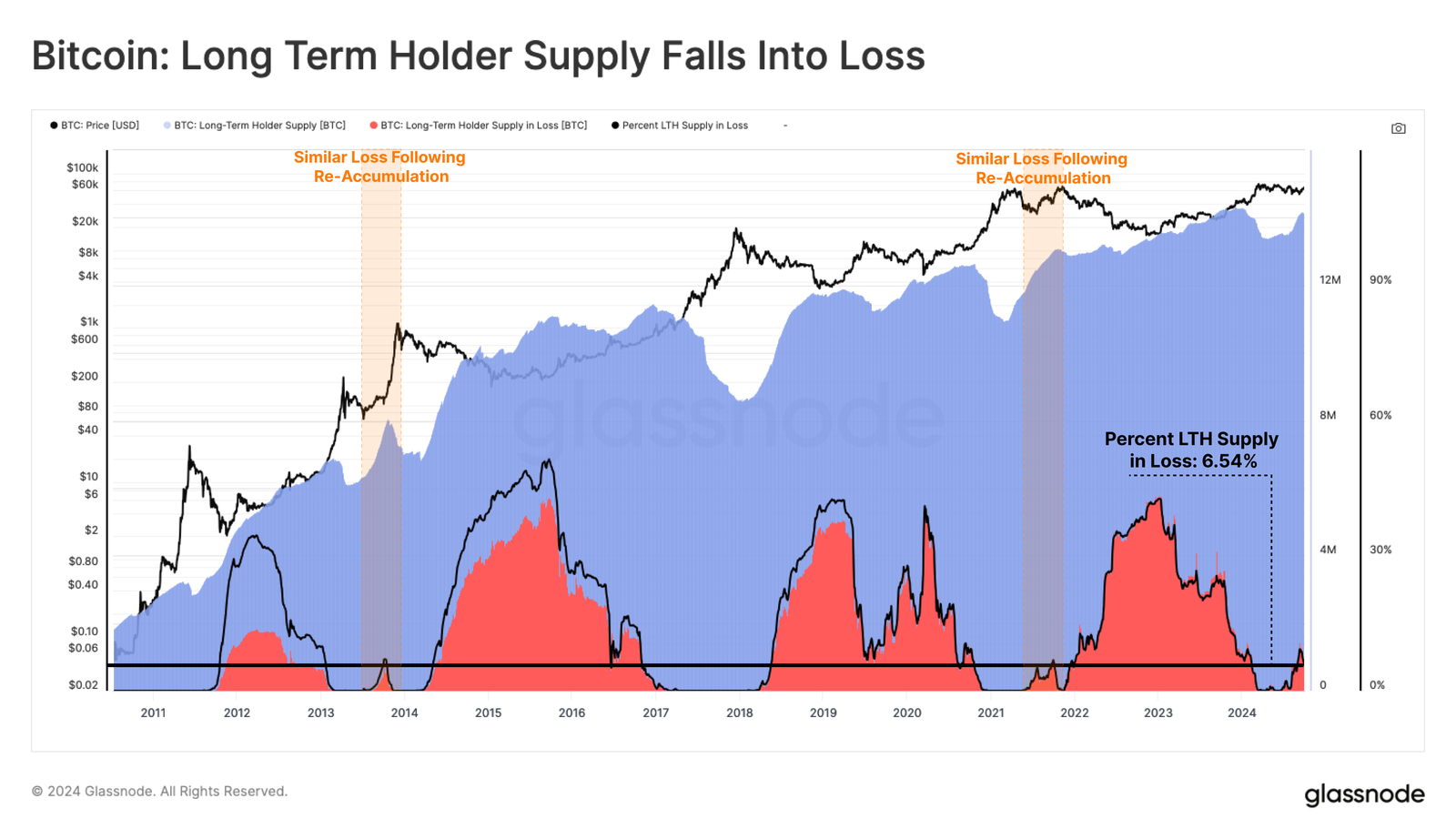

That said, about 6.5% of long-term holders (LTH) suffered losses on October 1.

However, Glassnode stated that the unrealized losses in the LTH cohort were relatively small but consistent with previous reaccumulation phases.

Source: Glassnode

The analytics firm added that the recent relief rally boosted STH’s profits, a different scenario from previous weeks.

Collectively, these reinforced the idea of a potential shift in market structure to extend the reaccumulation period.

But Peter Brandt believed the market structure shift could only happen if BTC rose above $71,000.

At the time of writing, BTC was weakly holding the psychological $60,000 level after a recent sell-off.