- BTC is up 4.16% over the past week, with fundamentals pointing to positive sentiments.

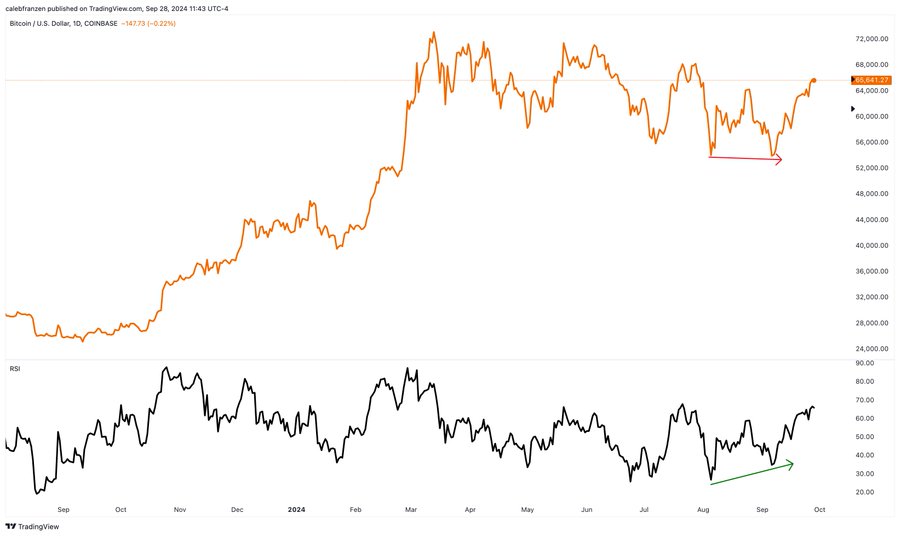

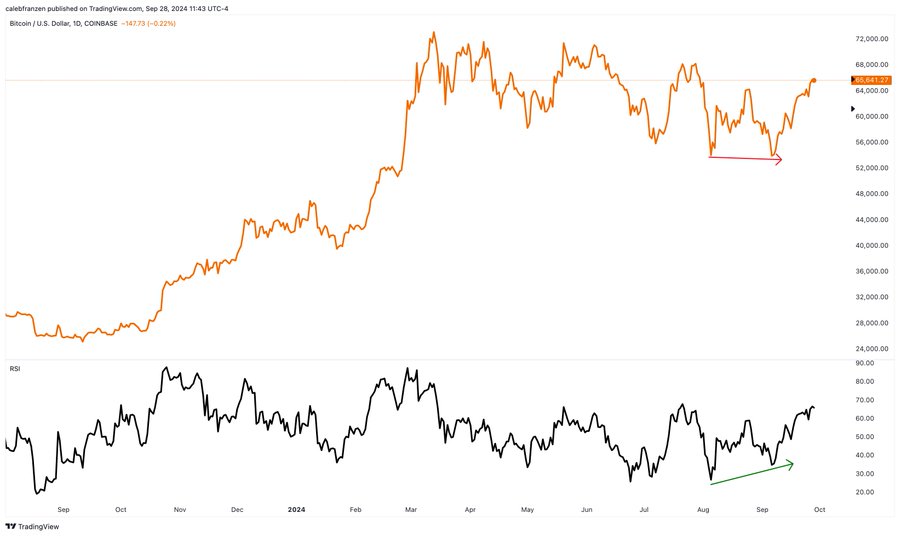

- Despite the lows, the RSI confirms a bullish trend with a bullish RSI divergence.

Bitcoin [BTC] has seen strong upward momentum all month. Historically, September is associated with a bearish trend. However, a dramatic shift has occurred this month, with BTC making higher lows.

At the time of writing, Bitcoin was trading as high as $65,530. This marked an increase of 10.52% on the monthly charts, extending the uptrend over the past week with an increase of 4.16%.

