- Bitcoin was trading below $66,000 at the time of writing, with analysts pointing to $71,000 as a key level for a bullish reversal.

- The supply of short-term bonds is declining, indicating growing confidence in the market, while open interest is showing mixed signals.

Bitcoin [BTC] has experienced a slight decline and is currently trading around $61,639, down 3.5% in the past day. This drop comes shortly after the leading cryptocurrency staged a remarkable recovery last week, reaching as high as $66,000.

Despite the recent dip, Bitcoin is still up 9.4% over the past two weeks.

While no clear drivers have been identified for the current downward movement, analysts are observing several trends and key levels that Bitcoin holders should pay attention to when evaluating the asset’s future price trajectory.

Major Levels and Shifts Among Bitcoin Holders

Veteran trader Peter Brandt recently shared his analysis in the Bitcoin market, highlighting a crucial level that bulls can regain.

According to Brandt, Bitcoin holders and investors should keep an eye out for BTC to close above $71,000, confirmed by a new all-time high (ATH), indicating that the uptrend since November 2022 is still in place.

Brandt stated in his message:

“Bitcoin’s recent rally has NOT disrupted its seven-month sequence of lower highs and lower lows.”

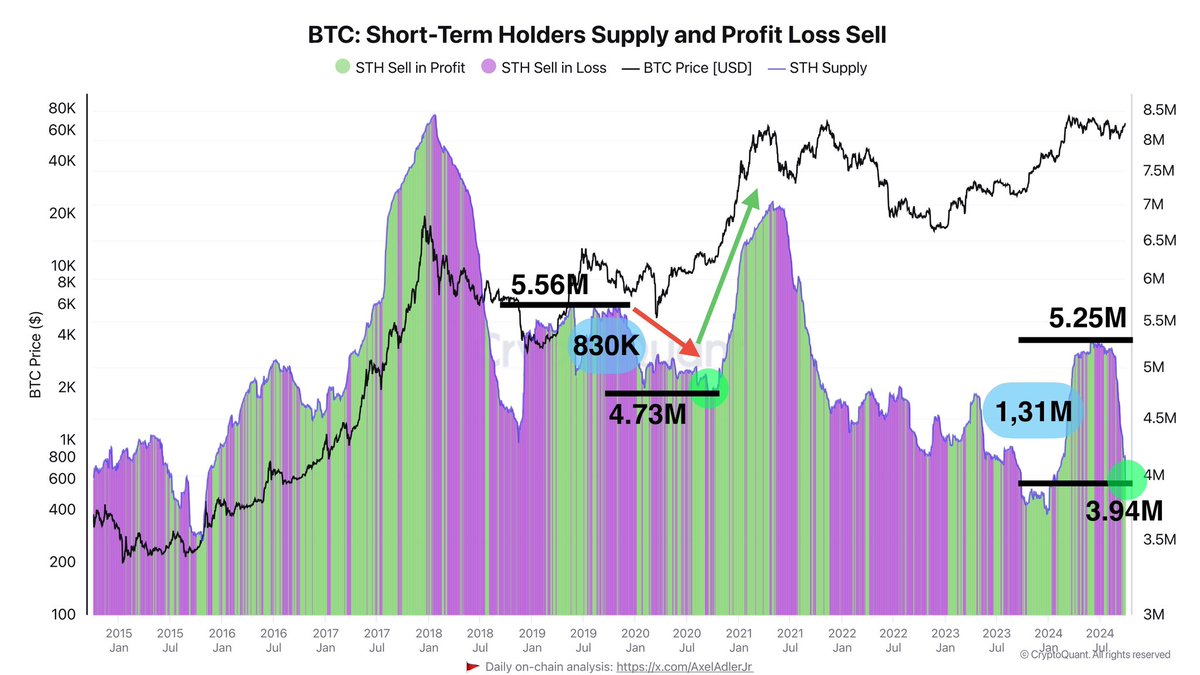

