- BTC and ETH saw an increase in long liquidation volume with the price drop during the last trading session.

- Assets started the new month with positive movements.

Bitcoin [BTC] and ether [ETH] September ended on a volatile note, with both assets declining. Short position traders dominated the market, increasing long liquidation volumes.

Despite these declines, the lack of a significant sell-off indicates a positive sign for the market.

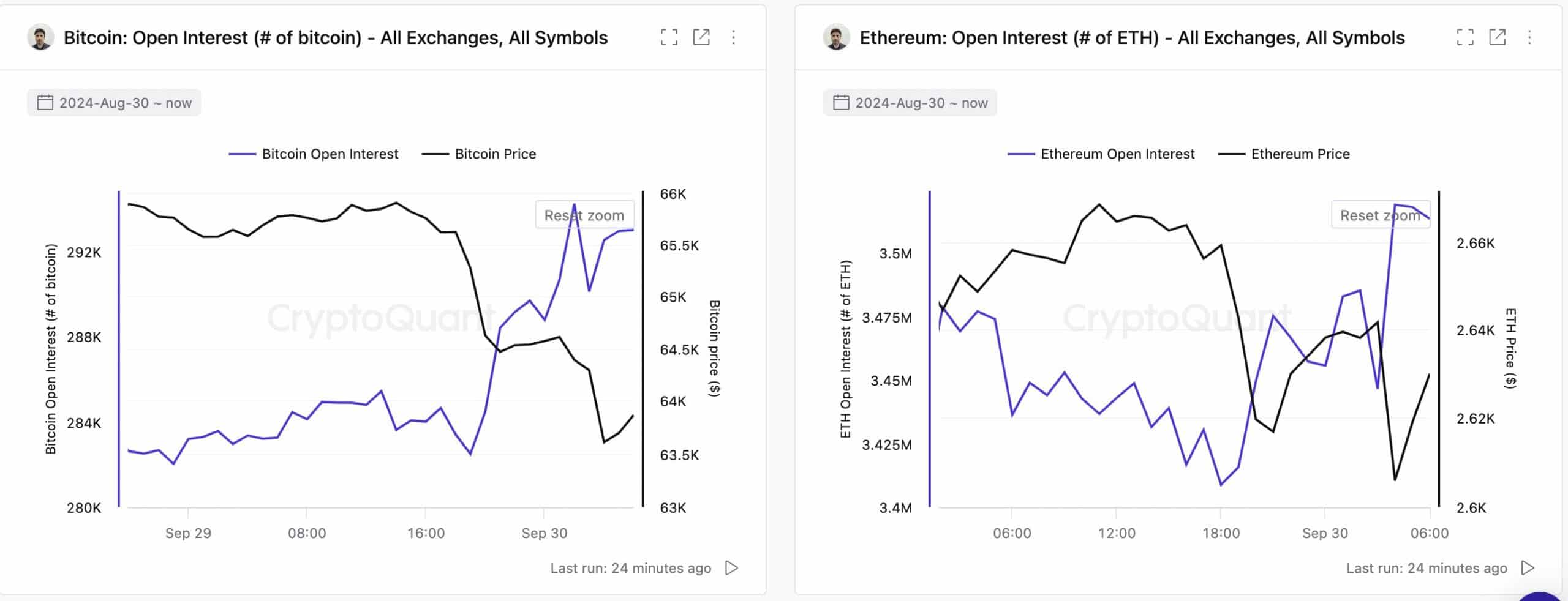

The open interest of Bitcoin and Ethereum is falling

According to CryptoQuantThe open interest (OI) of Bitcoin and Ethereum saw a notable decline during the last trading session. Bitcoin open interest fell from $18.6 billion to $18.1 billion, indicating traders were closing futures positions.

This drop in OI generally indicates lower liquidity, volatility and interest in derivatives trading, potentially leading to a long/short squeeze.

Source: CryptoQuant

Similarly, Ethereum’s open interest also saw a slight decline, although less significant than Bitcoin’s. As of now, BTC’s open interest has returned to $18.3 billion, and ETH’s OI has risen to $9.4 billion, reflecting renewed market activity.