However, over the past 24 hours we have seen a small correction with Bitcoin falling 0.46%.

Therefore, current market conditions have analysts talking about Bitcoin’s trajectory. One of them is the popular crypto analyst Caleb Franzen which suggested that a bullish trend will continue, citing bullish RSI divergence.

What market sentiment says

In his analysis, Franzen cited the bullish RSI divergence to argue that the bulls are dominating the market.

Source:

According to the analyst, the RSI has not formed a bearish RSI divergence on the daily charts. However, the RSI continues to confirm the bullish trend from the lows. Therefore, it confirms the bullish RSI divergence.

In context, the fact that there is no bearish divergence implies that the price increase is supported by momentum and that there is no significant sign of a reversal at this point.

When a bearish RSI divergence occurs, it signals weakening upside momentum and could indicate that a price correction is imminent.

So while BTC may have been making lower lows lately, the RSI is making higher lows, indicating momentum is increasing despite lower prices.

Normally, a bullish RSI divergence indicates that selling pressure is weakening and buying interest is growing, leading to further upside potential.

What BTC Charts Say

As Frazen noted, Bitcoin is enjoying favorable market conditions. Therefore, these market conditions could cause BTC to make even more gains on the price charts.

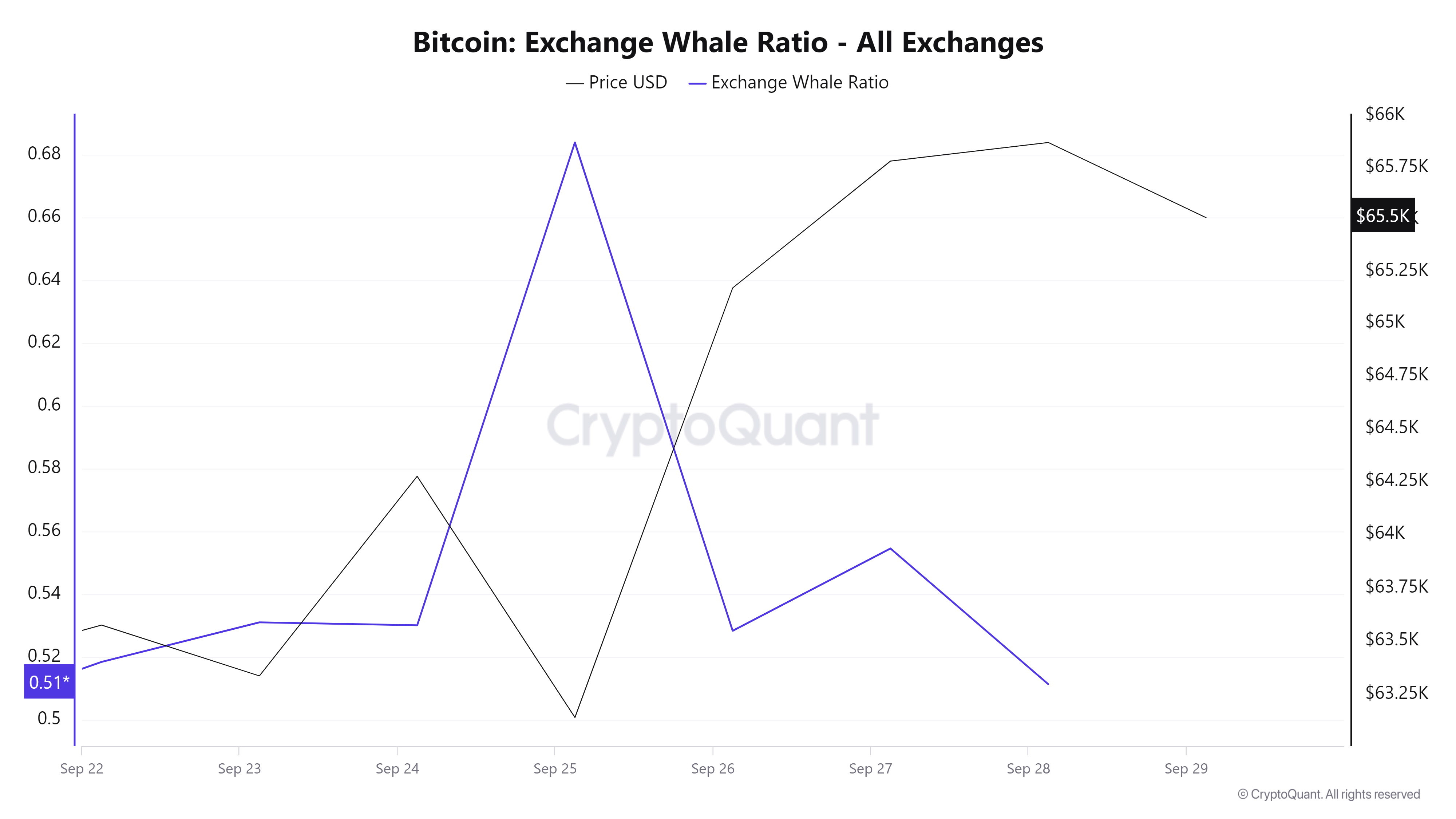

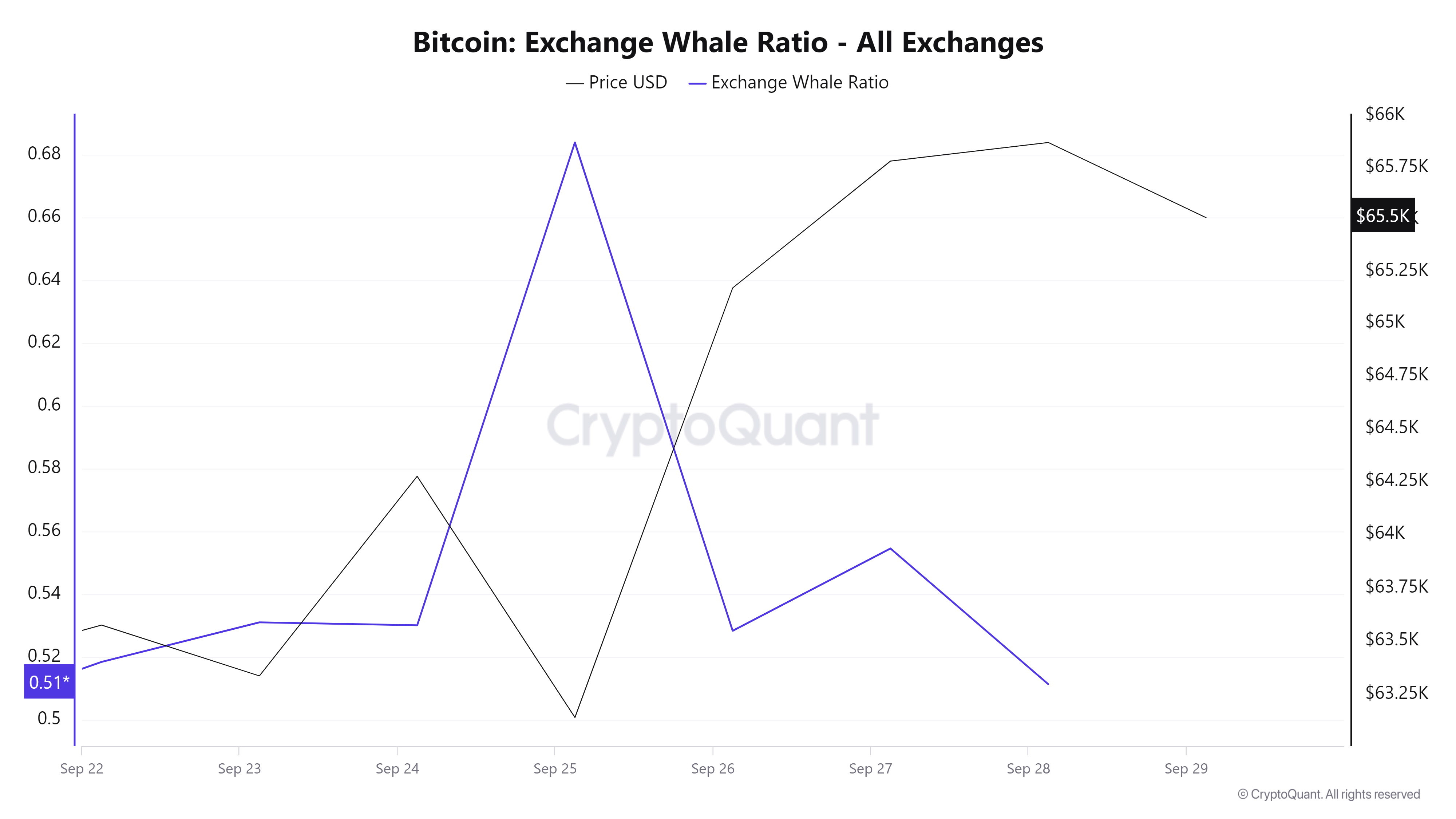

Source: Cryptoquant

For example, the Exchange Whale price has fallen from a high of 0.68 to 0.511 at the time of writing. This decline indicates that whales are moving their BT from the exchanges to private wallets.

Such market behavior is a bullish signal indicating that large investors have no plans to sell in the near term.

