- BTC rose 10.38% on the monthly charts

- Analysts are looking forward to a further rally, citing the historical relationship between MVRV and SMA 365

In the last 30 days Bitcoin [BTC] has seen a significant recovery on the price charts after two months of extreme volatility. Since reaching a high of $70,016 in July, BTC has fallen significantly, even reaching a local low of $49,000.

However, since the Fed’s rate cuts a week ago, BTC has made notable gains. At the time of writing, Bitcoin was trading at $65,839. This marked an increase of 10.38% on the monthly charts, with an extension of the bullish trend with an increase of 4.47% in 24 hours.

Will the king coin continue its rally?

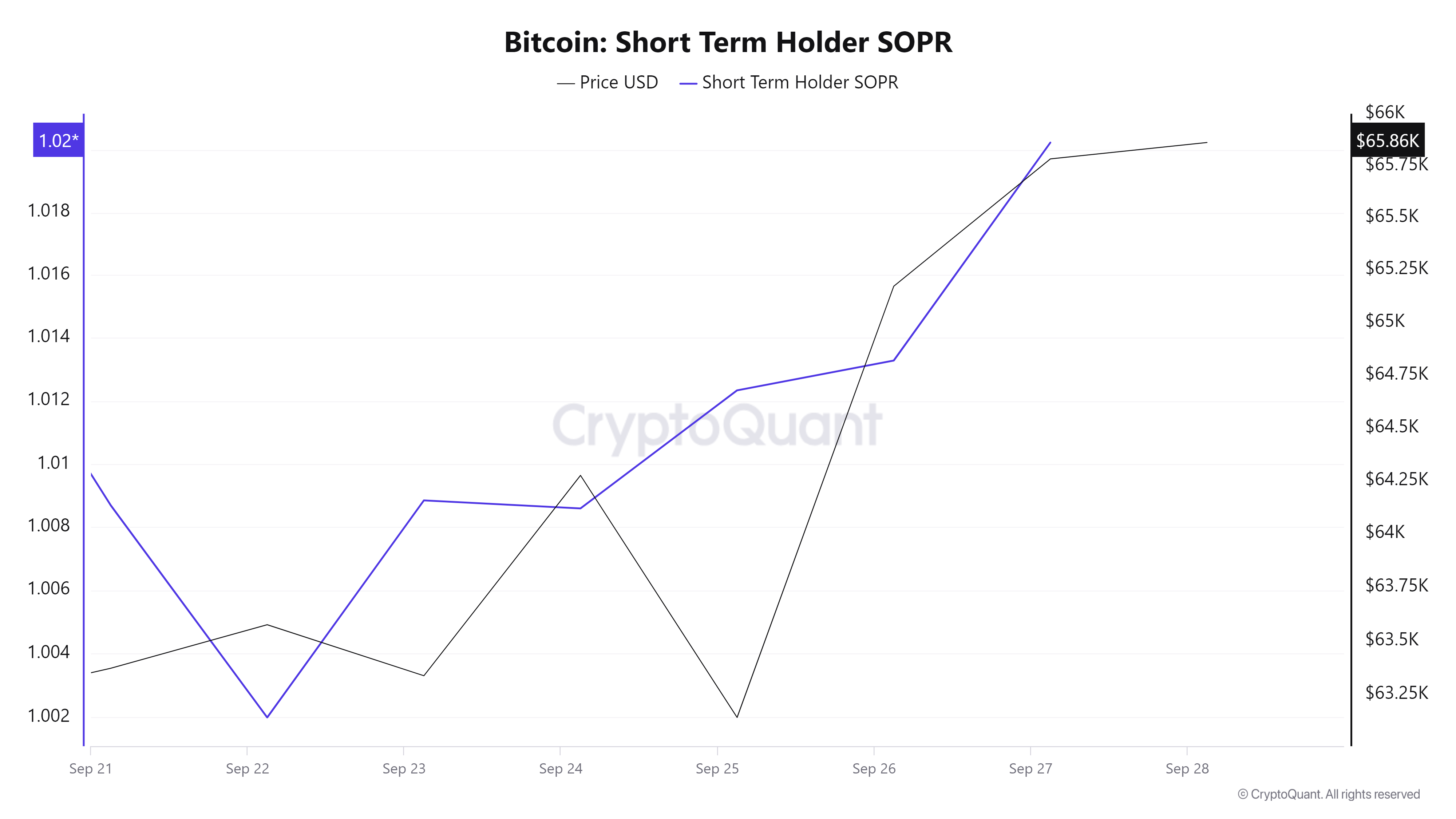

This recent wave has caught the attention of the crypto community, getting analysts talking. One of them is Cryptoquant analyst Burak Kesmeciwhich suggested that a rally could sustain itself in the long term, citing the MVRV measure.