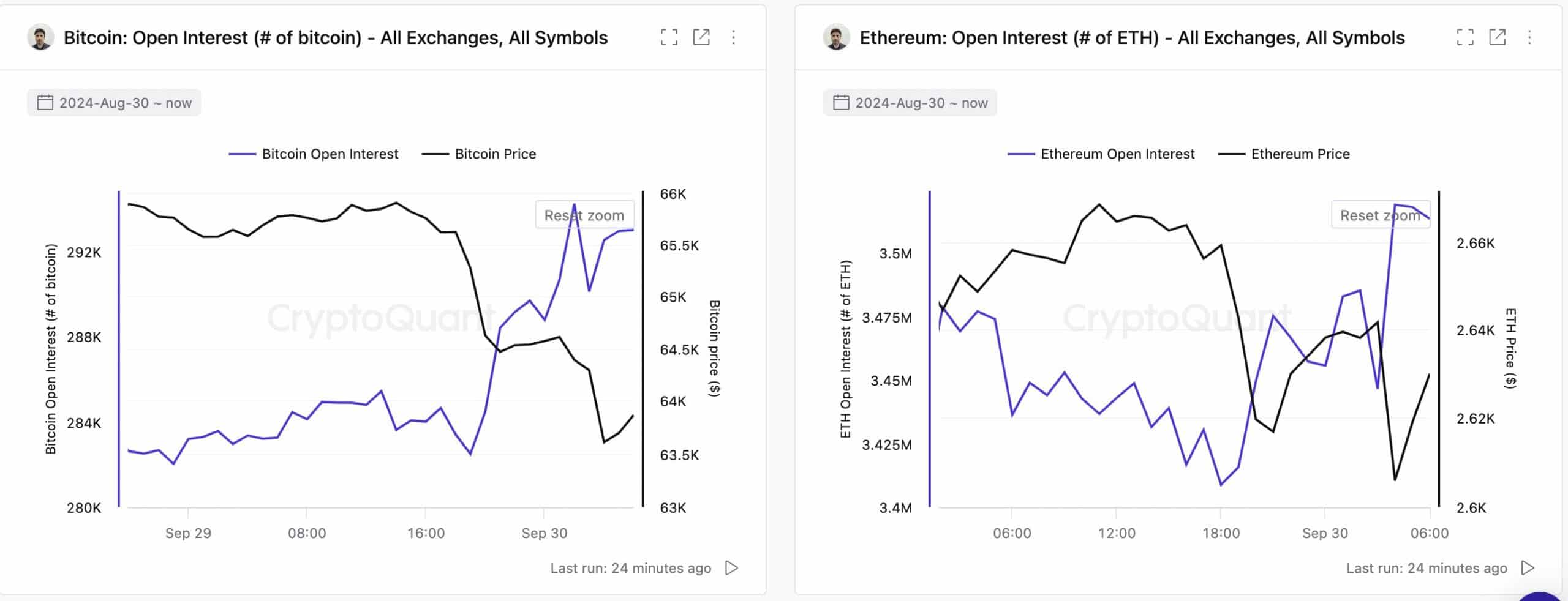

Bitcoin and Ethereum prices follow OI trends

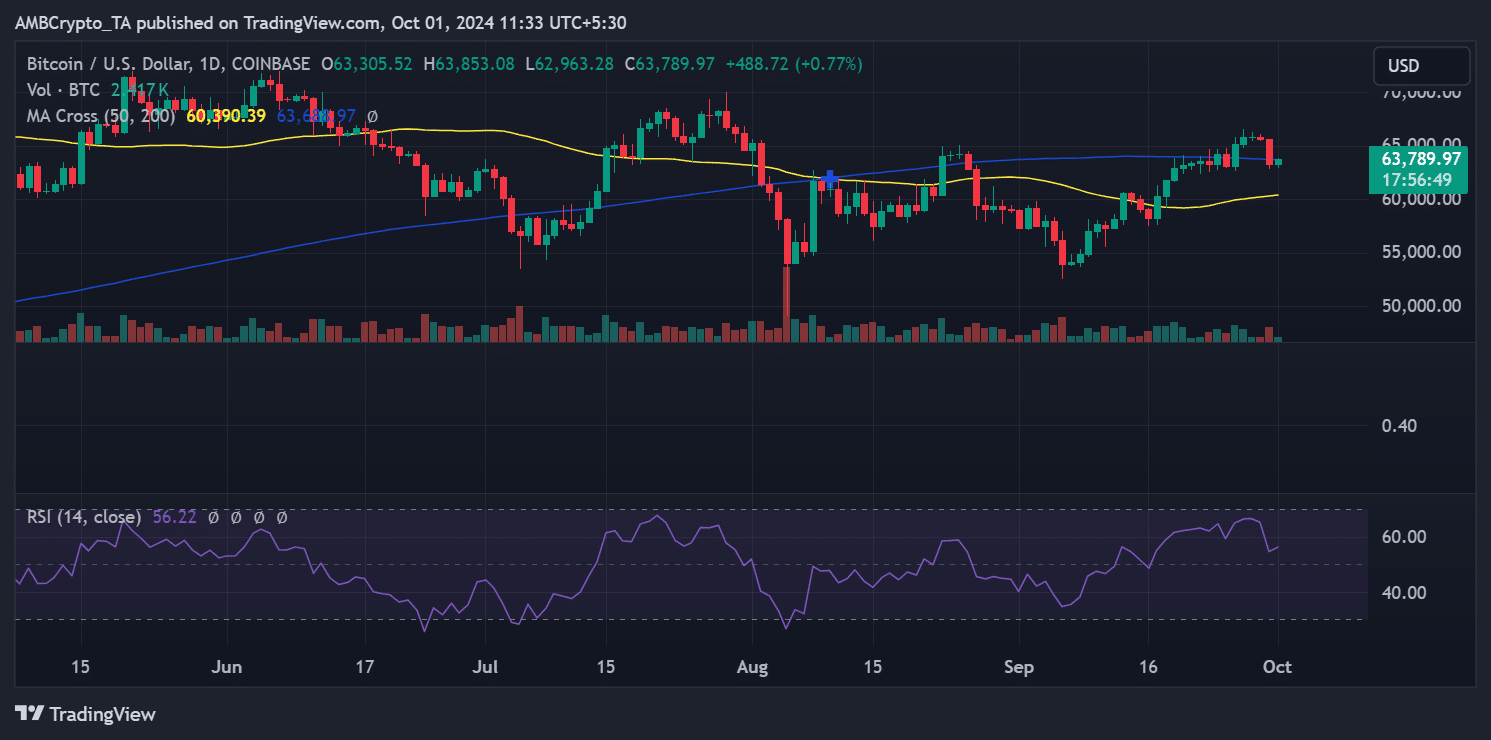

The drop in open interest had a direct impact on both Bitcoin and Ethereum prices. Bitcoin saw a decline of 3.50%, from $65,600 to $63,301, falling below the 200-day moving average.

Source: TradingView

Similarly, Ethereum fell 2.13%, from $2,657 to $2,601, remaining below the 200-day moving average, but still above the 50-day moving average.

Source: TradingView

At the time of writing, both assets have seen a slight rebound. Bitcoin was trading at $63,789 up 0.7%, while Ethereum gained over 1% to trade around $2,639.

Alternating currents remain stable

Despite the recent declines, there has been no significant sell-off. Data from CryptoQuant shows that Bitcoin recorded a negative result exchange flowindicating a balanced flow of BTC between exchanges and personal wallets.

On the other hand, Ethereum saw a slight increase alternating currentwith 14,000 ETH flowing onto the exchanges during the last trading session.

However, this volume was not enough to cause a major sell-off. Currently, the flow has turned negative again, with more than 23,000 ETH withdrawn from the exchanges, indicating reduced selling pressure.

Read Ethereum (ETH) Price Prediction 2024-25

Conclusion

While Bitcoin and Ethereum suffered notable declines in the final days of September, the lack of a major sell-off and the slight recovery in prices indicate a relatively stable market.

Open interest rate trends and currency flows indicate that investors are not rushing to exit their positions, pointing to potential for a near-term recovery.