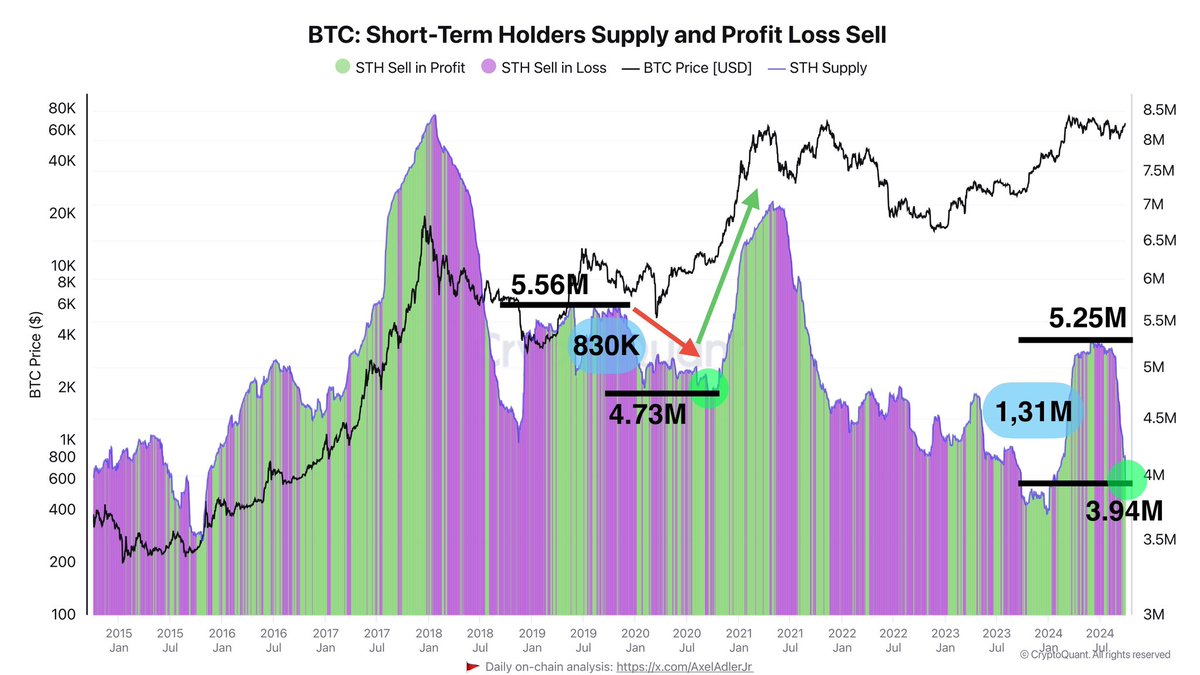

Meanwhile, recent data from CryptoQuant has highlighted a shift among Bitcoin holders, particularly short-term holders (STHs). The total supply of Bitcoin held by STHs has decreased by approximately 1.31 million BTC (approximately $83 billion).

Source: CryptoQuant

Axel Adler Jr, a CryptoQuant analyst, elaborated that this decline indicates ‘growing market confidence’ as there is less BTC circulating among STHs who choose to hold their assets (HODL).

Additionally, while some short-term holders have made profits by selling their coins, the overall trend indicates a move toward longer-term holding strategies.

Adding to the discussion on market sentiment, prominent crypto analyst Willy Woo shared his thoughts about the current and future structure of Bitcoin’s price.

He suggested that the medium-term outlook is moving from bearish to neutral, and could be on the way to becoming bullish. Woo also predicted that a new all-time high for Bitcoin could take some time, with the next bullish attempt possibly coming after a cool-off period of 1-3 weeks.

According to him October could remain flatbut bullish activity could increase in the months of November and December.

Open interest and active addresses indicate mixed trends

In addition to the insights of individual analysts, market statistics provide additional perspective on the state of Bitcoin.

