- Altcoin season saw a surge in value during the recent bull rally, driven by BTC testing $66K.

- However, it takes a crucial factor to trigger the start of an altcoin season.

Bitcoin [BTC] is poised for a possible price correction after failing to hold the $66,000 level. AMBCryptos analysis suggests that $61,000 could serve as the next support, which would mark a key low.

Historically altcoin seasons follow Bitcoin’s low. If this pattern repeats, the current dip could herald the next Altcoin season.

The next cycle could usher in altcoin season

Currently, Bitcoin’s market share stands at 57.37%, a significant drop from its recent peak of 58.59% just ten days ago. This declining dominance may indicate growing confidence in altcoins.

The rationale is clear: two days ago, BTC tested the $66K ceiling after a steady uptrend, allowing many stakeholders to take profits. Their departure could mark the next bottom.

Furthermore, this dip could attract renewed interest from holders, paving the way for potential altcoin growth.

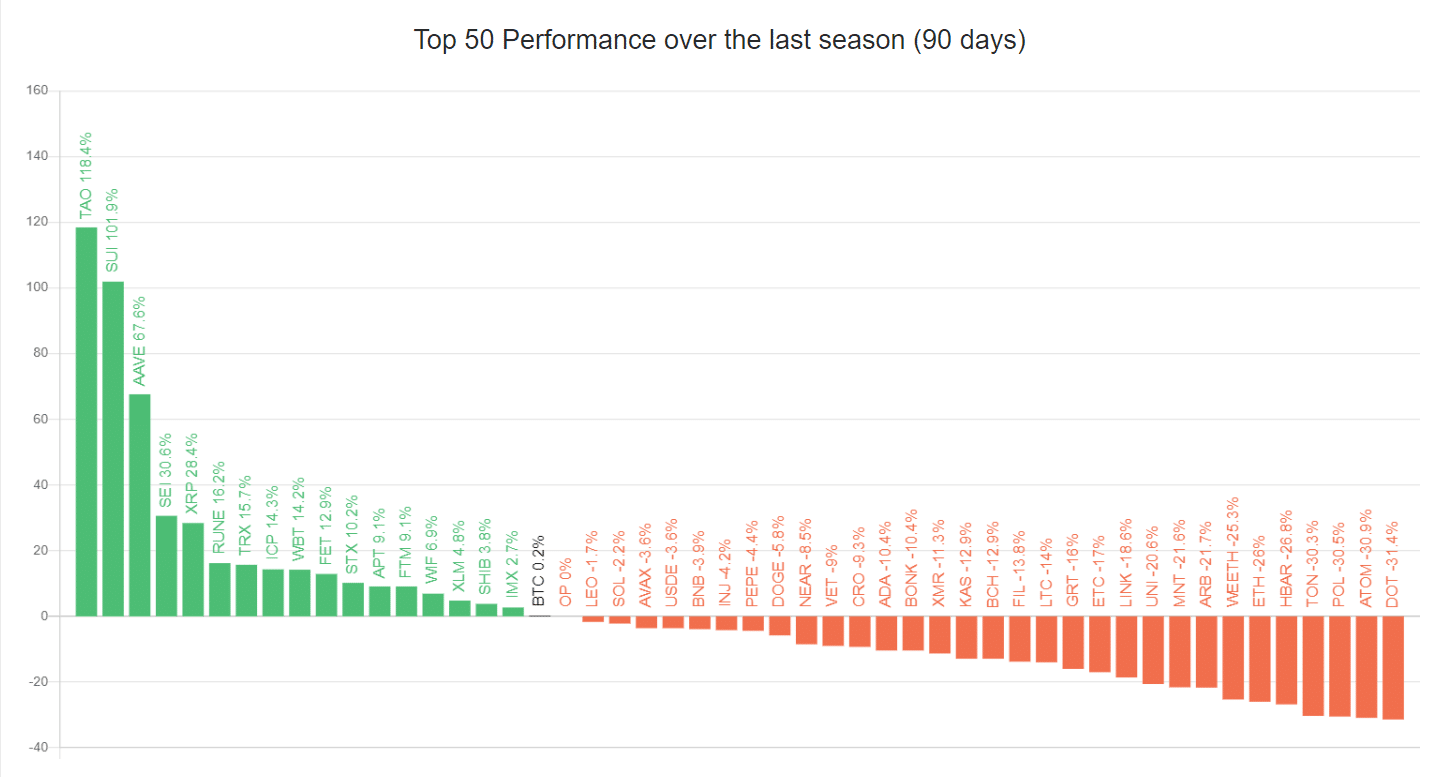

Source: BlockChainCenter.Net

Bee gift17 of the top 50 coins are ranked higher than Bitcoin, resulting in an altcoin dominance of 34%.

With many altcoins showing bullish momentum during the recent rally, a new cycle may be necessary to catalyze the start of the next altcoin season.

So keeping an eye on the upcoming Bitcoin cycle is crucial to find out when these coins might start rallying. In simple terms…

Bitcoin consolidation could be the key

While the market euphoria indicates a bullish start for Bitcoin in October, the daily price chart tells a different story.

If the mid-July rally is repeated — where BTC bulls held off resistance at $66,000 and broke through to $68,000 — Bitcoin’s dominance could be restored, which could dampen the prospects for an altcoin season.

However, the sharp decline in the RSI indicates a loss of buying momentum. If Bitcoin enters a consolidation phase, major altcoins could find themselves in the spotlight.

