- The price of BTC has been in a consolidation phase in recent days.

- Most on-chain metrics looked bullish on the coin.

After a price increase above $66,000, Bitcoin [BTC] began to consolidate again when the price of the king coin fell below that level. However, there was more to the story.

Bitcoin may be getting ready to retest its all-time high. If everything falls into place, expecting a new ATH wouldn’t be too ambitious.

Bitcoin’s secret plan

The past 24 hours have been quite volatile for the king coin as there have been price movements in both directions. But this volatility prevented the coin from breaking past the psychological resistance of $66k again.

Basically AMBCrypto reported previously, a bearish divergence appeared on Bitcoin’s price chart, suggesting a price drop. At the time of writing, BTC was trade for $65,692.70.

According to IntoTheBlock’s facts46.54 million addresses made profits, which accounted for more than 86% of BTC’s total BTC addresses.

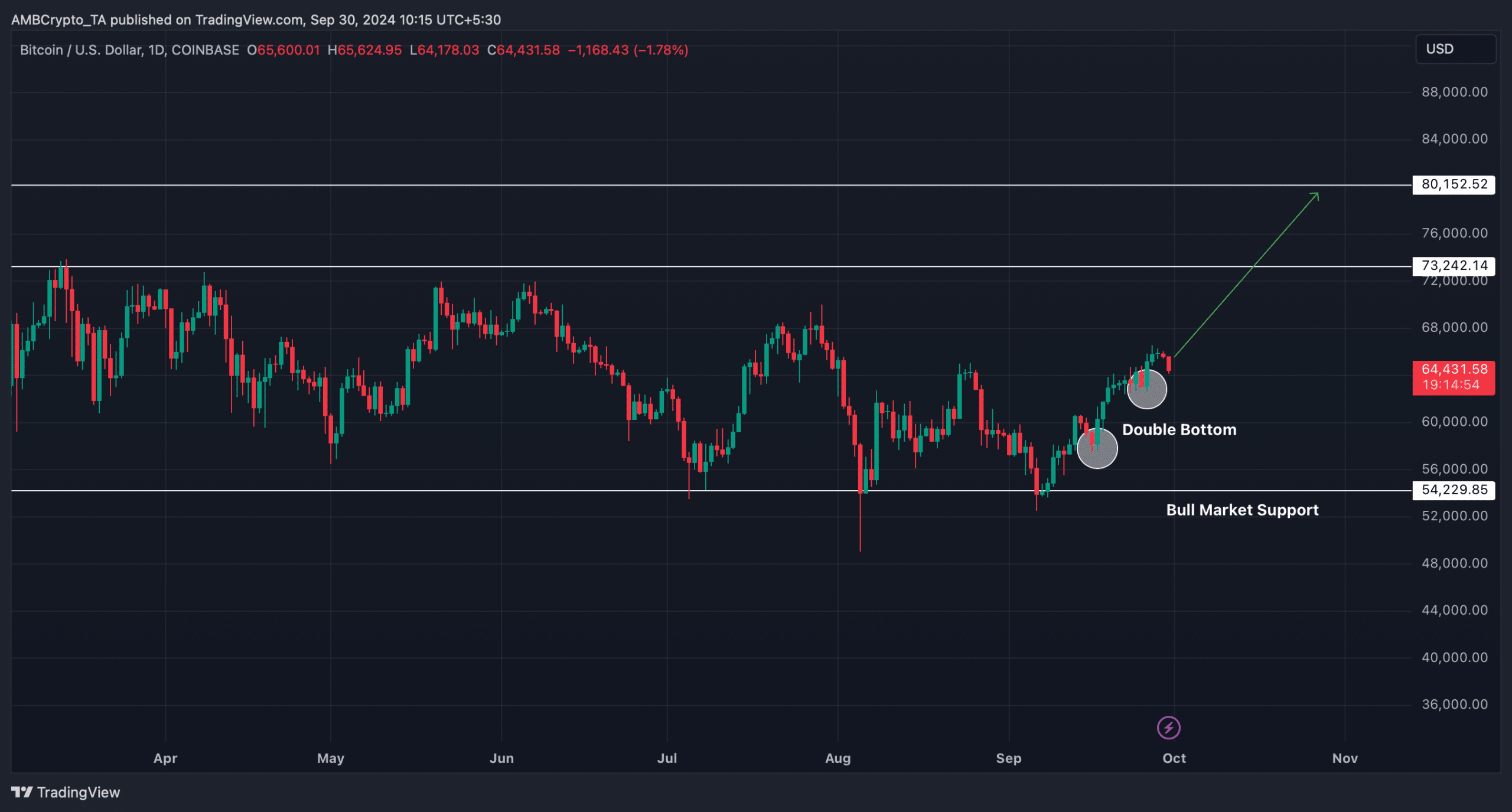

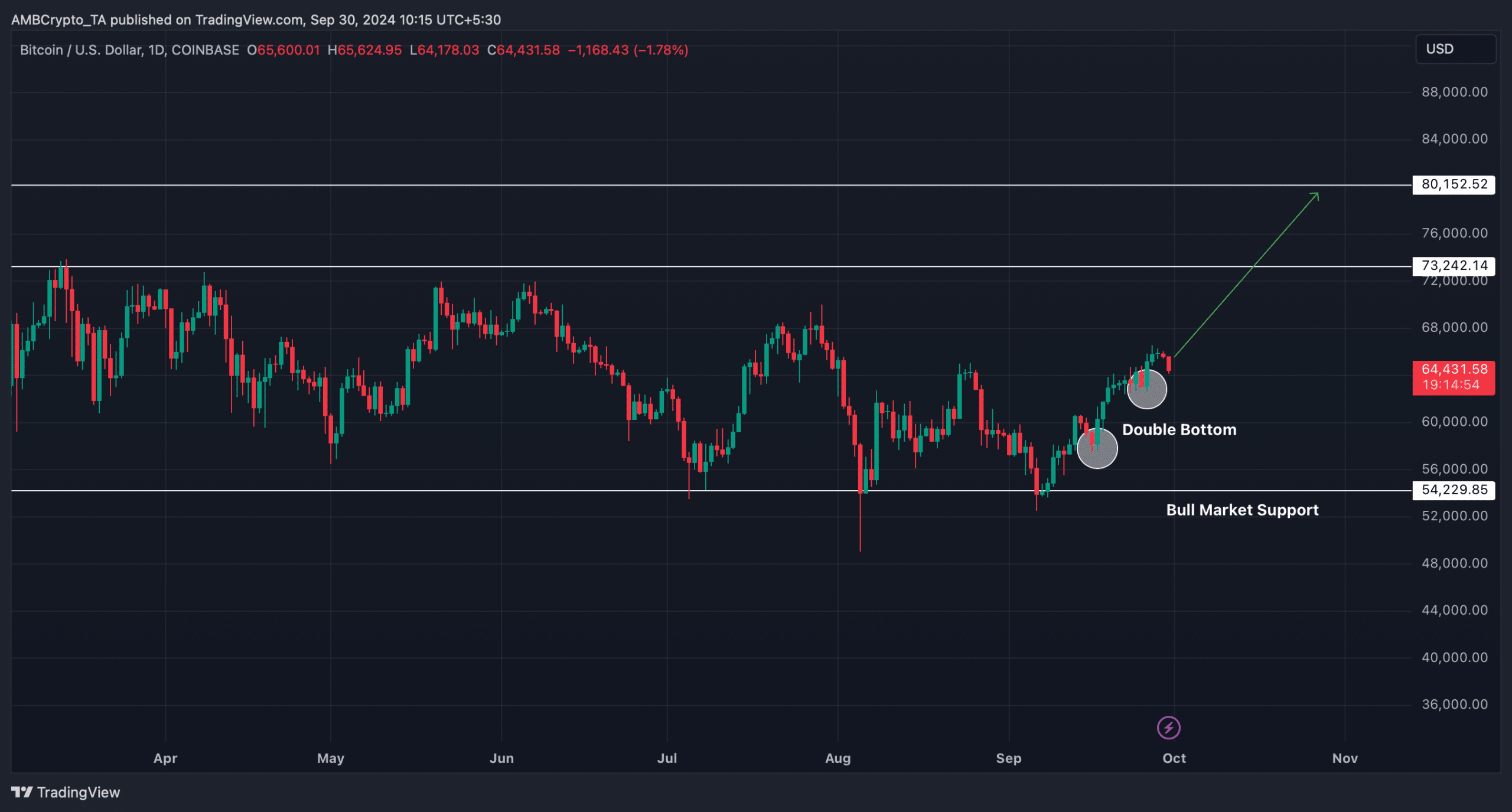

Nevertheless, AMBCrypto’s analysis revealed an interesting development. We found that BTC successfully tested the bull market support a few days ago. Afterwards, the coin showed a double bottom pattern.