Source: Cryptoquant

According to Kesmeci, the Bitcoin MVRV Metric is now giving another bullish signal, with the MVRV price above its SMA 365. After analyzing the historical relationship between the MVRV and the 365-day moving average, the analyst determined that BTC usually registers a rally. after the MVRV rises above SMA365.

At the time of writing, the MVRV was at 2.04 and above its SMA 365 at 2.02. So the analyst interpreted this as a strong bullish signal and stated that bulls have the market to lose.

When the MVRV and SMA 365 are set like this, it means the long-term trend is getting stronger. Especially since the current market value of BTC is higher than the average realized value of the past year. This upward movement is a sign of growing confidence among long-term investors and investors.

So, based on this observation, Bitcoin could see increased demand, something that could drive up prices.

What do the graphs say?

Although the metric highlighted by Kesmeci gave a positive picture, the question is: what do other fundamental figures say?

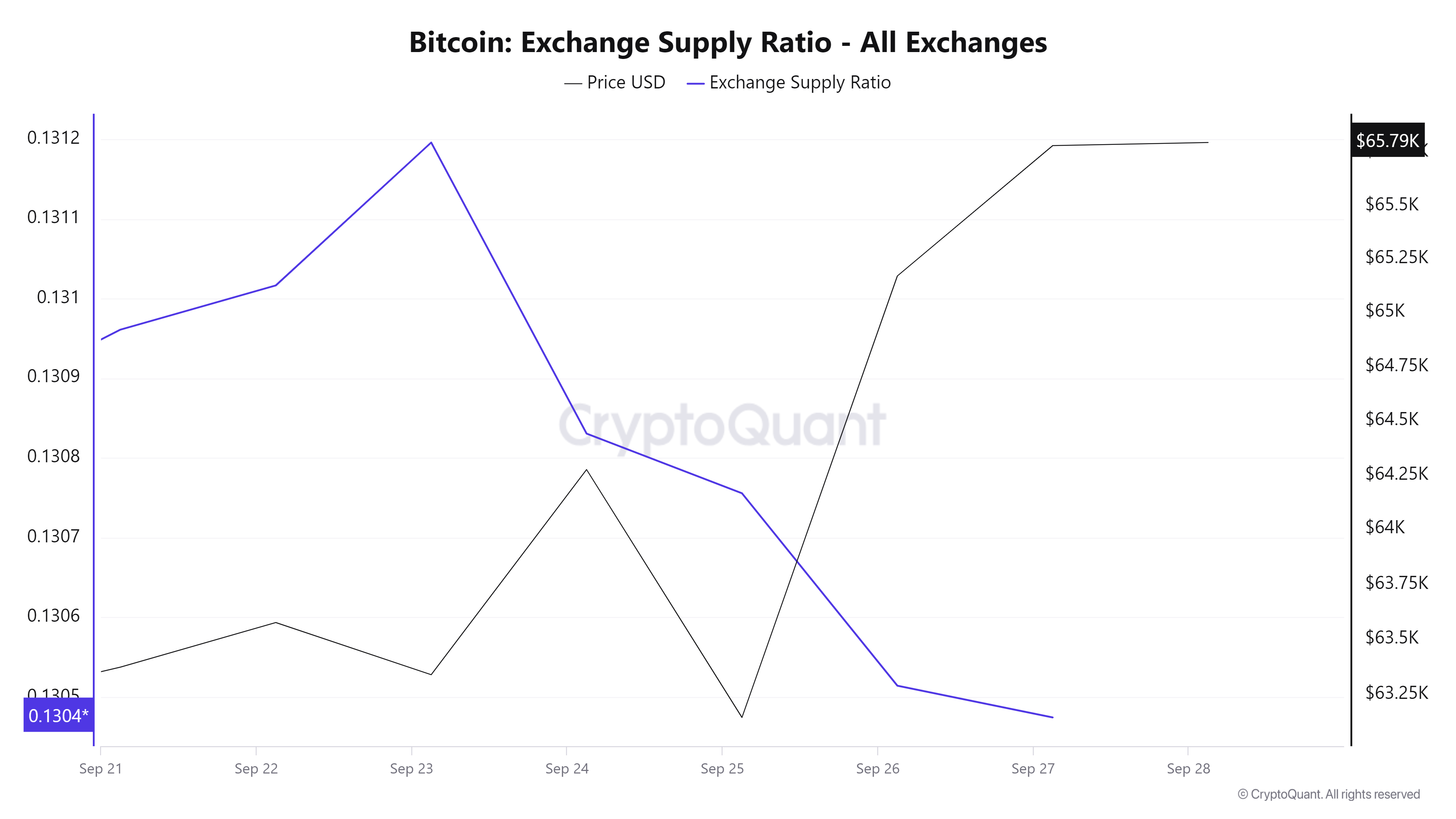

Source: Cryptoquant

For starters, the Bitcoin Exchange Supply ratio recorded a sustained decline over the past week. During this period, the exchange offer ratio decreased from 0.1311 to 0.1304.