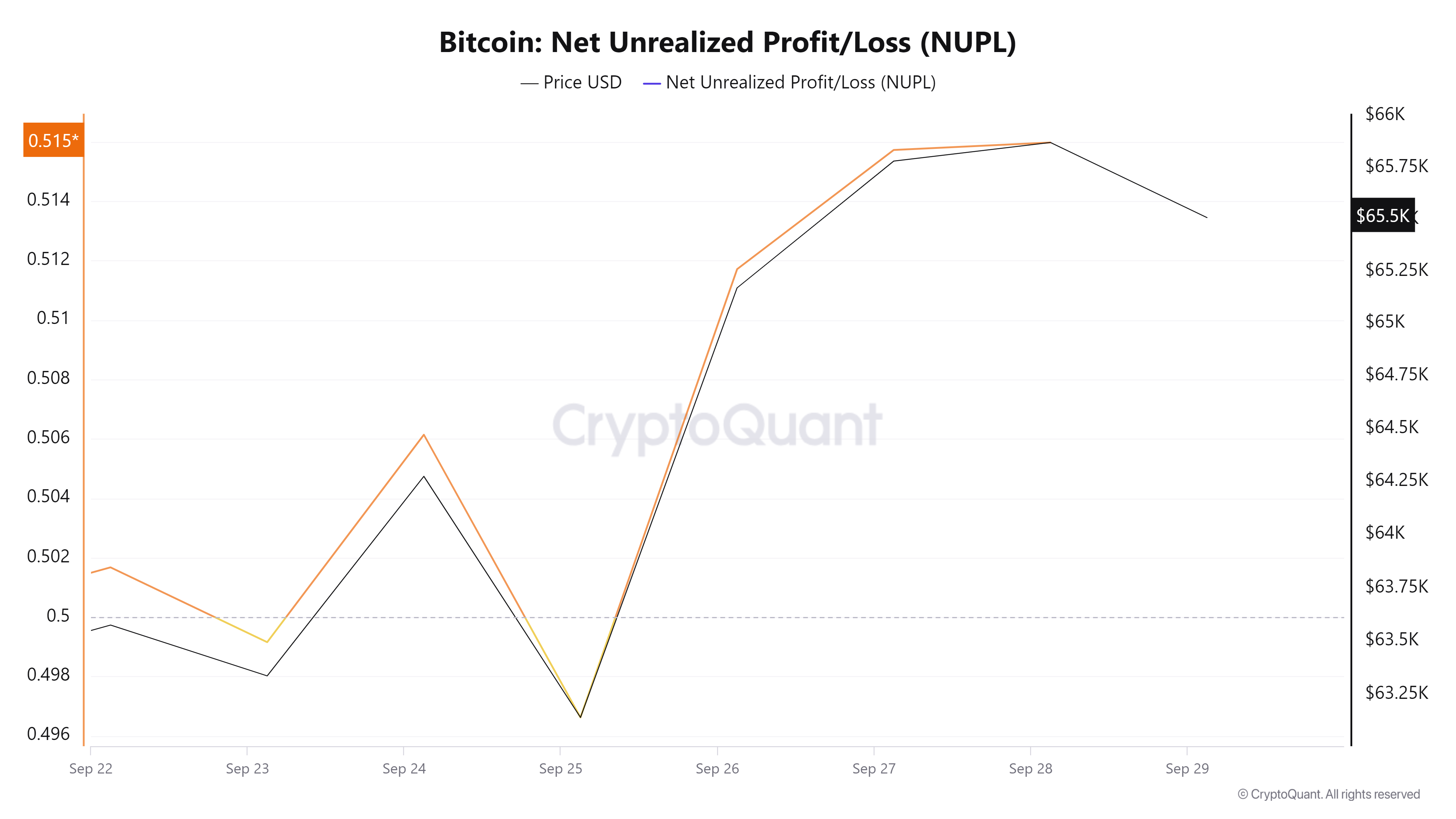

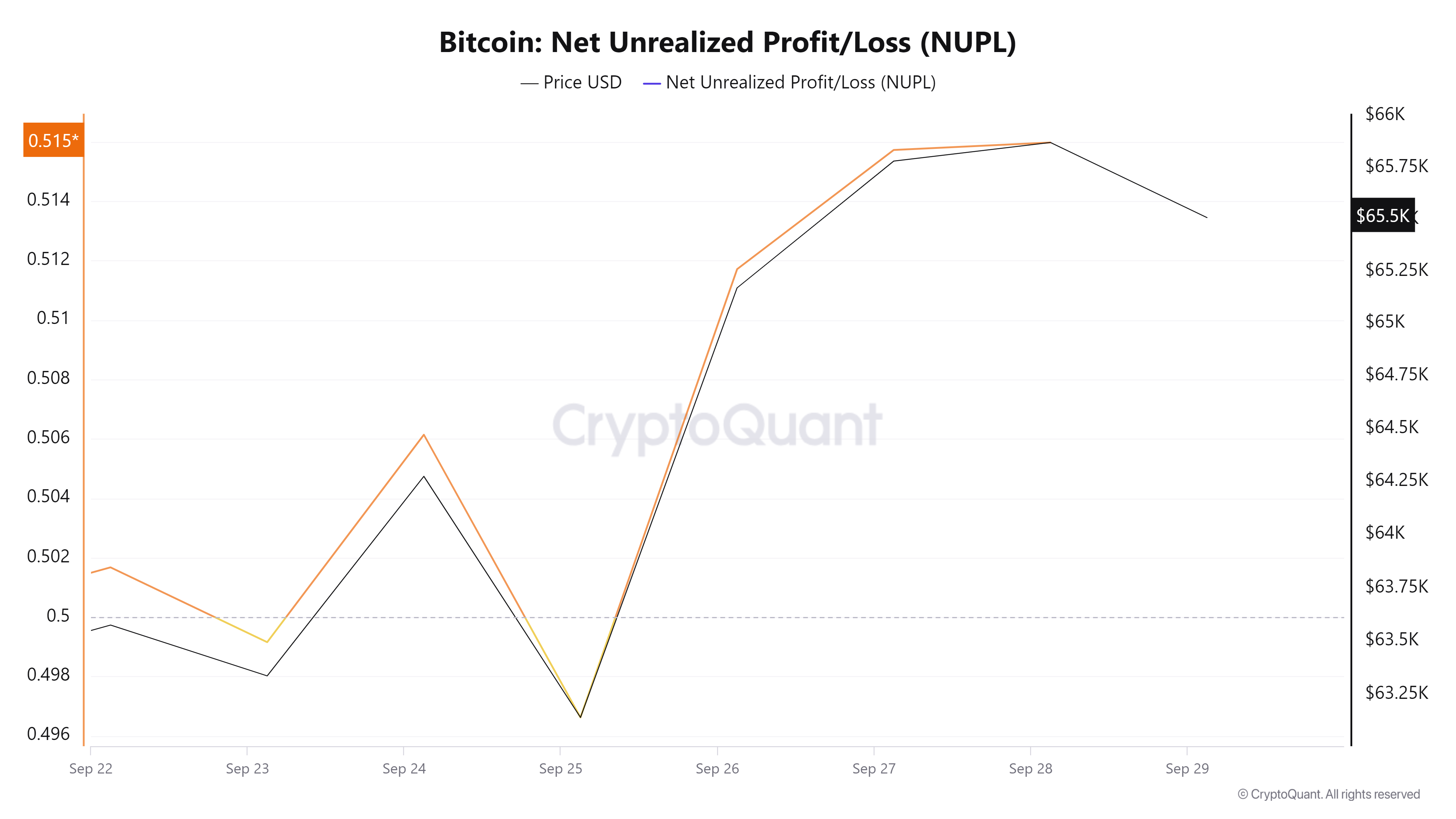

Source: Cryptoquant

Furthermore, Bitcoin’s net unrealized gain/loss (NUPL) has risen from a low of 0.4 to 0.51 over the past week. As the NUPL rises, it indicates that investors are seeing profits.

This usually happens during the bullish phase of the market, when prices rise above the purchase price. Therefore, this results in greater optimism as participants have more confidence in the future potential of the market and expect further price increases.