When that happens, it usually indicates that there were opportunities for a bull rally. If the pattern is tested, Bitcoin could soon retest its all-time high.

The good news was that a breakout above that level could push the coin towards $80,000 in the coming weeks.

Source: TradingView

The probability of BTC reaching $80k

AMBCrypto then checked the King Coin’s on-chain data to see if it also supports the possibility of a price increase.

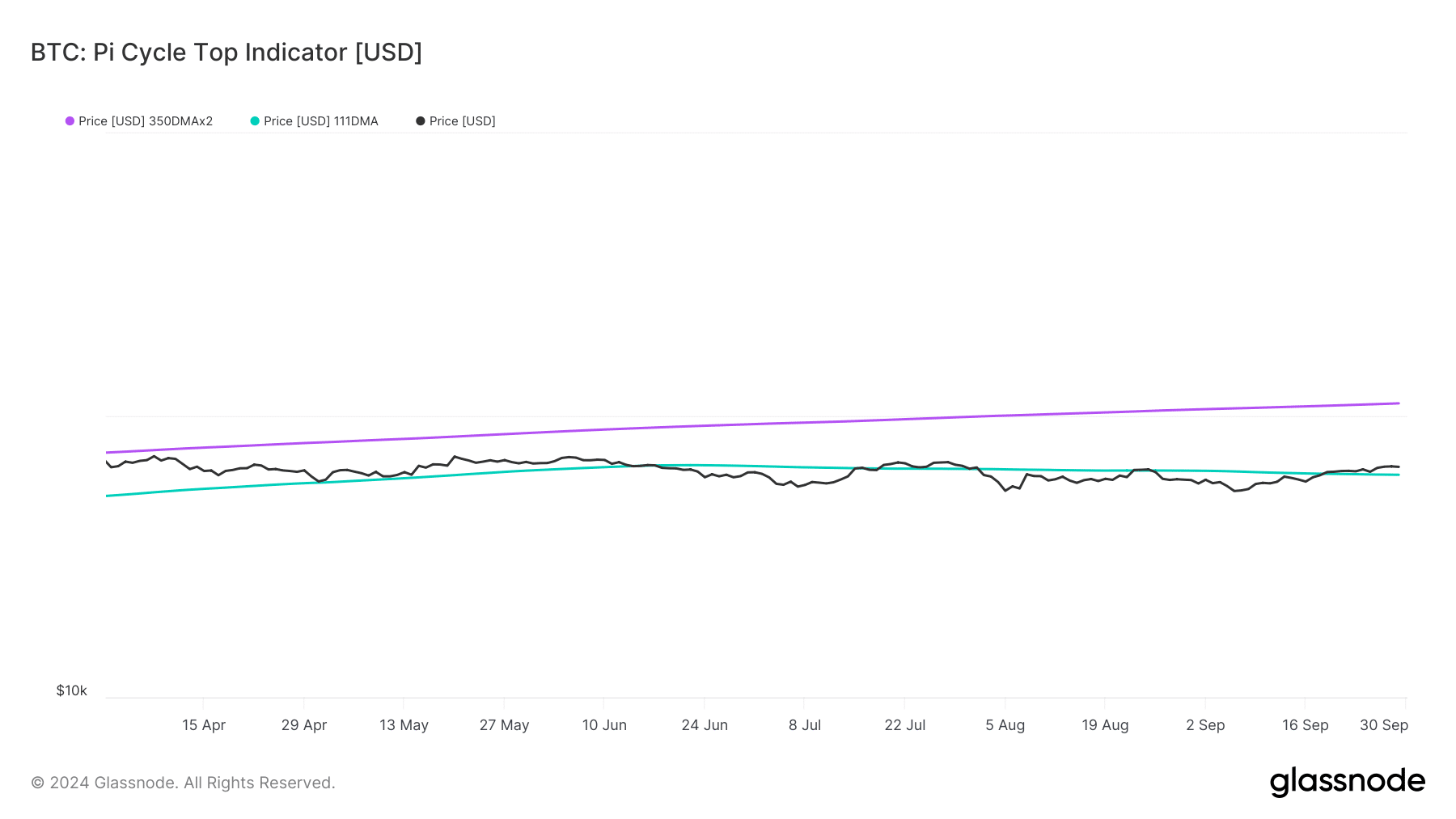

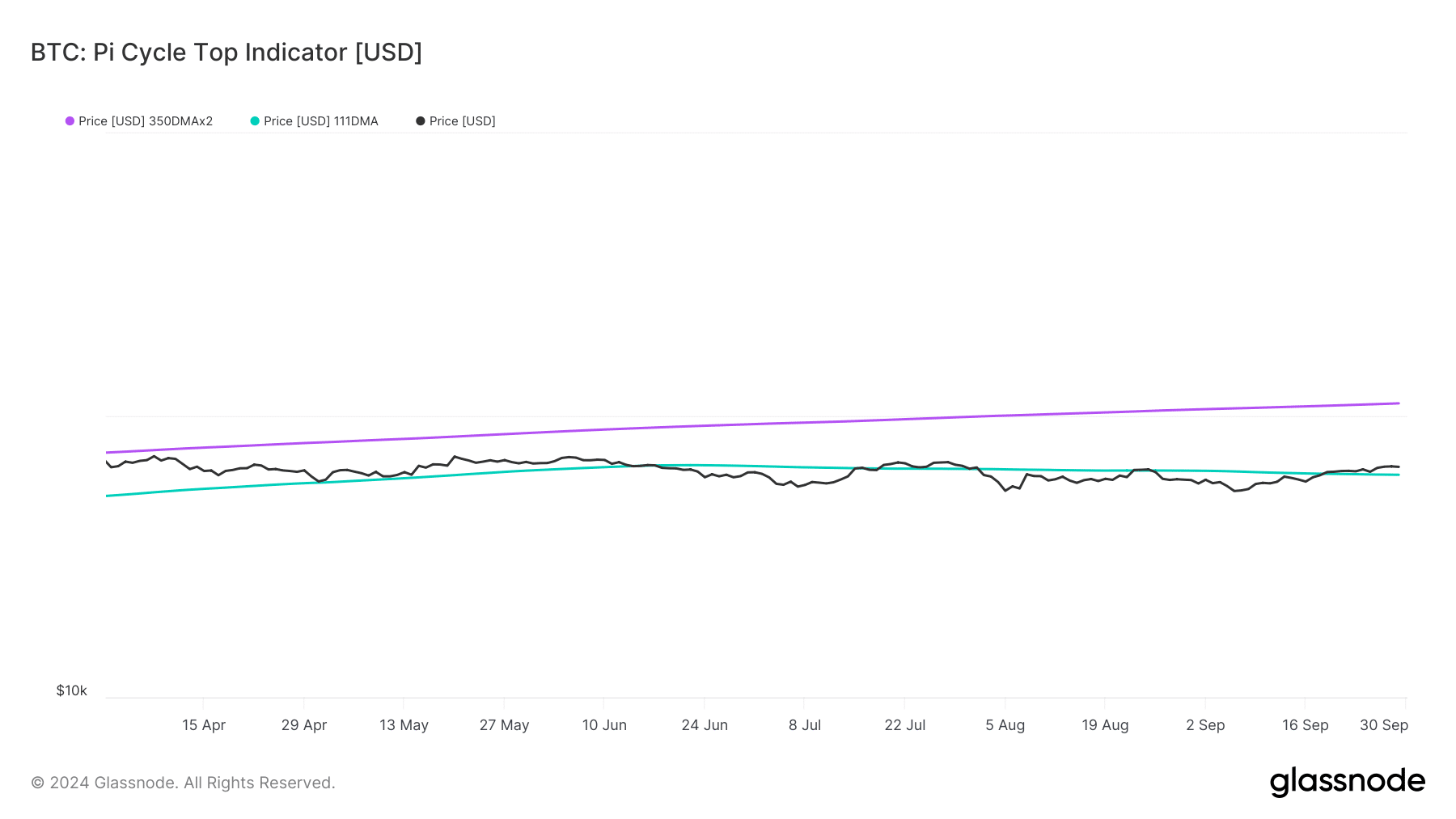

Our analysis of BTC’s Pi Cycle Top indicator showed that BTC had finally jumped above its potential market bottom of $61,000.