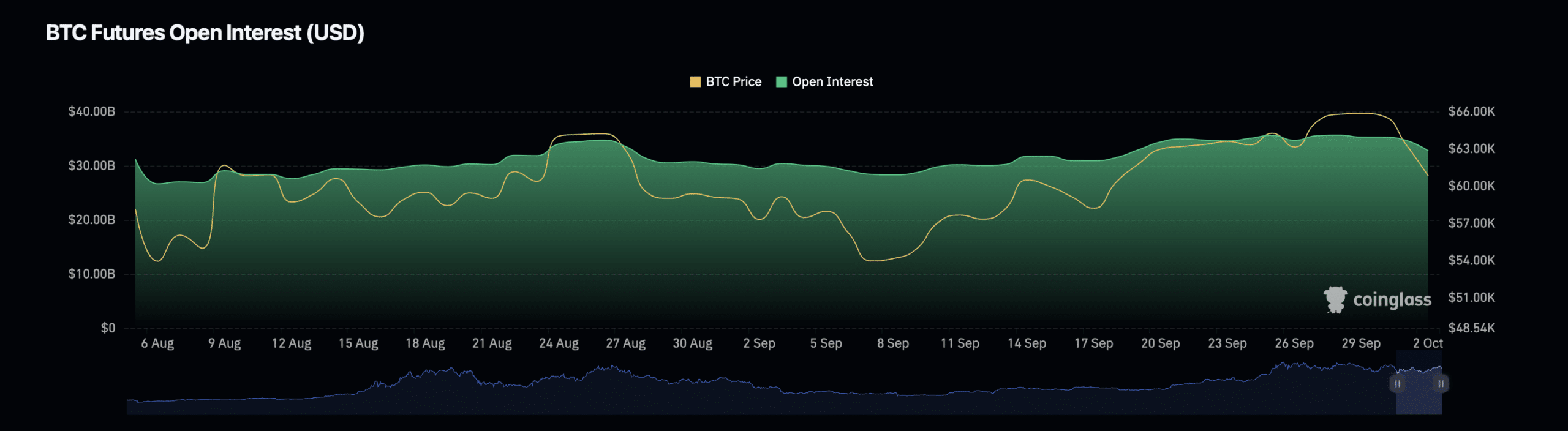

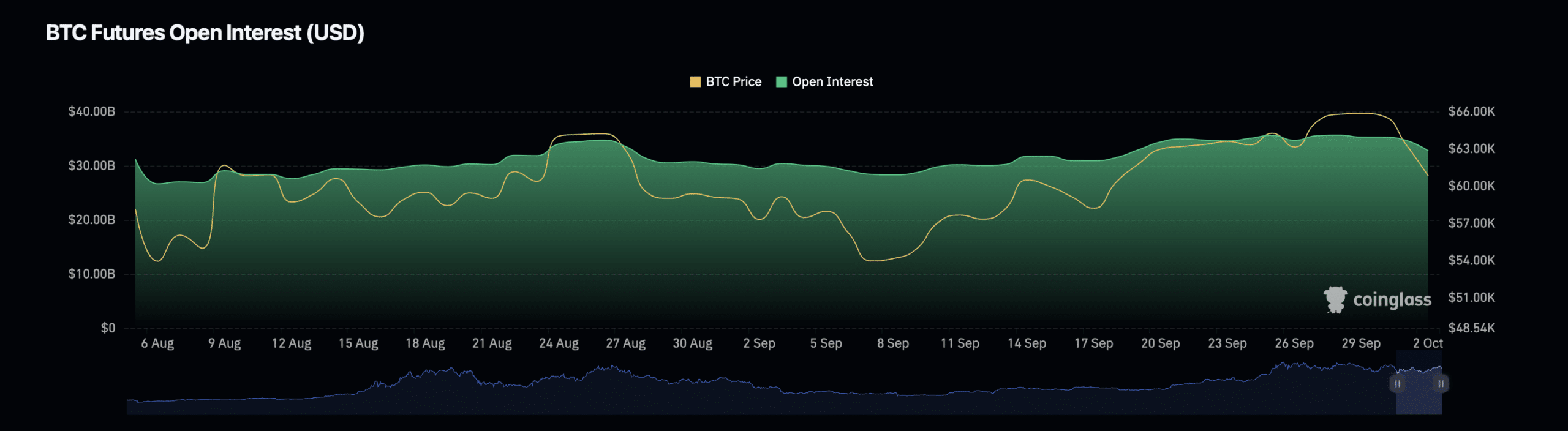

Open interest, a key indicator of the total number of derivatives contracts outstanding, is an area closely watched by Bitcoin holders.

According to facts from Coinglass, Bitcoin open interest recently fell 4.52% to $32.92 billion.

Source: Coinglass

Conversely, open interest volume has seen a sharp increase, rising 61.23% to $101.57 billion. This increase in volume, despite the decline in overall open interest, suggests that trading activity and interest in Bitcoin derivatives are increasing, although it remains unclear whether this growth will translate into sustained price appreciation.