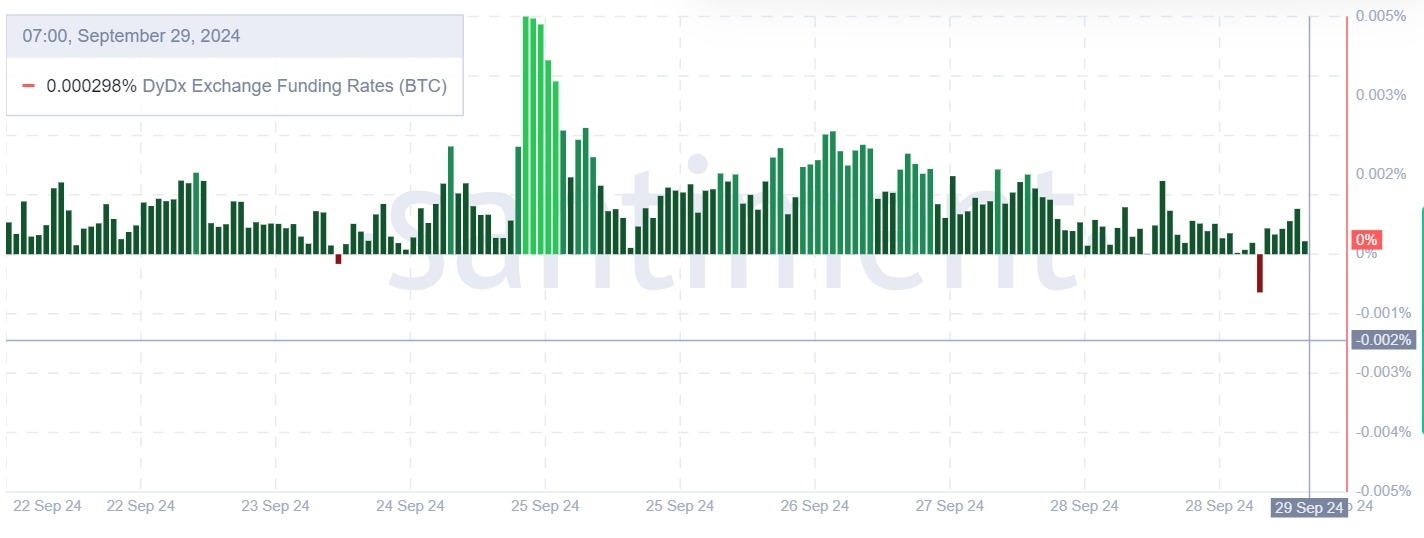

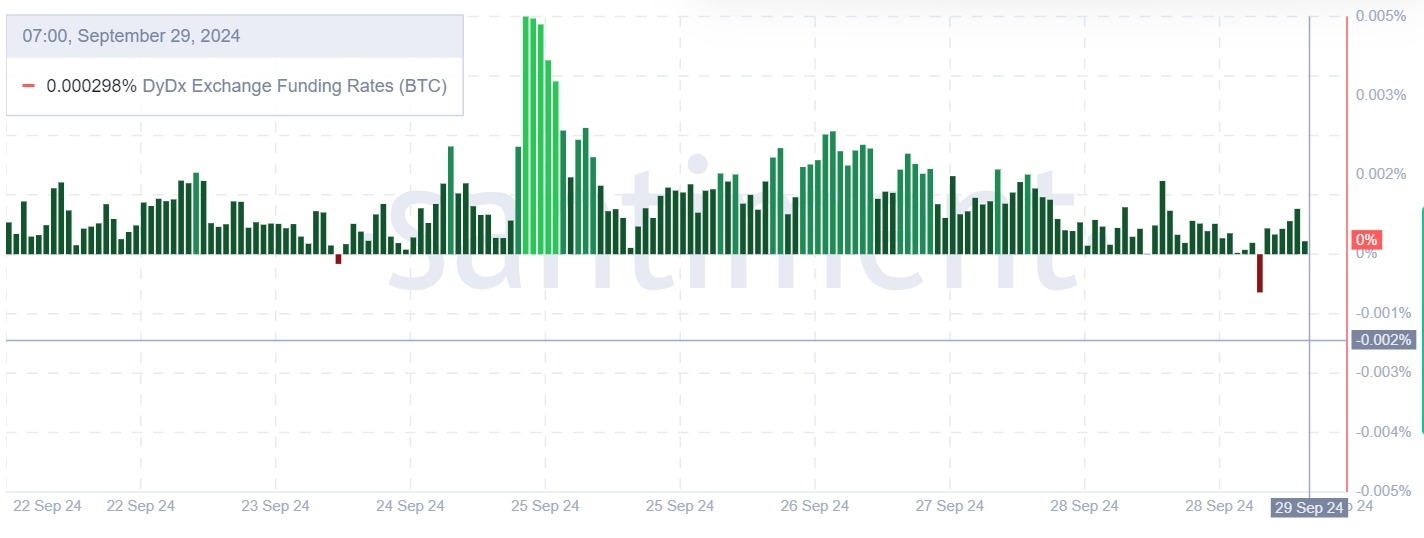

Source: Santiment

Finally, Bitcoin’s DyDx exchange funding rate has remained positive over the past week. A positive DyDx exchange funding rate suggests that holders of long positions pay those who take shorts to maintain their positions.

Is your portfolio green? Check out the BTC profit calculator

In such a market situation, investors are more inclined to take long positions in anticipation of price increases.

Simply put, Bitcoin is experiencing strong upward momentum with bulls dominating the market. Therefore, under these conditions, BTC will make further gains on the price charts by regaining the $66,500 resistance level in the short term.