- BlackRock’s Bitcoin ETF saw inflows of $184.4 million, bringing its 2024 total to $17.944 billion.

- Institutional ETFs are approaching and possibly surpassing Satoshi’s holdings by year’s end.

After a period marked by minimal activity, BlackRock’s Bitcoin [BTC] ETF (IBIT) has regained momentum, recording substantial inflows as of September 23.

Bitcoin ETF performance analyzed

IBIT saw an impressive one on September 25 in particular inflow of $184.4 millionwhile total inflows across all Bitcoin ETFs amounted to $105.9 million.

In contrast, Grayscale’s GBTC, which usually experiences outflows, reported no movement on the same day.

However, Fidelity’s FBTC and Ark’s ARKB experienced outflows of $33.2 million and $47.4 million, respectively.

This resurgence in ETF activity has propelled the US BTC ETF to an astonishing $17.944 billion inflows in 2024, marking a record-breaking accumulation of 916,047 BTC to date – only about 84,000 BTC short of the coveted 1,000,000 milestone BTC.

Given this impressive growth, Eric BalchunasBloomberg’s Senior ETF Analyst went to X and noted:

“US Bitcoin ETFs had a good day yesterday, pushing YTD flows to a new high-water mark of $17.8 billion. They are now 92% of the way to owning 1 million bitcoin and 83% of overtaking Satoshi as the top holder. Tap tap…”

Is Satoshi Nakamoto’s place under threat?

