- LINK’s Long/Short ratio currently stands at 1.031, indicating bullish market sentiment among traders.

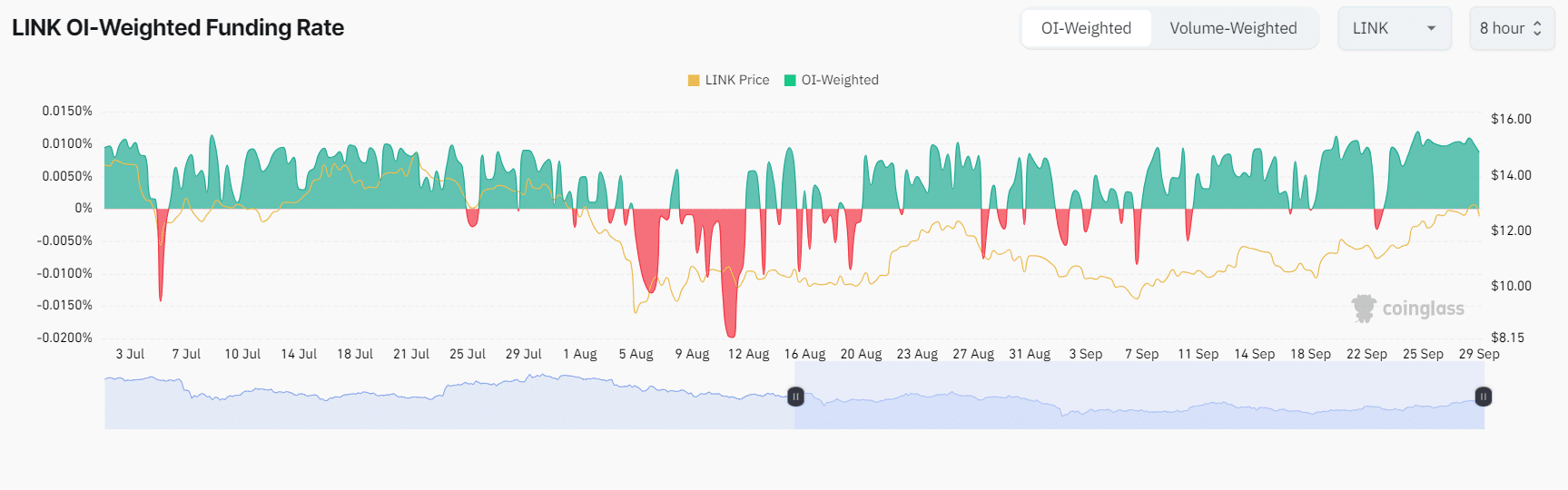

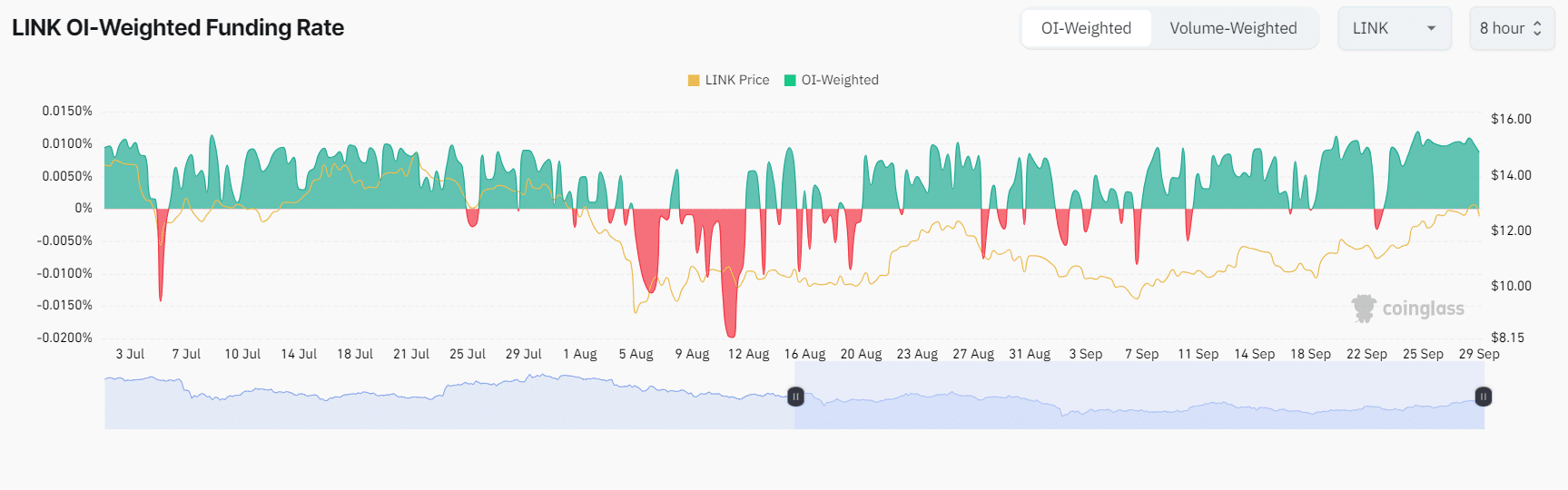

- LINK’s OI-weighted funding rate is positive at 0.0087%, further indicating bullish sentiment.