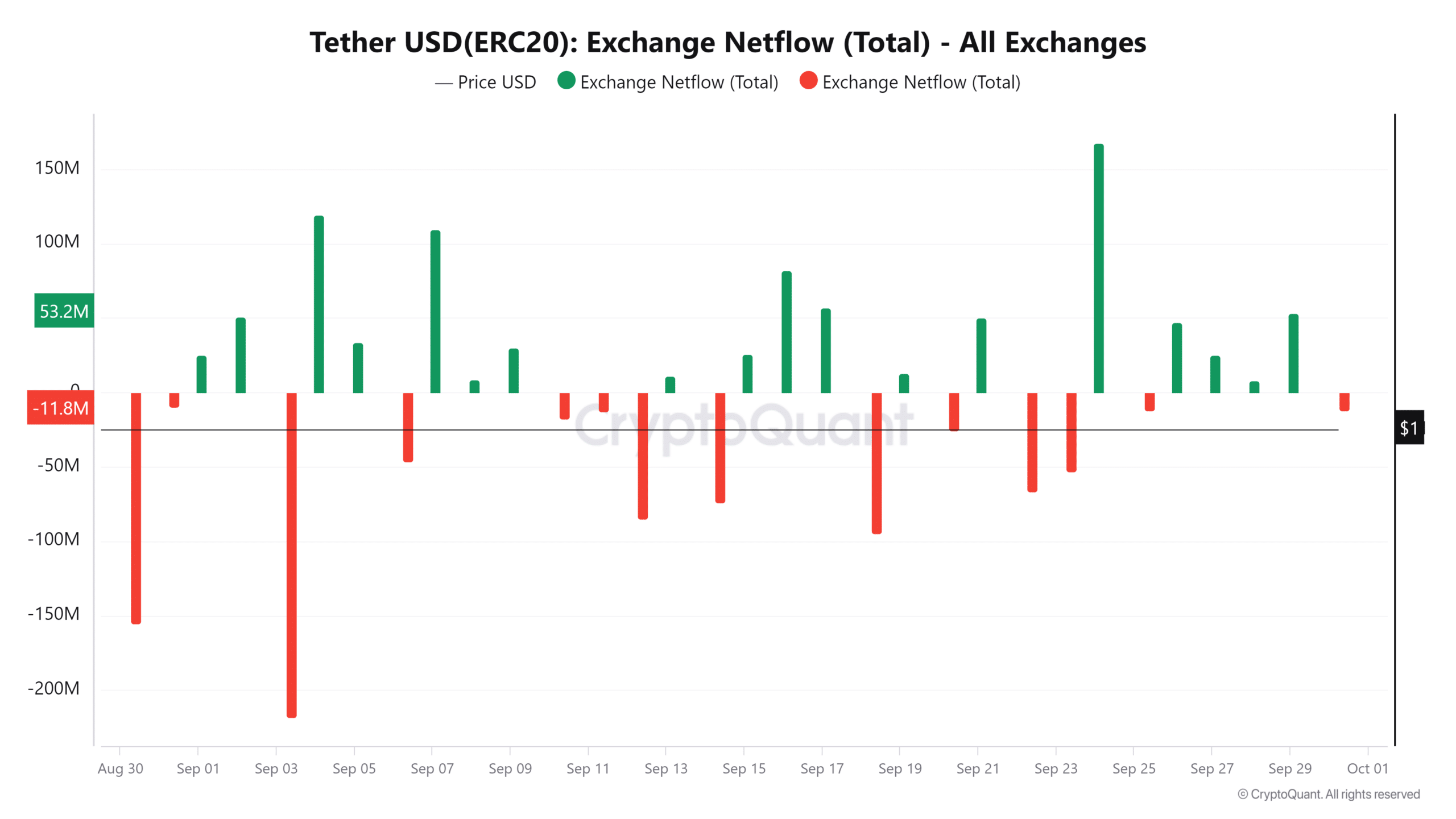

Furthermore, rising USDT outflows suggest more stablecoins are being withdrawn from exchanges.

Source: Glassnode

Historically, such drawdowns often coincide with Bitcoin losing to a major resistance zone, prompting investors to turn to USDT as a safe bet.

Furthermore, these investors see altcoins as more attractive assets while they wait for Bitcoin to fall.

As a result, liquidity is flowing into altcoins, which are seen as cheaper alternatives, especially during rising volatility.

In short, if BTC consolidates around $64,000 or less, investors can diversify their portfolios, potentially allowing altcoins to rise.

The season could be within reach

In addition to market sentiment, AMBCrypto identified a hidden pattern in historical trends.

Interestingly, when BTC’s dominance hit rock bottom six years ago, a reversal occurred 761 days later, marking the start of altcoin season.

Simply put, this pattern suggests that a similar timeline could soon herald the next altcoin season.

Source:

In other words, if Bitcoin’s dominance is currently waning, it could eventually lead to a revival of altcoin values if history repeats itself.

Read Bitcoin’s [BTC] Price forecast 2024-25

As previously mentioned, current market conditions indicate an optimal time for altcoin emergence, driven by declining Bitcoin dominance, increasing USDT outflows, and a historical pattern supporting this event.

Overall, it is crucial to keep an eye on these factors. If BTC enters consolidation – which seems likely – the next altcoin season could be triggered.