This article is available in Spanish.

The Bitcoin rally of mid-September has been delayed in the run-up to the end of the month. Although it ended September on a green At the close of the monthly candle, the cryptocurrency has once again fallen below the psychological price line of $65,000, with the fear and greed index returning from greed to neutral sentiment. This seems to have created doubts among Bitcoin investors. However, CryptoQuant CEO Ki Young Ju is not concerned with such a thought.

According to Ki Young Ju, Bitcoin is still in the middle of a bull cycle. This is positive news for Bitcoin investors as the crypto industry now transitions to a historically bullish fourth quarter of the year.

Bitcoin bull market not over yet

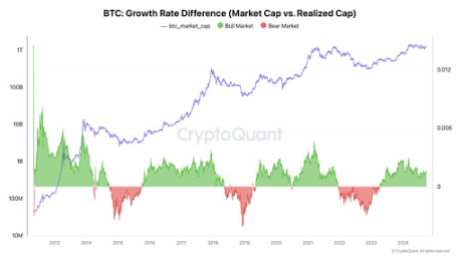

CryptoQuant CEO Ki Young Ju is part of avid Bitcoin investors who remain unfazed by the recent price fluctuations. However, his position is not only based on speculation, but is also supported by technical price data and analysis. Ki Young Ju outlines its bullish outlook about the difference in the Bitcoin growth rate, which offers an interesting look at the cryptocurrency. Essentially the difference in the Bitcoin growth rate compares Bitcoin’s market capitalization to its realized limit to measure its bullish or bearish strength.

Related reading

The market capitalization of a cryptocurrency is the total value of all coins in circulation, calculated by multiplying the current price by the total supply. The realized limit, on the other hand, takes into account the actual value paid for each BTC in circulation, based on the price at which each coin last moved. Higher market capitalization growth suggests that the spot price of the average coin has increased compared to the last time it was moved.

According to a Bitcoin technical chart he shared on social media platform Notably, the analyst noted in a previous analysis of the growth rate difference that this trend, which started in late 2023, tends to last an average of two years.

What does this mean for BTC?

Judging from past bull cycle trends, which Ki Young Ju noted typically last about two years, Bitcoin is expected to continue in a bull cycle for at least more than a year in the future. Furthermore, current fundamentals point to steady growth for Bitcoin as institutional investor inflows continue to pour in.

Related reading

Speaking of institutional investors, Spot Bitcoin ETFs, which ended last week with the largest inflows ($494.27 million) since July 22, have started the new week on a positive note. In particular, they recorded net inflows of $61.3 million yesterday, which a sign of good things to come. Institutional involvement, especially through vehicles like Spot Bitcoin ETFs, is a crucial factor in the continued price growth of BTC.

At the time of writing, Bitcoin is trading at $64,080.

Featured image created with Dall.E, chart from Tradingview.com