Chain link [LINK] is poised for a massive upside rally after recently breaking a bullish price action pattern.

Meanwhile, overall sentiment in the crypto market remains stable and there is no sign of a major rally in the major cryptocurrencies, including Bitcoin[BTC]Ethereum [ETH]and Solana [SOL].

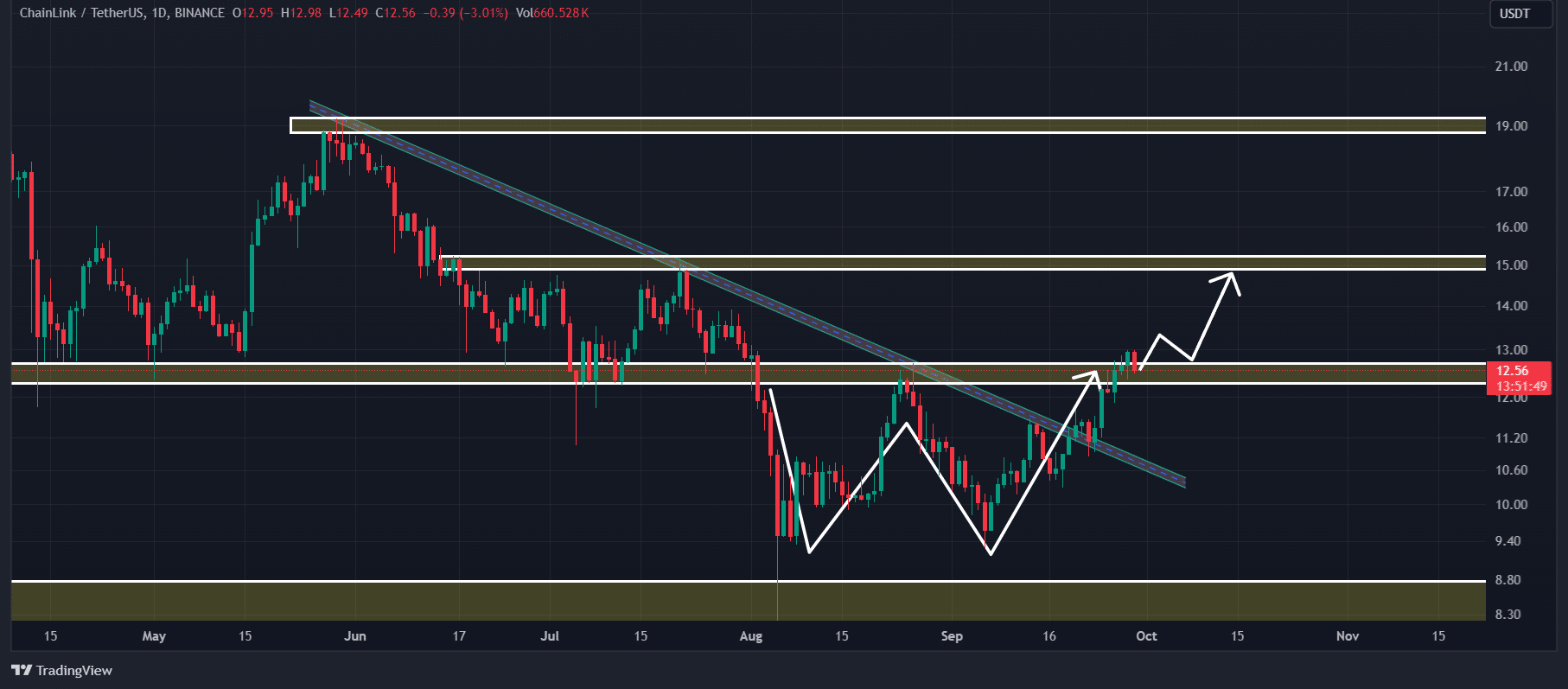

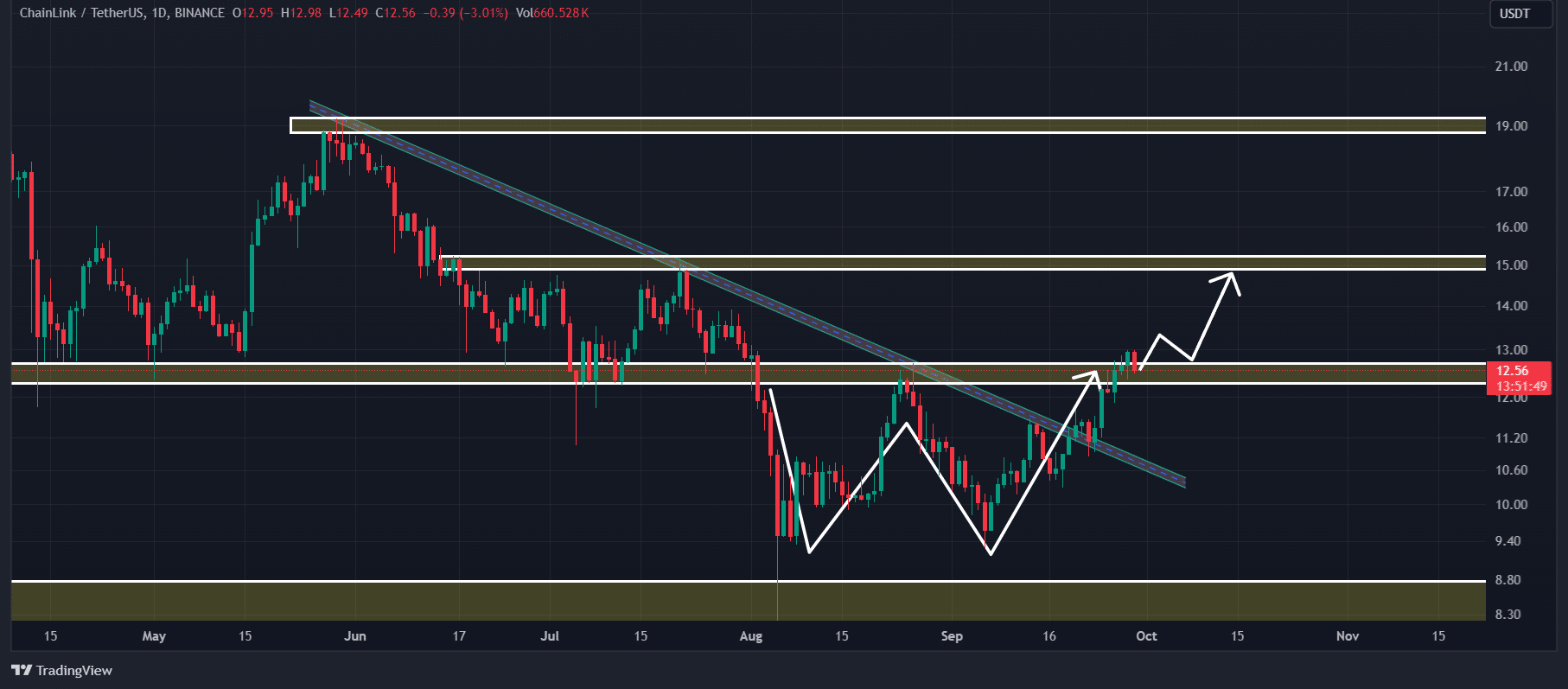

Chainlink technical analysis and key levels

According to AMBCrypto technical analysis, LINK turned bullish after the breakout of the long-awaited double bottom price action pattern forming on the daily time frame.

Investors and traders often view this pattern as a bullish signal and often prefer to go long.

Source: TradingView

Based on the recent price performance, if LINK closes its daily candle above the $13.10 level, there is a strong possibility that it could rise 20% to reach the $15 level in the coming days.

Despite this bullish outlook, LINK’s Relative Strength Index (RSI) indicates that the asset is in a downtrend.

In trading and investing, RSI is one of the crucial technical indicators that help users determine whether an asset is in an upward or downward trend.

Mixed sentiment from on-chain metrics

Beyond the technical analysis, LINK’s on-chain metrics reflect mixed sentiment. According to an analysis company in the chain Mint glassLINK’s Long/Short ratio currently stands at 1.031, indicating bullish market sentiment among traders.

Moreover, the LINK OI-weighted financing rate is positive at 0.0087%, further indicating bullish sentiment.

Source: Coinglass

Meanwhile, LINK’s future open interest has remained unchanged over the past 24 hours, indicating that traders have neither liquidated positions nor built new positions, possibly due to concerns about a possible price correction.

Read Chainlink’s [LINK] Price forecast 2024–2025

According to Coinglass data, the key liquidation levels are currently at $12.12 on the downside and $13.16 on the upside, as traders are over-indebted at these levels.

At the time of writing, LINK was trading around $12.65 and has experienced a price increase of over 1.2% in the past 24 hours. Moreover, trading volume has also fallen by 25%, indicating lower participation from traders and investors.