Historically, September has been a bearish month for the digital asset market. However, contrary to investor expectations, cryptocurrencies performed relatively better this time in September.

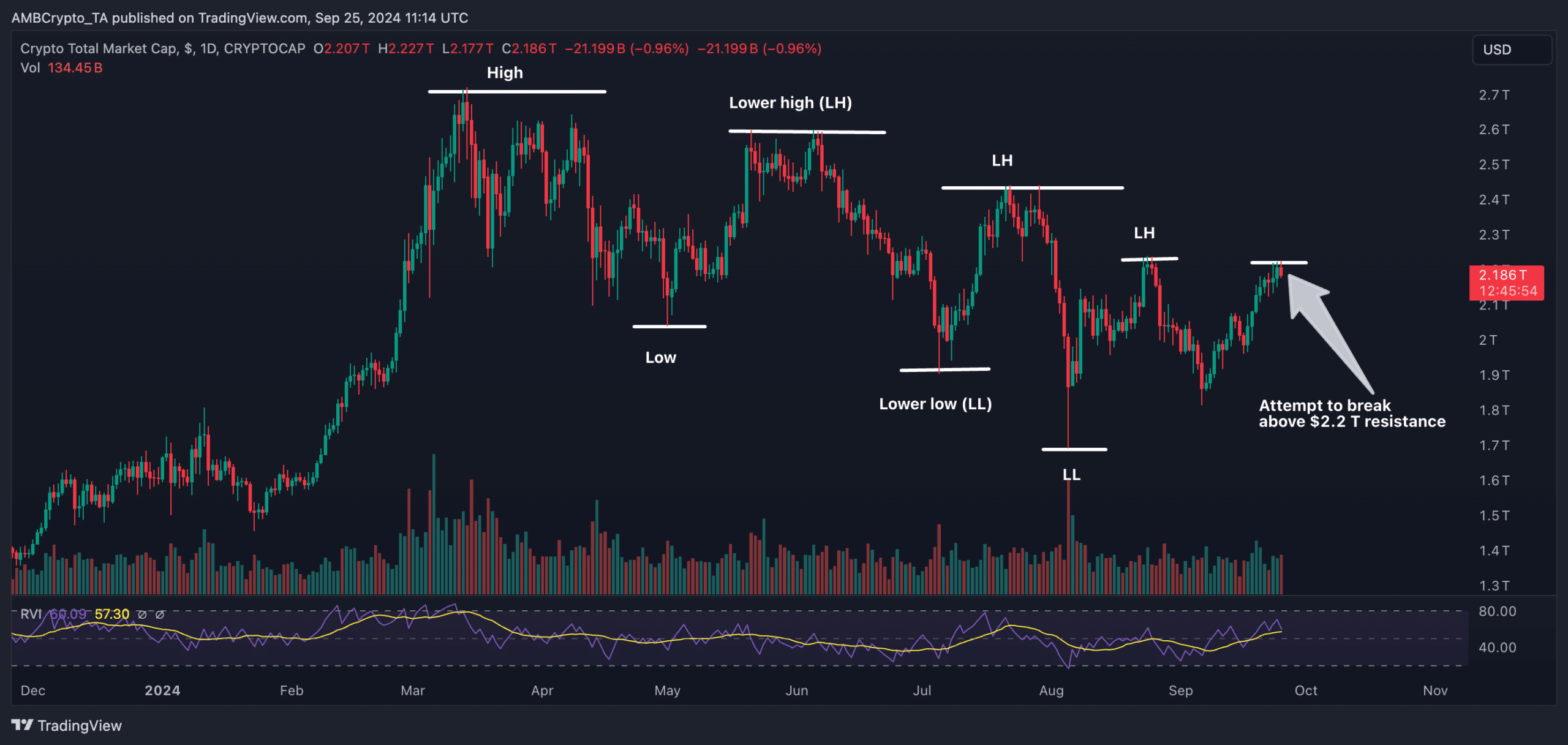

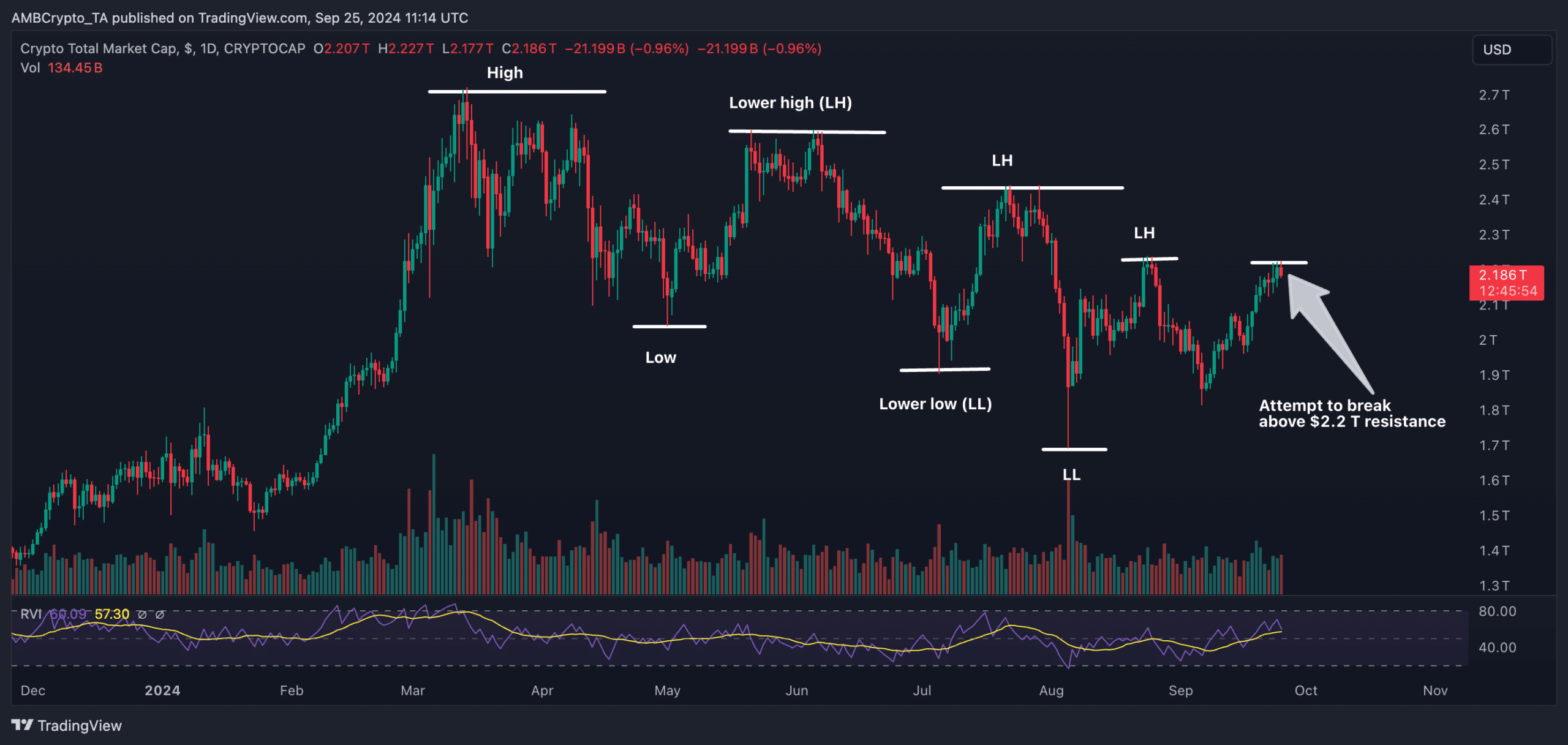

The higher timeframe chart of total crypto market capitalization showed lower highs and lower lows through August 2024. Thus, analysts expected another lower high to emerge below the $2 trillion threshold.

Instead, the crypto market rallied to reach the previous high of $2.21 trillion, debunking the bearish thesis.

At the time of writing, the RVI value of the crypto market cap suggested that the sector was poised for a brief pullback before a recovery towards the $2.4 trillion mark.

Source: TradingView

What can traders expect in October?

According to AMBCrypto’s September 2024 market report, a near-term price increase to the $69,000-$70,000 range can be expected.

Currency outflows have increased over the past month, while major holders have reduced their inflows into exchanges by 66.81% over the past 90 days.

With the Federal Reserve potentially easing monetary policy and ETF inflows increasing, a return to Bitcoin’s all-time highs is also very possible.

The report provides a comprehensive analysis of the four key factors influencing Bitcoin’s potential to reach its all-time high.