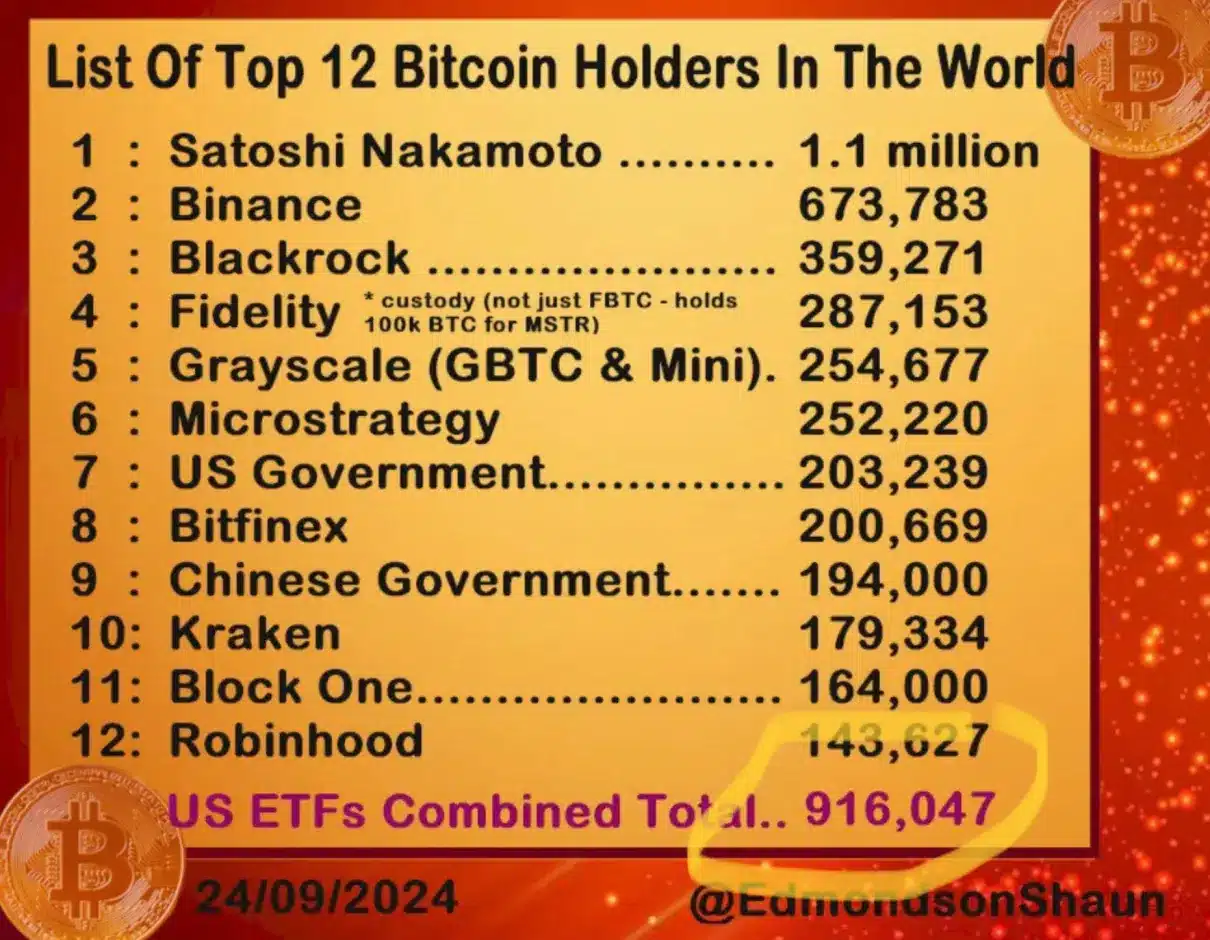

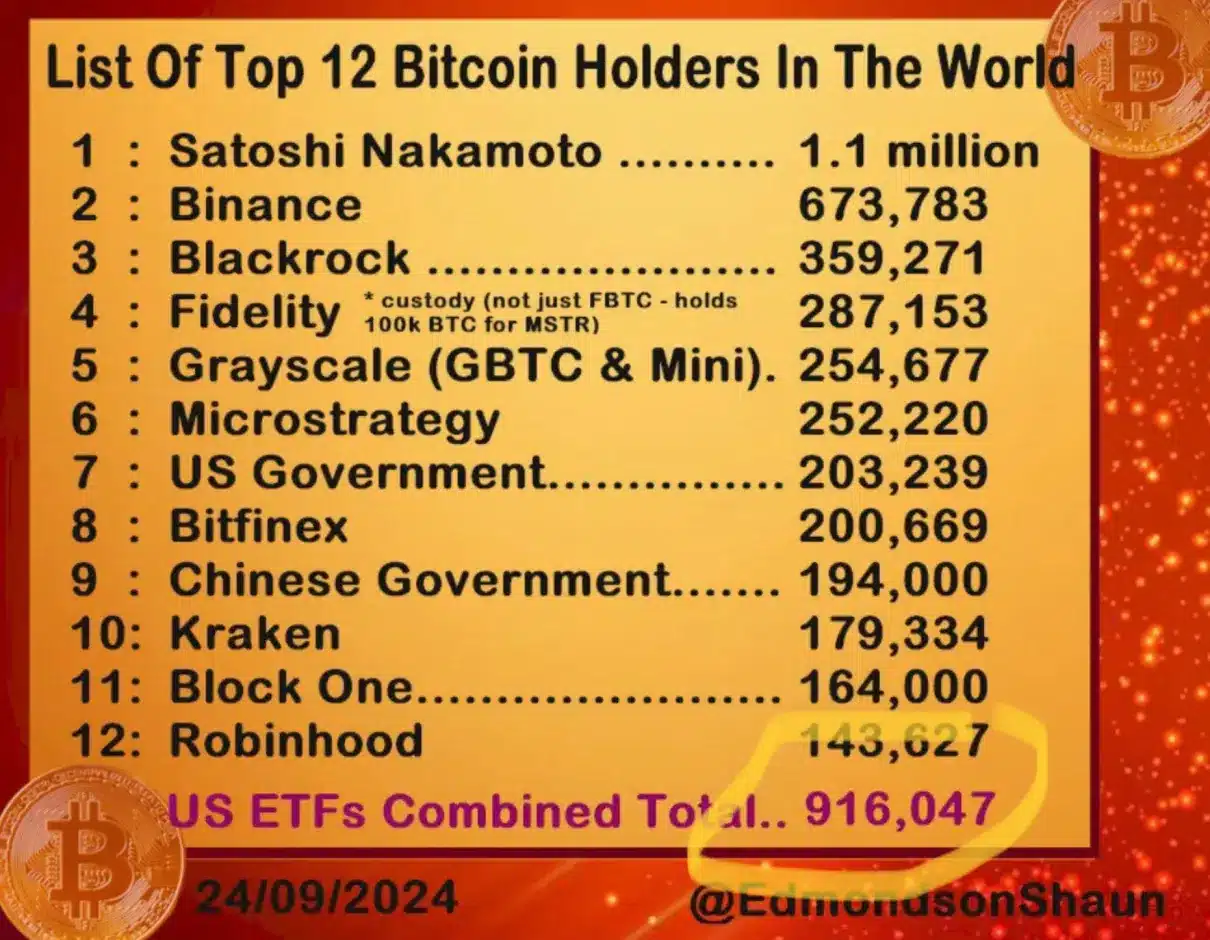

Satoshi Nakamoto, the creator of Bitcoin, is estimated to own approximately 1.1 million BTC, a figure that institutional BTC ETFs are quickly approaching.

Recent data shows that these ETFs have now amassed around 83% of Satoshi’s holdings, and if the trend of increasing inflows continues, he could soon surpass him.

Currently Satoshi Nakamoto leads the list of top Bitcoin holders, closely followed by Binance with 673,783 BTC.

Notably, major asset managers such as BlackRock, Fidelity, and Grayscale collectively own a significant 901,101 BTC through their ETF products, with individual holdings of 359,271 BTC, 287,153 BTC, and 254,677 BTC, respectively.

Source: Eric Balchunas/X

In contrast, the remaining five asset managers with BTC ETFs own a total of only 14,946 BTC.

Sharing a similar line of thought was Spencer Hakimianfounder of Tolou Capital Management, who said:

“ETF will be bigger than Satoshi by Christmas Day.”

What else is going on?

Meanwhile, MicroStrategy, led by Michael Saylor, is in sixth place with 252,220 BTC and is on track to potentially join the top ranks of Bitcoin holders.

So while BTC ETFs continue to draw attention, Bitcoin itself has seen a resurgence in price.

After experiencing challenges in breaking the $60,000 barrier, so was BTC trading at $64,358which reflects a modest increase of 0.91% over the past 24 hours.