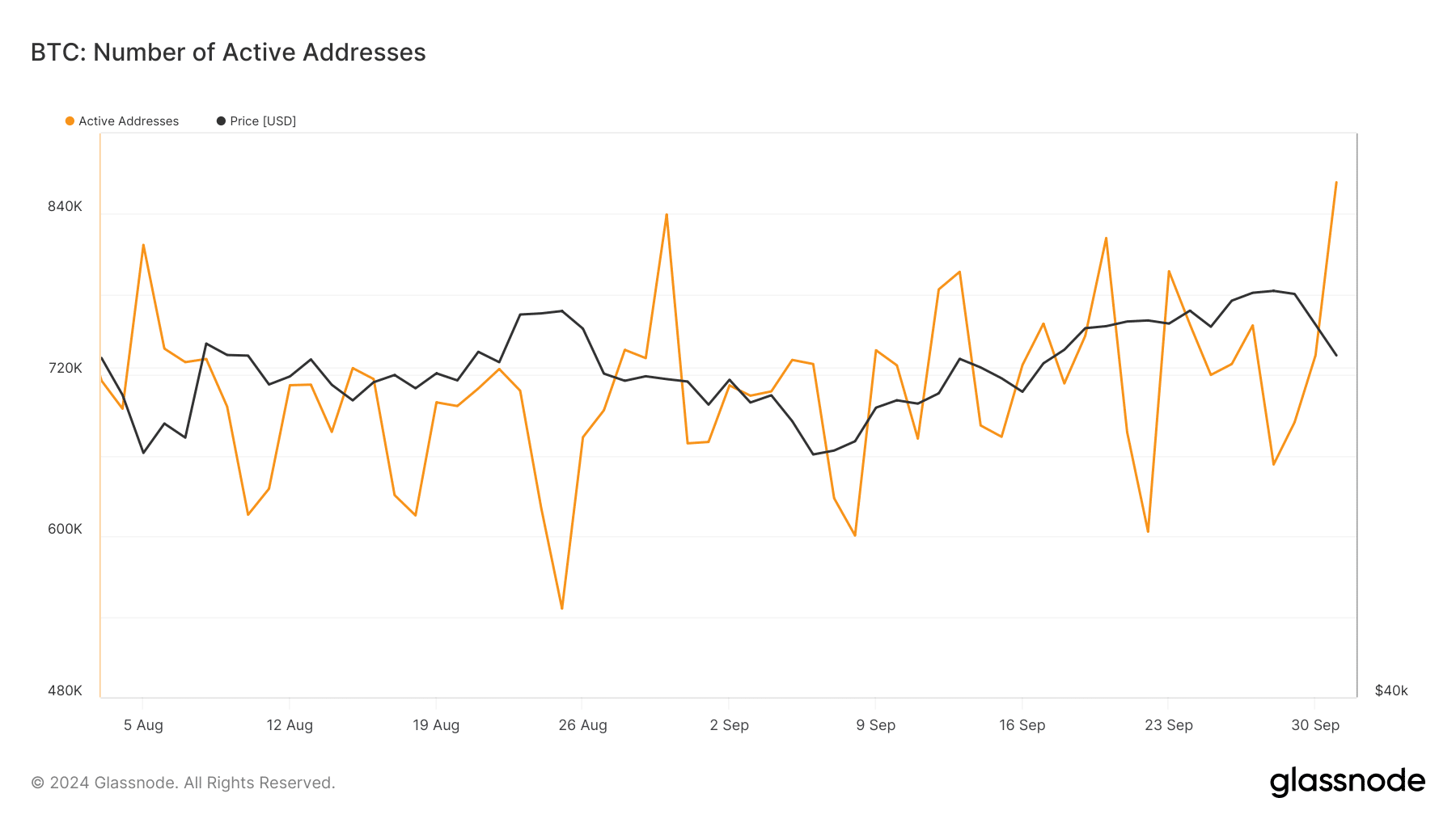

Another important metric is the number of active Bitcoin addresses, which is showing signs of recovery.

Read Bitcoin’s [BTC] Price forecast 2024-25

The metric has increased significantly, with more than 863,576 active addresses at the time of writing, which represents a significant increase from the 603,000 active addresses at the beginning of last month.

Source: Coinglass

This increase in activity could be an indicator of renewed market engagement and possibly signals a shift towards increased usage and trading among Bitcoin holders.