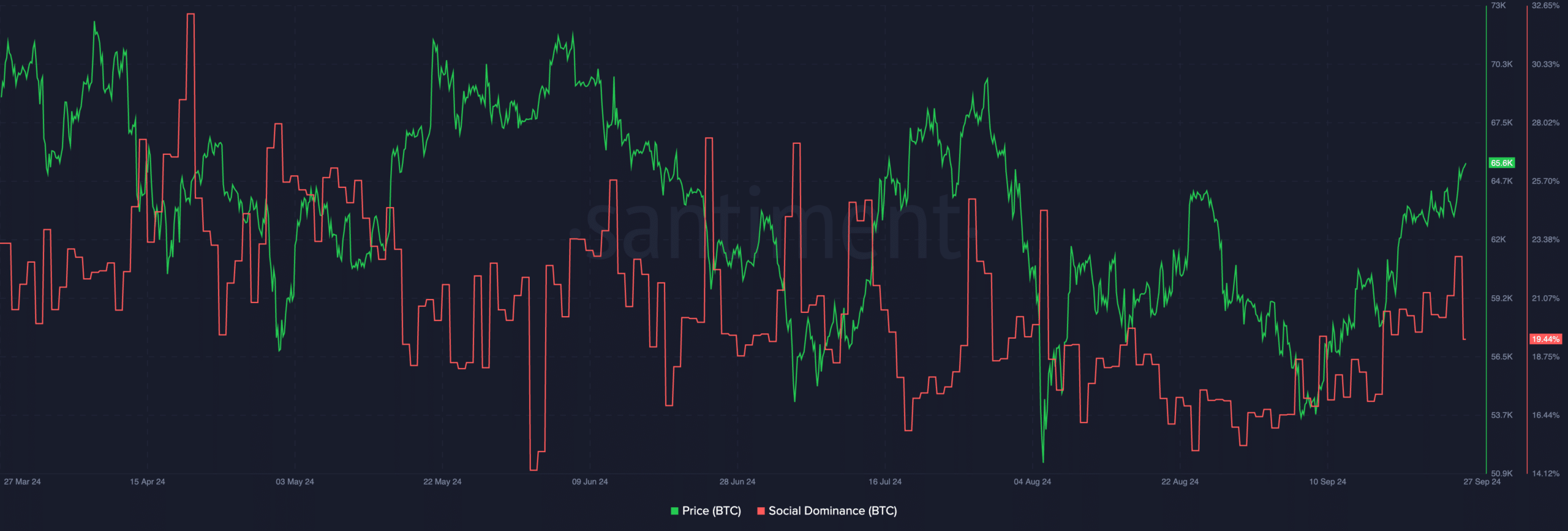

However, on its journey to the upside, Bitcoin’s declining social dominance could be a hurdle. If we look at the statistic, it is well below the level of April 20.

This indicates that investors are becoming increasingly interested in altcoins.

Source: Santiment

An altcoin season?

Despite the expectation of an altcoin season, we are still far away from it, according to AMBCrypto’s research. Investor sentiment has been significantly affected by Vitalik Buterin’s recent ETH sales, with more than half expressing major concerns.

Many investors admit that his actions have a major influence on their trading decisions.

Historically, Ethereum has often led the altcoin market, and many coins outperform Bitcoin during altcoin seasons. However, current market dynamics are different.

Ethereum’s price action hasn’t been particularly impressive, especially given the increasing outflows from spot ETH ETFs.

At the same time, Cardano continues to grapple with the long-standing challenge of robust development activities but limited user engagement.

While a majority of DeFi tokens suffered a setback in the past month, memecoins performed relatively better. Case in point: NEIRO token emerged as the undisputed champion, rising 2,600% in the last 30 days.

View AMBCrypto’s September 2024 crypto market analysis

Dive into AMBCrypto’s September 2024 Crypto Market Report for an in-depth look at the top emerging trends in the cryptocurrency space.

This report covers a range of key developments, including the rise in the number of altcoins, the rising influence of memecoins like Neiro, and the mixed performance of sectors like NFTs and DePIN.

This is what you can expect:

- Cardano’s paradox: Despite the growth of the ecosystem, trust is declining as the number of new portfolio creations drops sharply.

- ThePIN sector: Fetch.ai shines with a 63% increase in price, while Arweave struggles and loses 15% in value.

- Memecoin mania: Neiro is dominating the memecoin market with a staggering 2,600% increase, surpassing top competitors like Shiba Inu.

- NFT Market Trends: Despite market challenges, Bored Ape Yacht Club shows resilience with a 31.8% increase in sales.

Download the full report here.