If the metric is to be believed, this jump could lead BTC to reach its possible market top of $110,000, which seemed a bit ambitious.

Source: Glassnode

The Bitcoin rainbow chart also looked quite optimistic. The price of BTC was in the “BUY” zone, meaning this was the right opportunity for investors to accumulate before the price of the coin skyrockets.

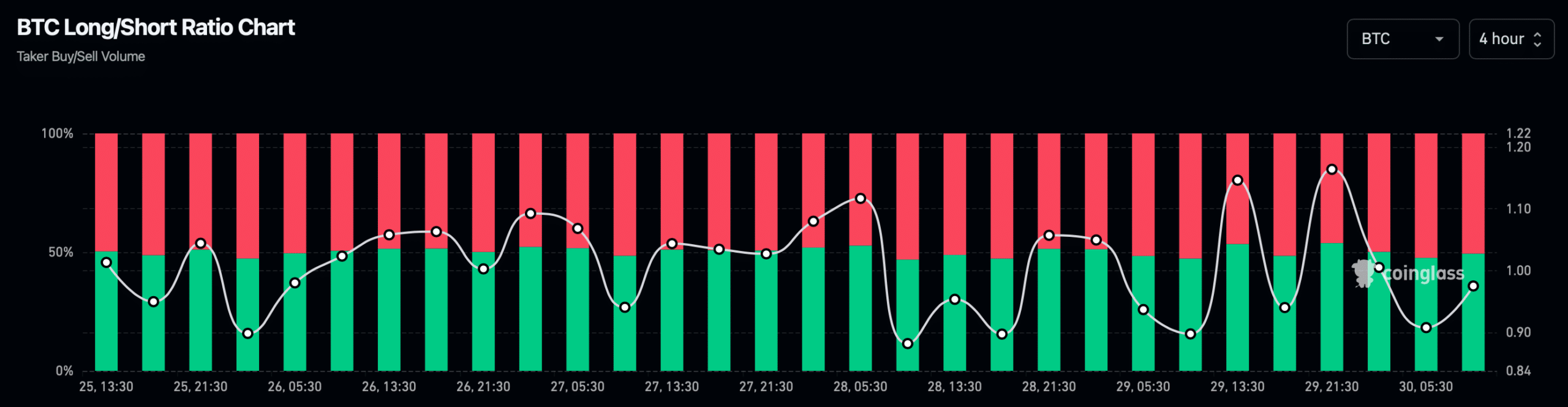

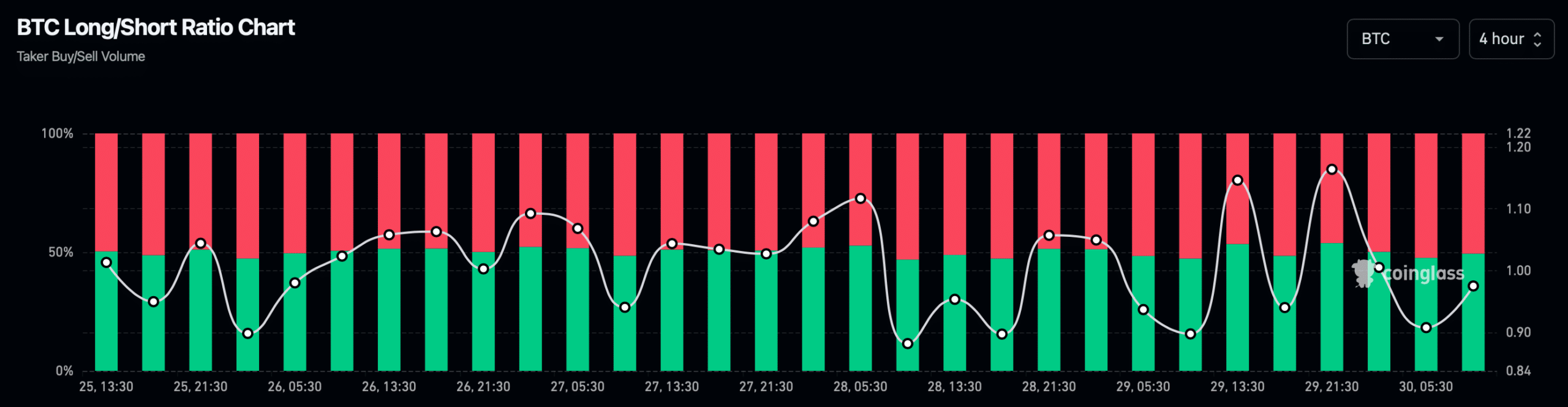

Another bullish measure was the long/short ratio, which increased. A rise in the measure means there are more long positions in the market than short positions, indicating a rise in bullish sentiment around an asset.