This decline reflects the investment behavior of investors as they store their assets in cold wallets, rather than on exchanges. This is a bullish signal, one that implies investor confidence in future values as long-term holders expect the price of the crypto to rise.

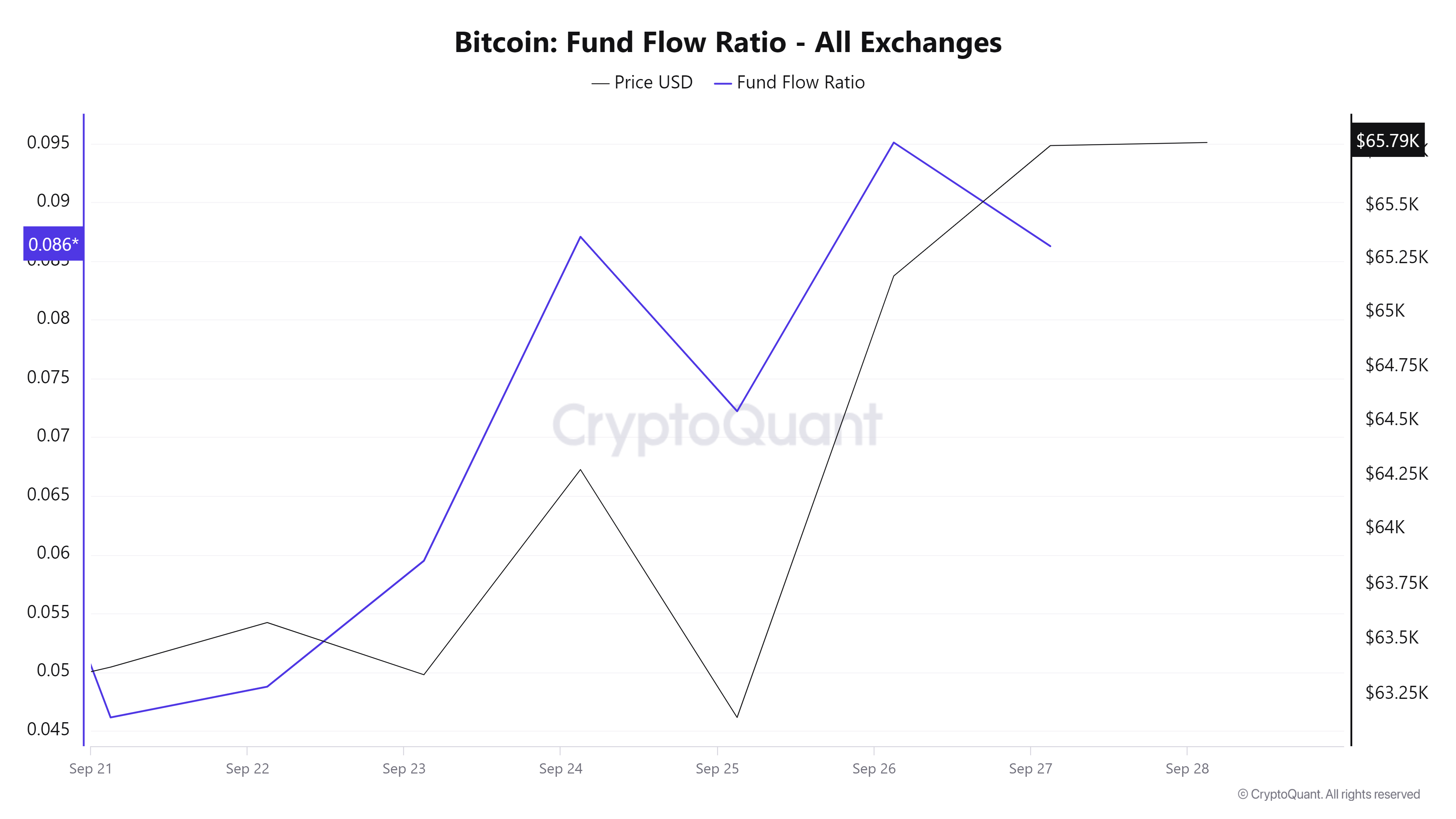

Source: Cryptoquant

Moreover, Bitcoin’s fund flow ratio has been on an upward trend over the past week. FFR has increased from 0.04 to 0.086 in the last seven days.