Source: Coinglass

Is your portfolio green? View the BTC profit calculator

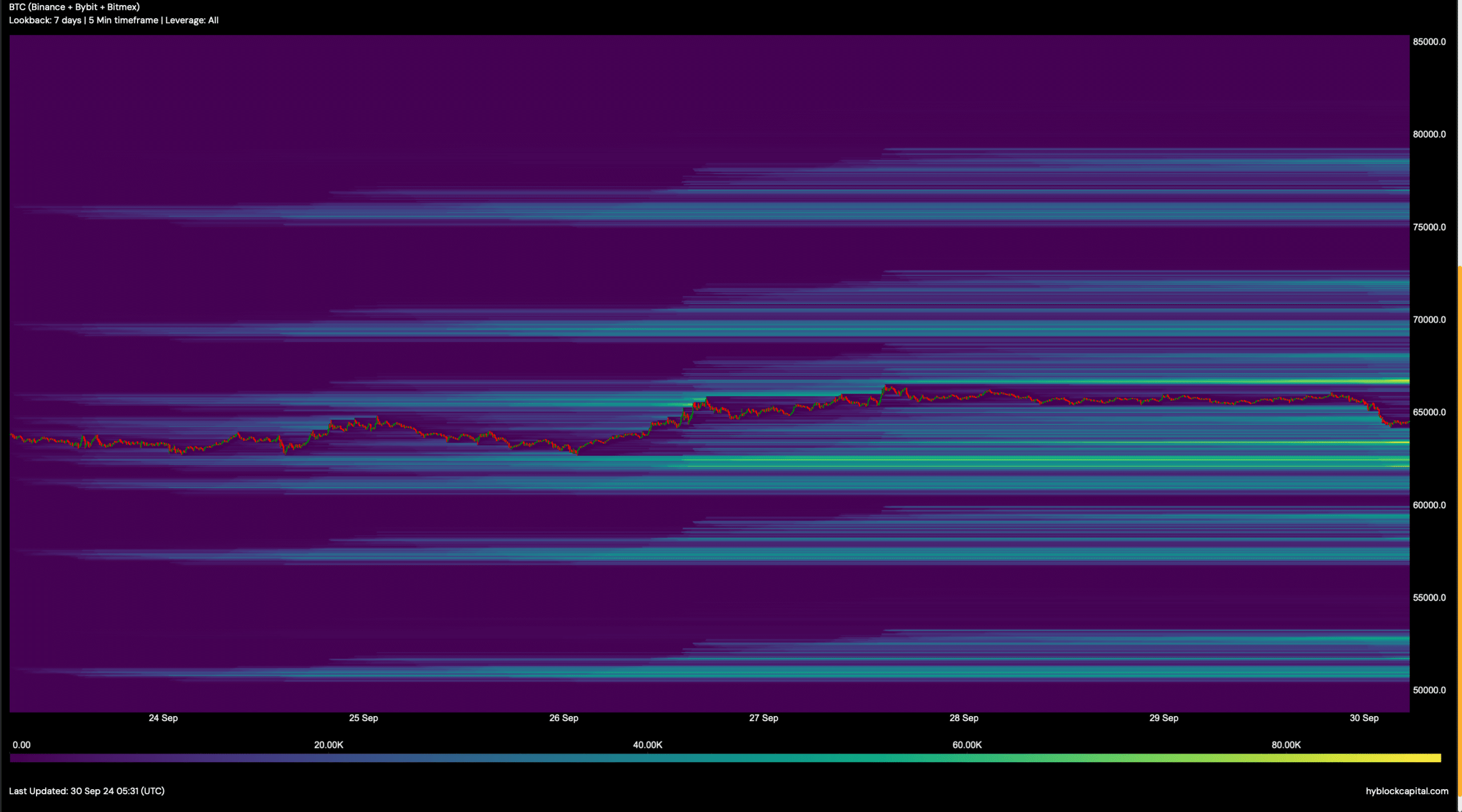

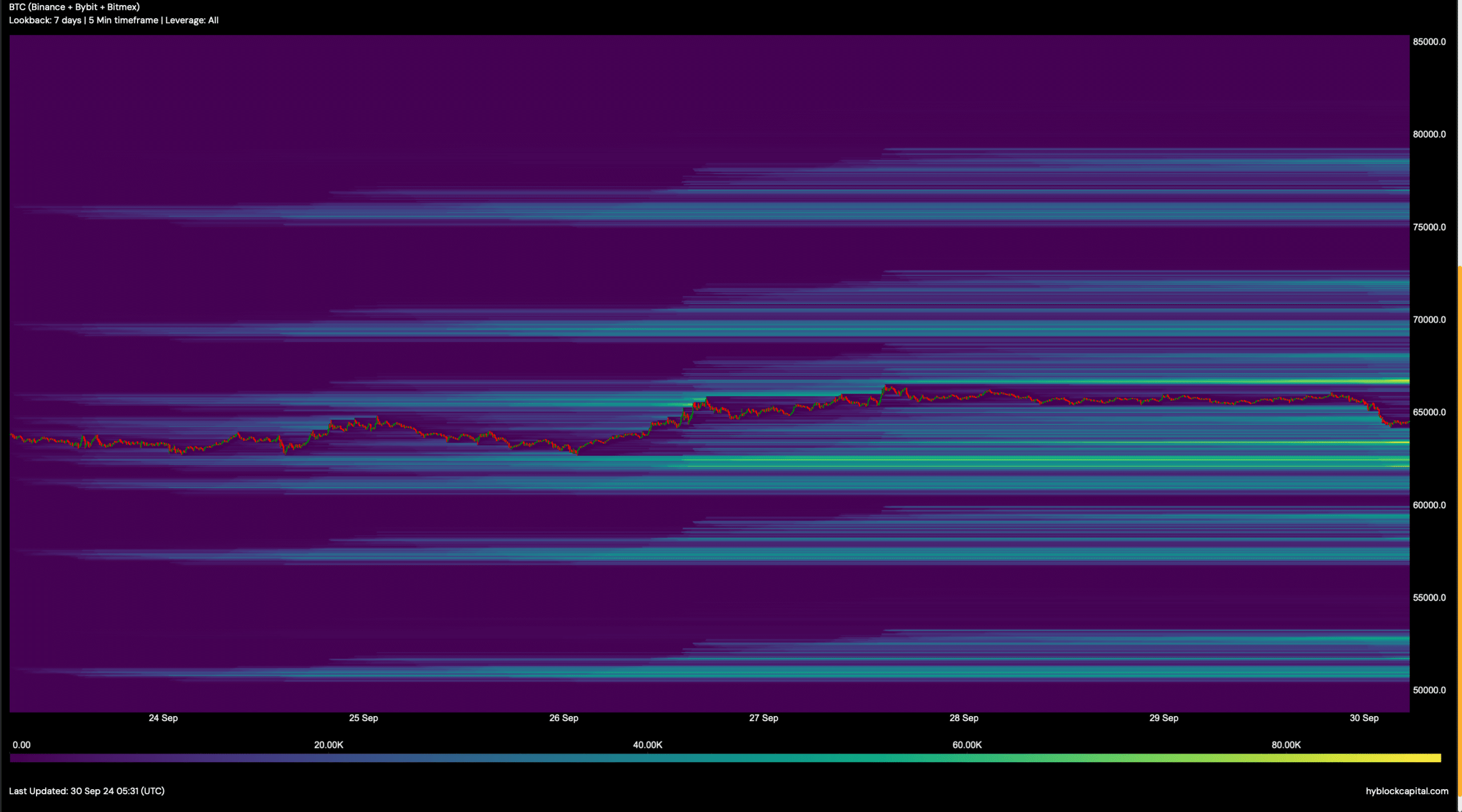

With most metrics looking bullish, AMBCrypto checked Hyblock Capital’s data to find out if resistance levels were ahead. We have determined that a significant amount of BTC will be liquidated at the $66,000 mark.

Therefore, it will be crucial for BTC to end the consolidation phase and cross this line. A jump above $66k could propel the king coin to new highs.

Source: Hyblock Capital