This is a sign of a greater inflow of money into BTC. By extension, this reflects growing confidence among investors. Under these market conditions, investors are more likely to purchase BTC in anticipation of future gains.

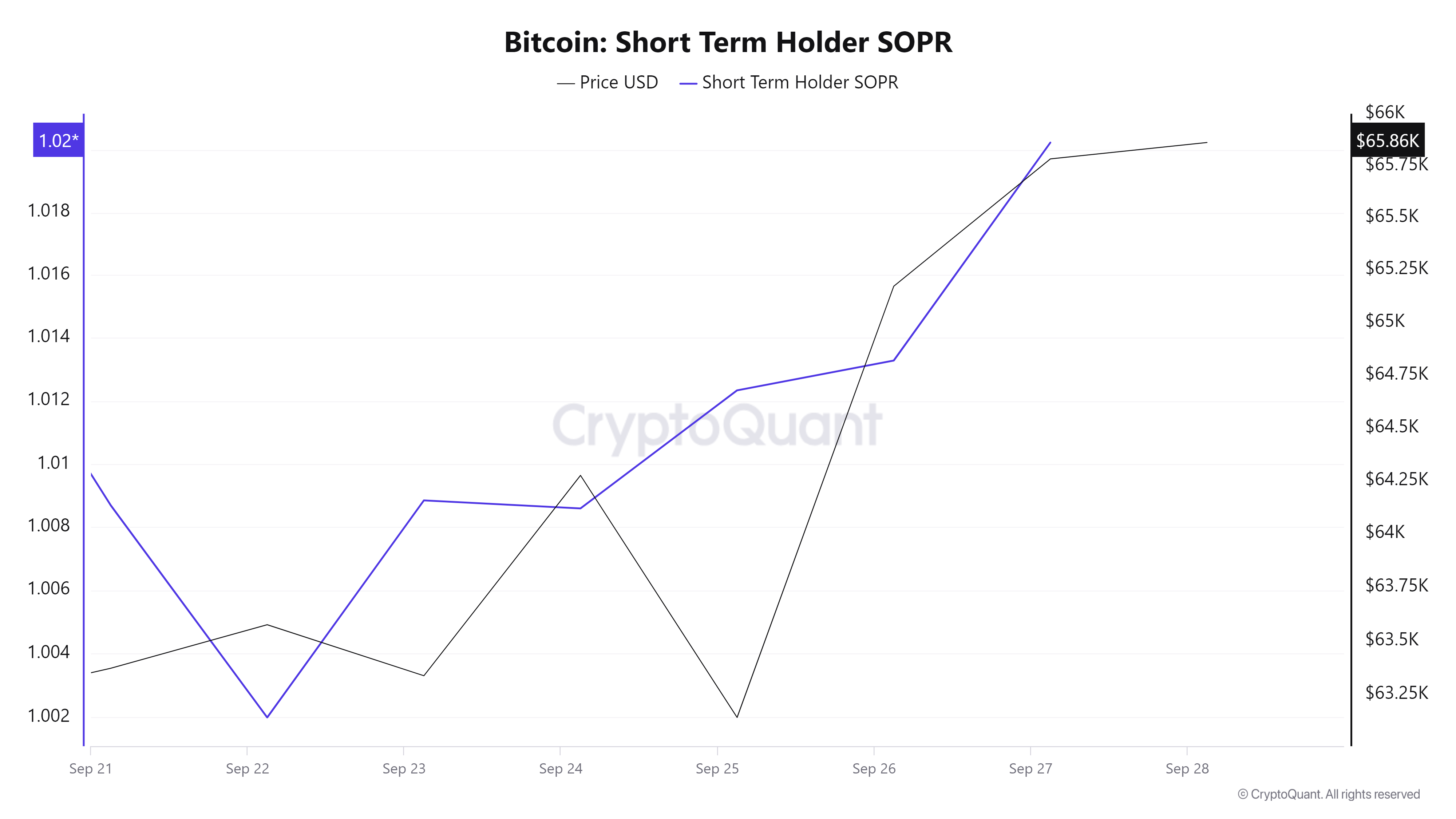

Source: Cryptoquant

Finally, Bitcoin’s short-term holding SOPR has also risen over the past week. A rising short-term SOPR during an uptrend shows that the market is strong. Although the short-term owner sells at a profit, demand is also high enough to absorb the selling pressure without leading to a decline. This means that the upward trend is likely to continue.

Simply put, BTC is experiencing positive market sentiment and rising investor interest. If these market conditions persist, BTC will attempt to break the $68,240 resistance level.